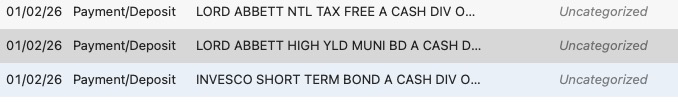

dividend are being categorized as payment at ed jones

catching the quicken mistakes is very time consuming. the below transaction came through as payments instead of dividends. the tax reports will not be correct with these transactions being categorized incorrectly.

Comments

-

The type of transaction should be dictated by the financial institution, which encodes the OFX code to download to Quicken. If they are misidentifying dividends as deposits, then only they can fix that; it's their error, not Quicken's. You might be able to get Quicken Support to document this and escalate it for Intuit to try to contact the financial institution to fix their error; I don't know how successful that would be, but it's probably worth a shot.

(If the financial institution allows you the option of downloading transactions in a QFX or OFX or Quicken format, you could do a download and open the file in a text editor to see exactly how they are encoding them. This won't fix anything, but might be the "proof" needed to pursue this directly with the financial institution rather than trying to escalate it through Quicken.)

Quicken Mac Subscription • Quicken user since 19931 -

understood. quicken, however, should do the work on behalf of ALL their customers. think how silly it is to have all edjones people calling them to explain the issue when quicken representing their customers would be more impactful.

i want software that makes my life simple. if using quicken does not make life simple (by working with institution to provide correct data), then it could be time to find new software.

-1 -

If the problem is that the financial institution is sending out the wrong info, then changing software on your end won't make things simpler for you since the new software will get the same bad info. And I'd be uncomfortable with Quicken changing the transaction type just because the letters "DIV" appear somewhere in the payee, which is the only thing Quicken can do on their side of things to fix this.

You can try to get Quicken to advocate for this to get fixed but Quicken isn't the banks customer; the bank has more incentive to make you happy than they do to make Quicken happy. And if your bank is doing something wrong and your solution is to blame someone else instead, that's a win for the bank and gives them even less incentive to fix things.

1 -

Quicken should negotiate their connections with other institutions. Quicken customers should not have to do that.

-1 -

@Brad L Vandermoon As I said, you can go through Quicken Support. The first thing is that Quicken — really Intuit, who handles the connectivity — needs to be aware that there IS a problem. (They wouldn't even know unless customers report it to them.) Then Quicken documents it and notifies Intuit; it's Intuit, not Quicken, which deals with financial institutions. (Quicken is a small company, and doesn't have staff to deal with thousands of financial institutions; they contract that work to Intuit.) And indeed, Intuit can reach out to Edward Jones.

Just understand that this can be a slow process: Intuit has to research it to determine what the financial institution is encoding incorrectly, then reach out to their designated technical contact at the financial institution, then exchange information, and then hope the financial institution IT team decides to make it a priority to code and deploy a fix. In the best cases, this could happen in 7-10 days; in the worst cases, if the IT staff has other time-sensitive priorities, it can take months.

Quicken Mac Subscription • Quicken user since 19931 -

it should not be "slow process" if quicken/intuit wants to keep customers. with advocates like you for bureaucracy, it could be a slow process. hopefully, capitalism will win and quicken will work to make their connections work.

-1 -

I’m not advocating for a slow bureaucratic process, or for Quicken; I’m just trying to help you have realistic expectations. The various Quicken programs deal with 10,000+ financial institutions; there are multiple new connectivity issues arising every week. Quicken is a company of about 200 people, of which only a small number deal with connectivity issues. That’s why they need a third party, Intuit, to handle connectivity. But the bigger issue is that most connectivity problems require at least a partial fix by the financial institutions, who often don’t see Quicken connectivity tweaks — for the small percentage of their customers who use Quicken — as their top IT priority.

I understand why we Quicken users would wish it to be otherwise, but that’s the reality.

Quicken Mac Subscription • Quicken user since 19931 -

@Quicken Kristina here's another incorrect item to pass on to the quicken team. i have sent in all the quicken logs and referenced this item.

-1 -

Hello @Brad L Vandermoon,

Thank you for reaching out! To help troubleshoot, please provide more information. When did you first notice this behavior? What kind of account do you have with Edward Jones (brokerage, 401k, etc.)? Has it always behaved this way, or was it previously downloading correctly?

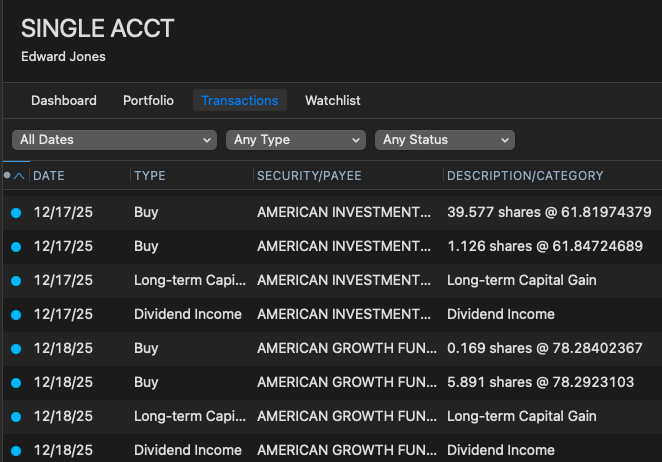

Since I have an account with Edward Jones connected in my Quicken for Mac, I checked to see if the same thing is happening in my account. My dividend income appears to be downloading correctly.

I look forward to your reply!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

This just started happening. And, I saw it start happening with transactions dated 1/2/2026. I have a dividend transaction on 12/31/2025. I can't be a 100% sure on this, but I do not think I had to change that transaction. I know I did not have to change dividend transactions dated 12/10/2025. So, problem started for sure started occurring after 12/10 and likely after 12/31.

[Edited - Readability]

0 -

Thank you for your reply,

I won't have any dividends download into my account until later in the month, so I won't be able to try to replicate it until then.

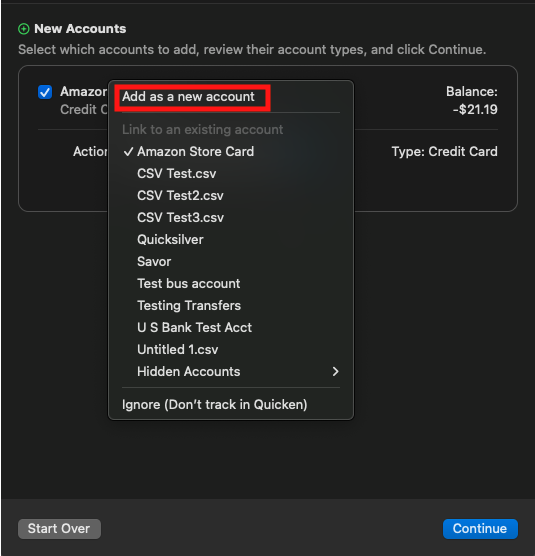

In the meantime, to test if the problem may be file specific, please try making a backup of your Quicken file, then deactivate the problem account, navigate to Accounts>Add Account… and try adding the account as new rather than link to the existing.

In the newly added account, check to see if dividend information comes in correctly.

Please let me know how it goes!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

i am gonna wait on this until we see dividends come down again from ed jones. thanks

1

Categories

- All Categories

- 54 Product Ideas

- 34 Announcements

- 240 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.1K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub