Issue with Merrill Lynch account since reauthorization - account balance is wrong [Edited]

Comments

-

@MELCO Question: You say it isn't that easy. But does it include doing what I suggested? I didn't mean to suggest that that would be all that was involved.

Sounds like the bulk of this particular problem preceded the switch to EWC+. The downloading of pending purchases and sales that came with EWC+ may have aggravated it but it did not create it. I would think that you want the date of the transaction for purchases and sales in Quicken to be the settlement date rather than the trade date and what we are getting now and before the switch to EWC+ is the trade date. Such a change would probably have some interesting ripple effects. There may be other non-EWC+ related and, maybe, some other EWC+ related changes you'd like to see to completely solve this problem. But shouldn't that be another thread?

Note: I have only one dividend reinvestment going on in my ML accounts. The dividend is paid quarterly. For at least the last year, the trade/settlement dates of all 3 transactions that appear on the LM website (Translated pre-EWC+ to Div, Add, Withdraw in Quicken) to cover a dividend reinvestment are the same day. Lucky me. But, in solving the whole problem, we probably should go back to the 3 transactions in Quicken we got pre-EWC+ so that the dividend and purchase can be in different months (years) if necessary. Also note that Ameriprise, which is on Direct Connect, uses ReinDiv.

Jim

0 -

@jdparker225 I didn't put my head to your scenario, so I'm not sure. If I understood it correctly, I'm not sure that resolves the issue. Personally, I update just about every day given all of the accounts and transactions I manage in Quicken. This keeps my daily Quicken process manageable.

For me, and I would suspect most everyone else, in the end, Direct Connect is now in the past and so everything needs to be related to EWC+ for which is Quicken's current solution. We can't even download transactions manually via Merrill Lynch anymore. I've accepted this. I just want the correct data downloaded, with the correct dates and matching the information on the Merrill Lynch web site and official Merrill Lynch statements. I want my Quicken life simplified, not added in work and complexity, and that is what I am currently getting today. With few exceptions, specifically related to Merrill Lynch, I have to touch every transaction and rarely can I just accept the downloaded transactions with confidence. I'm not saying that Direct Connect was perfect either, via Merrill Lynch, but I did trust the data and categorizations. Quicken's recent adjustments did help with some Merrill Lynch transactions, for which I am thankfully. Quicken should understand basic accounting rules for which they need to follow as well. Hopefully we get there.

Merry Christmas, Happy Hanukah and Happy Holidays…

MEL0 -

I've had many of the same issues mention earlier, but I have not seen any discussion on how the reporting of Mortgaged-Backed Securities (Freddie Mac and Fannie May Bonds) have changed with the switch to EWC+.

Sorry for such a long post, but I wanted to provide all the detail in a single post. I hope that the sectioning helps. The Mortgage-Back Securities Issues and Summary sections are the most relevant to the issue(s) at hand.

Background

This transition from direct connect to EWC+ has been very frustrating and the fixes/improvements slow to come. I have 2 different Quicken files (on for my accounts, and one for my wife’s and a joint BofA checking account). I have a mix of IRA (Roth and traditional) and taxable investment (managed and self-directed) accounts. I have mix of stocks, bonds and cash. Each of the managed ML accounts have hundreds of transactions per month. I’m running the up-to-date version of Quicken Classic for Windows.

After a few attempts, starting back in August, and reverting to back up copies and Direct Connect, I called the Quicken help desk in October. I spent just under an hour updating one of my files to the new EWC+ connection method and manually correcting several of the transactions. In the end I reverted back to my previous Direct Connect file and did updates via the file downloaded from the Merrill Lynch website until they stopped that option. I finally switch my wife’s/joint account file to the EWC+ process in early December. It went much better than my earlier attempts, but still have several issues. Even with my cautious approach, I have spent many hours trying to make this transition to EWC+ work.

Because of the issues I have postponed using EWC+ on my larger Quicken file, and have went without updates for 2 1/2 months. It took hours of manual updates to my smaller Quicken file and I still have issues with the reporting of my mortgaged-backed securities.

