New Fidelity Connection - Incorrect # of Shares/Missing Investment Accounts [Mac]

Answers

-

So I have a taxable account where FDRXX does not show up at all and balance shows a negative balance that is more than the missing FDRXX - I have created a dummy account to make Quicken reflect the real balance in reports. I have an IRA that my cash is held in FDRXX and shows up in Quicken as Cash, but is off by $6.76?!

0 -

My SPAXX transactions were showing up as something similar but not exact. I edited the transactions to change the equity it was showing to SPAXX and it corrected everything. That said, I haven't had anything new since I did that to test how easy it is.

My problem is a little different, because sometime in the past Fidelity (or Quicken) started using a mutual fund instead of SPAXX and it went back several quarters. I didn't really notice how out of line it was with my balances because I don't keep that much in Fidelity, and very little cash or MM. I discovered it when it was misreporting holdings - one of which I hold across 2 other brokerages, and that's when I noticed there were some other anomalies.

Quicken Premier Mac Classic (since 2022), Quicken Premiere Windows (1995 - current, but not actively using since Mac conversion)

0 -

Sadly this has gotten worse. After syncing today, my 401k balance is now nearly 3x too high.

0 -

Hello @richakaye,

Thank you for letting us know the balance discrepancy has grown in your 401k account. Are you able to see what is causing it to see such an artificially high balance? For example, are there duplicate transactions, duplicate securities, cash represented as both cash and a money market account, etc.?

I look forward to your response!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

I'll try a shorter version. I am invested in 4 funds in my 401k. Quicken says I have 11. They are doubled or tripled. Determining which ones are the right ones is a challenge. If it was possible to export the account transactions to a CSV or TAB-delimited file I might be able to use a better set of tools to clean this up. But that doesn't seem to be an option with an investment account, at least on a Mac. So I am just hoping that I will sync and it will magically fix itself. There are nearly 1800 transactions over 10 years and I really don't want to have to figure out how to manually unscramble this mess.

1 -

The downloads into my 401k has changed, but they're still wrong.

- 4 Buy transactions were downloaded instead of 9

- 2 of the 4 transactions have no security/payee and 0 shares

- the other 2 appear to be correct

My brokerage account has been mostly correct all along, except that it does not download FDLXX transactions.

2 -

Just saw the Email Digest of 9/17/25. Users are still reporting problems with the Fidelity connection, yet no status on the fix. The only advise "Make sure to sign up for the email digest to see a round up of your top posts." and report the problem. I have to shadow my fidelity accounts with a spreadsheet to have correct balances to make financial decisions I use Quicken for. When account portfolios are missing securities, when accounts do not have the correct balance from one of the top financial services company (or any really), users deserve better feedback in order to maintain confidence in Quicken. Is there a fix insight?

(Oh, and I posted the problem and checked the email digest.)

1 -

We really do need an update. This should be a very high priority to fix. It was working fine before the update and it's been broken since around July 30th, making Quicken basically useless for tracking the affected accounts since then. Please urge the team to prioritize this one. TIA.

2 -

To add my two cents……. I just completed the re-authorization for the Fidelity connection two days ago. I use a Fidelity brokerage account. My Fidelity Money Market fund (SPRXX) has disappeared from Quicken. I cannot add SPRXX manually to my brokerage account within Quicken. Under <Window>, <Securities>, SPRXX is still listed as a security. I looked at a .CSV download from the Fidelity website. SPRXX is there.

I use Quicken to consolidate several accounts into a single, useful financial picture. If I have to go to each Financial website individually, Quicken is no longer useful. Please get this fixed……

2 -

Hi everyone,

Thank you all for continuing to share your experiences and feedback — I know how frustrating this has been, and I want to acknowledge the impact it's having on your ability to use Quicken as intended.

If you're seeing issues with duplicate securities, missing transactions (like FDLXX or SPRXX), or inaccurate investment holdings, you're not alone — and we're continuing to gather examples to help the team investigate further.

A couple quick things that might help in the meantime:

- Make sure you're on the latest version of Quicken — recent updates have included fixes and improvements for the Fidelity connection.

- Please continue reporting specific issues via Help > Report a Problem, especially if you're seeing missing securities or zero-share transactions. The more detailed reports we receive, the better we can pinpoint the root cause.

We know many of you rely on Quicken to make informed financial decisions, and we understand how important it is to get this right. Your concerns are heard, and we're working with urgency to address them.

Thanks again for your patience and continued feedback.

Quicken Alyssa

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Same issue with Fidelity Money Market SPRXX. My net worth has been reduced by the amount of shares that are no longer tracked. I have submitted a problem report. I will restore a previous version, untracked Fidelity and hope the issue is resolved soon.

0 -

This morning quicken is once again showing the market value of my Fidelity cash management account as 2x of the actual … it's also still not matching bills when they are downloaded. What a colossal screw up.

1 -

I just was 'forced' to update my connection type for my Fidelity accounts and now balance are all wrong. Does Quicken ever test these changes or are we the test bed? Fortunately, I have been weaning myself off any dependence on Quicken for tracking my financial status and only rely on it for credit card transactions . Very sad state of affairs.

0 -

I am experiencing the same thing. Like usual, I guess we wait it out until they fix it. It is frustrating indeed.

0 -

It's definitely annoying. In my case it's easy enough to find the culprit as I have only one Fidelity account - Quicken is inserting 3 placeholders (one for each security held in my 401(k)) at the very beginning date i.e. bottom of the register. When I delete those everything reconciles once again.

I hope Quicken/Fidelity figure this out soon.0 -

I was forced to update my connection on September 17. The first sync led to incorrect balances on both of my Fidelity Netbenefits 401k accounts. Yesterday, one of them doubled in value for no apparent reason. It's mind boggling how bad this is.

0 -

I experienced the same issue with Fidelity transaction downloads after updating to the New Fidelity Connection. All my Fidelity accounts double in value. I was able to trace where the errors lies. When updating Fidelity accounts, the downloads added new fictitious shares in the transactions, exactly the same number of shares prior to the download; thus doubling the assets. In Account, Transaction tab, if I scroll back to the very beginning, I can see the erroneous transaction. Deleting the erroneous transaction corrected the problem but I have to repeat this deletion every time I perform an account update. Please correct this issue. Thanks.

2 -

So, a very similar issue to the one that causes a checking/credit account Opening Balance to reflect (I believe) the starting balance of a download? Maybe, maybe, this will encourage Quicken developers to fix the Opening Balance issue as well?????? @Quicken Alyssa can you forward this information and suggestion?

0 -

Hello @K. P. Lim,

Thank you for letting us know you're seeing this. To help troubleshoot, please provide more information. You mentioned that you're having to manually correct this every time you update the account. What exactly is happening? Are duplicate transactions downloading & redownloading after deletion, are placeholder transactions being generated, or is something else happening? Please include a screenshot of the problem transaction(s), if you're willing. If needed, please refer to this Community FAQ for instructions on how to attach a screenshot. Alternatively, you can also drag and drop screenshots to your response if you are not given the option to add attachments.

Thank you for providing your feedback!

So, a very similar issue to the one that causes a checking/credit account Opening Balance to reflect (I believe) the starting balance of a download?

What are you referring to here? I'm aware of the known issue with opening balances sometimes changing. What similar issue are you seeing?

I look forward to your responses!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

It's not what I've seen, but what I think is reported above. My impression of the Opening Balance issue is that when a checking/savings/credit account is reset or more likely reauthorized, the FI will include an opening balance for its download. If the download includes 90 days of transactions, then it includes what the opening balance was 90 days ago. When that happens, I think Quicken applies that downloaded value to the original years-ago opening balance record.

I have not looked at code or anything; that's just what I suspect happens because of when I find I need to correct the opening balance records that Quicken changes on me.

Now, from the discussion above, it seems like Fidelity might be including "you had NN shares DD days ago" value in their download, and that information might be applying into the investment register in a similar way that Quicken applies opening balance changes.

0 -

Thank you for your reply @Bob@45,

It may be a bit similar, but with erroneous placeholders and incorrect opening balances, deleting or manually correcting them usually fixes the problem. In this instance, it sounds like manual correction is a temporary fix; the erroneous transaction returns after every account update.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Hi Quicken Kristina,

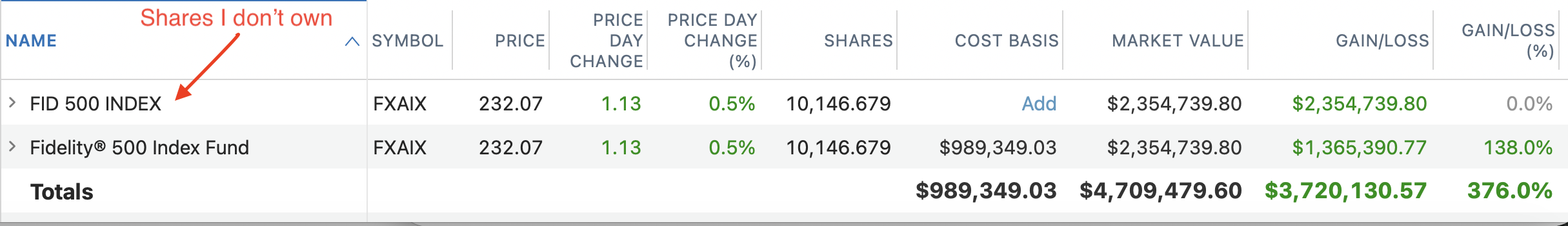

I'm sharing some screenshots as you'd requested. Performing an account update added shares of security in Transaction tab that I don't own (see highlighted line below.)

Though the stock symbol is the same, in my case it is FXAIX, but the stock description is different from the equity I actually own. This causes my portfolio value to double.

I can delete the added transaction to restore the account to its correct value but the erroneous transaction reappears each time I perform an account update.

This occurrence also appears in my 2 other Fidelity retirement accounts. I hope this helps to explain the issue so your technical team can resolve it quickly.

0 -

Jumping in with similar problems. My Fidelity balances and transactions were hosed after "updating" the connection method. I got partial success by deleting my Fidelity accounts and adding them back in. What's missing are my money market accounts (SPAXX, FDRXX and FZCXX). In the case of FDRXX, I'm seeing a cash balance instead of the fund.

Please fix - in the current volatile environment and nearing retirement, keeping track of our funds is very critical.

0 -

Thank you for your reply @K. P. Lim,

Based on the screenshot, what is most likely happening is that the data on that security is just different enough that Quicken is adding a new security and creating a placeholder for it. That would also explain why that transaction keeps coming back with every update. To try to resolve this issue, I recommend that you merge the securities. For information on merging securities, please see this article:

I hope this helps!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Hi, I too am having a problem after the Fidelity cut-over. I don't know if it is what's described here, what's described at

or something different. My issue is…

I have a 401(k), which is managed by Fidelity NetBenefits. The security in it doesn't have a public symbol.

After the cut-over, when it syncs it thinks I have 0 shares of this security, so it adds it and creates a phantom transaction. It adds it with a different non-public symbol than had been previously used.

So what I tried to do is update the correct security to use the new non-public symbol, deleted the extra security and the phantom transaction.

But after a sync it did exactly the same thing. It isn't matching the number of shares I own to the security I have. But that security is what has the entire price history going back many years.

Note that the name of the security isn't the same, but that shouldn't matter. Nearly all of my securities have different names than what's on Fidelity.

UPDATE 9/28: Never mind, I found the post with the solution: Window > Securities > select the two securities > Merge Securities.

0 -

Hi Quicken Kristina,

It appears the issue has been resolved, at least in my case. Tonight when I performed the account updates on my Fidelity accounts, no shares were added in the Transaction. My equities shares and market values in Quicken are in sync with the Fidelity website. Thanks for helping to resolve this issue quickly for me.

1 -

FWIW: For anyone finding this thread who is experiencing erroneous balances, or missing securities (particularly Cash securities) in their Fidelity accounts, before canceling your Quicken subscription or just waiting patiently for things to return to normal, you should first go see if Quicken added any of these "placeholders" or similar in those accounts. If you find them, try deleting them (backup first of course). That may fix your problem and perhaps they won't come back, and you can return to your life and forget about this thread! I wish this potential fix had been made clearer to me earlier. Thanks @K. P. Lim !

I suspect Quicken programmers feel like they fixed the problem introduced by changes they made when updating Fidelity accounts, but I bet those fixes will only prevent future problems and I doubt their fixes will go back and remove these offending "placeholders". You likely have to deal with those yourself, as I did.

0 -

I did an update this evening and I'm happy to report that Fidelity/Quicken is finally reporting the correct Cash amount and handling MM Funds correctly in my Cash Mgt and Brokerage accounts. Thanks to the entire Fidelity & Quicken teams for finding and fixing this issue. It was a long wait, but hopefully the wait is soon over for everyone on this thread.

2 -

Yesterday my Fidelity Cash Management account was good to go, today after downloading 3 transactions, it's showing a "market value" that is $5200 more than the actual balance … just for kicks, if I punch "reconcile", it tells me the online balance is $0.00 … arghh …

0 -

My Fidelity balances have gone from being ~20% inflated to over 100% inflated to now over 200% inflated. With a data set going back to 2015, trying to manually fix this up is a nightmare. I've tried some of the delete placeholders tricks and that has not proven to be fruitful.

0

Categories

- All Categories

- 69 Product Ideas

- 36 Announcements

- 223 Alerts, Online Banking & Known Product Issues

- 21 Product Alerts

- 582 Welcome to the Community!

- 673 Before you Buy

- 1.3K Product Ideas

- 54.1K Quicken Classic for Windows

- 16.5K Quicken Classic for Mac

- 1K Quicken Mobile

- 813 Quicken on the Web

- 115 Quicken LifeHub