Checking reconciled. linked transfers making a mess

Decades experience with Quicken. Worked well until Quicken was sold off to separate company.

Since then, Years of corrupted databases from fouled downloads and mixed up transfers. Bank personnel managing Quicken downloads has been empty slot or "trainee" position. This has left me Repeatedly rebuilding the database, even converting from a years worth of statements to extract transactions, and converting for import, because the bank limited downloads to 30 or 60 days. No more.

Now have again rebuilt, a year of checking account, and reconciled every transaction all year.

Next want to use downloaded transactions in Qfx format, to import credit card transactions. These will include payments pulled from Checking.

How do I do this without corrupting the reconciled Checking account?

Familiar with download transfer preference settings, but they don't answer this question. It's a different operation when you import a year at a time.

(Corrected reference to QFX, not OFX)

Comments

-

Complaint by OP. Nothing actionable.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

Hello @20yearsQ,

Thank you for sharing your experience. If I'm understanding correctly, you're wanting to find out if there is a way to prevent Quicken from seeing the transfers in the file you want to import and creating the other half of those transfers in the checking account? If that is correct, one option would be editing the category for the potential problem transactions in the file you want to import so that Quicken won't see it as a transfer (and won't add the unwanted other half of the transfer into the Checking account). Note - Quicken does not officially support imports using OFX format. Please see this article for information on what file types can be imported into Quicken:

If you've already imported and it created a mess by adding transfer transactions to other accounts, you can clean it up by changing the category for the problem transactions in the imported account. Considering that you said you're importing a year's worth of transactions, it might be easier to use the Find/Replace tool to find and edit the transactions in bulk.

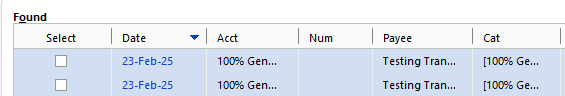

You can use the Find part to locate the incorrect transfers, as they show in the account you imported. Make sure only the incorrect transfers are selected, then set the Replace to change the category to a transfer back into the same account or to another suitable category. The screenshot below is from when I tested it in my Quicken.

Setting it to a transfer back into the same account will cause Quicken to remove the other half of the transfers that it automatically created, while still maintaining documentation in your recently imported account that a transfer happened. Choosing another suitable category should work similarly, since it should still prompt Quicken to remove the automatically created transfer transactions in the other account(s).

It is strongly recommended to backup your Quicken file prior to doing the import and make another backup prior to doing any major editing.

I hope this helps!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

1 -

My mistake. I am using QFX files, not OFX.

Can't say I am in love with importing a year, and then searching for transfers and manually changing Category to a category instead of a transfer.

If I change the category on the reconciled checking account, to a transfer to the new credit card account , and then import, will the import match these?

0 -

@20yearsQ You indicated you had made all the checking account entries for the year, but you did not indicate what you did for the CC payments from the checking account. Basically, two options there.

- Assign a generic category like 'CC Payment', or

- Assign a transfer category like [Visa 4321].

So the first question is whether you WANT the two transactions as independent transactions or do you want them as linked transfers. For most users, the linked transfers are preferred.

For the first case, the QFX import should just bring in those payments received as independent transactions. But if you have the Quicken preferences to perform transfer detection, it MAY identify the the same amount on the close to same date may be a transfer between the accounts. If it gets it right, you should be fine. (I personally do not choose that preference.)

For the second case, your Quicken cc account already exists and already has those transactions in it. When the QFX import brings in new transactions, the program SHOULD see that those new entries are matches for the existing entries (even though the date may be off by a day). You then get the option to accept the match or not.

As an old school Quicken user, I also opt not to let Quicken do things like auto-enter transactions or auto assign categories. I prefer to review and accept giving me (IMO) better understanding of what is in the records. YMMV.

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 237 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 122 Quicken LifeHub