zzz-Fidelity Updates

Comments

-

This is promising, and I'm glad it's working for you, but the official Fidelity thread on this hasn't had an update since Aug 27th. That tells me there are still problems being worked on, though I'm hoping that your experience means some of them are being fixed.

0 -

I am also having issues with Quicken merging different Money Market Accounts into the Cash category. Before, they were specifically identified by the type of account. For example, I have FZDXX and SPAXX listed separately on the Fidelity site, but they show as cash when downloaded into Quicken.

0 -

@Mark Torpey Preferences —> Downloaded transactions —>

0 -

Encouraging to read that your experience with EWC+ has improved. I've haven't transitioned yet (I tried in July and, thankfully, the connection failed). DC is working fine soI'm waiting until the last possible minute to pull the trigger.

(edited question out - I realized you answered it in your prior post)

It's become more and more obvious that different types of accounts, and perhaps how they are accessed, have different problems. I suspect that's slowing the fixes down bc the developers didn't know that earlier on (and perhaps still don't in some cases). It would be great if posters would identify, as you have, the types of accounts and how they're accessing them when posting. It might provide additional clarity in the fog of what's going on.

0 -

EWC+ is still not working for me. It downloaded a few transactions last month, but nothing since sep 3. And I have many transactions sitting at Fidelity since that date. Hoping they come through tomorrow.

Still have issues with existing shares not matching due to rounding. And my SPAXX is being treated as Money market account. I would prefer it be treated as cash.

0 -

@mrzookie Yes, any Brokerage, Managed and IRA accounts accessed and downloaded using EWC+ work well.

Remaining issues, as reported, are solely related to 401(k)/403(b) transaction downloads (Simple instead of Complete, while being set up for Complete):

At least that's what I think the issue is, as no 401(k)/403(b) Buy/Sell transactions are getting downloaded and reported, yet, solely one bi-monthly CONTRIBUTION transaction, which I presume Simple would do?

1 -

@Bill6 "Still have issues with existing shares not matching due to rounding."

Existing share balances in Quicken, previously imported and incorrectly rounded, will require a manual update in order to match and result in a positive reconciliation report:

New incoming ReinDiv transactions will be correct (three digits instead of two) and align between Fidelity and Quicken. Any previous discrepancies will not simply vanish of course, though.

0 -

Looking at Fidelity website, Portfolio Positions shows a quantity of x.2507, quicken shows x.2507. Looks the same to me, only thing that tells me different is Quicken's Online Center.

.2507 or .251 isn't going to change much, but before EWC+ they were a match with no complaints from Quicken Online Center.

I can adjust it in quicken but every time I login to Fidelity I will see a different number.

Prior to EWC+ upgrade they were a match, with no complaint from Online Center. So it is a change that has been introduced to my system since the EWC+ upgrade. When I lose functionality or integrity between systems, I consider it a bug.

0 -

Quicken does not complain about share quantity mismatches unless the difference is more than some small amount, .001 share I think.

The recent EWC+ limitation of 2 decimal places and apparently rounded up will produce mismatches, though.

QWin Premier subscription0 -

I started this thread on 7/29 with the first post. I've been away for a month and still have the same issue.

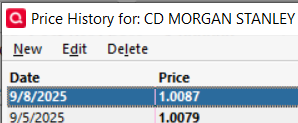

All CD's that were purchased from Fidelity are not updated with the current prices. Also, CD's previously were priced at $100 a share. Now they are priced at $1 a share.

0 -

Same issues. A month passes and still no fix to this problem tells me it will likely never be repaired. I renewed my subscription a few weeks back, thinking this issue was resolved. I see no reason to continue with QUICKEN. This is a worthless APP if I am required to make dozens of manual price changes every two days to arrive at an accurate balance.

0 -

Update to my last post!!!!!!!!!!!!!!!!!!

All my fixed income securities—Bonds, Treasuries, CD's—-The last update was 9/5/2025

No update for yesterday—9/8/2025 as of 7:23 Eastern standard time

0 -

None of my securities are usually updated during Sundays or Mondays mornings (if mutual funds).

Deluxe R65.29, Windows 11 Pro

0 -

Even before this I used the Fidelity or NetBenefits app to see my balance. I can do this anywhere. It's important to have an accurate balance but for me Quicken is most useful to track spending, reconcile my bank and credit cards and help cut tax return prep time. These issues will be fixed, hopefully soon.

Barry Graham

Quicken H&B Subscription0 -

I've been a Quicken customer since the early nineties and have seen my share of hiccups with the program but considering what it now costs to access a yearly subscription, there is no excuse for this kind of mess for such a long period of time.

1 -

I just don't like to see people making their life harder just to make a point, for those considering giving up on Quicken.

Barry Graham

Quicken H&B Subscription0 -

@Bill6 "I can adjust it in quicken but every time I login to Fidelity I will see a different number"

What worked for us was manual correction of related ReinDiv transactions from two digit rounded to correct three digits after the decimal point, after migration until the issue was ultimately fixed. That way, Fidelity and Quicken balances will be fully aligned and new ReinDiv transactions are being registered correctly with three digits, no two digit rounding since then. Good luck!

1 -

@Gary R "All CD's that were purchased from Fidelity are not updated with the current prices. Also, CD's previously were priced at $100 a share. Now they are priced at $1 a share."

Yes, the reason we decided to adjust number of CD shares in Quicken, in order to benefit from the new daily price format download. This approach results in related "Security Comparison Mismatch" pop-up messages from Quicken, yet provides correct Market Value reports updated daily.

0 -

@GBB "Same issues. A month passes and still no fix to this problem tells me it will likely never be repaired."

Well, from our pov, hopefully the new CD price format will remain as is. In fact, it would be slightly bothersome to adjust CD shares manually back to x100 increments. Not a big issue, yet for now it works for us in terms of reported Market Value, which is all what counts for CD's and we look at anyway.

0 -

Not sure what you are referring to re "my choice". I didn't indicate anything other than my disappointment in Quicken's poor implementation of this change of download method. This is not free open source software.

0 -

I corrected my comment, which was intended for those considering giving up. I agree it is disappointing.

Barry Graham

Quicken H&B Subscription0 -

@shtevie "… there is no excuse for this kind of mess for such a long period of time" appears to imply that you have been connecting your Fidelity accounts recently using EWC+?

Have you actually migrated to EWC+ and are currently facing any concrete issues, personally, and, if so, of what nature are they? Are you still downloading using DC, or are you actually not downloading Fidelity transactions at all, and are simply referring to postings of others on here?

1 -

I use OSU pretty much daily but I have separately updated my and my wife's Fidelity accounts via Direct Connect just a few times since July. I remember the disruption caused to my Chase accounts back when that conversion was implemented and I wisely refrained from partaking in this one any earlier than necessary. Personally since activity in our Fidelity accounts is so much less than our bank and credit accounts, I would be content to download my Fidelity activity once a month to my PC manually from their website and upload it into my Quicken program, but apparently that option has been removed recently by Fidelity and there's no indication when it will be reinstated. :-(

1 -

Same with me. My last DC download from Fidelity typically is on Saturday morning. Then there is nothing downloaded, again, until Tuesday morning.

The exception to this is if I did not download on Saturday. Then Friday's updates will download on Monday morning. But if I did download on Saturday, then there will be nothing new to download until Tuesday morning.

It's been this way with Fidelity for as long as I can remember and I've been downloading from Fidelity since the early 2000s.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1 -

Fidelity has never settled and/or processed transactions on Saturday or Sunday. If they are settled and completed Friday nite (or early AM Saturday) they will come down whenever you pull them, be that Sat, Sun or Mon. If they were not settled and processed on Friday nite, they don't arrive until Tuesday. The occasional exception to the rule was month and year end divs and cap gains but even those are happening far less than they used to.

Another quirk with Fidelity downloads is that they process transactions in multiple steps. If you happen to attempt a download in the middle, you'll get nothing, and never will. And, the process seems to be stretched out during month-end. And, Fidelity funds are the most prone to getting stuck in the middle. The fix it is to go to a backup that was taken before the processing started (typically happens between 11 and 1am Eastern, but sometimes starts earlier and/or ends later) and wait a while longer before downloading, or manually enter the "stuck" transactions. You can usually tell what's completed by the fact that the bolding in the Activities & Orders list is gone, but even that isn't a sure thing. In my almost 20 years of using Quicken this is the single biggest reason I've needed to restore files.

1 -

September 10 update: Updated my accounts this morning and Fidelity fixed income prices are still changing back to $1 value from $100. When will this be corrected?????

0 -

@GBB "When will this be corrected?????"

There is nothing intrinsically right or wrong to report a, let's say, $1,000 CD investment as 10 shares x $100, 100 shares x $10, 1 share x $1,000 or 1,000 shares x $1. What is important is that a new $1,000 CD investment gets reported as $1,000! Just because Fidelity for some reason followed a 10 x 100 convention under Direct Connect does not necessarily mean that daily CD prices will be reported in the same fashion under EWC+.

If Fidelity/Quicken decided to stay with the new CD pricing convention for EWC+ price downloads going forward, there is nothing here to be corrected. In fact, as mentioned above, we are rooting with Quicken for the new CD pricing format to stay as is, and to simply get rid of the unnecessary "Securities Comparison Mismatch" pop-ups for CD's.

0 -

HKBMember ✭✭✭September 9edited September 9@GaryR

"All my fixed income securities—Bonds, Treasuries, CD's—-The last update was 9/5/2025"Status: 09/09/2025 AMI checked back later in the morning and all fixed income was updated. Great!!!!!!!!!!!!!!

I changed all my CD quantities to reflect the new $1 Fidelity pricing. All good

Everything seems to be working just fine now.

1

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 237 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub