New Fidelity Connection - Incorrect # of Shares/Missing Investment Accounts [Mac]

Answers

-

Quicken for Mac Deluxe Version 8.2.1 (Build 802.57282.100)

Recently more account balances have been incorrect bc Q counts the FDIC accounts used to hold cash in a brokerage account twice- once as specific assets (in the list in the banks used for the FDIC sweep, or a Fidelity (F) cash reserve), and again as moneys held as "Cash", even though they are one and the same .

I am not sure when the problem started but seems to have been with the change in how F downloads are done which was recently implemented.

1 -

@Quicken Jasmine I too have experienced significant issues since switching the connection method for my Fidelity accounts. More specifically, I have multiple investment accounts, a company 401k previously synced via Netbenefits, and a Fidelity Visa card. All the accounts with the exception of the company 401k are fine. Sadly, the company 401k has improperly doubled in value. I also attempted to use the chat support option. I was told to go figure out what was wrong and manually delete transactions in an account with over 1700 entries. While I was trying to figure out some reasonable way of identifying duplicate transactions, the agent terminated the conversation. I have not received any summary of this support interaction to my registered email. To say this was a disappointing and unsatisfying support experience is an understatement.

I submitted a problem report as suggested several times in this thread. I have not gotten any notification that a problem report was submitted. I do hope for some follow-up within a reasonable timeframe.

0 -

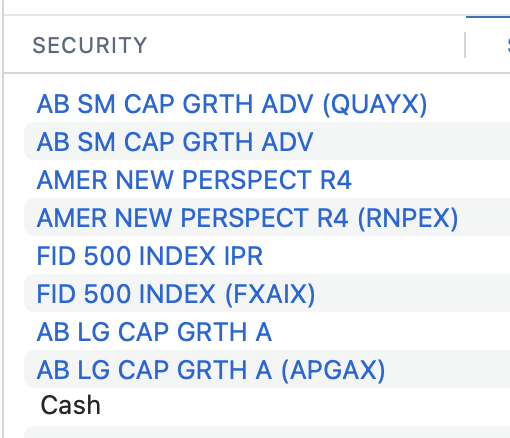

Is there a fix to this problem yet. My Fidelity account is so messed up my contribution amounts are not correct. It changed the name of the investments so that now I have the old values of investments with the original name and also the new values with the new name. Is there a way to just rename the old investments to the new names so that the new data pulls will update the old investments?

I really do not wish to lose all my historical data and pull this data again but I am not sure what to do with the account at this point, it is in such a mess.

0 -

in my Fidelity brokerage account when I go to reconcile, Quicken says I have a cash balance of say $10,000 when in reality that 10,000 is a money market fund in my portfolio - so I cannot reconcile as Quicken things I am off by 10K which is obviously wrong as that 10K is an asset in my portfolio in Quicken. Please fix this mess with the Fidelity changes.

1 -

I want to leave a comment to warn folks that the updated connection method is still way broken. I opened up a Support case and they acknowledge a problem report has been submitted, but all my 401k transactions are downloading as cash transactions. As a result, there are no (zero, zippo, zilch) security or transaction type or share information. The suggestion to enter the securities information manually was completely ludicrous.

And the download is not properly matching up ticker symbols. This is resulting in transaction adjustments which are just totally wrong and duplicating balances.

I agree with a previous comment - this is a complete mess. Quicken - did anyone actually test this on real data?

0 -

Thank you for sharing!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

-1 -

For my Fidelity cash management account, quicken is still saying my "market value" … ie my balance is 2x of reality … it's also not matching up scheduled bills as they get paid and I have to manually do that …

0 -

Also is there any way to find out, besides calling in and opening a new case, about when Fidelity and Quicken address some of these issues that have had "problem reports" opened?

0 -

The digest lead me to a Quicken for Windows discussion about the same issues. So it truly is a connection problem not a Quicken for Mac problem. Based on past issues, I'm confident Quicken will fix this. (https://community.quicken.com/discussion/7964717/can-we-get-a-running-list-of-problems-and-fixes-re-ml-and-fidelity-ewc-transitions)

I found this list of known problems helpful:

Here is the list of issues that are currently being investigated under CTP-13955:

Missing accounts:Investment accounts not shown in the account linking screen, preventing setup or reconnection.Incorrect share balances:Share quantities downloaded with reduced precision (e.g., 2 decimal places instead of 3), leading to inaccurate holdings and potential placeholder entries.Misclassified securities:Money Market Funds (e.g., FDRXX, FZFXX, SPAXX) are being treated inconsistently—sometimes as cash, other times as holdings, or disappearing altogether.Transaction duplication:Historical transactions redownload as new entries and fail to match existing register data, forcing manual cleanup.Account display mode changes:Investment accounts that were previously set to “Complete” tracking revert to “Simple” without user action.Incorrect transaction placeholders:Cash management accounts show erroneous transactions with incorrect labels and values, sometimes doubling balances.CDs misrepresented as stocks:Certificates of Deposit are converted to stocks with inflated share quantities and distorted prices.Net worth discrepancies:All of the above lead to incorrect account balances and distorted net worth calculations.

0 -

Add to this my Fidelity Money Market account, also doubled.

0 -

This is a Mac thread but All of these problems exist on Windows Version too.

0 -

I am having the same sort of issues as others, the missing money market shares except that the fund is FZDXX which is the Premium money market fund. This a different fund from the one that represents the cash balance in the account. This issue began on 7/31/25. I have tried to fix it by using "add new shares" that doesn't affect my cash balance. This doesn't work. After adding the shares, nothing changes. The balance in my account in quicken is off by the value of my shares in Fidelity.

Any competent software company tests changes before issuing them to the public. Apparently Quicken doesnt.doesn't

0 -

Hello All,

Over the past few years, several large investment firms have moved their connections to EWC+, which, once fully implemented, functions the same as Direct Connect.

Each firm’s transition may include unique challenges, and occasional issues can occur during the process. To ensure a smooth implementation, Fidelity began their migration in phases, starting with an optional migration period in late July.

At this time, Fidelity has paused the migration for additional users while both their team and ours work to resolve the issues that have been identified. Throughout this process, Fidelity has been a strong partner to Quicken and continues to work diligently to address customer concerns as they arise.

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

1 -

i just added a "buy" in the fidelity of the exact MMF use (I buy FZDXX) of exact amount of the current value.

Example if my FZDXX shows $50000 i have that amount equal to $50000 on the buy. That will zero then correct balance. Each month it changes, but i just edit that transaction, then my cash shows correctly and still show the FZDXX as $50,000 and overall balance works.

Everyone on forums says its the download and they way Fidelity does things, but not sure why Quicken could not give you some options in settings to mask it. Maybe an option that says something like "don't double count cash and MMF" and lets you select the MMF's or something. Oh well, works for me.

Make sure when put entry in (or adjust it), it's close to current date, if put it way in past doesn't work0 -

I was not given the choice of migrating - Quicken Mac forced that. Is it possible to REVERT to the older connection method while you work on the issues in your test environment? And why weren't these problems found during the validation phase? (Seems like they would be hard to miss.) TIA.

0 -

@Pacific_Shark_Chum I thought they were not forcing people to switch until the 20th. But no, I don't think it's possible to go back once you've made the switch. When I set up a new account & search for Fidelity, the new option is the only one available - the old Fidelity Investments Mac option is not displayed.

0 -

I have 7 Fidelity accounts in QMac. On this past Sunday, I decided to go ahead and try the conversion (with backup in case I needed to revert). Here's how it went…

After the conversion, my three taxable accounts all updated and matched with Fidelity website within a dollar with one exception. There was one duplicate transaction which after deleting made everything match up.

The four IRA accounts were a different story. Each of them differed from Fidelity website by $8 or $10k. Since I didn't care about the transaction history being in Quicken for these accounts, here's what I did: In each account, I deleted all transactions and then did an online update. This created, of course, a placeholder transaction for each security, but the accounts were still significantly off. So I deleted all of these placeholder transactions and did another update. This created a new and different set of placeholders. I needed to create a balance adjustment in each account to show the cash balance which did not download in the last update. After doing these, the balances tracked with Fidelity within a dollar.

This morning (Tuesday), after a full day of the markets being open, all of my balances track with Fidelity website within a buck. So I'm good to go. Whew.

Quicken Mac Subscription; Quicken Mac user since the early 90s0 -

Regarding shares being renamed, this happened to me in a Merrill managed account. the ticker stayed the same but the equity name was appended with what looked like comments that would normally go in a memo field. So, instead of, say, "Amazon" it might show "Amazon Executuion blah blah blah" in the name field. Because of my column widths in the transaction register, I really didn't notice it as significant, but Quicken depends on the name being specifically identical to previous names regardless lf the ticker changes or not. So, I didn't realize it at first, but I would see "Buy" in the Type column and the beginning of the new security name would always match the previous ones + whatever verbiage was appended. Because of this my share totals in the Register would be wrong since the ticker was right but the name forced the beginning of new totals for the "new" equity.

My solution was to go to the Securities screen (under Windows menu), then highlight both securities - which were always alphabetically adjacent - and right click - Merge Securites, picking the old one as the one to merge into. That trued up everything. Hopefully this will not continue as new transactions hit my managed accounts.Quicken Premier Mac Classic (since 2022), Quicken Premiere Windows (1995 - current, but not actively using since Mac conversion)

0 -

Hello All,

We want to make sure everyone is aware that the Fidelity migration is currently paused. For more details, please see this comment from @Quicken Kristina posted previously in this thread which includes additional information about the situation:

Thank you!

-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.0 -

I do hope there is going to be a reasonable solution for those of us who have already had our Fidelity accounts seriously mangled.

1 -

Indeed … It took months for them to resolve a major problem with Barclays last fall when they combined card and banking services so I am not hopeful that anything will be done quickly.

0 -

Can those of us who converted and are now in a completely broken state go back to the old connection? The current situation is a mess not including what will be required to clean up multiple 401(k) accounts from Fidelity that now have completely mangled transactions for 45 days.

0 -

Hello All,

The migration will not start back up tomorrow. It will remain paused while both Fidelity's team and ours work to resolve the issues that have been identified.

Thank you for your continued patience while we work with our service provider and Fidelity to address the reported issues.

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Quicken: Could you please provide an update on the Fidelity connection issues? FDRXX still not showing up in any of my Fidelity accounts.

0 -

I hope this is a TOP priority for the Quicken support team. There are many Fidelity Investment customers using Quicken.

0 -

Hello All,

We just posted a new Fidelity alert with the latest updates on what’s been fixed, what’s in progress, and available workarounds. You can view the full details in this Community Alert.

Highlights include:

- Duplicate Transactions (Windows) > fix included in R64 release.

- Missing Transactions (401k, Brokerage, IRA) > fixes verified/rolling out.

- Bond redemptions showing as cash > fix live.

- $0 account balances > fix verified/complete.

- In progress: incorrect CD balances, doubled cash balances in Money Market accounts.

Please bookmark the alert thread to stay updated.

Thanks for your patience while we work through these!

-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.1 -

Hi Anja, Quicken Mac isn't mentioned in the Community Alert, so I'm assuming those fixes are still being worked on? Should Mac users attempt to fix their accounts via Balance Adjustment transactions or should they wait for further guidance? Thanks to the teams for working on this.

0 -

I'm on Mac too and am waiting for my Fidelity MM accounts to show up again. This has happened before, and the resolved, but recently it happened again. I am using "Quicken Connect (FDP_WSI_OAUTH)" connection for three Fidelity accounts. My past transactions show correct purchases of the MM Funds, but they all have disappeared from my Quicken Portfolio views.

Interestingly my Sidebar is set to report my "online balances" and they only show my balances of my other positions, not any of my MM amounts. So it does indeed appear to be the result of how Fidelity is reporting our holdings to Quicken. My affected funds are FDRXX and SPAXX. I am on Sequoia 15.6.1 and Quicken Premier Version 8.3.0. Waiting for further instructions.

0 -

Hello @Pacific_Shark_Chum & @jfishsun,

Those fixes are still being worked on. If it's urgent for you to force the accounts to show the correct balance, then yes, making a backup of your file and adding a balance adjustment may be a viable work around. It would be a good idea to include a memo or note explaining why the adjustment was made.

To clarify, you mentioned that your MM accounts are not showing in your portfolio. Are these separate accounts, or are they funds that should show up in one or more of your Fidelity accounts? Are transactions associated with these MM accounts present, or are they missing?

I look forward to your response!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Hi @Quicken Kristina. Thanks for the engagement.

I have three Fidelity accounts. They are all acting a bit different so I will detail them here in case it helps Quicken debug.

- Account One is 100% MM fund. Nothing shows in my Portfolio for this account. Zero holdings and zero amounts in the Sidebar, Dashboard and Portfolio views. All the correct individual MMF transactions are shown in the Transactions view from prior downloads though.

- Interestingly if I try to Reconcile this account Quicken asks if I want to Reconcile using the Online Balance, which is shown as the correct amount of the MMF. So the Fidelity online balance reported to Quicken includes the MMF amounts as a positive balance for the account. This is different from Vanguard for instance, where their MMF is reported as a holding and thus their online balance is shown as $0 when I try to Reconcile one of theirs.

- Account Two has a portion of the account in a MM fund and the rest in another investment (i.e. ETF). Only the other investment is shown for this account in the Quicken Sidebar, Dashboard and Portfolio views. No MMF shares or dollar amounts are shown. As with Account One all individual transactions of the MMFs are still shown in the Transactions view. Also as with Account One if I try to Reconcile, the correct amount for the MMF is shown as the Online Balance (value of the other investment is not shown in this online balance as expected).

- Account Three is acting different from the other two. Like Account Two this has both a MMF and other investments. Unlike Account Two though, for some reason the MMF is shown in the Quicken Dashboard, Portfolio, and Sidebar views, along with the detailed transactions. All the amounts are correct. When I go to Reconcile it also shows the correct amount for the MMF like in Account Two. This is the only Fidelity account where Quicken shows me all the correct amounts in all views.

The only difference I see between the three accounts is that Account Three uses their FDRXX fund, whereas Accounts One and Two use their SPAXX fund. So FMPOV this problem appears to be based on how each of the Fidelity Funds are accounted for by Quicken, rather than how Fidelity accounts for them. But I'm just guessing of course. :)

Hope that helps.

0 - Account One is 100% MM fund. Nothing shows in my Portfolio for this account. Zero holdings and zero amounts in the Sidebar, Dashboard and Portfolio views. All the correct individual MMF transactions are shown in the Transactions view from prior downloads though.

Categories

- All Categories

- 56 Product Ideas

- 34 Announcements

- 238 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub