Quicken STILL creating bogus opening balance transactions

I found the other discussions of this oddly closed, like it's a verboten topic. But it happened to me yet again yesterday, when one of my credit cards was wildly off, and yet, exactly by the amount of the previous payment when I attempted reconcile. After eliminating a problem on Citi's end, I scrolled back about a month and noticed my credit card balance was strangely positive, and then I remembered to go back to the beginning of time on the account (more than 10 years ago, ahem) and, sure enough, there was the conveniently added opening balance for the exact amount of my payment last month (and not some nice, round figure that you could say was coincidental), all reconciled and ghosted grey.

In reading previous discussions, I found that having to reauthorize an account through the bank/credit card portal seems to be a trigger for these. And I remembered I did have to reauthorize Citi just this week. This needs to be flagged as a known bug and addressed. I have had these pop up about every two years or so, leading to me tearing my hair out trying to reconcile accounts, and then it's just a stupid programming mistake.

Please do not simply close this discussion. Please leave it open for future members to also add their comments until it gets fixed. Otherwise, why are we paying so much for a subscription to use the product?

Thank you.

Quicken Classic Deluxe R65.29, Windows 11 Home

Comments

-

Hello @deliusfan,

Thank you for sharing a detailed account of your experience with this issue. I am happy to hear you were able to resolve it!

You are correct, opening balance transactions being changed/added has been an issue in the past. Currently, this is not a known or widespread issue. As you stated, disconnecting and reconnecting accounts can be/was a trigger for this to occur.

Posts in the Community are closed after 30 days of inactivity. After they are closed, you can still view them, but no new comments can be posted to them. Just wanted to explain this process to eliminate any confusion with that.

A couple of things you can check:

- Where is your data file located?

- You can see this by going to File. The first file listed at the bottom of the menu shows your file pathway/location.

- Is your file being backed up/synced by any third-party services like Dropbox, OneDrive, or Blackblaze?

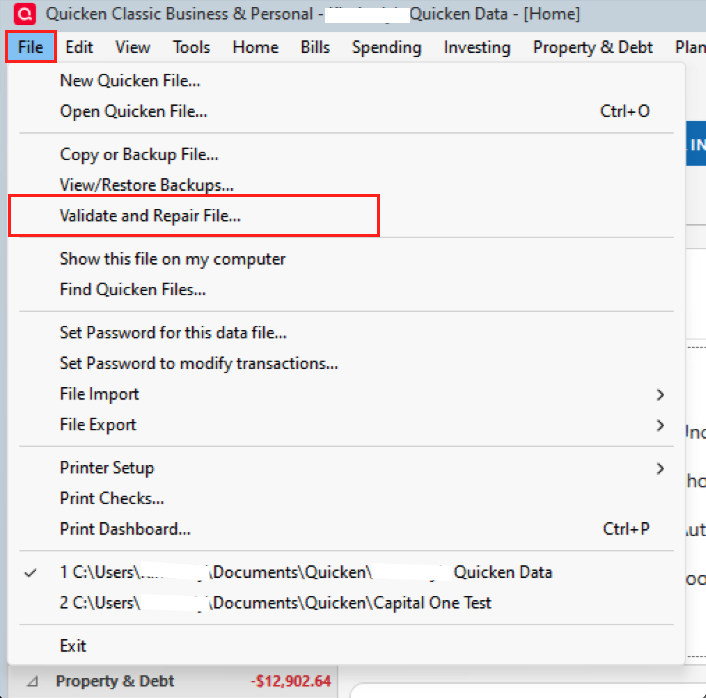

You can also try validating your file to clear up/repair it.

To do this:

- Save a backup.

- Go to File.

- Select Validate and Repair file…

- Check the first box for Validate file.

- Click Ok.

Once the validation has completed, it will produce a report of anything it has found/corrected.

Let us know what you find!

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

1 - Where is your data file located?

-

To my knowledge this problem has never been reported as fixed. It should still be a "known problem".

The problem comes up infrequently and as such has never been something that you can just look at the forum for a few days and say it is fixed.

I certainly wouldn't start mucking with my data file in an attempt to try to fix it.

As for closing of old threads. That doesn't in the least imply that something is fixed. Threads are closed because of the lack of activity for a given period of time.

Signature:

This is my website (ImportQIF is free to use):1 -

@deliusfan As you have probably gathered, the issue of opening balances being changed when reauthorizing or reconnecting accounts has been going on for a long time. There have not been many reports recently, but as you have seen it has not been resolved.

One trick many of us have learned is to add the correct opening balance for each of your accounts as a Memo in the Opening Balance transaction. That way if an account does not reconcile, you can check to see if the opening balance has been changed and correct it if necessary.

QWin Premier subscription1 -

I have the same issue. When I even try to make it $0 another transaction pops up at the old number. Like there is a gremlin in my file!!! I am using the latest Quicken Deluxe and never had this issue in the past until about November of 2025.

0 -

For years, the Costco Anywhere Visa by Citi has been a constant problem in Quicken. Ever since I added Citibank, syncing has never been reliable.

Most recently, Quicken showed my balance about $1,800 higher than Citi’s actual online balance. After investigating, I found that Quicken or Citi is silently inserting balance adjustment transactions at the very beginning of the register. Those bogus adjustments completely corrupt the running balance. As soon as I delete them, the Quicken balance immediately matches Citi’s online balance again.

This makes Citibank by far the most unreliable account I have in Quicken. This is not a new issue. It has been happening for years. There is always something broken with Citi’s online services, and it’s long past time for Quicken and Citi to fix this instead of pushing the cleanup onto users.

0 -

To the best of my knowledge, this is not a problem specific to either Citi or any one other bank.

It's a bug in Quicken which basically applies to any and all banking or credit card account register(s) which happen to have been in need of deactivating / reactivating or reauthorizing.

At that point in time, something somewhere in Quicken sees a need to recalculate the Opening Balance transaction as if the just activated account is/was a newly created empty account register going through its very first transaction download ever and must have an Opening Balance transaction calculated. This should never happen for old accounts being reactivated.0 -

I understand that explanation, but it doesn’t match my real-world experience. I’ve been using Quicken since Microsoft Money was discontinued, and over the years I’ve had to deactivate and reactivate many accounts across multiple banks and credit cards. None of them have ever recalculated or silently altered an existing opening balance like this.

Citibank is the outlier. It’s also the institution with by far the most “will not connect” and forced reauthorization failures, which is exactly what drives users into repeated deactivate/reactivate cycles. If this were truly a generic Quicken bug affecting any bank equally, I would have seen it elsewhere by now. I haven’t.

So even if the underlying bug is in Quicken’s reauthorization logic, Citi’s unstable connection clearly triggers it far more often. The result is a Citi-specific reliability problem in practice, regardless of where the root cause technically lives.

0 -

I have used Quicken since 1992 and I have had a Costco Citi card for at least 10 years probably more. Before it was setup with Direct Connect and when they switched over a year or so ago it was switched to Express Web Connect +. In all that time I think I have encountered the Opening Balance problem like once, maybe twice, and never in the Costco Citi card.

Now back when I was using Direct Connect there were lots of people that didn't understand that if they used Citi Cards for the financial institution instead of Citibank they could use Direct Connect that made it very reliable, instead they ended up using Express Web Connect which was very unreliable. If one had bank accounts with Citibank they did have to use Express Web Connect for those.

The Opening Balance problem is definitely tightly connected to an unreliable connection. It isn't directly connected to a given financial institution.

To understand why this is the case one needs to ask why Quicken is changing the opening balance in the first place. Imagine you setup a new account with a connection to a financial institution and they send 90 days of transactions, but the real account is older than 90 days. When that information is downloaded besides the transactions Quicken gets the online balance. Quicken uses that balance to back calculate the opening balance and put in that transaction so that you start with the right opening balance to account for the missing transactions that are older than 90 days.

So, if Quicken thinks this is a "new account" it is going to do this back calculation and change the opening balance. And from the discussions on here and my few experiences with it, resetting or re-adding the account seems to trigger this, but not on every reset/re-add for some reason. But for sure as the number of times you have to do this in an account, the more likely you will encounter it.

Signature:

This is my website (ImportQIF is free to use):1 -

I understand what you’re describing, but in real use Citi is still the outlier. Citi connections fail and force resets far more often than any other institution I use, which means Citi accounts are repeatedly pushed into the exact conditions that trigger this opening balance bug. Other banks don’t do that, so the issue rarely surfaces elsewhere. Whether the root cause is Quicken’s logic or Citi’s connection is almost beside the point, the combined behavior makes Citi accounts uniquely unreliable in practice.

0

Categories

- All Categories

- 48 Product Ideas

- 34 Announcements

- 248 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.5K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 124 Quicken LifeHub