How to setup Social Security Payments

I'm about to start receiving retirement benefits. I've been reading the discussions which all seem to recommend setting these up as a split income reminder. Is there a reason not to set it up as a paycheck? Why or why not? That's what it feels like.

Comments

-

A "paycheck" txn is nothing more than a fancy front end for a split txn. Do what works for you.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

There have been reports of paycheck data becoming corrupted. Do a search in this forum on "paycheck corrupted" to see them.

It is probably safer to use a plain old split transaction.

Quicken user since version 2 for DOS, as of 2025 using QWin Premier (US) on Win10 Pro & Win11 Pro on 2 PCs.

1 -

Interesting… I've never had a problem with a paycheck in all the years (version 2 for DOS) I've been using this. Other problems, yes, but not that. I think I'll set it up as a paycheck and see what happens. Won't be hard to roll that back a couple of transactions.

0 -

I think I'll set it up as a paycheck and see what happens. Won't be hard to roll that back a couple of transactions.

The current issue with paycheck corruption sometimes results in years-old paychecks losing data. Then you'll have more than a couple of transactions to repair. I wouldn't risk it. A normal split handles SS just fine.

Quicken user since version 2 for DOS, as of 2025 using QWin Premier (US) on Win10 Pro & Win11 Pro on 2 PCs.

1 -

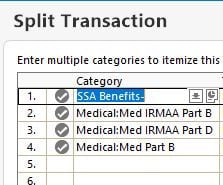

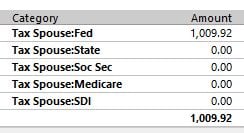

Given that in general social security checks splits are quite simple and "custom" to begin with it actually seem like the paycheck wizard is the wrong tool for the job. Now when you have a 401K contribution where Quicken does some hidden splits to hide the employer contributions from the taxes and such, it makes more sense, but not for something as simple as this, which aren't even defaults on the paycheck reminder:

Signature:

This is my website (ImportQIF is free to use):0 -

you probably have a point. There is also the tax withholding.

0 -

what kind of Retirement Bene….. SSA or some other pension - or even IRA RMD -

either way, I would set it up as a plain split transaction -

and make sure that each line item has the appropriate Category either by default,

or a new one you created to capture the correctly associated Category / Tax Line Item -Here is one - like @Chris_QPW above - but with extra lines for the extra added IRMAA charges of SSA -

Lastly…. for a simple education/teaching pension -

with nothing other than Fed taxes,

it is a simple 2 liner Pay Wizard … Gross + Fed0 -

Yes, it's just SSA retirement. Thanks for the feedback and suggestions.

0 -

Here is an issue I discoverd with using a memorized transaction rather than a paycheck. I get the SS retirement check on the 4th Wednesday of every month. I can set that up with a paycheck, but a split income reminder only gives me the option to choose a specific date. The date of the payment will vary each month. Am I missing an option?

Here's the paycheck option

Thanks

R

0 -

The trick with the reminder is to choose 1, 2, 3, or 4 as the day. The number chosen then becomes the week number. Try entering 4 as the day instead of 26.

Quicken user since Q1999. Currently using QW2017.

Questions? Check out the Quicken Windows FAQ list1 -

thanks

0

Categories

- All Categories

- 52 Product Ideas

- 35 Announcements

- 237 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 508 Welcome to the Community!

- 677 Before you Buy

- 1.4K Product Ideas

- 55.1K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 122 Quicken LifeHub