Problem with setting up a GIC account and having it fall within "Investing" - not 'Saving

Douggie

Quicken Canada 2016 Member ✭✭

https://community.quicken.com/discussion/7888556/investing-type-of-accounts-on-the-left-no-longer-useable

My only options in Quicken Deluxe (Canada) are: Spending, Savings & Asset.

Quicken Premier (US) options are more useful: Spending, Savings, Investment, Retirement & Asset.

My only options in Quicken Deluxe (Canada) are: Spending, Savings & Asset.

Quicken Premier (US) options are more useful: Spending, Savings, Investment, Retirement & Asset.

0

Answers

-

Hello @Douggie,

Thank you for contacting the Quicken Community, though I do apologize that you are experiencing this issue.

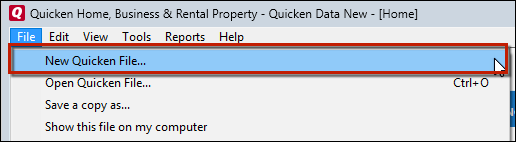

First, I suggest creating a test file and adding the GIC account to see if it produces the same issue as being a Savings account rather than an investment account within Quicken. It is recommended to save a backup before proceeding with troubleshooting steps in the event that you would like to return to your original starting position. Below are instructions on how to create a test file:- Choose File menu > New Quicken File.

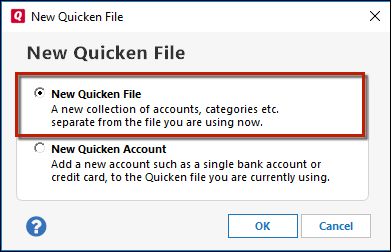

- Select New Quicken File.

- Click OK.

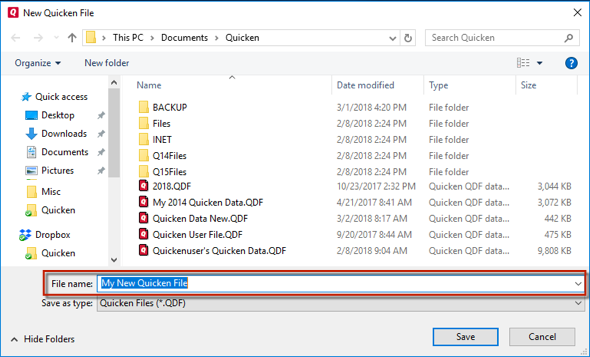

- In the File name field, enter the name of the new file, then click Save. Use a name like "Test File" to tell it apart from your main file.

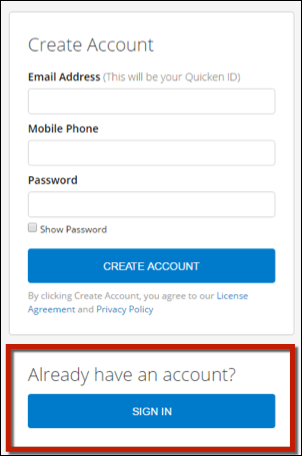

Don't use any of these characters: * ? < > | " : \ / (asterisk, question mark, left and right-angle bracket, pipe, straight quotation marks, colon, BACKSLASH, FORWARD SLASH). Also, don't add the .qdf extension; Quicken does that for you.- Sign in with your Quicken ID. If you are prompted to create a Quicken ID but already have one, click Sign In under the Create Account prompt.

- Select to not use Mobile.

- Click Add Account to start adding accounts to the new file.

After adding accounts, see if you are experiencing the same problems in this test file.

Please let me know how this goes, I look forward to hearing your response.

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

Were these GIC accounts originally created as Account Type = Savings accounts and then moved to the Investing area with Account Intent = Investing?Just a shot in the dark, but it looks to me as if dragging the US file across the border into the Canadian version uncovered some kind of incompatibility (bug?).

If this was my data file, I'd bite the bullet and leave the accounts where they are. Not perfect, but the only alternative I can think of would be to create new investment accounts, new securities and new transactions to "buy" shares with the funds in the old GIC accounts. I'd leave it alone, it's ugly, but it works.In a perfect world, a programmer would now step up and say "I'm gonna take a look at the Canadian version and see if I can fix this" ... in a perfect world ...0 -

Just to clarify, I have never used the US version -- my GIC accounts were originally set up in an old (20016?) desktop version of Quicken, but when I bought a new computer this year I moved to the "subscription model" of Quicken -- which has been reworked, upgraded etc. I think Quicken now perhaps treats account classifications or how accounts display differently?0

-

> @"Quicken Jasmine" said:

> Hello @Douggie,

>

> Thank you for contacting the Quicken Community, though I do apologize that you are experiencing this issue.

>

> First, I suggest creating a test file and adding the GIC account to see if it produces the same issue as being a Savings account rather than an investment account within Quicken.

Yes, same problem when I try to start from scratch.

In the past, I have used a "saving" or "chequing" account type account for my GIC accounts as that best matches how they function (a CIC is a term deposit, with interest received once a year). In the past, these accounts could be assigned to display under "Investing", since these are for large amounts of money and are not for day to day "spending" use.

Now however, I cannot chose to have these accounts grouped or displayed under "Investing". Edit Account Details >> Display Options only allows me to chose between 3 options: Spending, Saving or Asset.

Choosing either Spending or Saving causes the accounts to be grouped and displayed under "Banking"; choosing Asset causes the account to be displayed under "Property & Debt".

What I would like to do, and what I used to be able to do with earlier versions of Quicken, is have a "saving" or "chequing" account type account for my GIC display under "Investing".

The only types of account that the current version of Quicken allows in this "Investing" category seem to be brokerage accounts, which is an account format not well suited for a GIC (a GIC does not have securities to track etc.).

Perhaps this is something that the coders could reinstate in a future version.0 -

As someone else wrote in the original post that I cited with the same problem, it seems that the US version of Quicken seems to offer accounts to be grouped and displayed as either: Spending, Savings, Investment, Retirement & Asset. The Canadian version has fewer options, for reasons unknown.0

-

Hello @Douggie,

Thank you for attempting the test file and for providing more information.

Due to the same issue occurring within your active data file and the test file, you will need to contact your financial institution for further assistance as this means that there is an error with the way that their servers are sending the data over to Quicken. I do suggest requesting to speak to a tier 2 representative or a supervisor as they are generally more familiar with third-party applications such as Quicken.

I do apologize for any inconvenience that this may cause.-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

I think you are miss-understanding the issue Jasmine -- I am not creating these accounts with any linkages to my financial institutions. This is solely a Quicken issue, whereby Quicken limits how an account can be grouped and displayed. As I noted earlier, perhaps the US version offers greater flexibility. Not sure why the Canadian version would be crippled.0

-

Hello @Douggie,

Thank you for further explaining the situation.

We recommend that you contact Quicken Support directly for further assistance as they can walk you through troubleshooting steps in real-time and provide functions such as screen share.

The Quicken Support phone number can be found through this link here. Phone support is available from 5:00am PT to 5:00pm PT, Monday through Friday.

I do apologize that I could not be of more assistance.-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0

This discussion has been closed.

Categories

- All Categories

- 56 Product Ideas

- 36 Announcements

- 225 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 703 Welcome to the Community!

- 671 Before you Buy

- 1.2K Product Ideas

- 53.7K Quicken Classic for Windows

- 16.3K Quicken Classic for Mac

- 1K Quicken Mobile

- 812 Quicken on the Web

- 111 Quicken LifeHub