How can I properly record a Roth to traditional IRA recharacterization?

I have done a recharacterization and a roth conversion this month for tax purposes. Quicken is having numerous problems with importing the transactions in a logical way. Is there a way to record these transactions manually?

Answers

-

Hello @thetallestpaul,

Thank you for letting us know you're running into this problem. To clarify, are you converting a Roth IRA to a Traditional IRA? What is happening when the transactions import? Are you importing from a QFX file, through One Step Update, or via a CSV file?

I look forward to your reply!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

I am converting it, but only after recharacterizing it.

So in total I have transactions to recharacterize from Roth to traditional (for 2025 contributions), and then a transaction to convert the balance back to Roth.

I am downloading the transactions directly from my custodian, but I am interested in manually reentering the past transactions as they are not adding up correctly at all. I am not particularly concerned with using Quicken for tax calculations, but I would like the balances to make sense if possible.

0 -

Thank you for your reply,

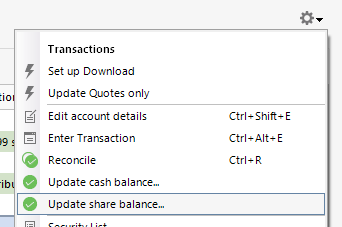

What is incorrect about the past transactions? What is not adding up? If needed, you can adjust share balances and you can adjust the cash balance. You can do that from the transaction register of the investment account by clicking the gear icon near the upper right and selecting the appropriate option.

Note - Adding an adjustment transaction will not change your past transactions. It will just adjust the numbers to match up with the current reality.

I hope this helps!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

I am not a tax professional, so you should not rely solely on any of the following thoughts.

As I understand a recharacterization, it lets you undo a Roth or traditional IRA contribution and transfer the contribution amount and any gains to the other type of IRA. You must complete this before the next tax filing deadline.

From my quick read, I don't see that you are allowed to undo a Roth conversion. Google AI says

Under the Tax Cuts and Jobs Act (TCJA) effective for 2018 and later, youcannot recharacterize (undo) a Roth IRA conversion, a significant change from prior law, making conversions permanent decisions that can't be reversed if values drop, though you can still recharacterize regular Roth contributions (not conversions) by the tax deadline. This eliminates the "undo" button for Roth conversions, impacting financial planning for moving funds from traditional IRAs or 401(k)s to Roths.Key Changes & What's Affected:Roth Conversions(Traditional IRA/401(k) to Roth):Prohibited from recharacterization starting in tax year 2018.Regular Roth Contributions(Direct Contributions):Still allowed to be recharacterized to a traditional IRA by the tax filing deadline (including extensions).Why it Matters:Before the TCJA, if a conversion lost value, you could recharacterize it back to a traditional IRA and avoid paying tax on the inflated amount, but this "safety net" is gone for conversions after 2017.

Also the cutoff date for Roth conversions is Dec. 31.

So did you make a Roth contribution last year and now you want to recharacterize that and change it to a Traditional IRA contribution? As I understand it, the Roth conversion would be in the 2026 tax year, unless you actually did it last year.

QWin Premier subscription0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub