Fidelity Online Balance - includes investments values - can't reconcile

Since the cutover the online balance includes the value of the investments. This is unlike Vanguard, Schwab etc. With the investments in the online value I can't reconcile the transactions as the assets aren't reflected in the transaction totals.

Any thoughts or ideas?

Comments

-

Hello @Carefree,

Thank you for letting us know you're seeing this problem. To help troubleshoot, could you please clarify what you're seeing? When you say it includes the value of the investments, do you mean that your holdings are reflecting in the cash balance?

I look forward to your reply!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

i am having same issue. online balances are really not right. my 8/2 download provides all transactions through 8/2 but the online balance is of 7/31, so accounts don't reconcile. also any reinvested dividends are incorrectly being rounded to 2 points after decimal, but fidelity keeps 3 points after decimal. since balances aren't right quicken is adding placeholder transactions. my dividends for nmco and nmz also were not categorized as a dividend. this is a mess and makes me fix 14 accounts and many transactions. at this point, a spreadsheet would be easier.

1 -

i've also noticed in my roth account that reinvested dividends don't necessarily have the right amounts. what was downloaded for cost in one security was 16.54 but it was actually 16.66.

0 -

So when I click on reconcile, on the far left the Online Balance includes the value of securities. The transactions register is transactions, and doesn't include the value of securities. So say my securities are worth 20,000 and I got interest of $10. IF I try to reconcile the interest, the online balance shows as $20,010 and not $10. There are not transactions of $20,010 only $10 and that is what should be reconciled.

I don't have the issue at the moment that others seem to have with respect to transactions not downloading correctly. My holdings at Fidelity are a single fund so not complicated like others.

0 -

Thank you for your reply @Carefree,

Are there any placeholders that account for the difference in the cash balance? You mentioned that your holdings are a single fund, what kind of fund is it?

Hello @Brad L Vandermoon,

Thank you for letting us know you're seeing issues also. The issues you describe sound like known issues that are being investigated in CTP-13955. Here is the list of known issues (they are happening both in Quicken for Mac and Quicken for Windows) currently being investigated:

- Missing accounts: Investment accounts not shown in the account linking screen, preventing setup or reconnection.

- Incorrect share balances: Share quantities downloaded with reduced precision (e.g., 2 decimal places instead of 3), leading to inaccurate holdings and potential placeholder entries.

- Misclassified securities: Money Market Funds (e.g., FDRXX, FZFXX, SPAXX) are being treated inconsistently—sometimes as cash, other times as holdings, or disappearing altogether.

- Transaction duplication: Historical transactions redownload as new entries and fail to match existing register data, forcing manual cleanup.

- Account display mode changes: Investment accounts that were previously set to “Complete” tracking (Detailed tracking in Quicken for Mac) revert to “Simple” without user action.

- Incorrect transaction placeholders: Cash management accounts show erroneous transactions with incorrect labels and values, sometimes doubling balances.

- CDs misrepresented as stocks: Certificates of Deposit are converted to stocks with inflated share quantities and distorted prices.

- Net worth discrepancies: All of the above lead to incorrect account balances and distorted net worth calculations.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

1 -

No placeholders. It's a mutual fund. On my Dashboard you see the fund value plus $1.54 which is what the online balance should be, not the sum of the two. And no I don't want to reconcile off any other method such as a statement. I have been using Quicken for 25 years. This happened right after the cutover. It's not complicated. Fidelity is showing the wrong ONLINE Balance as it includes asset values that represent the value of the mutual fund. That's not how the transactions register works and it's not how Vanguard or Schwab work. It's a Quicken/Fidelity data problem from the changeover.

1 -

@Quicken Kristina Thanks for the list of items being investigated. All funds are part of accounts with additional holdings. It looks like the issues are being looked at through CTP-13955. It would be nice to see a link for this.

BTW …. [Removed - Disruptive] I spent hours today manually balancing all my accounts and transactions that were downloaded the past couple days.

[Edited - Readability]

0 -

Thank you for your reply @Brad L Vandermoon,

Unfortunately, since the CTP is an internal ticket, I'm not able to provide a link to track the issue. For now, I recommend bookmarking this discussion to track any updates.

In response to your question in the Windows discussion, I'm not aware of a Quicken for Mac equivalent to the Compare to Portfolio feature in Quicken for Windows.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

1 -

This week I was asked to update my connection with Fidelity and BOA, I did and now when I try to reconcile my Fidelity accounts my online balances want to add in my market value where my previous reconciliation was 0. This effectively double my account balance. This is happening with all my Fidelity accounts. I have been using quicken for decades and this seems to be an on going accurance everytime we need to do these connection changes. Hopefully you get it fix fast since right now I have to use the statement balance which is a manual entry to ensure my accounts are correct.

2 -

@Bill O Sr you would think there would be testing and confirmation of something as simple as what you and me are seeing. And with the experience of others already in place. I don't understand how this happens. Send a note to your Fidelity team if you have one. Their funds have higher fees to support all the people, so make use of them.

0 -

@Quicken Kristina please add the security value included in the transactions/online balance issue to the CTP.

0 -

Thank you for your replies @Carefree & @Bill O Sr,

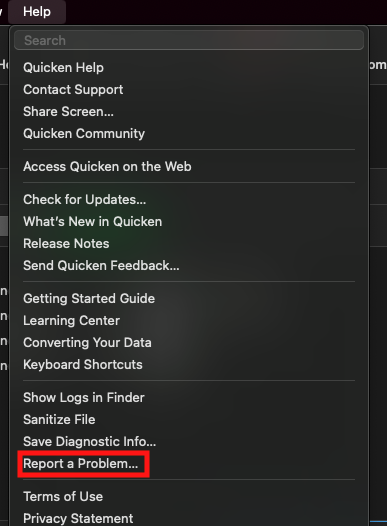

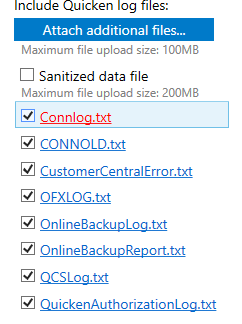

I have reported this issue with market value reflecting in the Online Balance, and preventing successful reconcile, to the proper channels for further investigation and resolution. Please navigate to Help>Report a Problem and send a problem report with log files attached. Please also include a screenshot of the issue. Note - Problem reports allow a maximum of 10 attachments. If needed, you can unselect files with OLD in the title to make room, or you can send a second problem report with any additional attachments.

While you will not receive a response through this submission, these reports will help our teams in further investigating the issue. The more problem reports we receive, the better.

We apologize for any inconvenience!

Thank you.

(CBT-753)

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

new issue with fidelity reinvested dividends are now being handled by two transactions. one transaction is a deposit of the dividend and then there is a corresponding buy. this would not seem a big deal but this is a municipal bond fund and the earnings should not show up as taxable. this transaction used to come in as one "reinvested dividend" with category of "dividend income tax free".

0 -

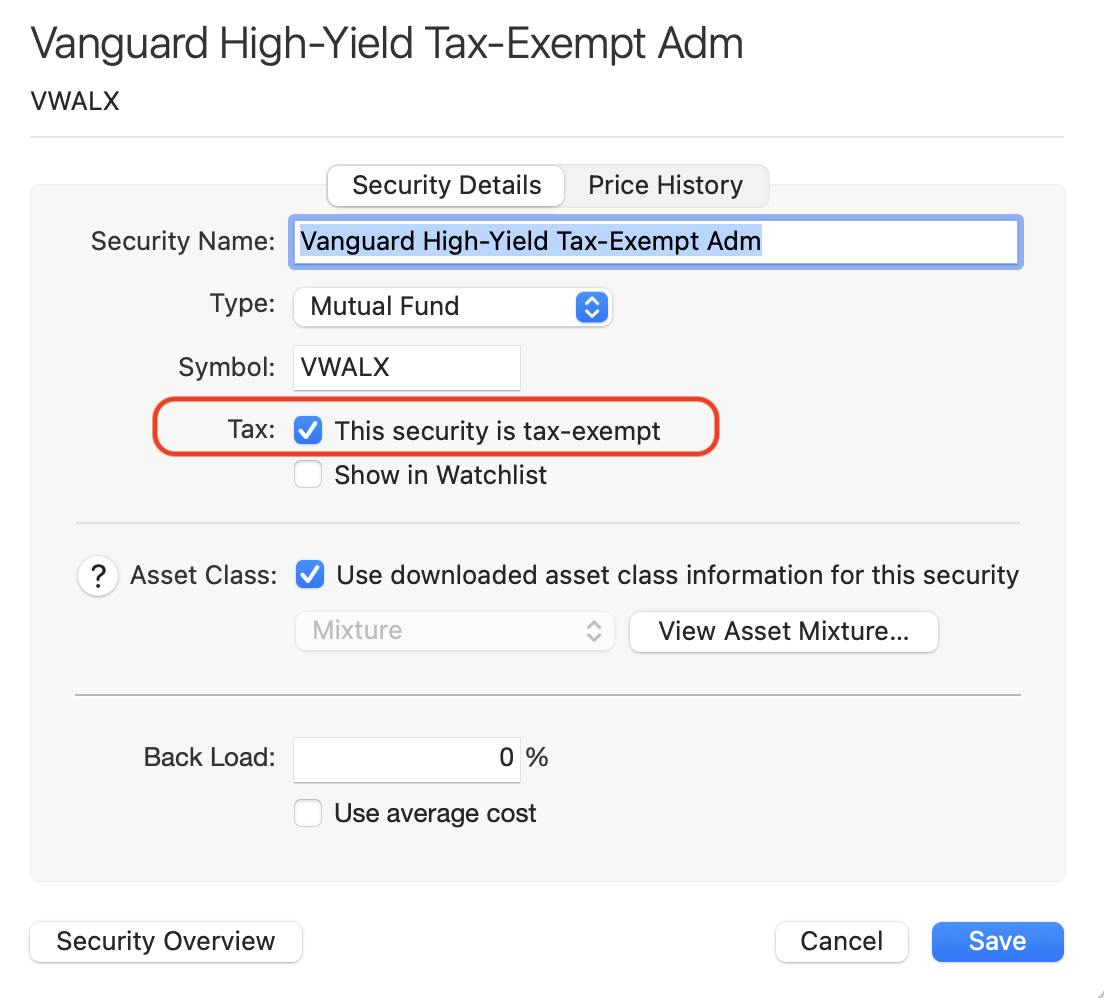

@Brad L Vandermoon If the security is tax-exempt, you just need to make a one-time change to denote the security as tax-free. Open the security (Window > Securities) and check the checkbox for tax-exempt. Here's an example:

Now, it doesn't matter whether the dividend is entered as a single Reinvested Dividend transaction or two separate Dividend and Buy transactions.

Quicken Mac Subscription • Quicken user since 19930 -

@jacobs yep .. i get what you are saying. but the income transaction doesn't come in associated to that ticker. so, it will end up showing as taxable income.

0 -

@Brad L Vandermoon Does the income transaction come in as Type=Dividend with an amount but no symbol? Or as Type=Payment/Deposit? It should be the former. If not, it sounds like Fidelity is encoding the transactions incorrectly.

For the time being, you’ll want to record it as Type=Dividend and enter the symbol; otherwise you’ll have no record of the performance of that security. (Unless you don’t care.)

Quicken Mac Subscription • Quicken user since 19930 -

payment … which is the problem i am reporting. it was handled correctly before the connection change.

0 -

@Quicken Kristina any update on the fixes? How cooperative is Fidelity being. When I contacted them, the reps blamed Quicken.

0 -

Thank you for the follow-up @Carefree,

I can see that the issues are in work. I'm not seeing any new updates on the tickets.

For the issue with the Fidelity online balance including the market value, we still need the logs I asked for earlier so that our teams can investigate.

For instructions on sending logs, please see the earlier post I quoted below.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Hello All,

Over the past few years, several large investment firms have moved their connections to EWC+, which, once fully implemented, functions the same as Direct Connect.

Each firm’s transition may include unique challenges, and occasional issues can occur during the process. To ensure a smooth implementation, Fidelity began their migration in phases, starting with an optional migration period in late July.

At this time, Fidelity has paused the migration for additional users while both their team and ours work to resolve the issues that have been identified. Throughout this process, Fidelity has been a strong partner to Quicken and continues to work diligently to address customer concerns as they arise.

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

2 -

This is good to hear! Meanwhile, is there any way to revert to Direct Connect while Fidelity and Quicken resolve these issues?

The problems I've encountered:

- Reconciliation Fail: for any accounts with investments other than cash (Money Market Accounts, Checking) reconciliation must be done manually. Even then, the date must be set to the last Statement date shown in Quicken and the amount must be set to the value shown in Quicken. The dates simply do not align with the values. My Brokerage account cannot be reconciled because it contains multiple classes of assets and transactions. Only the cash account is potentially reconcilable, but practically speaking it isn't realistic. I've not been able to do it.

- Internal Categorization Fail: previously, Quicken automatically categorized investment transactions such as purchases and sales of securities. For example, when a bond reaches maturity date, the sale was recorded in Quicken as "Sell Bonds" - it is not editable and does not affect the user's budget unless a Category was set up for this. Now, the autogenerated Category reads "Personal Income" for the entire amount of the Bond.

- Multiple transactions from as far back as 2020 have appeared during reconciliation. No way to deal with these except to accept and enter an off-setting adjustment, or delete them and fly without the transaction in Quicken (probably the preferred approach if they are old as mine are).

- Security Values mis-stated: I purchased a security for $300 per share. After the transition, the share price was increased on the last day of 2024 to $3000. It was returned to $300 on 1/31/2025. This dramatically change the Net Worth shown in 2024. Editing the share price produced another error, which reduced my Net Worth by the same amount.

I will enter these issues via the steps you identify above but want to share my experience here with the Community. And thanks to Quicken for your response to the issue - far better than Fidelity's apparently. Which is nuts. I've been on the phone twice with Quicken CSRs and they have been polite and put in a good effort to solve the problems with the tools they have.

0 -

I am reluctant to send information when I don't know what is being sent. My Fidelity rep is well aware of the issue and Quicken should certainly understand the online balance issue. There are no other issues for me. Remove the asset values from the online balance and it would it all work. Thanks for keeping up on this, and I continue to dialog with Fidelity.

0 -

Thank you for your reply,

Sending logs would help our team investigate, but if you're not comfortable doing it, you don't have to.

In the Report a Problem window, you can click on the log file to view it, if you'd like to review the information being sent.

You are also able to unselect any files that you do not want to send. The files our teams would need for this issue would be the OFXLOG and the QCSLog.

I hope this helps!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Hello All,

The migration will not start back up tomorrow. It will remain paused while both Fidelity's team and ours work to resolve the issues that have been identified.

Thank you for your continued patience while we work with our service provider and Fidelity to address the reported issues.

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Any further feedback from Fidelity and Quicken on this?

0 -

everything seems to be working for me with fidelity.

0 -

Thank you for the follow-up,

I'm glad to hear everything is working!

We do now have a Community Alert for the most frequently reported issues and the status + work arounds. If you haven't already done so, I recommend bookmarking that alert to receive notifications of any updates, once available, and to know when the issues are resolved:

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

@Quicken Kristina - I don't see the online balance issue on that list. I have returned home and still have that issue. Can't reconcile due to that. Transactions look ok.

0 -

looks like i was premature in stating everything is working. I am experiencing the below fidelity issues:

- online balance does not include money market interest on some accounts but not all

- still rounding to 2 positions right of decimal on some purchases of an etf occurring on 8/18. interesting that this rounding did NOT occur in a different account purchasing the same etf on 8/26.

i sure hope you guys get this fixed as this creates much work for your clients.

0 -

Thank you for your reply @Carefree,

The online balance issue is less common; I've seen only two reports of it on the Community and so far, neither person reporting it has sent logs, and we are not able to replicate the issue. That drastically slows our team's ability to investigate the issue.

That said, there are known issues that do impact balance and are on that alert. It is possible that the fix for those issues will also correct the issue you are seeing.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0

Categories

- All Categories

- 63 Product Ideas

- 35 Announcements

- 225 Alerts, Online Banking & Known Product Issues

- 21 Product Alerts

- 704 Welcome to the Community!

- 673 Before you Buy

- 1.2K Product Ideas

- 54K Quicken Classic for Windows

- 16.4K Quicken Classic for Mac

- 1K Quicken Mobile

- 812 Quicken on the Web

- 115 Quicken LifeHub