Tax category

Is there a way to exclude Tax (mainly refunds) from the Spending report? it's skewing my month spending report and budgetting. thanks

Comments

-

Please give us an example or two of these kinds of transactions, what's causing them, how are you entering them?

Can you please capture one or more images of the parts of your Quicken window showing the issue, sensitive information blacked out as necessary to protect your privacy but annotated to describe the situation, and attach the image(s) here?

How do I post a screenshot in the community from a macHow do I post a screenshot in the community from windows

Please save images to files of file type PNG or JPG only. They're easier to work with than PDF files.

0 -

If you're talking about and Income type tax (vs. Real Estate or Sales), then I have a Category called "Prior Year Tax", which has 2 sub-cats … State & Federal.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

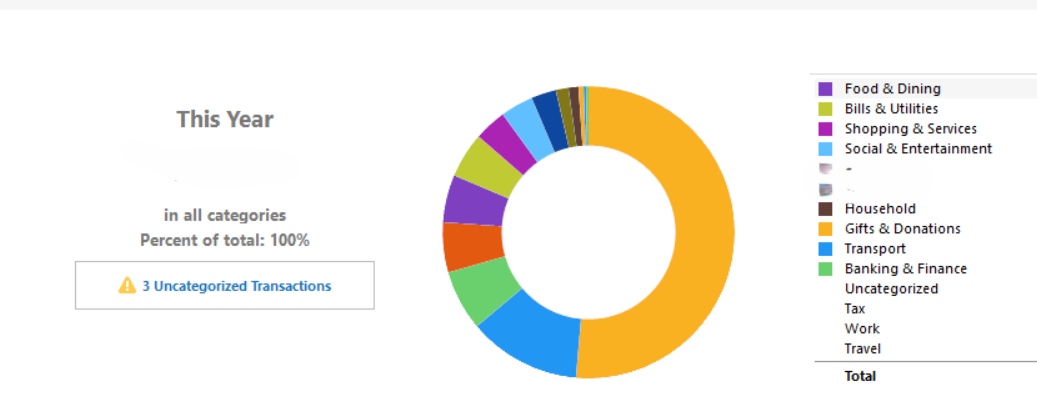

so typically, my tax refund is pulled from my checking account, and recorded as a positive number (i.e. adding to my checking account balance)

but by doing so, in the Spending tab, my march spending is offset by this big tax refund, so it appears that my march spending was much less. is there a way to not have the annual tax refund be included?

hope this is clear

0 -

Clear as mud …

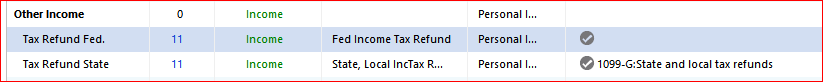

Thanks for the images.

How about you use Income categories for your Tax Refunds instead?This way, you wouldn't have the refunds showing up as negative Expense.

1

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub