Unable to import Target Red Card transactions via OFX, QFX, or CSV

Comments

-

If the categories are not present in those transactions then they are gone so there is nothing to recover.

One option you might want to consider: Backup your data file and then restore a recent backup file (dated from just before when you got your download connection fixed). Yes, you will need to go through the download reconnection process, again, but all of your transactions should still have the categories. It might save you a whole lot of work. If it doesn't fix the issue, then you can restore the backup file you created at the beginning of this process.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

I have been able to download my Target MC transactions without issue. However, I have to go through 2 factor authentication. When I start automatic downloads for all my accounts, I get a popup asking where the authorization code should be sent to- email, text etc. I tell it to send an email. The another popup opens asking for the code. I enter the code, and all my transactions are downloaded. This is the same whether I'm on windows or MAC.

0 -

I have a handful of accounts that ask for MFA on Quicken download. I turn those off for automatic, and download those manually once a week.

0 -

is there a way to turn off MfA for Target downloads.

0 -

Hello @Liz Renninger,

Unfortunately, the financial institution decides if an how often multi factor authentication is required. You might be able to reduce or remove it by adjusting settings on the financial institution website.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

even with the 2FA, the downloaded transactions have stopped again. My last download was April 25 2025. I have had two recent transactions - one on May 11 and another on May 17. Not sure if others are experiencing this new hiccup in downloading transactions.

1 -

Hello All,

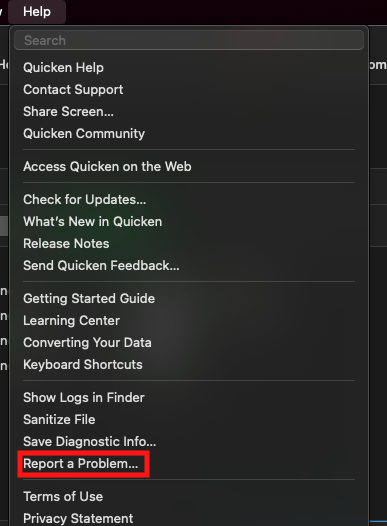

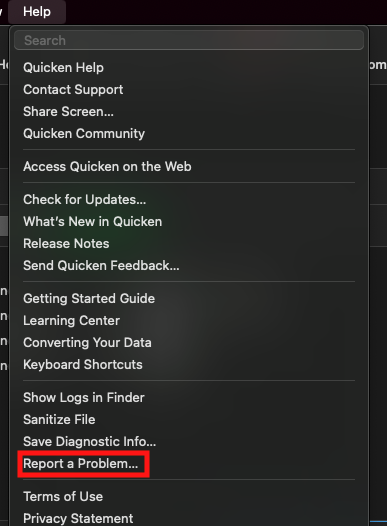

The team that is working on the issue needs to see the QFX file, as it is coming from the financial institution, in order to further investigate this issue. Please navigate to Help>Report a Problem and attach one of the problem QFX files you have downloaded from the financial institution to the problem report.

Please note that problem reports are limited to 10 attachments. If there are already 10 attachments selected, please unselect one to make room for the QFX file. Please let me know when you've sent the problem report, so I can forward the information to our team!

Thank you!

(CTP-13044)

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

File sent. Had to append a .txt extension onto the QFX file for the "report a problem" to find the file. Also attached image with the error message.

1 -

I'm also have the same issues. In Feb or March Target Red Card (after being down for some huge update on the Target Red Card site) did download some information into my account. Mac. I don't remember exactly what it said but strange information added to the Payee column and blank amounts for the most part. I also have tried going to the Target website and downloading the QFX and it does show an error "Download Unavailable!" this FI is inactive, we cannot connect." Hope this helps! It is frustrating.

1 -

Hello @LMSCHWEBER,

Thank you for letting us know you're also encountering this issue. I moved your post to the QMac thread on this issue.

The issue with QFX has already been reported in ticket CTP-13044. If you would like to contribute to the investigation, please navigate to Help>Report a Problem and send a problem report with log files and a copy of one of the problem QFX files attached.

Note - Problem reports are limited to 10 attachments. If you need to include more than 10 attachments, you can unselect any log file with "old" in the filename, or you can send a 2nd problem report with the additional attachments.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0

Categories

- All Categories

- 58 Product Ideas

- 34 Announcements

- 238 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 512 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub