zzz-Fidelity Updates

Comments

-

While I prefer DC, I think that EWC+ is secure and I'm not switching away from Quicken. Intuit is trustworthy and we trusted them when they owned Quicken. There are plenty of other ways for data to be compromised these days. I'm sure there are others that can explain better than I can why EWC+ isn't more risky than any other way of interacting with your data online.

Barry Graham

Quicken H&B Subscription0 -

DC + 2FA: identical to logging into a web site, except: you may have your credentials stored in Quicken's vault (on your computer) and you're using an additional piece of software (Quicken) to interact with the web site.

EWC: Quicken shares your credentials with Intuit, who then DOWNLOADS AND STORES your financial data nightly. Quicken fetches this data from Intuit when you update. Notice: a third party now has your credentials AND access to your data.

EWC+: identical to EWC with the exception that instead of storing your credentials a secure token is generated which is used to log in to your accounts. Better than EWC in that your password won't be compromised but no different in terms of sharing access to your account + stored data at a third party.

Sorry, in this day and age of account breaches it is OK to provide these as an option but it is unforgivable that DC + 2FA is being eliminated in favor of these other solutions. It is also unacceptable that you have to dig hard to find these details, if you look at official "details" on these connection methods they're smothered in semantics and it's difficult making an informed choice. Personally, I'm not taking the risk with the ability to log in to brokerage and retirement accounts.

1 -

Is there any updated ETA when the Fidelity download issues to Classic will be resolved?

0 -

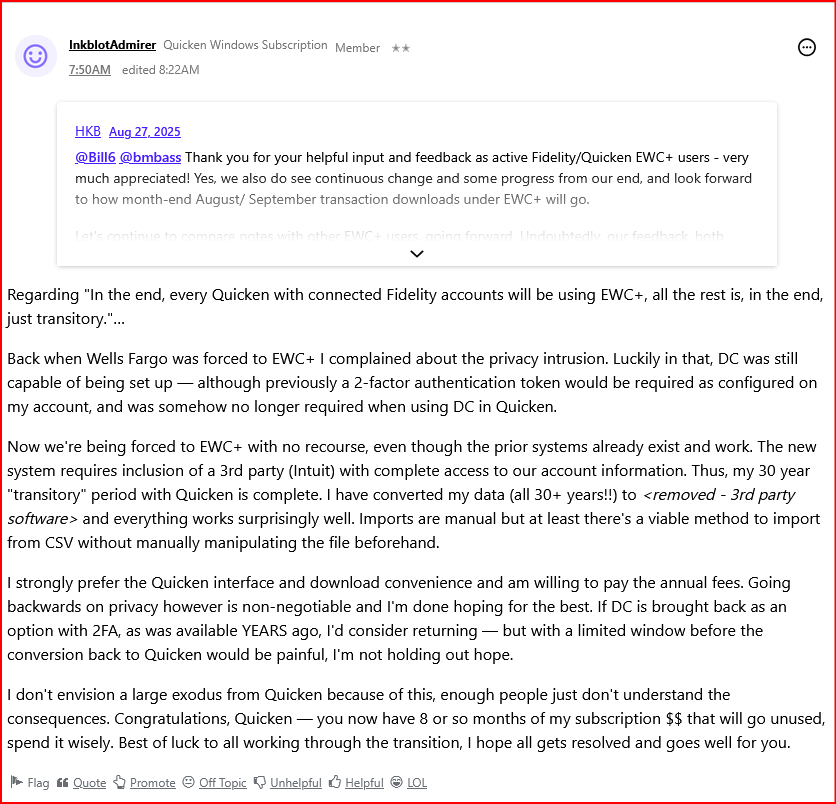

@InkblotAdmirer said -

…it is unforgivable that DC + 2FA is being eliminated in favor of these other solutions.

It is the financial institutions that are eliminating support for DC, not Quicken. So, if you want to be angry with someone about this be angry with Fidelity.

BTW, the financial institutions that are migrating to EWC+ (which is based upon a newer FDX API) are doing this with all aggregators and 3rd party softwares, not just with Quicken. I recently needed to use Plaid to link a savings account to Fidelity and was required to use the exact same authorization process for that as is used by Quicken for EWC+ with Fidelity. It is they who have banded together to form a consortium that established this new protocol.

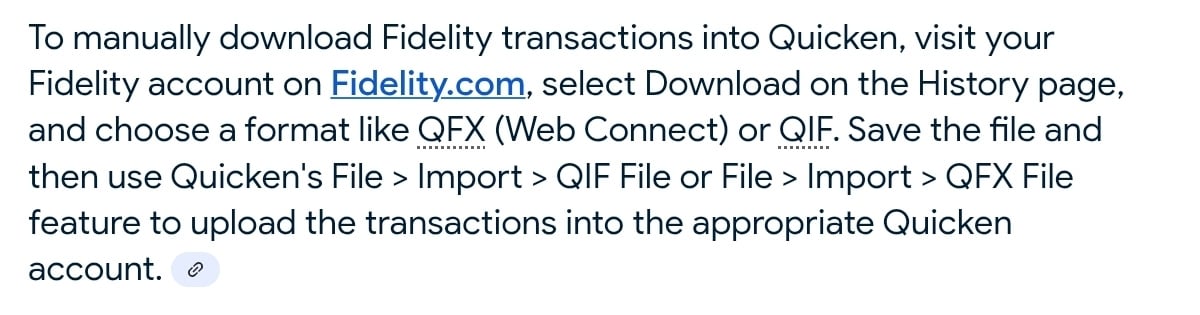

So, if you switch to another 3rd party for your personal finances aggregation because you don't like EWC+ (i.e., the FDX API), then make sure they support manual downloading and importing from the financial instutitions' website. Quicken does have a download method for doing this called Web Connect but not all financial institutions support WC.

If you want to read up more about the FDX API and the consortium that established it click on this link: https://financialdataexchange.org/ I found it interesting to see how and why the financial industries are driving this change.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

2 -

@InkblotAdmirer is it an exposure that with DC your password is stored in the vault on your PC?

Barry Graham

Quicken H&B Subscription0 -

Quicken almost never provides ETAs for when connection issues will be resolved because with connection issues there are up to 3 different parties involved in the process. So, it's not something that they alone control.

On rare occasions we will get an ETA for when we will see resolution to a software issue but that is quite the exception when it does happen. And when it does happen they will post something like "the fix will be included in the next version update" with no date provided.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

-1 -

Only in the sense that your password is stored in a file on your computer. Someone would need access to the file, but it should be protected by your vault password (can't remember if these are mandatory or if it can be in the file unprotected).

@Boatnmaniac I get what you're saying regarding who's responsible here, but Google around and there's evidence Quicken "charges more" for the DC service vs. EWC+ — so put yourself in a financial institution's shoes, if they're only going to support one solution why not the cheaper (for them) one? And I'm not really angry here, just disappointed that companies no longer act in the interests of their customers but treat them as loyal cows to milk.

And in the end it doesn't matter, the solution is the same: don't participate in the update services that are more prone to abuse.

Quicken could act in the best interest of their customers and give them viable alternatives (EASY ways to import downloaded data from financial institutions being an example) but they're not — we get glitzy new dashboards instead. They could still do this but these conversions have been coming for a few years now, and they haven't.

0 -

Just curious what thoughts are on temporarily using .csv files. I haven't used then in quite some time, but I have a few Fidelity funds with many securities in it and manual really isn't a reasonable option (that is what an agent advised me if I didn't want to wait). Since Fidelity still has a csv download I was wondering if its worth the effort to download and then format and name columns as required by Q?

0 -

rdc25 wrote: Just curious what thoughts are on temporarily using .csv files. I haven't used then in quite some time, but I have a few Fidelity funds with many securities in it and manual really isn't a reasonable option (that is what an agent advised me if I didn't want to wait). Since Fidelity still has a csv download I was wondering if its worth the effort to download and then format and name column

Why has this option been removed by Fidelity? It would be a great alternative right now.

0 -

@InkblotAdmirer said -

Quicken "charges more" for the DC service vs. EWC+ — so put yourself in a financial institution's shoes, if they're only going to support one solution why not the cheaper (for them) one?

Actually, it is Intuit that charges for DC, not Quicken, and it's always been this way. It is also the reason why support for DC by the large majority of financial institutions pales in comparison to support for EWC and EWC+ which has no Intuit fees attached to them. But I do agree with you that it is likely a big part of the reason for financial institutions moving away from DC is the cost.

However, it is also for security concerns. From the FI perspective EWC+ likely provide THEM with the highest level of security because it is they who have now have some enhanced control over how data is downloaded and how they can control that. And they don't need to let an external program actually get inside their system like DC does (especially with regard to the DC Bill Pay feature) to download data which is also a known security concern for them.

However, I think the biggest reason for financial institutions migrating to EWC+ is that it gives them a way to consolidate all the various aggregations download protocols into a single one that is being forced on all the aggregators they work with. So instead of having to staff employee support for software, internal coding, hardware and security for a several different protocols that now will need fewer employees

No matter how you slice and dice it, it boils down to cost reduction.

Quicken could act in the best interest of their customers and give them viable alternatives (EASY ways to import downloaded data from financial institutions being an example) but they're not

Well, we don't know what kinds of legal "strings" Intuit placed on Quicken when they sold it to HIG Capital back in 2016. What is known is that it is a very common practice in the business world for companies, when they sell off their proprietary property, to attach legal and financial requirements on the buyer so they can't just change the product in ways that would perhaps be financially disadvantageous to the seller. Supporting that this might be in play with Quicken is that Quicken pays Intuit for their proprietary aggregation services which includes the proprietary Quicken manual download/import process (i.e., Web Connect). If this is the case, then Quicken might be legally prohibited from adding other more generic download processes that Intuit would not financially benefit from. I don't know this for sure but it is a logical assumption based upon what I do know of the Intuit/Quicken relationship.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1 -

I can confirm that it picked up a cash contribution to the Roth IRA (dated yesterday), but not the buy transaction for a mutual fund (also happened at the close, yesterday). It's possible that the buy transaction was logged as being "downloaded" already this morning.

However, it did identify that there was a shares difference. So it is downloading holdings properly and comparing.

I usually have a lot of end of month transactions, so we will see how that goes on Saturday.

At least it picked SOMETHING up!

0 -

Seems like this discussion is being censored.

0 -

Actually, all the removed posts here and in other threads appear to be from one person. I don't think this discussion is being censored.

Barry Graham

Quicken H&B Subscription1 -

Yes, all the removed posts were made by one person.

There are a few things that can cause the removal of a person's posts from this community. The two most common causes:

- The person had done something rather extreme regarding non-compliance with the Community guidelines resulting in the closing or deletion of their account.

- The person requested their account to be closed and/or their posts removed.

We will never know which of these has occurred but they still have a Community account so I'm guessing it was their decision to have their posts removed.

We all need to keep in mind that this Community is a privately owned website that we are allowed to use at the pleasure of the site's owner (i.e., Quicken, Inc.). Quicken places few restrictions on our use of this site but does insist that we comply with their guidelines and terms and conditions that we all needed to agree to abide by before we were permitted to open an account here. IMO the guidelines can be summarized pretty simply:

- Treat everyone (both users and Quicken employees) respectfully.

- Vulgar language is prohibited.

- Don't post rants.

- Don't knowingly post false information about Quicken or others in the Community.

- Do not promote a competitor's products. (It's best to not even talk about competitors' products at all. There are other non-Quicken sites for doing that.)

One thing I can say is I have never seen a person's posts get edited or "censored" no matter how unflattering they might be about Quicken provided they are in compliance with the guidelines. Even anger and frustration posts are typically left intact as-is provided they are compliant with the guidelines.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

2 -

@Quicken Kristina @Quicken Anja

OSU today with Fidelity (EWC+) brought down a Long Term Capital Gain as a DEPOSIT, but had the Long Term Cap Gain as part of the Description/Payee area. I am pretty sure in the past these were correctly categorized as CGLong (a similar download was categorized correctly today as part of my Charles Schwab download, also EWC+).

2 -

To be clear, that is a Long Term capital gain distribution, typically from a mutual fund or ETF, and not the gain from a sale, right?

These would be recorded differently if you were doing it manually.

QWin Premier subscription0 -

This content has been removed.

-

@MichaelALA Very sorry for the situation you find yourself in! Concerning "(I) would like to find a way to go back to a 'before' file, and "MERGE" the fidelity from that file with my current file", unfortunately I have never heard of this being an option in Quicken and personally would not try it on my QDATA file. What I fail to understand is how Fidelity EWC+ would at all be able to access and subsequently download transactions from another investment account provider with presumably different login information, connected with Quicken through Direct Connect. Maybe I don't quite understand the full complexity of the issue you are facing and someone else on here has better advice for you on this seemingly very complex issue?

1 -

@Jim_Harman " To be clear, that is a Long Term capital gain distribution, typically from a mutual fund or ETF, and not the gain from a sale, right?"

Yes, this is exactly right. I can confirm from my end the exact same issue @bmbass described in his earlier comment. I manually corrected the downloaded Quicken Deposit to a correct CGLong transaction, the related Buy Shares activity was correctly downloaded and accounted for by Quicken, already.

0 -

My Fidelity count finally updated today. My last transaction update goes back to 7/30. Everything seemed to come down correctly with a few exceptions - uncategorized transactions for CGLong, assorted fees (previously sorted as _unrealizedgains) and a few dividends treated as deposits (as it did not have tickers associated with it). I manually corrected and all seems aligned now. One other issue was one account had cash balance off but have not been able to see why (I manually updated).

Will continue to monitor…

0 -

This content has been removed.

-

-

@MichaelALA Thank you, I do hope someone else will be able to help! My only remaining thought for you, unfortunately, is the following: migrating from DC to EWC+ initially required extensive manual corrections, in order to ensure account balances before and after the migration were aligned. This happened around this time last month, since then the EWC+ transaction download experience improved. If your issues can be narrowed down to the 'synovus bank deposit sweep' you mentioned, maybe going through a potentially work intensive, yet hopefully ultimately successful manual review/correction process may be worth the effort and help resolve some/most of your current serious issues you are experiencing? Just a thought! Best of luck and success to you!

0 -

Hello All,

We just posted a new Fidelity alert with the latest updates on what’s been fixed, what’s in progress, and available workarounds. You can view the full details in this Community Alert.

Highlights include:

- Duplicate Transactions (Windows) > fix included in R64 release.

- Missing Transactions (401k, Brokerage, IRA) > fixes verified/rolling out.

- Bond redemptions showing as cash > fix live.

- $0 account balances > fix verified/complete.

- In progress: incorrect CD balances, doubled cash balances in Money Market accounts.

Please bookmark the alert thread to stay updated.

Thanks for your patience while we work through these!

-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.3 -

Thanks again Barry. I was not getting transactions downloading after the initial solution but after Super Validate I got transactions downloaded for the first time since this fiasco started.

1 -

@MichaelALA like @HKB I can't think of any way that setting up Fidelity download could cause changes to Wealthscape accounts when you download, unless you incorrectly linked them during setup of download, and you were setting up download for both Fidelity accounts and Wealthscape accounts at the same time. Actually I can't see how downloads into ANY account can cause changes in a different account, other than if you have a linked checking account.

Also when you refer to "cash acct the 'synovus bank deposit sweep'" are these accounts in Quicken with transactions (aka linked checking account)

or are you referring to a fund representing cash in your Fidelity and Wealthscape accounts? If you are referring to funds, and they both have the same ticker symbol, I can see that the market value could change if you only update quotes when you download, but it wouldn't create new transactions in a different account. If you are referring to linked Checking accounts, each account should have its own linked checking account.

So I am left with recommending that you contact support, who can ask the right questions to find out exactly what is happening and, hopefully, fix it for you. I wish you success.

Barry Graham

Quicken H&B Subscription-1 -

In the referenced Community Alert, what does "pending positions" mean?

Deluxe R65.29, Windows 11 Pro

0 -

This is good news — and the detail appreciated. @Quicken Anja, you should also update your other post that you had us bookmark.

When can those of who stayed on or switched back to "zzz-Fidelity - DC" be expected to be forced to EWC+ again?

I, for one, still don't see the R64 update as part of the normal OSU process. When can we expect to see that too?

0 -

Brokerage Cash Management Account not treating CASH or FIDELITY GOVERNMENT MONEY MARKET (SPAXX) as "core" . Showing both as non core.

0 -

@Quicken Anja I checked the community alert for this thread but it didn't mention a fix for new accounts being set up as simple tracking only, not complete tracking. Will this issue be addressed?

1

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub