Fidelity/Quicken Bad to Worse

This is something I have seen new. Fidelity on their Managed Brokerage Accounts has been switching from Mutual Funds to a huge number of stocks all small quantities. They claim this is to help tax reasons. So here is the consequences.

A. I have three accounts. Two have less than twenty positions. The Managed account over 200. So, when you go to the Portfolio view it is worse than slow trying to scroll down through it. How long is it now going to take me to flush this out.

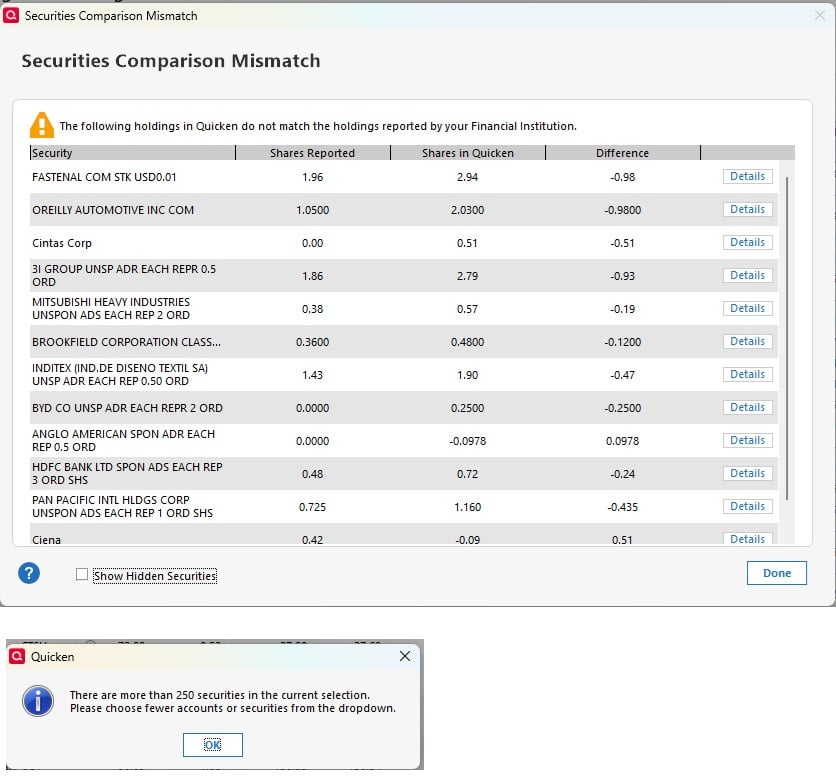

B. If you go to the Portfolio X-Ray option, it says there are more than 250 securities and will not work even if only looking at that specific account. This tells you the number of securities.

C. Today when I did the account update, there were 163 transactions to be processed. After that completed, I had 15 mismatches. Can't say if the data sent was wrong or errors in processing.

So, on top of the other issues, either Fidelity is doing something wrong or Quicken no longer has the ability to handle how they (Fidelity) are changing. I have pushed here as hard as I can. Now I am going to work on the Fidelity side since I see they have an add on my Quicken startup.

Comments

-

Here is an additional comment. In a portfolio of approximately $500K, Fidelity has created 700 positions. I can see why Quicken might be having a hard time, but it is what it is.

-2 -

Going from a small handful of mutual funds to many hundreds of stocks just isn't going to work with Quicken, at least not easily.

This might be an impetus to move from Fidelity to some other FI.

0 -

I called Fidelity this morning to vent a bit. After talking to my advisor I then transferred to the Online Support that handles Quicken. They told me that recently they had a conference call with Quicken and said everything was being handled. I also learned that the Fidelity logo at Quicken startup has nothing to do with them and it is a Google push.

0 -

I'd be interested in understanding how this gets handled, particularly if Fidelity is sticking with hundreds of individual stocks in the account. If they ever do "handle" it please post back with how it worked out. I'd think there might very well be hundreds of Quicken users that have the same set up as yours.

0 -

At the time (beginning of 2025), they said this option would be better for taxes. But I never dreamed there would be so many. They divide the portfolio into different categories, Growth, International……. Then there are blocks of stocks bundled under each. I told them that at the beginning of the year this was going to be addressed.

0 -

I had an actively managed account (not at Fidelity) years ago and hated it. I got trades every day and more stocks than I even knew existed. Surely the account "managers" got commissions on each trade.

Such an over-active account is trouble in QWin. I closed that account and am happier managing my own investments.

Quicken user since version 2 for DOS, as of 2025 using QWin Premier (US) on Win10 Pro & Win11 Pro on 2 PCs.

1 -

Study after study has proven that this kind of thing results in worse performance than using index funds.

It is easy to see why. The whole point of “stock picking” is identifying some potential better than average investments and invest in them. As the number of securities goes up this isn’t possible all you are doing is building an index. And as the size of the investments go up the trading in those investments starts to influence the price of these securities and so it isn’t possible to get “good deals”. Then you add in the fact that they are charging more to manage this you are bound to lose.

So, now let’s come to the argument of tax savings. First off it isn’t like the something isn’t already happening in an index fund, it is. So, this is a supposed savings taxes vs extra fees, and active management that has been proven not do better than indexes, with no history to check what they are doing will return better over time.

What good is it if you save $1,000 on taxes if the performance and fees lose you $10,000?

And as others have mentioned it will be next to impossible to monitor this in Quicken in complete investing mode. You would have to switch to Simple investing mode to even have a chance. And in that mode you will have to take their word for the tax numbers.

I personally see this as nothing more than a money grab, and them setting up a situation where you can do any meaningful comparison because their “index fund” isn’t going to line up with any standard index fund.

Signature:

This is my website (ImportQIF is free to use):1 -

At the time (beginning of 2025), they said this option would be better for taxes.

I don't know their sales pitch, but I think you got sold a bill of goods. I suppose the argument is you avoid capital gain distributions that mutual funds make due to other holders selling shares by you owning all the individual companies. In this alternate structure, if you want to cash in 1% of your portfolio, you sell 1% of 700 securities instead of 1% of one mutual fund. What a headache.

0 -

What do you think the advisors in a big place like Fidelity would actually be doing trading based on the individual’s needs instead of just lumping all such accounts in a “do the same thing” kind of system?

Signature:

This is my website (ImportQIF is free to use):0 -

I went through the same thing in April of this year. Account exec said buying the stock "sleeves" would present more flexibility for ongoing active loss harvesting. I was expecting 40 or so stocks, but it took forever to download. Turns out they dumped 500 issues into my file. Some of it was just absurd - 1/4 shares and $10 positions. The only way to deal with it in Q was to turn on simple investing, which I didn't want to do. I got on the phone and had them sell the whole mess 3 days later. I do have to admit that there was a lot of profit and losses racked up in those 3 days, and it might have actually have been worth it over the long haul, but it would have killed my file.

0 -

So. the account has 80% in Mutual Funds and 20% individual stocks. They are telling me that the approach they are using will save me $7K in taxes. So, they are asking me if Quicken is worth $7K per year.

I tried switching to Simple Investing on the account. I thought it would only use the total account balance, but I still see all of the securities listed along with any mis-matches.

0 -

Yeah, simple mode gets rid of the individual transactions, but it still includes all the securities. Complete mode uses the individual transactions in the download and simple mode uses the number of shares in each security plus the cash amount that is in the "summary information" of the download.

If all you want it the balances, I would suggest you use a manual investment account and just a dummy security or two if you are going to separate out the mutual funds from the individual stocks, and then just periodically do an add/remove shares for these.

EDIT: I should point out that Quicken really doesn't do good with a lot of securities/security lots/transactions. So, going with simple mode will at least reduce the number of transactions and hopefully improve the performance, especially over time.

Signature:

This is my website (ImportQIF is free to use):1 -

Does Simple Mode only bring the security amounts as specified by Fidelity. Where the errors pop up is Quicken using the transactions to calculate the security volumes and showing mismatches with Fidelity. Also there are many errors when a security changes names or there are stock splits.

If the portfolio is only brought down in its entirety, maybe I need to close my existing portfolio and reopen it again.

0 -

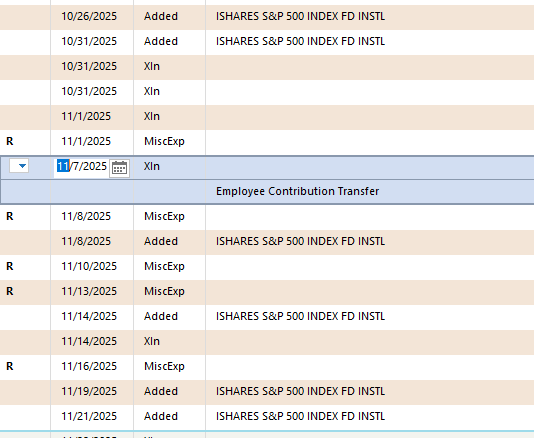

I changed an account that I have setup for some time with simple mode to complete mode to show you what kind of transactions are put in the register (which Quicken hides in simple mode):

Note that since this is a 401K account that just reinvests there aren't any removes, but it could just as easily go that way in an active account:

As you can see there are Xin for the contributions, and there is a MiscExp for recording a difference in the cash amount reported by the financial institution and what is in Quicken (as in money comes from paycheck, financial institution reports there isn't any cash (because shares are being bought) so a MisExp removes the cash.

Then there is an Added share transaction to bring the share amount to the current amount of shares.

In your case that would happen for every security. The reason this would result in less transactions would be that if you update say once a week then there would be a set of these transactions once a week for each security that changed. Whereas if the transactions were being used (in Complete mode) you might have several buys/sells in during that week for each of these securities.

Signature:

This is my website (ImportQIF is free to use):0 -

So. the account has 80% in Mutual Funds and 20% individual stocks. They are telling me that the approach they are using will save me $7K in taxes. So, they are asking me if Quicken is worth $7K per year.

The potential tax savings depend to a large extent on what type of mutual funds you hold, and of course the size of your portfolio.

If you buy and hold index funds, your ongoing tax liability will be very low, because their turnover is only a few percent per year.

QWin Premier subscription0 -

One thing I wasn't sure is clear in my comments. On your original comment the problem was the security mismatching. With Simple investment mode you would never get that because the way you get that mismatch in the first place is because Quicken looks into what you have in your Quicken register and compares it to the "summary information of the number of shares the financial institution says you have" and when there is a difference reports it. But in the case of Simple investment mode, it does the same comparison but instead puts in add and remove transactions into Quicken to match what the financial institution sent. So, by definition you can't have a mismatch. But note that is all based on the assumption that the financial institution does send the right "summary information".

Signature:

This is my website (ImportQIF is free to use):0 -

I made the change to Simple for that account. At least at this point it looks to be running one day behind. Today is Saturday when I updated again and usually would see Fridays close in all the accounts. This one appears to be Thursdays close. I think I saw something about this in another thread.

0 -

One thing that I have seen with a few financial institutions is the "summary information" isn't kept in sync all the time (with it usually lagging behind). In the case of Chase, I know exactly what it is doing. Say, I buy or sell a security, the buy comes down the same day, but the "cash" lags behind until the transaction is closed.

This behavior can cause your original problem too. Since with Complete investment mode they are comparing the transactions in Quicken to the number of shares reported by the financial institution and then reporting differences. Whereas with Simple mode it only uses the "summary information" to change what Quicken has and therefore there isn't anything to report, it just believes whatever it gets from the financial institution.

If this is what is happening at Fidelity and it is now constantly buying and selling securities, you would get mismatches all the time.

Signature:

This is my website (ImportQIF is free to use):1

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub