No Transactions for Fidelity HSA Accounts (Ticket 1999090) – HSA accounts are not downloading transa

Are there any updates for this problem (going on over two months)?

Answers

-

Hello @Robhermann ,

Thank you for asking this question!

Unfortunately, no, we have not received any updates from Fidelity on this issue. There has been no indication from them that they intend to change the way this information is sent to make it compatible with Quicken.

Any updates or changes we receive will be posted on the Community Alert. Make sure you have it bookmarked to stay updated!

Thanks again, and we apologize for the inconvenience.

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

This seems to be an unacceptable answer. What can be done to escalate this item and get HSA accounts working again? They worked in the past, they actually worked for a while after the conversion to EWC+, but then for some reason stopped and haven't worked ever since. What needs to be done to get someone working on this problem?

-1 -

@bmbass and others, I think your best bet at this point would be to exert whatever pressure you can on Fidelity.

Fidelity's FAQ page on exporting account information here

suggests this:

If you need further assistance downloading your Fidelity account information into Quicken or QuickBooks, please call Fidelity at 800-544-7931 and a specialist will be able to assist you.

Please let us know what they tell you.

QWin Premier subscription1 -

If Quicken is waiting for a solution from Fidelity, it's not coming. I talked to Fidelity Electronic Channel Support, Fidelity HSA, and they have no intention of changing how they present their data to Quicken. According to the tech I talked to, Fidelity doesn't even have a seat of Quicken to test with.

Boiler Plate response I got today after rating my Fidelity Customer Service encounter one star:

Your concern with downloading information from your Fidelity HSA into Quicken is a known issue. This needs to be addressed by Quicken. To learn more about this problem, please enter the following link into your web browser*:

This is a failure of leadership and ownership on both sides of the problem. At least be honest and state that you are in a stalemate with Fidelity and both companies are now ignoring the problem.

2 -

Giving up on Quicken and Fidelity solving this problem, in Quicken, I switched Tracking Method from "Complete - Positions and Transactions", to "Simple - Positions only". Another Fail. The Fidelity Index Fund isn't showing a 12/19 transaction. Last transaction shown is 10/3. And the Government Cash Reserves show a Zero Balance. Off by over $6,000. The zero balance might be transaction data Quicken is processing that, for each transaction, Fidelity presents a matching deposit and withdraw that zero out. I have this problem with a Vanguard Cash Plus account. My Vanguard accounts are another headache altogether.

And, of course, there is no way to correct balances in the Simple-Positions Only format (except for just adding Cash).

Can the "Simple - Positions Only" problem be solved? Or is Quicken waiting on Fidelity to solve this too?

0 -

[Removed-Rant/Disruptive]

0 -

I opened a new Fidelity HSA account in 12/2025. I created a new Quicken Investment account at that time, type EWC+. I have had the same problem others discuss here, where no download transactions are getting downloaded, with red flag next to account indicating "You have 1 transaction to review", but there is nothing there under "Downloaded Transactions". There are no actual download error(s), so it appears the connection to the servers is working, just no data transferred. The version of Quicken is the latest, Windows R65.29. I spoke to Fidelity today and they said this is a Quicken problem and to contact Quicken, so I am doing that.

In reading the history of this problem on several threads over the past 3 months or so, this problem seems to correlate to a similar problem with Citi accounts back in Q4 of 2024. In this case, the problems all started with the Quicken accounts moving from Direct Connect ⇒ EWC+, much in the same manner that appears to have happen now with this Fidelity HSA issue (and maybe other Fidelity type accounts too? I personally don't have any other Fidelity accounts.)? My last post on this Citi issue was 10/2024, asking for better comms from Quicken when these type of large impact software changes are done, requiring client-end changes by their customers. It appears these more recent Fidelity changes are similar, even if not exact same root cause.

In this case, for me personally, since the Fidelity HSA is a new account, this download transaction problem appeared right away. However, others with longer Fidelity HSA account in Quicken seem to indicate this all worked fine when the HSA account was defined as a "Direct Connect" instead. If true, this is exactly the same thing that happened with the Citi accounts in Q4 2024. In the end with the Citi accounts, all users had to change to EWC+ instead. In this case, I am already using EWC+, so that is not a fix. What needs to be done to fix this?

0 -

The issue is for some inexplicable reason, Fidelity's data format for HSA accounts differs than their brokerage and IRA accounts and that data format for HSAs is not compatible with Quicken. Even though you have it connected through EWC+, the "behind the scenes" work between Fidelity and Quicken to get the HSA transactions is broken.

It also doesn't appear that anyone is trying to fix it, so as of now, I think we have to give up on EWC+ for HSAs. Unfortunately, Fidelity controls the EWC+ linking process, and they show HSA accounts to be "eligible" to be sent to Quicken.

Quicken Classic sees HSAs as normal brokerage accounts. If Quicken could somehow classify the "type" as HSA, they could potentially make it ineligible for linking (even if you push the data as part of the EWC+ setup), that that would first require Quicken to allow us to setup an account type called HSA instead of brokerage.

0 -

Same issue here, and sadly, after using Quicken since 1984, this is the end of the road for me. [Removed-Third-party Software] has no problem with the HSA account. I prefer using Quicken, but the recent Fidelity issues all around make it not worth the effort.

[Edited-Readability]

0 -

@Quicken Alyssa and everyone, I called Fidelity HSA support number yesterday and asked about this problem. The rep put me on hold and looked into it and said Fidelity and Quicken are working on the problem. He said the HSA download problem wasn't permanent and was an integration issue. He didn't have an estimated time for problem resolution.

Thanks to a poster on another thread that provided this phone number to the HSA team: 800-544-3716. I suggest we place as many calls to Fidelity to keep pressure on Fidelity for a fix.

1 -

Still waiting for a resolution on this myself. I am now also starting to experience similar issues with some of my Citizens Bank accounts. 2 accounts don't update, one had a corrupted opening balance after reconnecting. (I thought at least that problem had been fixed… Silly me)

0 -

@DaveQN , I did call Fidelity support today, spoke to someone in HSA account/Quicken tier1 support named Steve, and he said to call Quicken support about this. He said Quicken owns this problem overall, with Fidelity providing some available developer contacts to Quicken "if there are questions".

After the call with Fidelity support, I had an online chat with Quicken support, tier1 contact named Aroldo. We discussed my several posts/discussions/findings here over the last few days related to these Fidelity HSA problems. He said he added this to existing ticket 1999090, but said I have no visibility to view it. He said he couldn't send me exactly what text he added. I then asked him to create a new ticket, which he did, 12164069, but I again have no visibility, so I don't know what it exactly states. My entire reasoning for wanting the visibility to see the written text is because I want to make sure the details of the findings and questions are clearly stated and eventually acknowledged. I personally don't have the confidence the current system will have this outcome.

Thus, just to get a single summary of my own related findings over the past days, I am going to summarize here, with hope that these eventually get answered, either directly and/or seen in outcome of future positive change results of a fully functioning product:

Problem #1 - Transactions:

(a) Downloaded transactions are not occurring. Nothing or blank entries with bogus dates(0/0/1900 or 0/0/2027) are seen in Quicken Online Center and Quicken account register.

(b) Quicken Online Center "Transactions" tab shows unknown entry with Date of "0/0/1900", Activity of "Credit", and Amount of $0.00. Can this be explained/expected?

(c) Ever since initially doing the first "Download transactions" for this account in 12/2025, a red flag indicating 'You have 1 transaction to review' has existed next to the Fidelity HSA account name label in Quicken. There have never been any functional downloaded transactions to date, so I don't know what this 'phantom' transaction is referring to? How can I permanently get rid of this red flag?

(d) Within the Quicken Online Center, there is a "Transactions" column under the "Transactions" tab. My experience is that this is supposed to be a counter of outstanding unaccepted transactions. However, I am seeing strangeness/randomness? of Quicken sometimes counting the $0.00 transaction(one per account) as part of this count(ie, 1) and sometimes not(ie, 0). To further complicate this, I have had times where I click on a specific account name under the "Transactions" tab and this value immediately changes from "0" to "1"(haven't ever seen it go from "1" to "0" from just clicking the account name; however, it has gone back to 0 from something occurring within the app, then back to "1" again after I repeat the same account name click within Online Center). Can someone explain if any/all of this is normal or not?

No Transactions for Fidelity HSA Accounts (Ticket 1999090) – HSA accounts are not downloading transa

0/0/1900 and 0/0/2027 Quicken date transactions

Problem #2 - Balances:

(a) Do the below variables and correct associated values need to be showing up for this Fidelity HSA account in Quicken Online Center "Balances" tab, similar to E-trade accounts, in order for account completeness/accuracy?

Buying Power

Total Account Value

Total Long Securities ValueFidelity Cash Balance Doubled (money market accounts)

Problem #3 - Holdings:

(a) The download date displayed in Quicken Online Center "Holdings" tab is not the real time download time. Is this to be expected or potentially causing problems?

(b) There are experienced times when the Fidelity Market value seen in the Quicken Online Center "Holdings" tab can be inflated, specifically for the cash fund, FDRXX. One such example is given and shown.

(c) The security Holdings seen in the Quicken Online Center "Holdings" tab does not correlate to what is seen in the Quicken account registry for this HSA account when selecting "Holdings" here - shouldn't this be the same?

Fidelity Cash Balance Doubled (money market accounts)

Problem #4 - Register:

(a) Since the downloaded transactions are not working, the register relies on manual entries only.

(b) Even though FDRXX is being customized as "Treat this Money Market as cash: FDRXX", it does not appear this is currently having any effect on how/what gets mapped in the registry so that CASH gets defined/summed correctly - should it?

1 -

Regarding Problem #4b above, related to the Register cash value being inaccurate even after setting the custom Quicken setting to use the FDRXX security for cash, please read this other post indicating the Cash balance was correctly updated upon running the "Set/Edit" option a second time.

My guess is that this result change is perhaps somehow related to what Fidelity Holdings data values are specifically set to and being downloaded to Quicken Online Center at a given moment in time, but this is just a guess. A developer that knows the details of how they want this to work and the coding is required to analyze/fix.

1 -

Hello All,

Thank you all for adding to this discussion with your comments and concerns. And thank you to those who reached out to the financial institution as well.

For the issue of Fidelity HSA accounts not downloading, please continue to refer to the Announcement. If and when any progress and or changes occur, they will be posted there.

If you are having other issues, please start a new thread for those if you have not already done so, in order to keep the Community and this discussion organized.

I have sent you a direct message. Please navigate to the inbox in the top right-hand corner of the Community page and check your inbox.

Thank you!

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Partial good news:

An OSU today today 1/15 at 4:45 PM Eastern time for two Fidelity HSA accounts returned cash and reinvested dividends from 12/19 and 12/22/25 plus an FDRXX reinvestment from 12/31. These matched to transactions that I had entered manually.

The purchase of FDRXX from the cash dividend was not downloaded. Earlier dividends between 10/3 and 12/22 were not downloaded, but I had entered them manually.

So it appears that Quicken and Fidelity are making progress on supporting HSA downloads again.

QWin Premier subscription0 -

Good news from my end. I just did a One Step Update and it downloaded transactions for my Fidelity HSA going back to 18 December. Now, if we could get all the transactions we missed…

1 -

Now, if we could get all the transactions we missed…

There is no way to know for sure, but I doubt the missing transactions between about 10/3 and 12/22 will be downloaded. If you have not entered them manually already, I think you should do that. If they do eventually download, they should match to the transactions you have entered.

QWin Premier subscription0 -

I updated to Quicken Mac 8.4.2 just now and then did a sync, and a transaction downloaded for my Fidelity HSA for the first time in months, so it seems to be fixed for Mac as well. Like @Jim_Harman I did not get the missing transactions from prior to late December.

0 -

I am still at Windows 11 SW version R65.29. I too can confirm 2 download transactions for my HSA account, dated 12/31 and 1/9, were downloaded with my 17:11 CT download on 1/15. It does not appear a SW update/version change helped with this most recent progress, but rather assuming some sort of data update was done somewhere inline to fix some broken component(s) of this portion of the problem.

@Quicken Alyssa , I replied to your message. Also, can we expect the Announcement to get updated with any sort of partial summary or tech updates are made, such as this 1/15 download transaction progress? I'm hoping transactions continue to fully work, but only time will tell. Also, I wish I could inline edit/update the original post I placed above on 1/13 with detailed summary of those issues(appears I only have 24 hours to edit), as it is difficult to use a single discussion thread to follow/track all these details over time. Is the only alternative way to create yet another separate post? If so, I think I'm going to just stick with this existing post.

At this point in time, it appears issues 1a, 4a, and 4b from my 1/13 post above are at least partially resolved, if not fully. I can't validate this is true for everyone, just for what I alone am seeing right now in early 1/16 with my R65.29 version(but others responses sound promising so far!).

The other stated issues/questions in the above 1-4 list are still outstanding from my perspective. As I mentioned above, it is yet unclear to me if any/all of these specific items are or are not included with this very generic Announcement or anywhere else within the Quicken problem/support tracking system? In my opinion, much improved multi-way transparency and communications is needed between Quicken development/support groups and its end users to get to a more efficient "Quick(en) solution", in particular in response to these large scope end-user problems (including better planning & preparation prior to SW upgrade execution!).

0 -

This is great news! I downloaded this morning and dividends appeared in my HSA account as 12/31/25. No previous transactions were downloaded.

0 -

Hello All,

This issue has been marked as resolved!

If you are still experiencing issues, please contact Quicken Support directly so they can investigate any issues on a case-by-case basis and process escalations if needed.

Thank you!

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Related specifically to 1c above, which I'll restate below(removing the text that downloaded transactions are not working since that in general is working now), is anyone else seeing this problem? To date, this red flag for the Fidelity HSA account has never gone away for me:

1(c) Ever since initially doing the first "Download transactions" for this account in 12/2025, a red flag indicating 'You have 1 transaction to review' has existed next to the Fidelity HSA account name label in Quicken. I don't know what this 'phantom' transaction is referring to, perhaps the single $0.00 entry? How can I permanently get rid of this red flag?

Note that although above screenshot shows count of 3, this count/message generally shows 1, I assume referring to this only one record displayed in Online Center?:

0 -

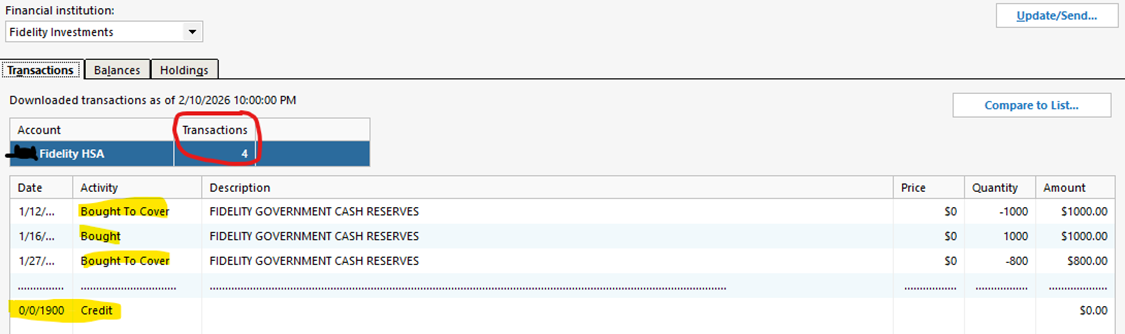

Note that I had what I think are unexpected extraneous (ie, aren't these redundant transactions already accounted for in the register by other types of downloads, such as "Bought", etc….?) downloaded transactions show up for my Fidelity HSA on 2/11. I don't know why these occurred at this time. Further, I don't know why these Cash based (FDRXX) transactions are showing up? For example, shouldn't Quicken filter out these "Bought to Cover"/CvrShrt transactions? I think there may be some missing filtering logic here due to how Fidelity does their cash/FDRXX transactions. Full description is here .

Below is copy of what I saw in Online Center on 2/11. I think "Match" was NOT made for 2 of these 3 transactions in the Register download because correct/already recorded transaction date was 1 business day prior to what these downloaded "Bought to Cover" transactions state. ie, the stated 1/12 transaction date below actually occurred on 1/9 and already in Register as such, and the 1/27 transaction actually occurred on 1/26 and already in Register as such. Note that the correct 1/9 and 1/26 recorded Register transactions are defined as "Bought" Action with # of shares recorded(as desired), NOT this type of "Bought to Cover"/Cash/FDRXX transaction.

0 -

Thank you for adding to this discussion with these additional details.

It looks like you are working on these issues with one of our support agents. I hope they are able to get to the bottom of this issue with you.

Thanks again!

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

@Quicken Alyssa For full disclosure, I have not even discussed this "CvrShrt" issue with Quicken Support and the Quicken Support rep has been minimally responsive, adamant about me providing personal Quicken data to her in order for them to do anything, including just giving me an answer on "what is the application expected/normal behavior?" One other user response on the "CvrShrt" transaction issue was given here .

To be honest, this specific detailed problem("CvrShrt" Fidelity transaction issue) has not been my priority #1. I have yet to get a clear written detail of what actually Quicken Support think is in full scope for the problem incident supposedly open with them (and lacking answers or even suggestions at this point in time), case 12169833.

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 237 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub