I bought a CD in Brokerage acct

How do I enter it? It's not a bond, right? My statement says I purchased

Quantity 200,000.0000

But price shown is 100.0000 not $1

So should I change the Qty to 200 or the price to 1?

Then at the end of the month how do I enter the current price of 99.919? And why does the price change? Or should I just leave the price at $1 until it matures? I don't think I pay tax on the interest until it actually matures. So should I account for the market value changes? I'm not planning on selling it until maturity. But if I do I guess I can figure out the prices then.

I'm staying on Quicken 2013 Premier for Windows.

Answers

-

I'd be inclined to treat the CD as-if it were a bond and change the QTY to 200.

Since it's in a brokerage account, it's POSSIBLE that you'd want to sell it before maturity … and that would probably be at a price other than par.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

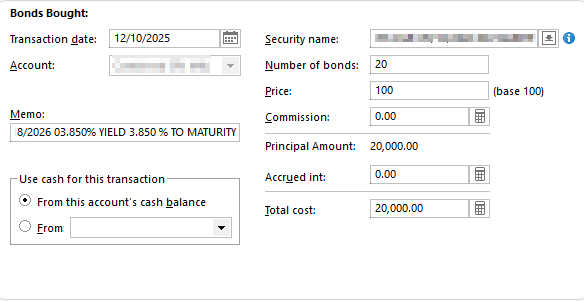

The CDs that I have with Edward Jones download as Bonds.

A recent CD for $20k was entered as:

I don't understand how the math of 20 units at a price of 100 (base 100) works out, but that is what Quicken did with the information provided by EJ. Maybe someone else can explain it, but it is nothing I ever learned in my math classes.

[added] Regarding the quote price, I'd leave it at $100. Yes, EJ does run them up and down slightly thru out the life of the CD, but that is what it would be expected to be sold at based on current CD rates and how much longer before the maturity date. I've got some that are at $100.159 and at $99.993, but as far as I'm concerned, they are just $100.

-splasher using Q continuously since 1996

- Subscription Quicken - Win11 and QW2013 - Win11

-Questions? Check out the Quicken Windows FAQ list0 -

@splasher, Bonds are priced at a $1000 "unit", so 20 units is $20,000. That's just how the investment industry does it.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

@NotACPA I fully understand that bonds are priced at a $1000/unit, but please explain the rational behind "20 units at a price of 100 (base 100)" that Quicken shows in the buy transaction that I displayed in my earlier post.

Thats the math that I don't understand.

-splasher using Q continuously since 1996

- Subscription Quicken - Win11 and QW2013 - Win11

-Questions? Check out the Quicken Windows FAQ list0 -

20 units @ $1000 ea = $20,000 at 100 (Base 100) means 100% of face. Since bond prices fluctuate, they MIGHT have been bought at, say $102 (102% of face) which would have been $20,400 rather than the $20,000 purchase price.

And if the bonds/CD are sold prior to maturity, they could sell for, say 99% of face, or $19,800

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

I would phrase it that bonds are sold in $1,000 units, so buying 20 bonds is $20,000 worth, mature face value. But bonds are priced around a par value (mature face value) of $100. Thus Quicken treats 20 bonds as 200 ‘shares’. The form you are seeing is asking for how many bonds you bought, not how many ‘shares’ or other units.

0 -

At this point, my head hurts from all of this badly represented math and I will never try to enter a bond purchase manually. IMHO, being an engineer (slide rule type,, not railroad), the price should be shown as $1000, not 100, rather than the nod of the head and a wink of an eye stuff that Q is doing behind the scene to come up with the correct total cost. 😣

-splasher using Q continuously since 1996

- Subscription Quicken - Win11 and QW2013 - Win11

-Questions? Check out the Quicken Windows FAQ list1 -

Basically, prices are presented as a percentage, thus 100 for buying the CD initially.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

"And why does the price change?"

It's a "traded" security so the price does change from day to day.

0 -

Now I understand. Q attempts to use a standard security entry form that isn't really suited for dealing with bonds putting information in fields that aren't really what they are labeled as, Price being the worst offender.

They could easily use a bond specific form that states that bonds are $1k/unit and relabel the Price field as percentage of standard unit price and it wouldn't take an expert in invest terminology to use it.

-splasher using Q continuously since 1996

- Subscription Quicken - Win11 and QW2013 - Win11

-Questions? Check out the Quicken Windows FAQ list0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub