zzz-Fidelity Updates

Comments

-

By the way, it appears that "Simple" transaction downloads under EWC+ for Netbenefits 401(k)/403(b) accounts, reported above, has been corrected as well. We today received our first "Complete" transaction downloads, a matching full "Bought" transaction dated 08/15/2025, as well as a Sold and a MiscExp transaction dated 09/02/2025 for related 401(k) fees.

This is important progress for us, as our remaining EWC+ issues had all been related to Fidelity Netbenefits downloads, while Brokerage, Managed Accounts and IRS accounts had already been working as expected under EWC+ earlier. It appears we are nearing the end of the tunnel of this saga!

1 -

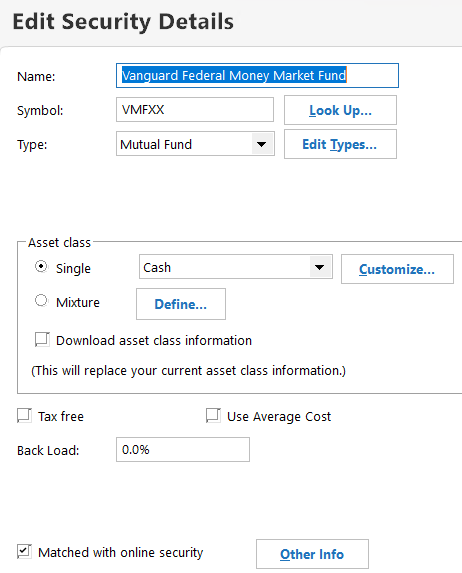

So evidently what I did was wrong. This exchangeOut security stole the CUSIP from Vanguard Federal Money Market Fund (VMFXX), and my Vanguard accounts started getting messed up since transactions and share balances were reported as exchangeOut instead of VMFXX.

To fix it I deleted the exchangeOut security, unmatched VMFXX from online, and re-matched it with the checkbox:

0 -

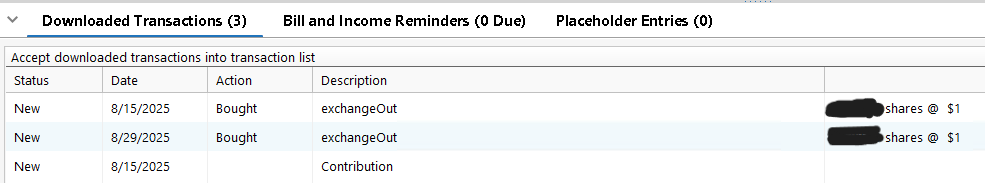

I'm not having the same luck. Today I got these old transactions downloaded. I'm not sure if they were downloaded before.

Though it's possible they fixed it between my & your downloads.

0 -

@EvDob Yeah, that matching thing confused me as well. As I couldn't get rid of it, I matched it with the 401(k) fund I am buying in that account and, thus far, did not encounter any negative issues from doing so. Hopefully it will continue to be like that, the matching request doesn't make much sense anyway.

Will continue to report on 401(k)/403(b) Simple/Complete transaction downloads, next one will come in on or shortly after 09/15.

Best of luck and success!

0 -

Sounds like another serious bug which should be fixed by Fidelity and/or Quicken.

0 -

I will be canceling my subscription. There is no advantage to monitoring consolidated accounts on Quicken if Fidelity / Quicken provides incorrect fixed income prices.

1 -

There IS something intrinsically right or wrong, though…it's the monthly statement. If it says 10 shares @ $100, Quicken needs to say 10 shares @ 100, not 1,000 shares at $1 or any other variant.

If Quicken doesn't match the Fidelity statement, then it's wrong.0 -

For the 1st time since all this began, I received a new prompt this morning to update the connection method for my Fidelity accounts by re-authorizing. I chose "Remind me next time" and continued with DC with no issues.

3 -

I, too, got a new prompt to update the connection type for zz - Fidelity DC. I passed on that and came here immediately to see if there's any reports of resolution by Quicken staff. I'll continue with DC until I can't.

3 -

As other users commented above, I received the same prompt this morning to update the connection type for zzz-Fidelity DC. I chose to "Remind me next time" and everything downloaded without issues. I recommend that all ignore the prompt to update the connection type based on all of the problems that have been well-documented here for two months now. Quicken has not provided any updates regarding this new connection type working without user difficulties - so probably best to avoid changing connection types for now.

2 -

It appears that the Fidelity migration from Direct Connect to EWC+ has been restarted even though it is not clear that all the problems with the new connection method have been resolved.

At the start of my One Step Update today I received a message that my Fidelity accounts need to be reauthorized. I chose to click on the "Remind me later" button at the bottom of the window and everything proceeded as normal with the "xxx-Fidelity Investments - DC" connection.

If you have several Fidelity accounts, you may need to scroll down to see the Remind Me Later button.

QWin Premier subscription3 -

@BrittMayo Thank you for your message. If all we have left to discuss, in terms of the Fidelity/Quicken DC → EWC+ migration, are the minutiae of CD pricing, then it appears we not only are seeing the light at the end of the tunnel, yet are, in fact, stepping out of the tunnel into the light!

The fact is that CD's are bought in $ amounts, the construct of shares for CD's is artificial, what counts is Market Value. Following the CD price format change end of July, everyone who decided to adjust reported "CD shares" in Quicken and aligned with new daily CD price updates has not been facing issues in this respect.

Now, Fidelity/Intuit/Quicken might decide to stay with the current CD pricing format, after all this change might not be purely accidental, or they might eventually change back. Either way, straight forward StkSplit transactions will effectively deal with this matter - it really is a non-issue for us and other Quicken users at this time.

0 -

@HKB fair comments, but it would have been nice if there had been a post here before these migration messages, telling us that it's now safe to migrate (assuming it is).

Barry Graham

Quicken H&B Subscription1 -

I too, got the notice in Windows and chose Remind Me Later. I did not get the notice in Mac. I shall wait until I have no choice or a very few trusted folks here give the nod before making the change.

Does anyone have a comprehensive checklist of all that was "broken" to check against? I never wrote one down. I know decimal places, CD price format, Simple vs Complete. Would be nice to have a list to compare against.

0 -

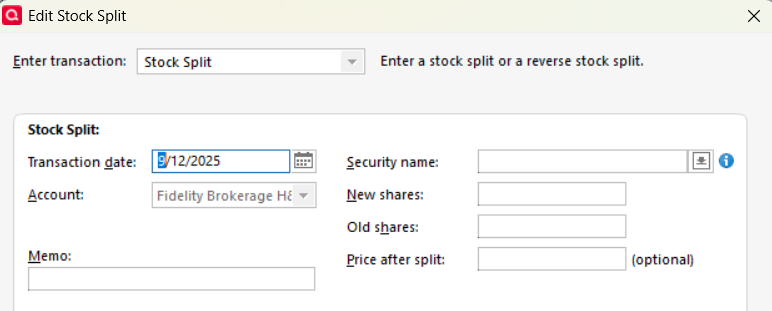

@HKB Was entering a 100:1 StkSplit transaction for each CD all you needed to do to correct the CD pricing issue, or did you have to make other adjustments as well?

I suppose you would have to enter the StkSplit with the same date as the $1.00 prices started to download and also correct the price history and transactions for each CD to undo any changes you had made after that date.

It would certainly be nice to know how Quicken and Fidelity plan to resolve this issue to minimize any future corrections users will need to make.

QWin Premier subscription1 -

I didn't get the migration message, although the the OSU did take a lot longer than usual.

Barry Graham

Quicken H&B Subscription0 -

@Jim_Harman I remember, when I went through all necessary manual adjustments following the EWC+ migration end of July, I adjusted the original CD "Bought" transactions and block deleted previous CD price quotes. Thinking about it later, I thought it might have been easier and more efficient to use StkSplit transactions for the purpose, by completing the following StockSplit transaction table, including nwe & old shares, price after split etc:

I hope this helps! Please post here how it goes, in case we'd need to change back, if and when CD price updates should change. Thank you, much appreciated!

0 -

I did not receive a notice and OSU ran quickly. They are probably phasing in the conversion in stages again.

Deluxe R65.29, Windows 11 Pro

0 -

I have 2 zzz - Fidelity Net Benefits accounts that are both still on DC connection. I did not get any reauthorization notice for either today.

0 -

I did not receive the EWC+ reauthorization prompt during the OSU I ran just now. Just need to remember that if it does happen to always click on that "Remind me later" link in the popup.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

@BarryGraham "… fair comments, but it would have been nice if there had been a post here before these migration messages, telling us that it's now safe to migrate (assuming it is)."

I agree. Presumably, there will be an official Quicken posting later today. Advance notice would have been better, specifically if there is a new migration deadline for current DC users.

0 -

Same. No intention to renew after about 3 decades of Quicken use. I worked in IT for my entire career and the first thing you do when an "upgrade" breaks something important is you back it out and then figure it out behind the scenes. Quicken's insistence on keeping it broken while they investigate is very telling.

0 -

There are several lists of the problems caused by the EWC+ changes (there may be better ways to point to them, but I couldn't figure it out):

https://community.quicken.com/discussion/7964537/zzz-fidelity-updates/p5#

from Quicken Kristinahttps://community.quicken.com/discussion/7965333/ctp-13955-fidelity-conversion-to-ewc-has-caused-numerous-problems-when-are-fixes-expected?utm_source=community-search&utm_medium=organic-search&utm_term=CTP-13955#

https://community.quicken.com/discussion/comment/20506468#

from Ray and ChapGPTAs far as the CD prices go, I also adjusted my CD purchase to show $1 / share price and number of shares based on that price. However, when Quicken changed mid-August to show CDs again as sets of 100, BUT kept the prices at $1/share, this caused additional problems. I still have my CDs at $1/share and 10000 shares for a $10,000 CD. However, I get the Security Comparison Mismatch because shares reported is 100 instead of the 10000 I have in Quicken. Are you guys not also seeing this Security Mismatch problem? Would doing the Stock Split somehow solve this Security Mismatch problem? I don't see how Quicken can leave things as CD prices at $1, but Share count as sets of 100, this will not work correctly for VALUE of the CDs.

My other problem is the way CASH is being treated. I also get a Security Comparison Mismatch for my Fidelity "cash" accounts (all mine are SPAXX). I would like this changed back to the way it worked before the EWC+ conversion where SPAXX was treated as cash and not a mutual fund.

0 -

On minutiae of CD pricing: funny enough, we just received the above Fidelity CD Full Call Alert e-mail message: apparently Fidelity internally CD pricing is inconsistent, this one priced as 1 bond x $1,000. As mentioned above, of all the issues CD pricing is not one of the critical ones.

0 -

The "cash" accounts - I have three - are a concern for me/ Right now they work just fine in ZZZ. Do not want that to change.

I mentioned lists earlier as there are several as you show. Would be nice for one master issues list we can agree on and check against. I have not looked or spent the time, but I wonder of any of those links (or other posts) are complete.

0 -

I does kind of make it seem like the end users are the testers.

Deluxe R65.29, Windows 11 Pro

0 -

I suspect the reason they didn't back it out is because the only way to go back to DC, after being with EWC+ for too long to restore a backup, involved complex workarounds (which I included here) to avoid switching to Simple Tracking. Unless Fidelity is all you track, I recommend imagining how ditching Quicken would affect you as a whole. For me personally, it's still worth it for everything else I use it for, and ditching it would cause hours of extra work over the year, particularly at tax time.

Barry Graham

Quicken H&B Subscription0 -

Got the prompt to change to EWC+, so I backed up my file and tried it. For me it didn't ask or treat the money market (SPAXX) as cash, so I restored the backup and am still on DC. I thought this was fixed?

1 -

Happily, I did NOT get the prompt to change to EWC+ this morning. I would have delayed it regardless. I'm not interested in being a beta tester for quicken. Still on legacy zzz-Fidelity-DC.

0 -

I did receive notification to change to EWC+. It then went away. Wondering if Quicken pulled it back!!!

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 237 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub