Tax Planner "_401Contrib" category doesn't include 457 contribution [edited]

The paycheck wizard use of the hidden _401Contrib category system does not capture more than one tax deferred contribution to retirement accounts. This failure makes the Tax Planner fail to account for tax deferred contributions and thus fails to estimate taxes properly.

For example, I contribute to 403(b) and 457 accounts. The tax planner handles the _401Contrib for the 403(b) account but not the second, 457, account. Others have noted this in the past:

The workaround is to pretend to edit each contribution that is missing from the tax planner. When the unchanged item is saved, Quicken asks if it was an "Employee Contribution".

Can we get this fixed?

Thank you.

Comments

-

Hello @Michael Sayre,

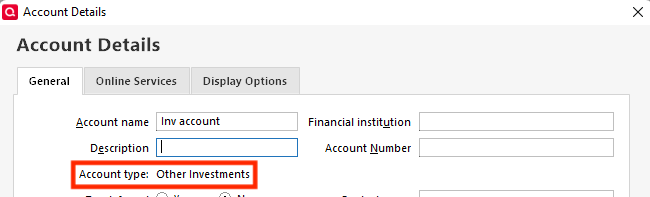

Thank you for bringing this issue to our attention. To clarify, what account type is the 457 account in your Quicken? To check that, navigate to Tools>Account List, then click the Edit button next to the 457 account. On the General tab, just below the Account name and Description fields, it should display Account type.

I look forward to your response!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

@Quicken Kristina the account type is "401k or 403(b)".

Michael

0 -

I just noticed in the Tax Planner that the 457 contributions handled differently within the Wages page. After the manual adjustments mentioned in the earlier post, the Details section shows the correct values for Actual YTD, projected amount, and the Annual total. However, the "Wages and Salaries - Self" total still includes the 457 contributions as income. This error causes the total tax due calculations to be quite incorrect.

Michael

0 -

Adding a 1 dollar value to the adjustment column in the Details section causes the total for "Wages and Salaries - Self" to recalculate (after changing the focus to a different child window like "Wages and Salaries - Self (Other)" and back again).

The code underneath the Tax Planner seems pretty finnicky.

M

0 -

@Michael Sayre To be clear, this issue is with the Tax Planner, not the Tax Summary Report as indicated by your title, right? Or is it both?

If it is just the Tax Planner, I will change the title so it more clearly describes the issue.

QWin Premier subscription0 -

Thank you for your replies,

You mentioned that putting in a value forces it to recalculate. Does that correct the issue permanently, or does the problem come back next time you open your Tax Planner or Quicken program?

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Sorry for the delay in responding. The issue is with the Tax Planner. I have not used the Tax Summary Report so do not know if the issue is also present there.

@Quicken Kristina, the issue comes back the next time I open the Quicken program and the next time I open the Tax Planner.

0 -

OK, thanks for clarifying, I have edited the title.

QWin Premier subscription0