Mortgaged-Backed Securities Issues:

Both of my Quicken files have several Mortgaged-Backed Securities; Freddie Mac (FHLMC) bonds and Fannie May (FNMA) bonds. These bonds pay “Interest” each month as well as a “Principal Payment” each month. The monthly interest payments come in as an interest income “IntInc” transaction and I don’t see any change with EWC+. The problem(s) is(are) with the monthly “Principal Payments”. Note that 1 bond is handled as 10 shares in Quicken (see discussion links at bottom of this post).

In the past (Direct Connect) the Principal Payments would come in as an Interest Income “IntInc” and the memo field would have something like “Principal Payment: FNMA PMA5635 03 50%2055 AMORTIZED FCR .9”. This is technically incorrect, at the Principal Payment is not interest and not taxable. It is the principal paid and should be imported as a Return of Capital (RtnCap). I use to go back and manually correct these entries. Years ago, Merrill Lynch would reduce the shares (reported to Quicken) of the bond by a fractional amount each month to account for these principal payments. More recently, Merrill Lynch would only reduce the share by a whole number every few months. Note, that in the statements, Merrill Lynch would always show the original number of shares, but the “Adjusted/Total Cost Basis” would change each month to account for the return of capital. The problems were that principal payments were categorized at interest income (corrected by changing the transaction to “RtnCap”) and manually removing shares (Removed) to reconcile the share balance in Quicken to that reported by Merrill Lynch. A little time consuming, but that market value would be close to that of the Merrill Lynch statement of online value.

Currently (EWC+) the Principal Payments come in as a deposit “Deposit” and the “Category” field is blank. The name of the bond is included (I believe in the Memo field). My manual (time consuming) correction is to change the deposit to a return of capital (RtnCap) and select the corresponding security name (it is not carried forward from the deposit). In addition to having all of these uncategorized transactions, is that: Merrill Lynch is reporting to Quicken the original number of shares (no need to manual remove shares), but the market value of the bond calculated by Quicken (using the original number of shares purchased) can be way off. I think that Quicken could easily correct this by calculating the Market Value by using the market price times the (original) number of shares times the “pool factor” (identified by “AMORTIZED FACTOR” in the ML statements). This may require Quicken to add a new import field (pool factor or amortized factor). The factor would default to 1 for stocks and mutual funds. Note that the "pool factor" or "amortized factor" changes each month and is based on how much principal is paid by the individual loan holders; see the related bond discussions at the end of this post.

Miscellaneous:

The one benefit is that dividend reinvestments now come in as a single “ReinvDiv” transaction instead of 3 separate transactions (Div, Added, & Withdraw).

When it comes to Advisory Fees, in the past the Payee was “Advisory Program Fee” with the memo field “INV. ADVISORY FEE <mth>”. With EWC+, the Payee is “INV. ADVISORY FEE <mth>” and the memo field is blank. Since Quicken keeps track of past Payee’s, it seems inefficient to have the month included in the Payee name, instead of just having it in the memo field. When I click on the drop-down arrow next to Payee field, I will have one screen full of various “INV. ADVISORY FEE <mth>”. I wish that the memo field was populated as before. This is likely a Merrill Lynch issue (or Quicken communicating to Merrill Lynch issue).

Summary:

The problems with mortgage-backed securities have been known and documented for many years. My request to Quicken is to include the Pool Factor or Amortized Factor when calculating mortgage-backed securities like Freddie Mac (FHLMC) bonds and Fannie May (FNMA) bonds. Additionally, and likely easier to implement is to import the Principal Payments from Merrill Lynch as Return of Capital “RtnCap” transactions. (I believe that I read in another discussion that is the case on the MAC version and for a different financial institution.) This may require coordination with or changes by Merrill Lynch. It would also be great if the memo field would be populated again and the other open issues documented in this discussion be resolved.

Related Bond discussions:

1 -

@DrAl Excellent post. Thank you.

I don't use Mortgage-Backed Securities, but your frustration echoes mine for so many things I have reported, post EWC+, for which has exposed them, besides your Mortgage-Backed Securities issues. Quicken doesn't even use the settlement date for buy and sells, they use the trade date, for which is not correct, because a sale is not complete until the trade settles and ownership transfers. I'm finally realizing that this has been a historic issue, the difference for me is that I never received pending transactions until EWC+, and I assumed, incorrectly, that they were using the settlement date when the transaction did download, and now I am realizing that they still used the trade date. Quicken is "a comprehensive personal finance management and small business accounting software that helps users track spending, create budgets, manage investments, pay bills, and monitor overall financial health". You would think they would be using standard accounting principles for their software. This is what I pay for. Apparently, this is not the case, and I'm glad I haven't been burnt with inaccurate financial data sent to my accountant and tax preparer, especially related to buy and sell transaction dates.

For me, the amount of additional work, and manual corrections, with the transition from Merrill Lynch Direct Connect to EWC+ is unacceptable. I can't believe thorough testing was done before the forced cutover, given the feedback on this thread alone.

MEL0 -

One of the things I've been waiting for is to see how my one ML ReinvDiv works with EWC+. Well, it did work but it was interesting. There still are three transactions on the ML website: Dividend, Reinvestment Program, and Reinvestment Share(s) that used to get translated by Quicken under Direct Connect to, respectively, Dividend, Withdraw, and Add. All three have the same trade and settlement dates (in this case 12/30/2025). However only the Dividend and Reinvestment Program transactions appeared on the site yesterday and they were pending all day through 8:00PM EST. These did not download because they were pending. I checked repeatedly all day. This morning about 5:00AM EST the third transaction, Reinvestment Share(s), appeared but with yesterday's date. None of them were pending and the download combined the three into a ReinvDiv.

So it appears that ML timed the appearance of the three transactions so that the download of Reinvestment Share(s) wouldn't appear on the website as pending and be dowloaded as pending like Bought and Sold transactions are.

As I said: Interesting.

Jim

1 -

@jdparker225 Yes, that's interesting and sounds about right to me. I don't get very many reinvestment transactions so I can't contribute much, but, I do have one situation that I wonder how the steps you describe would be handled by the new EWC+. In my one case, a dividend was declared and instead of buying full and fractional shares to use up the entire div, this holding only allowed full shares to be reinvested leaving the remaining balance in cash. I tried to manually enter all of that into one ReinvDiv trx, but couldn't figure out how to do it - there wasn't a place for the remaining cash. I wound up splitting it into two trx - a ReinvDiv and a Div for the reminder.

0 -

Have you simply tried OSU to see how EWC+ handles it rather than entering it by hand? Backup your file, do OSU for ML only, see what happens, restore backup if you don't like what it does. Or do you not hot have that holding anymore?

As far as not contributing much: As I said in my post, I have only one ReinvDiv in my ML portfolio and it does allow fractional shares.

Jim

0 -

FYI…from another Quicken support forum post:

ONGOING 12/30/25 Bank of America/Merrill Lynch - Cut-Over Migration

Quicken AlyssaQuicken Windows Subscription Moderator modDecember 30ONGOING 12/30/25This issue remains ongoing, and our teams continue to work toward a solution. No ETA or further details are available at this time, and this Alert will be updated once more information, updates, etc become available.We apologize for any inconvenience and appreciate your patience.Thank you!MEL0 -

@jdparker225 Sorry, I wasn't clear - the steps I described were with EWC+, but before the latest fixes. I did the manual cleanup after the download. I don't recall exactly how it looked after the download and before the cleanup. I just know it wasn't right. I still don't see a way for the ReinvDiv trx in Quicken to handle leftover cash div.

0 -

@WoodCountry OK, got it.

There is another thing interesting: the ReinvDiv transaction has the per share cost basis of the acquired shares. The old way, under Direct Connect, (Div, Add, Withdraw) did not. It didn't matter to me because the security in question is in an IRA. You can figure out the cost basis per share (Amount in Withdraw or Div divided by number of a shares in Add), but it is not explicitly there.

Jim

0 -

Is there an explicit list of EWC+ issues Quicken is working on? For me, the things I have encountered have been fixed. Whoopee! Lucky me. But I know that there are thngs that others have encountered that haven't been fixed. I wonder how the list of things Quicken is working on matches the list of things that others have encountered.

0 -

I've only seen what you've described with one particular fund, a Fidelity MM fund in one of my ML accounts. It's an ML thing that happened with DC and has continued with EWC+. I can see the whole dollar reinvests only on the ML site, so, in my case, Q is doing exactly what it's expected to

I get a lot of reinvest txns, especially at this time of the year. For the most part, I've found what you've written is true, but there have been a couple of exceptions where the div txn is sent before the reinvest. In this case, there is no reinv txn created in Q and I need to do it manually by adjusting the Buy that eventually comes down. I've seen it with 2 securities so far this month. The first is VGIT, for which it happens every month and has done so under DC as well. The second is VOO, which worked correctly under DC. In both cases, the reinvest txn (the $0.00 txn on the ML site) did not appear on the ML site for several days after the other two, so this is probably a Vanguard and/or ML thing that eventually becomes a Quicken thing.

0 -

My Quicken Merrill Lynch EWC+ experience downloading the last of the 2025 transactions on 1/1/26. Still much work to do on Quicken's part.

I am still getting pending buy and sell transactions...recorded as the trade date, not the settlement date. Pending Sales on 12/31/25 that will not settle until 1/2/26. The Merrill Lynch web site has a placeholder for the unsettled trades, but I suspect, as with years past of Direct Connect downloads, the official Merrill Lynch Statement will not show the sale in 2025, but it will on my January 2026 statement when it officially settles.

Many of my Cash Account interest transactions are downloading as "Interest" not as "Reinvestment Interest".

I have various reinvested Dividends paid on 12/31/25 but dividends not settled yet, most likely in 2026. The dividend is issued, and the money is deducted, but the shares are not recorded as it waits to settle. This will also not match the official Merrill Lynch statement. So, what I have done in years past is wait for all the information on the reinvestment, recorded it as a reinvestment with the proper shares, then remove the shares on 12/31/25 and re-add them in 2026. This will match the official Merrill Lynch statement.

I am still getting no Memo fields.

All this requires manual review and manual re-entry on my part... About an hour this morning.

Happy New Year.

MEL0 -

This is a bit off topic. I justify it because I never would have noticed this had this topic not have come up. There are two questions below.

Prior to EWC+, my ReinvDiv transactions (in an IRA account that has stock in my former employer) were recorded as a (Div, Add, Withdraw) triplet of transactions. Well, I was looking at those transactions and noticed that the Withdraw transactions all had category of Div Income except one which had a category of Pension and two which had a category of Salary. The stock involved is the same payee as my former employer which used to pay my salary and currently pays me a pension.

But what caused the category of these Withdraws to be what they are? (Question 1 - but there's more on this below.)

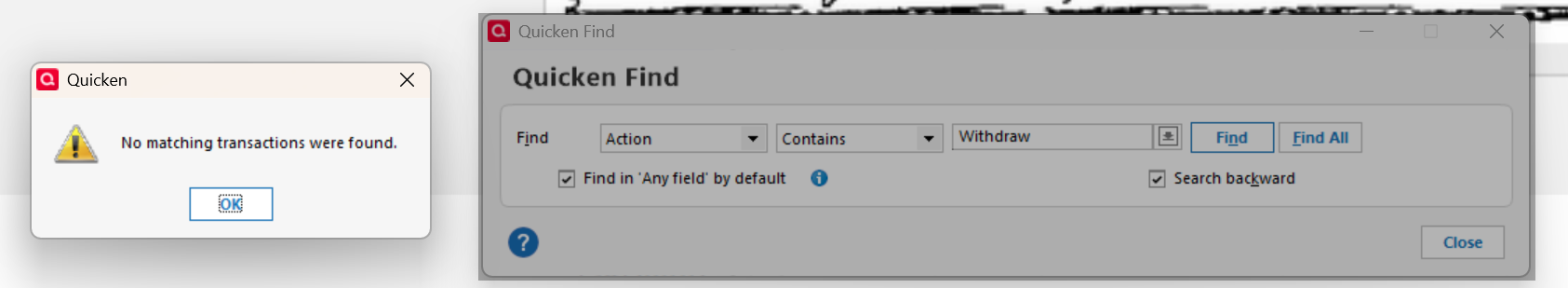

Then I started wondering, what should be the category of a Withdraw be. So I tried a find where Action contains Withdraw and the find returned this:

Why doesn't find work with action Withdraw? (Question 2) It worked fine for other actions.

(Back to Question 1) I was able to find the all the Withdraws by going to each FI and sorting by action and I noticed that almost all the Withdraws I looked at outside of the Withdraws from the (Div, Add, Withdraw) triplets had no category. Some had category set to "[<other-Quicken-account]". Some of those were done by me when the transfer hit the other Quicken account.

Thanks

Jim

0 -

@jdparker225 For Question 2, see this bug report

0 -

@Q97 Thanks. And, yes, it doesn't work for Deposit either. Haven't done an exhaustive test of what find works for and doesn't, just some random samples. My accounts don't have samples of every possible action anyway.

Hope somebody can provide something on question 1. I've been looking at memorized payee list and category list but haven't seen anything that yields any hints.

Jim

0 -

As of 1/2/26, reconciling Quicken with my official Merrill Lynch statements, all as described below is accurate… It took me 3.5 hours to reconcile Quicken to my Merrill Lynch statements…

My post from 1/1/26:

"My Quicken Merrill Lynch EWC+ experience downloading the last of the 2025 transactions on 1/1/26. Still much work to do on Quicken's part.

I am still getting pending buy and sell transactions...recorded as the trade date, not the settlement date. Pending Sales on 12/31/25 that will not settle until 1/2/26. The Merrill Lynch web site has a placeholder for the unsettled trades, but I suspect, as with years past of Direct Connect downloads, the official Merrill Lynch Statement will not show the sale in 2025, but it will on my January 2026 statement when it officially settles.

Many of my Cash Account interest transactions are downloading as "Interest" not as "Reinvestment Interest".

I have various reinvested Dividends paid on 12/31/25 but dividends not settled yet, most likely in 2026. The dividend is issued, and the money is deducted, but the shares are not recorded as it waits to settle. This will also not match the official Merrill Lynch statement. So, what I have done in years past is wait for all the information on the reinvestment, recorded it as a reinvestment with the proper shares, then remove the shares on 12/31/25 and re-add them in 2026. This will match the official Merrill Lynch statement.

I am still getting no Memo fields.

All this requires manual review and manual re-entry on my part... About an hour this morning.

Happy New Year."

MEL0 -

I just had something happen I have not seen in a while and it does not look like Quicken with EWC+ handled it correctly but I'll need to wait a bit before I know for sure. It has to do with Comcast's spinoff of Versant Media Group. I own some Comcast stock so I got some Versant stock. It appeared on ML website as 3 transactions:

- Dividend Versant Media Group Inc, still pending, n shares, $0.00 (Trade/Settlement date are today 1/6/2026)

- Stock Dividend Due Bill Versant Media Group Inc., still pending, -n shares, $0.00 (Trade/Settlement date are today 1/6/2026)

- Stock Dividend Due Bill Versant Media Group Inc., Settled, n shares, $0.00 (Trade/Settlement date are yesterday 1/5/2026)

What got downloaded was a Div action transaction with security = Versant Media Group Inc., Share Bal = 0, Inv. Amt and Cash Amt blank, Cash Bal unchanged. Since my holdings on the website show n shares of Versant, there is a placeholder entry for those n shares in Quicken. It will be interesting to see what transpires when the other two are no longer pending.

My guess is that the intent of such transactions is to have them all trade/settle on the same day so they can be combined into 1 transaction similar to what has happened with ReinvDiv but these are split accross multiple days. Probably need to turn whatever I get into an Added transaction fo n shares. Unless soeone has a better idea.

Thanks

Jim

1 -

This morning the two remaining transactions were settled so I did another OSU and got 2 more do-nothing Div transactions. The share balance in those transactions was n because of the place holder transaction. I created an Added transaction and deleted the placeholder.

Bottom line: this spinoff of Versant by Comcast was not handled correctly. I submitted a problem report.

Thanks

Jim

1 -

Anybody else having cash balance issues with non-retirement accounts in Windows? On Mac and Windows on 12/18 for an ETF account, the cash balances match. On 12/19, they differ by about $5k. There are no transactions between 12/6 and 12/28. I assumed it was just a timing thing and would work itself out. It has not. Thoughts?

Lance

*Edited to correct the month

0 -

@Lance W. I don't understand what the issue is. It sounds like

- You have Quicken on Mac and Windows and both have the same Merrill Lynch ETF account

- On 12/18 the cash balances in these two versions of the account match

- Since 12/19, the cash balance between those two versions differ by about $5K

- There are no transactions in either Quicken version between 12/6 and 12/28 to account for the change in at least one of those balances

Is that true so far? If so, I find that stunning. I don't have an ETF account so maybe they are different from other investment account types but, in my experience, I have never seen a cash balance change without some transaction that may or may not be correct to cause it.

Well, once I had an opening balance of a checking account get corrupted. That made everything from day 1 off by the amount of the opening balance change. Could that be what happened in your case? I posted the problem here:

Assuming that is not your case, I have a couple of questions:

- How do things in the two Quicken versions compare with what is on the ML website?

- Did the cash balance of both Quicken versions change or just one of them?

- How do they compare to the ML 12/31 statement?

Jim

*Edited to correct month per Lance.

0 -

@jdparker225 Thanks for responding.

- True but there is more. Windows and Mac fully mirror each other.

- True.

- On 12/19 the accounts had a $5k difference in cash. Today, it's over $6k.

- True.

I noticed this morning when checking my windows budget, a variance in Financial Advisor. Most of our Non-Retirement and Retirement accounts are managed. There is normally a variance due to appreciation of the value and thus the management cost. This was too big and turned out to be no management cost transaction were recorded in windows Non-Retirement accounts. The missing transaction were in ML and Mac Non-Retirement accounts.

I checked the opening balance first thing and it was correctly still zero. I have spent 10's of hours trying to reconcile an account only to find out a ghost had changed the opening balance overnight. Nothing special about an ETF and a change to a cash balance requires transactions.

- Mac is spot-on with ML and windows differs from both.

- Just windows.

- I did not check the 12/31 statement yet. When I saw the variance, I assumed it was the pending transaction issue. Then checked for pending transactions but there were none. All the variance was in cash, so I started backtracking: 12/31 variance but smaller, 11/30 balance, 12/18 balance, 12/19 out of balance.

I stopped there and sent my message to see if it was a known issue. I have not idea if the cash issue and missing Financial Advisor transaction are related and I have much more work to do.

Do you know anything about the known issue that one of the Quicken moderators mentioned about ML sending no/bad transaction? I did have missing IRA dividend transactions around 12/19 - 12/23 in multiple retirement accounts. I spent hours running down the missing ones to replace them to reconcile December. I could not find the post or a thread about a known issue.

Lance

*Edited to correct the months

0 -

@jdparker225 I apologize. On my handwritten notes I wrote 11/ instead 12/ and carried forward in my post. I feel like a fool. I will edit my posts above with the correct month. You may want to do the same so your post makes sense. Sorry,

Lance

0 -

@Lance W. There hsve been issues during the switchover to EWC+ where transactions don''t download or that transactions download with incorrect data. I and many others on this thread have experienced both. That is what this thread is about.

Where transactions stop downloading, which sounds like what you are seeing, the usual fix is either

- Reset Account. Right click on the account, Select Edit/Delete account, select "Online Services" tab, select "Reset Account" and follow the prompts.

- Deactivate/Reactive online services. Go to "Online Services" tab as noted above for each ML account (including any that are hidden) and select "Deactivate" if available to make sure all ML accounts are deactivated. Then pick any valid account and go back to "Online Services" and Activate and follow the prompts. This will reactivate online services for all your ML accounts.

Then try One Step Update again. That should pick up the transactions you missed.

I'd try the Reset Account first because it's a bit easier. Since the downloads are working on the Mac, we are talking baout doing this on Windows.

Good Luck

Jim

0 -

After weeks of relatively stable transaction downloads (of what was known to be working), I received 4 incorrect transactions yesterday. All were involving ETF fractional shares.

The first 2, which should have been "Fractional Share Sale", came through without a transaction type, so they defaulted to "Deposit". The second 2, which should have been "Remove Shares", came through as "Bought".

Looking back to Dec, I had received couple of dozen "Reinvest" ETF transactions with both whole shares+fractionals and fractionals alone that came through fine. I didn't see any transactions similar to the 4 received yesterday, so this is most likely a problem that's been there all along, but was not previously identified.

I sent a problem report.

1 -

@mrzookie Thanks for your effort, testing and reporting. I hope it helps. I've given up believing that Quicken has a good grasp of the process, how to resolve it and a solid grasp of general accounting principles. I've succumb to the belief that I need to trust, but verify, all transaction downloads and continue my prudent monthly reconciliation effort with my financial institution's official statements. Interestingly, this does work with other vendors.

MEL0 -

I just figured out something that may have been obvious but I didn't see it. Also, I don't think it has anything to do with the switch to EWC+. (Other than the fact that the problems associated with the switch to EWC+ caused me to take a closer look at how things are done by ML.)

Anyway, FWIW: If you do ML OSU in the morning before trading begins (or anytime Saturday or Sunday), your Quicken account balance will more likely match ML's online balance than if you do ML OSU in the evening of a weekday.

This is because DIV transactions (maybe others as well) often have a trade and settle date on the same day, say on the 15th. In the evening of the 15th (say around 8:00 PM Eastern), the transaction is still pending. However, the dividend has already been reflected in the online balance. If you do an OSU in the evening of the 15th, Quicken won't get the DIV transaction. So your Quicken balance and online balance won't match. If you do OSU early enough the following morning it won't still be pending and there won't be any new transactions so your Quicken/online balances will match.

There may be other transactions that get in the way of the two balances matching, but at least the odds seem better doing this.

Jim

0 -

I received my monthly cash account interest payment downloads yesterday (1/31/26). All had no memo field, and all were downloaded as interest, versus reinvested interest payments as they should be. All required manual manipulation and correction. Time for my official Merrill Lynch monthly official statement reconciliation, for which at the end of the day, is the only thing that matters as this is the officially recognized statement for accountants and reporting authorities. Still work to do Quicken.

MEL0 -

@MELCO Interesting. For me, reinvestment did not work for dividends under Direct Connect but but does work under EWC+. Under Direct Connect, I got Div, Add, Withdraw transactions to "accomplish" the dividend reinvestment. The only reinvestment I have going on with ML is dividend reinvestment.

It is interesting to me that they went to the effort to make dividend reinvestment work but forgot about interest reinvestment. Does capital gains reinvestment work? Both long and short term?

Things weren't perfect with Direct Connect. Not only was dividend reinvestment not working correctly but interest payments to my IRA accounts were never in the downloaded transactions. Those are the isues that I am aware of. It seems like, with Direct Connect, errors would be (mostly) the fault of the financial institution. But with EWC+, it seems like the errors are more evenly divided between FI and Quicken.

There is, IMO, an inherent advantage to EWC+: if the financial institution provides all the data in an intelligble format, then Quicken can control the transactions that are downloaded. The only advantage to Direct Connect is that it has been around long enough that most of the kinks have been worked out. So EWC+ is "better" if the Quicken software works.

But what is their software development strategy? Do a minimum amount of work, test nothing, release the product, and then make fixes (or not) as errors are reported?

As I reported earlier, my most recent issue (1/5/2026) is that Comcast's spinoff of Versant was not handled correctly. I reported the error to Quicken but I don't think they have fixed it. So, yes, we know there is still work to do but we have no idea how much. How will we know when it's done?

And I just got notified that the subscription price increased.

Jim

0 -

My stock and mutual fund trades are still downloading based on the trade date, not the settlement date. Still work to do Quicken. We have already discussed the significance and importance of using the settlement date.

MEL0

Categories

- All Categories

- 58 Product Ideas

- 34 Announcements

- 238 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub