Fidelity Download Bob@45

At this stage, to keep things organized and allow our team to properly investigate, could I please ask you (and anyone else encountering issues) to

start a new separate discussion threadin the Community specifying theexact issue you’re seeing? That way, we can troubleshoot and follow up directly.

Quicken Classic Premier Windows R64.35 Build 27.1.64.35. Saturday I did a full Mondo download to ensure I had all current modules without error, and since that brought me to only R64.30, I then applied the R64.35 update.

I did my cut-over this morning, my first reauth for Fidelity. Miscellaneous comments follow, with my primary issues are at the top of this list:

Transactions downloaded from my Trad Rollover IRA from 9/2 forward. Transactions downloaded for my Roth IRA from 7/31 forward. Curious why the Roth download went further back than the Trad download. The great majority matched or near-matched correctly and I accepted them after reviewing each one.

- NO transactions downloaded for my HSA, which had dividends received and reinvested on 10/10, and SPAXX dividends 9/30 and 10/26.

No issues with the Roth download.

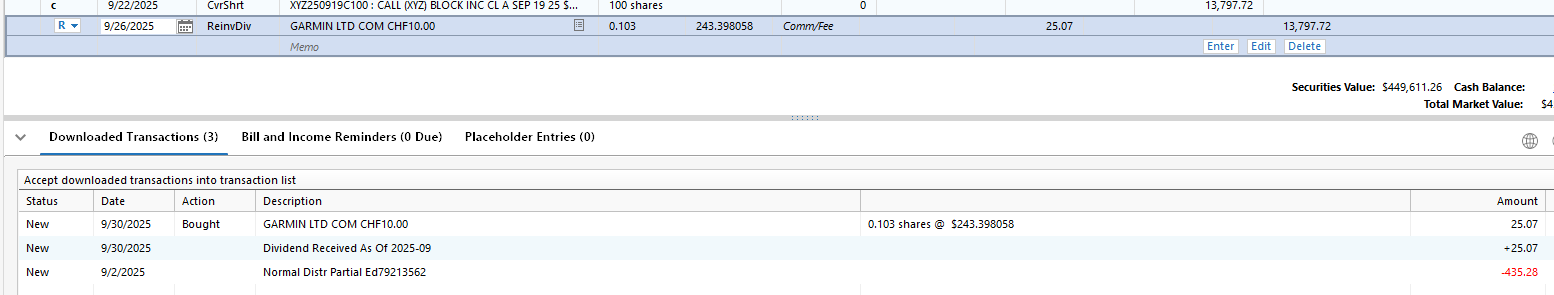

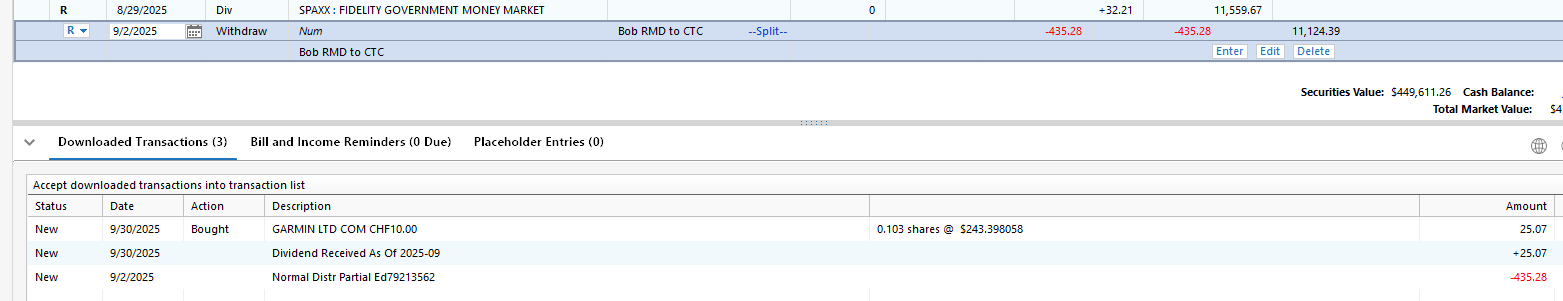

The Trad download had 3 records that did not match

- I received a dividend automatically reinvested on 9/26 which Fidelity apparently posted 9/30 (Garmin). The download includes a Bought record for those shares, plus a download record which has NO action, NO security, and a comment/payee of "Dividend Received As Of 2025-09". When I click Edit for this, then the action shows as a Deposit, not as a Dividend.

- I did an RMD distribution / Withdrawal on 9/2. I received a download record with NO action and a Payee of "Normal Distr Partial Ednnnnnnnn". When I click on Edit this now shows as a Withdraw. I suspect if the download had been flagged as a Withdraw this might have matched, and was not matched because it had no Action.

I am leaving these three records as not-accepted in case @Quicken Kristina or someone thinks I should do something with them. My inclination is to delete them and ignore today's mismatch. I expect I will need to manually correct any and all dividends, reinvested or not, until Quicken or Fidelity fixes this.

Minor issues and comments follow.

- The first time I tried to reauthorize, I got as far as opening a login page to Fidelity. Once I supplied my username and password, I got a mostly blank page with an Agree button at the bottom. I clicked I Agree, and the Fidelity page cleared and went nowhere. The Quicken application received no response from Fidelity and just kept spinning until I hit cancel.

- The second time I tried to reauthorize, I took snapshots of each and every step. When I got to the Fidelity Access User Agreement (which was mostly blank the first time), this time it was filled in, with two check boxes at the bottom I didn't have the first time. I read the agreement, checked the boxes, and clicked I Agree. I selected the four accounts I want to download (It offered me my Pension account, which has no funds but simply pays me a direct deposit monthly, so there's nothing for me to record on the Fidelity side). Fidelity reported "Your accounts have been authorized successfully!" but Quicken then reported "Sign in to Fidelity Investments bank failed. Try again." I suspect this is just because I spent so much time taking snapshots and reading the agreement that Quicken timed out, though it didn't complain until after Fidelity said it had succeeded. The third time the authorization process worked OK.

Cash Representation could be a problem:

- I received the Cash Representation pop-up window, offering to "Convert this fund into my cash balance (recommended)" four times, once for each account. THERE'S NO INDICATION ANYWHERE ON THE WINDOW INDICATING WHICH ACCOUNT THIS IS FOR. I happened to want it converted for all four accounts, so for me that was not a problem, but for someone else it certainly could be. ANYTIME a prompt comes up that applies to a specific account, it should indicate which account this is for.

Minor Reconciliation issue:

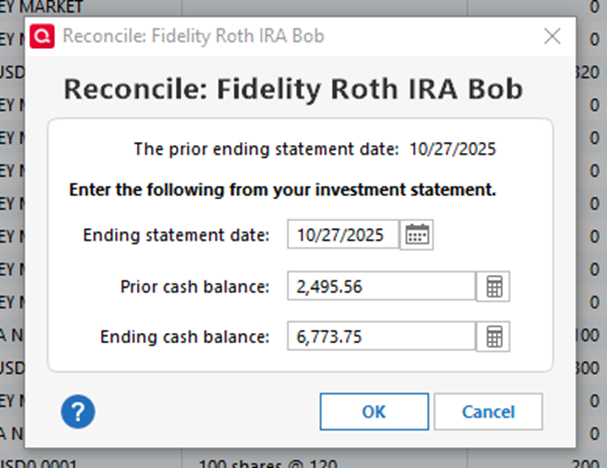

- I had reconciled all accounts before doing this. As each Matched or Near-matched record was accepted, the Clr flag on that record flipped from R to C. There were no download issues with my Roth account, so I did another reconcile for this account. Though the "prior ending statement date" on the Reconcile window showed 10/27/25, the Prior Cash Balance it displayed was the balance that predated the oldest transaction downloaded today (i.e. prior to 7/31/25). The ending balance was correct so I clicked OK, and all records are now flagged R again.

I'm glad I waited until now to do the migration. My thanks and kudos to all the adventurous ones who preceded me.

Bob

Comments

-

Nov 1 download, 10:48 PDT. I did not experience the communications errors others did; I suspect they were fixed/cleared by the time this Californian woke up.

Trad rollover IRA:

There's no way for me to match the 9/2 downloaded "Normal Distr Partial" record against the actual withdrawal done 9/2 and manually entered, so I just deleted the download record.

My SPAXX dividend downloaded as a DIV, which looks OK. Accepted, and I'm happy with the result.

Reinvestments: In additon to the Garmin dividend reinvested end of September (that's an international stock), Today I downloaded a reinvested dividend for MAA which is domestic. It downloaded as a DIVidend of 120.51, and a BOUGHT of 0.938 shares @ $128.47548 = $120.51. Mathematically that's $120.51000024, which makes me think it's the same issue I have with ETrade reinvestments. They D/L as REINV if the dollar amount matches exactly, but as div and buy if there's a minor discrepancy in the math, a rounding error. That works for me.

Since the Garmin was manually entered and I'm happy with that, I deleted the downloaded Garmin records also, and then did an Accept all.

The results in my register look OK to me, but I got a bogus Securities Comparison Mismatch, which I reported in

No issues with my Roth (which received on a SPAXX dividend).

HSA shows "last download today this morning" but the SPAXX dividend in that account did not download.

0 -

Hello @Bob@45,

Thank you for sharing your experience!

NO transactions downloaded for my HSA, which had dividends received and reinvested on 10/10, and SPAXX dividends 9/30 and 10/26.

Currently, transactions are not supported for Fidelity HSA accounts. Please see this announcement for more information:

I received a dividend automatically reinvested on 9/26 which Fidelity apparently posted 9/30 (Garmin). The download includes a Bought record for those shares, plus a download record which has NO action, NO security, and a comment/payee of "Dividend Received As Of 2025-09". When I click Edit for this, then the action shows as a Deposit, not as a Dividend.

This is a known issue, which our teams are already working to resolve. If you haven't already done so, to track the status of the issue and know when it's resolved, I recommend bookmarking this Community Alert.

I did an RMD distribution / Withdrawal on 9/2. I received a download record with NO action and a Payee of "Normal Distr Partial Ednnnnnnnn". When I click on Edit this now shows as a Withdraw. I suspect if the download had been flagged as a Withdraw this might have matched, and was not matched because it had no Action.

I haven't seen reports of this issue yet. Is it happening only with RMD distributions/Withdrawals, or are there other transaction types which are missing information also?

The first time I tried to reauthorize, I got as far as opening a login page to Fidelity. Once I supplied my username and password, I got a mostly blank page with an Agree button at the bottom. I clicked I Agree, and the Fidelity page cleared and went nowhere. The Quicken application received no response from Fidelity and just kept spinning until I hit cancel.

The second time I tried to reauthorize, I took snapshots of each and every step. When I got to the Fidelity Access User Agreement (which was mostly blank the first time), this time it was filled in, with two check boxes at the bottom I didn't have the first time. I read the agreement, checked the boxes, and clicked I Agree. I selected the four accounts I want to download (It offered me my Pension account, which has no funds but simply pays me a direct deposit monthly, so there's nothing for me to record on the Fidelity side). Fidelity reported "Your accounts have been authorized successfully!" but Quicken then reported "Sign in to Fidelity Investments bank failed. Try again." I suspect this is just because I spent so much time taking snapshots and reading the agreement that Quicken timed out, though it didn't complain until after Fidelity said it had succeeded. The third time the authorization process worked OK.

I'm glad to hear it did finally work on the third attempt. Which browser were you using? It is possible that the problem the first time was due to outdated information in the browser cache. Did you do the 2nd and 3rd attempt using the same browser? Your theory about the 2nd attempt is likely correct. Quicken does time out if it doesn't get a response from the financial institution within a set amount of time.

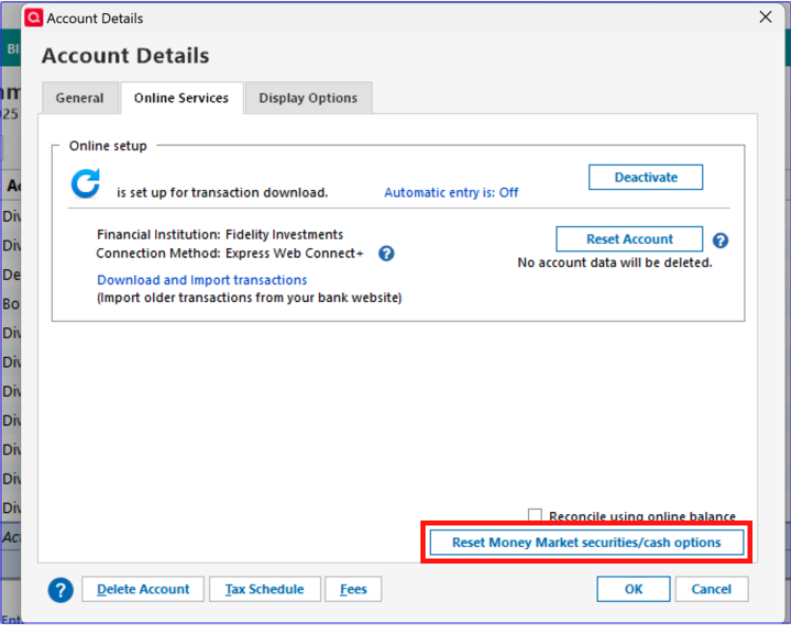

I received the Cash Representation pop-up window, offering to "Convert this fund into my cash balance (recommended)" four times, once for each account. THERE'S NO INDICATION ANYWHERE ON THE WINDOW INDICATING WHICH ACCOUNT THIS IS FOR. I happened to want it converted for all four accounts, so for me that was not a problem, but for someone else it certainly could be. ANYTIME a prompt comes up that applies to a specific account, it should indicate which account this is for.

This issue with the pop up not telling you which account it's asking about is a known issue. The current work around is to reset the cash representation if the wrong option is selected for an account. To do that, navigate to Tools>Account List, click the Edit button next to the problem account, and on the Online Services tab, click the Reset Money Market securities/cash options button.

I had reconciled all accounts before doing this. As each Matched or Near-matched record was accepted, the Clr flag on that record flipped from R to C. There were no download issues with my Roth account, so I did another reconcile for this account. Though the "prior ending statement date" on the Reconcile window showed 10/27/25, the Prior Cash Balance it displayed was the balance that predated the oldest transaction downloaded today (i.e. prior to 7/31/25). The ending balance was correct so I clicked OK, and all records are now flagged R again.

I'm glad to hear you were able to resolve the minor reconcile issue. I haven't been able to replicate that behavior in my Quicken, but I suspect what happened was that matching to the cleared transactions cause the reconciled transactions to lose their reconciled status. Did this happen only with your Fidelity accounts? Was it a one-time thing on reauthorization, or has this continued to happen?

I look forward to your reply!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

I did an RMD distribution / Withdrawal on 9/2. I received a download record with NO action and a Payee of "Normal Distr Partial Ednnnnnnnn". When I click on Edit this now shows as a Withdraw. I suspect if the download had been flagged as a Withdraw this might have matched, and was not matched because it had no Action.I haven't seen reports of this issue yet. Is it happening only with RMD distributions/Withdrawals, or are there other transaction types which are missing information also?

= = = = =

The only transfer out of Fidelity I've done recently is this one RMD withdrawal. I won't have another until January.

Just to see if I can gather more information, I'm starting a transfer from an external checking account into my Fidelity brokerage account. After it lands, I'll transfer that money out again. I'll let you know what happens with those transfers. In some things it seems Fidelity may be downloading different data depending on whether it's an IRA or a non-IRA brokerage account, but we'll see.

1 -

I had reconciled all accounts before doing this. As each Matched or Near-matched record was accepted, the Clr flag on that record flipped from R to C. There were no download issues with my Roth account, so I did another reconcile for this account. Though the "prior ending statement date" on the Reconcile window showed 10/27/25, the Prior Cash Balance it displayed was the balance that predated the oldest transaction downloaded today (i.e. prior to 7/31/25). The ending balance was correct so I clicked OK, and all records are now flagged R again.I'm glad to hear you were able to resolve the minor reconcile issue. I haven't been able to replicate that behavior in my Quicken, but I suspect what happened was that matching to the cleared transactions cause the reconciled transactions to lose their reconciled status. Did this happen only with your Fidelity accounts? Was it a one-time thing on reauthorization, or has this continued to happen?

= = = = =

It's happened in all the Fidelity accounts that matched on previously reconciled records. It doesn't happen on non-investment accounts because Quicken won't match/accept/apply downloaded records against already reconciled records (and none of them are downloaded weeks late anyway).

0 -

I'm glad to hear it did finally work on the third attempt. Which browser were you using? It is possible that the problem the first time was due to outdated information in the browser cache. Did you do the 2nd and 3rd attempt using the same browser? Your theory about the 2nd attempt is likely correct. Quicken does time out if it doesn't get a response from the financial institution within a set amount of time.

It's not just Quicken. I am frustrated by all sorts of financial institutions that also say "read our terms and conditions before continuing on" and then they time out while I'm reading the terms and conditions, aborting whatever registration I had begun.

It'd be nice if they would present the T&C early in the process, and record in a cookie that the T&C have been read, before asking for a dozen or more pieces of personal information that I need to enter a second time after they time out.

But since Quicken has no control over the external institutions, it's not something you're going to be able to adjust for on your end.

1 -

Quick update: Verizon (VZ) reinvested dividend downloaded today in my trad rollover IRA. Everything looked good with this transaction.

0 -

Thank you for your replies,

I'm glad to hear the reinvested dividend downloaded correctly.

Please let me know if the other issues you brought up persist.

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0

Categories

- All Categories

- 52 Product Ideas

- 34 Announcements

- 247 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 514 Welcome to the Community!

- 680 Before you Buy

- 1.5K Product Ideas

- 55.5K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 832 Quicken on the Web

- 126 Quicken LifeHub