zzz-Fidelity Updates

Comments

-

Well, there is some progress with EWC+. I'm getting 3 decimal places for share quantities now, woohoo! But for some reason these transactions came in this month as BoughtX & DivX, but once I accepted them, the BoughtX changed to Bought. That's probably what happened last month also. So I changed the DivXs to Div, and the cash balance is correct.

1 -

The problems with Fidelity transactions downloads remain. I first reported them on 8/6. Today, 8/29, the problems are still there. All Fidelity accounts are reset; complete tracking option; and EWC+.

For one of the accounts, out of 4 transactions (all reinv) only one downloads, showing the reinvested amount, but with no information about the fund, the shares, etc. In short, completely screwed-up.

20+ years customer… INCREDIBLY FRUSTRATING.

4 -

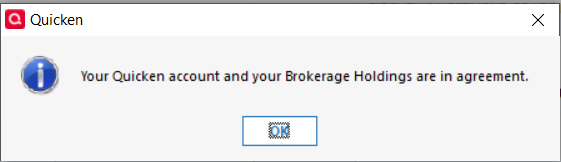

On this end, all month-end transactions downloaded correctly from Fidelity into Quicken R64.19 over EWC+. ReinvDiv rounding issues have been resolved, Reconcile Shares between Fidelity and Quicken EWC+ are aligned:

Not sure where the vastly different user experiences under EWC+ come from, there may be other things going on here beyond the purely obvious.

Fidelity Brokerage & IRA account issues appear to be resolved on our end, Fidelity Netbenefits (401k/403b) accounts continue to download as "Simple" instead of "Complete" transactions.

3 -

@HKB @Quicken Janean @Quicken Kristina

My Fidelity Brokerage & IRA account OSU using Quicken (Windows) R64.19 over EWC+ does properly register three decimal places for number of shares on transactions. My particular issue seems to be RESOLVED. 😃

Windows 11 Home / Quicken Premier Subscription - Quicken user since the last century1

Windows 11 Home / Quicken Premier Subscription - Quicken user since the last century1 -

My NetBenefits regular 401(k) account downloads as Simple investment tracking, whereas my NetBenefits 401(k) BrokerageLink account is correctly downloading as Complete.

0 -

New problem: now my 401(k) investments with no ticker symbol aren't updating their prices anymore with One Step Update.

0 -

@BarryGraham Today, DC did pull transactions from 08-29-2025 of the same type that was missing for the same accounts a few days ago (not the same transactions - different transactions). For those that reestablished DC through "add new account" (and not creating a file template), I wonder if somehow, on the backend, the same fix that seems to have corrected some EWC+ issues also fixed DC.

Seems odd, given the infrastructure for DC and EWC+ are so different, but I can't explain it otherwise.

0 -

If I switched to EWC for Fidelity, but turned off downloads, do I turn it back on, or are there other steps?

0 -

I would try to just download transactions again. If that doesn't work, reset the account, and if that doesn't work, then do a full disconnect and reconnect.

There's a chance that transactions from late July to late August just never show up and you'll have to enter those manually. We don't have enough data points to know of those will come through on a full connection reset.

0 -

I'm still on legacy zzz-Fidelity-ZZ and my Fidelity netbenefits account only updates prices on one step update after about 8:30pm california time every day. Any new connection would have to update prices otherwise I won't change connection methods.

0 -

I'm not sure what you mean by "Any new connection would have to update prices…" There are 6 ways that Quicken gets security price quotes. You can read more about this and see the hierarchy in the Support Article at this link: .

And as long as Fidelity continues to provide securities prices via downloading then the download method used is irrelevant. And from what I've seen so far the securities prices are downloading fine with EWC+ (except for bonds and CDs…still an ongoing issue for me with regarding to share volumes and prices).

If your concern is about the time that price downloads are available: Mutual funds prices are available only after the markets have closed and the MF companies have calculated the new prices. For me (in the Central time zone) I can download new prices generally after 6:00 or 6:30 p.m. each business day. Sometimes it is much later than that for MFs that have foreign investment content. So for you that 8:30 p.m. time period sounds about right since Pacific time is 2 hrs behind Central time. There is nothing we nor Quicken can do to change this regardless of the connection method.

Does this answer your question? If not, please provide additional comment so that we can better understand what your concern is.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1 -

@Boatnmaniac Robert & I are talking about investments in 401(k) which don't have ticker symbols and whose prices are only available from Fidelity. These have always become available only in the early morning hours Eastern time.

0 -

Sorry I wasn't specific, Fidelity manages 401k's and Deferred Compensation Plans using custom non-public funds that don't have stock tickers so the normal quicken market updates don't work. These fund prices only update once per day and only when I click on "update transactions" for the specific Fidelity Netbenefits account or do a one-step update on all accounts. And prices are not updated until about 8:30pm Pacific Time. As there is no stock ticker there is no other way to update the prices. If I go to the Portfolio Tab in Quicken and click "update", the prices on these funds do not update. This functionality of getting prices thru the connection to Netbenefits for proprietary funds is essential and must be preserved on any replacement connection. And I will not change to EWC+ until I get confirmation that this works.

0 -

I've had 401(k) accounts managed by Fidelity before. In those accounts some of the funds were publicly traded funds which downloaded in the evenings after the 6:00-6:30 p.m. (CT) window….which correlates well with the 8:30 p.m. (PT) Robert mentions.

But for any private 401(k) funds (or "trusts" as some call them) in the account, you are correct that the prices tended to be available for download much later than that.

Regardless of which situation is applicable here, when Fidelity decides to stop support for DC that zzz-Fidelity connection will no longer work and it will be either switch to EWC+ or stop getting downloads at all for that Fidelity 401(k) account.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

Thanks for the clarification. And I hope they get the price downloads for these types for non-public funds/trusts fixed before the forced cut-over to EWC+ occurs. Just know that when Fidelity decides it's time to force the cut over it will either be change the download connection or have no download connection because Fidelity's plan is to eliminate support for DC entirely.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

I know that I'm at the mercy of Fidelity/Quicken who will at some point force me off the legacy connection. What concerns me is that there is a list of things that have been fixed and things still needing fixes that was posted by @Quicken Janean on 8/29 and it does not include pricing on proprietary funds without stock tickers. I hope that Quicken/Fidelity is aware that this functionality isn't working on EWC+ and has it on their list of things to test for and ensure it is working before we are forced to switch.

P.S. Just to be more specific, on my Fidelity Netbenefits account in Quicken Classic, there are two different update options on the menu "Update Transactions" and "Update Quotes". "Update Quotes" never does anything. "Update Transactions" will download any new transactions and update fund prices on their proprietary funds without stock tickers, but only after around 8:30 or 9pm Pacific Time. I don't know the technical details of how the fund prices get updated. I only know it works and that this is critical functionality. Sure, I'd like it earlier in the day, but the timing isn't critical, only the functionality is.

1 -

Can someone please explain why we can no longer manually download our transactions from the Fidelity website and then import them into Quicken? Why has this option been taken away? .CSV download is now the only option on the Fidelity web site. I have 7 Fidelity accounts and would much prefer to manually import my transactions once or twice a month than risk having decades of my financial data corrupted due to a faulty auto download by One Step Update.

1 -

@shtevie This is a question only Fidelity can answer:

https://www.reddit.com/r/fidelityinvestments/

They are in control of the download options they do or do not provide to their customers.

0 -

I asked a Fidelity rep a couple of weeks ago and he could not give me a definitive answer except to say it was temporary. I was hoping a Quicken rep or someone else here might have uncovered an answer.

0 -

@EvDob Regarding one of your accounts downloading as Simple Tracking, did you switch back to DC? If not, at what point did it switch to Simple Tracking?

Barry Graham

Quicken H&B Subscription0 -

@BarryGraham Barry, this is under EWC+ for @EVDob and other EWC+ users. From the very beginning Fidelity Netbenefits (401k/403b) downloaded transactions in "Simple" format under EWC+, while accounts are set for "Complete".

As reported earlier for August month-end EWC+ transaction downloads:

"Fidelity Brokerage & IRA account issues appear to be resolved on our end, Fidelity Netbenefits (401k/403b) accounts continue to download as "Simple" instead of "Complete" transactions."

0 -

@BarryGraham HKB is correct. I haven't switched my wife's accounts back to DC. (I never changed mine from DC.) She has a regular 401(k) account and two BrokerageLink 401(k) accounts with NetBenefits, all set to Complete investment tracking. The regular account started downloading with Simple tracking as soon as I switched it to EWC+, but the BrokerageLink accounts are working, downloading with Complete tracking.

0 -

Thanks. I'm trying to make sure I understand what you mean by Simple Tracking. Do you mean it converted the account so that it is now a Simple Tracking account, or do you mean it downloaded the transactions in simple format into a Complete Tracking account? In my case, before I switched back to DC, it didn't download my contribution into my 401k, and only downloaded one of 4 investment transactions. Then, a few days ago, in the EWC+ version of my file, when I was experimenting, it did download all 4 transactions into my 401k account. I didn't look closely to see if there were issues with those transactions since I had a DC version of my file and wasn't paying attention to the balances in the EWC+ version.

Barry Graham

Quicken H&B Subscription0 -

It downloaded the transactions in simple format into a Complete Tracking account. (Which of course were useless. I ended up deleting all of them and entering proper transactions manually.)

0 -

OK, thanks for the additional explanation. Your concern make more sense to me now.

BTW, each 401(k) plan private fund does their own daily price updates. I don't understand all of the details of all that goes into that process but I do know that two of the biggest influences on the timing are how soon foreign investments updates are provided to the private fund team and how significant any plan participants' buys and sells of the private fund were. Before I retired I had 401(k) plan private funds that were updated at about the same time as when public fund prices got updated. Others were a little later in the evening (like yours) and others would not update until the early morning hours of the next day. Like you, the timing was no big deal to me as long as the updated pricing did download.

It only became an issue for me with my last employer's 401(k) because that plan did not support downloading into Quicken at all so I had to manually export the data in QIF format and then edit that file so Quicken could import it. It was such a PIA to do that I only did that about once every 1-2 wks.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

@Boatnmaniac I really appreciate all your expertise helping everyone. Thanks. One more question, I also have a few California Muni Bonds (actual bonds, not funds) in my regular Fidelity Brokerage Account. No stock ticker so they don't update price like stocks or mutual funds. They do get a new price early in the morning on the day after each trading day (e.g. Monday's price shows up early Tuesday morning) and it updates in Quicken when I do a standard one-step update. Do you know whether this works in the EWC+ connection? I haven't seen comments about it. Thanks

0 -

Thank you for the kind words. It is much appreciated.

I downloaded with EWC+ on 8/30 in the Fidelity test file I created in early August. That was the first download attempt since about 8/7. One account has a fair number of bonds (actual bonds, not bond MFs) in it. From what I can tell it looks like the bond-related transactions in that account downloaded correctly.

I can't say the same about a lot of other things, especially with regard to brokered CDs and MMF Core accounts, but it is a noticeable improvement in how EWC+ with Fidelity is working.

You know you can test this out yourself to see what might be working and not working. There are 2 ways to do that:

- OPTION 1: In your primary data file —> File > Copy or Backup File > Create a copy or template > Next > give the copied file a unique name….TEST_FIDELITY EWC+ would be a good one (I would suggest to not change the location for the copied file so it makes it easier for you to find) > Save Copy. Quicken will create a unique copy file with it's own ID and Cloud Account ID so there is absolutely not cross-talk with nor affect your primary data file. Open that file and deactivate the Fidelity accounts after which you can do Add Account to download with EWC+ making sure to link the downloaded data with the appropriate accounts in Quicken. Doing it this way will allow you to see how it might impact the historical data.

- OPTION 2: In your primary data file —> File > New Quicken File. Then do Add Account to set up the new Fidelity Investments EWC+ accounts. Historical data prior to early June will not be present but it will be less "cluttered" because of that so you can more easily see how well the EWC+ connection downloads.

If you do this, let us know the results.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1 -

Hi @Boatnmaniac Thanks for all the help over the years from me as well. Sorry to diverge from the current topic a bit, but this has me a little confused. Are you saying there is a difference between a copy and a backup? Seems to be and I would surmise a copy can be run but a backup only restored. If that is the case, is a copy FULLY functional where one does not need to reauthorize accounts, etc? BTW, I would be trying this on Mac, but I assume would be similar.

I ask because of my thread elsewhere on Wells Fargo issues. Once upon a time and for years, one could get Wells CC online bills through Direct Connect. No longer. And for at least a year has been impossible to have DC and EWC+ to the same Wells FI.

If a copy has no risk of destabilizing what I have working now, that might be worth a try. And if so, glad I found this post!

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 237 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub