Chase Accounts Not working (Again)

Hello,

I'm having the same problems as here

Quicken randomly stops importing chase credit card transactions. Two seperate cc accounts. I have to disable online and then reestabllish the connection. It happens constantly. VERY frustrating. Today during the reestablish I got this:

I'm about ready to cancel chase or quicken.

Windows legacy

Comments

-

Hello @outflying,

Let’s try a few troubleshooting steps for this issue—these steps should resolve things for you, but if not, please come back and post more about your experience so we can investigate.

It sounds like you already followed some of the steps in this article; can you confirm that you did all of the steps below? If not, please give it another shot and let us know the results.

First, backup your Quicken file.

To resolve this issue

First, you'll need to deactivate the affected accounts:

- Select Tools > Account List

- If present, select the Show Hidden Accounts checkbox at the bottom of the Account List

- Select Edit on each account with this error and Deactivate them on the Online Services tab

- When finished, close the Account List.

Second, reactivate the accounts:

- Select Tools > Add Account

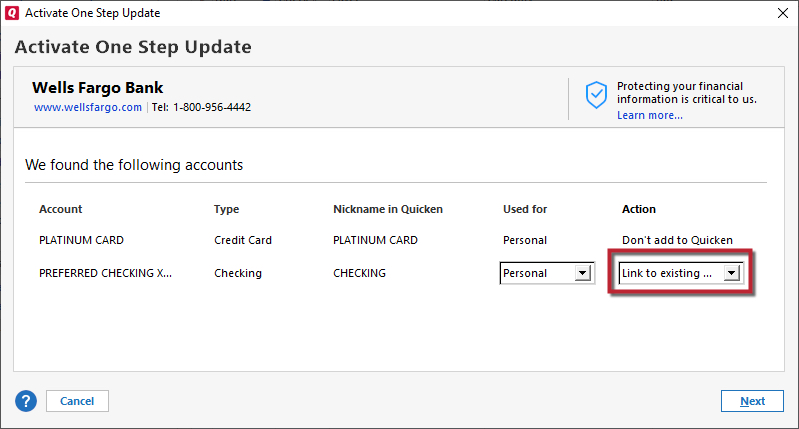

- Go through the flow of re-adding the deactivated accounts to Quicken, use your login credentials and answer any security questions, until you reach the screen where Quicken displays the Accounts Discovered at the financial institution

- Select to LINK each of the found accounts to the accounts you already have set up in Quicken. For accounts you don't want to link, select Don't add to Quicken.

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

When I add one chase account, it disables the other. It loops back and forth, back and forth. When I reauthorize A, it deactivates B. When I reauthorize B, it deactivates A. Frustrating!!!

0 -

Installed the latest quicken update, got the new logo, then first download from JP Morgan/Chase I was asked to reauthorize all of my Chase accounts for Quicken access. Did that, Chase website took me back to Quicken where I attempted again to do a one-step update and the (lack of) progress wheel spun for 15 minutes before I had to go to task manager to end Quicken, re-start the computer to clear the cache and try again. Now the (lack of) progress wheel has been spinning for another 20 minutes. Does anyone have a solution for this issue?

0 -

Use another card, Chase apparently isn't interested in fixing their services.

1 -

Whereas Chase has certainly messed up the QFX file, downloaded transactions with Express Web Connect +/One Step Update is working for me, and based on the lack of complaints for this I would venture to say thousands of others.

As for the CC-800 and maybe other connection problems I have chased that kind of problem at times with Chase and some other financial institutions and it can certainly feel like you can't make any progress on this.

From what I have seen if Quicken gets an error while downloading, which might be a temporary error, Quicken sometimes thinks the account is no longer at the financial institution. Quicken marks that account "deleted". Sometimes it will correct this on the next One Step Update, but what I have never found to work is the troubleshooting that is in the help that comes with the CC-800 error.

Sometimes doing what @Quicken Jasmine works, but when that fails (or maybe instead of that) I would deactivate all your Chase accounts and then reactive/link.

An even more drastic method that might clear up even more problems is to use:

File → Copy of Backup File → Create a copy or template, function

In the process of copying Quicken deactivates all the accounts, gives the data file a new unique Id which creates a new Quicken Cloud dataset. It means that you will have to setup all the accounts for downloading again and if you are using Quicken Bill Manager set that up too. And maybe even things like the Zillow estimate.

Signature:

This is my website (ImportQIF is free to use):0 -

One Step Update isn't working for me. I've tried the online services options, sometimes they work fine but most of the thine they don't. For instance when I update one credit card, Quicken has the right total but it is missing charges. I'm about to give up on Quicken, but not sure if it's Chase banks fault or the Quicken software. I've been using Quicken for a long time, seems it always worked in the past, maybe they outsourced their maintenance?

Any suggestions?

0 -

@kloach0315 the maintenance of the "connected services" is definitely "outsourced", but in truth that really hasn't changed who is maintaining that part of the system or even if that is the exact place of what is causing the problem. Quicken Inc pays Intuit for "aggregation" as such Intuit is the one that is actually dealing directly with the financial institutions. But that hasn't changed since when Intuit owned Quicken, it would be the same department in Intuit doing it.

But the system has grown more complex and as such more possibilities to where the problems might popup.

Chase used to use Direct Connect which is the OFX/QFX protocol directly from Quicken (the program) to the financial institution.

Chase as now gone to Express Web Connect +.

That means the flow is now:

Quicken (the program) → sync to Quicken Connection Services (Quicken Inc server/Quicken Cloud dataset) → Intuit server → financial institution.

About the only thing I can suggest is a way that for me seems to get things working again. I will point out why things seem to go bad for me. Every once in a while, I have seen the CC-800 error and as I said before I think what mostly is happening here is that Quicken is assuming temporary errors are where the online account is deleted, when of course they aren't. I have noticed that they have changed the "recovery/fix" dialogs that now include a question if the account has been closed or not, and as such once it recovered using this "fix process".

Past that I think the main reason I run into problems is because I tried to look at certain problems people are having and mess up my data file. In the past with Direct Connect I was able to jump to old versions of the data file and do other things like that and not affect my downloading for the current file. Express Web Connect + has the "server components" that have to stay in sync, and it seems it doesn't take a lot to break that syncing. For instance, doing a restore these days is a dangerous operation, because it can actually result in a syncing of data from the Quicken Cloud dataset down to the Quicken Desktop data file. If the problem is in the Quicken Cloud dataset, then that problem is pushed right back on the data file.

Anyways, the best recovery flow I have is:

Deactivate all Chase accounts for downloading transactions. Clear out the financial institution name on all the accounts in the Account Details. Use "Add Account" instead of trying to just reactive them from the Online Services tab. Go through the setup using "Chase" (or the Chase icon), reauthorize them through the Chase website and then VERY carefully make sure each online account is linked to the correct one in Quicken. Note that Quicken picks the wrong Quicken accounts at least 50% of the time. The "nick name" that is greyed out is the one selected to be linked in Quicken.

To give a bit of background of why all, and clearing out the financial name, and using Add Account. The "all" part just makes sure that you get all of the problems at once. The clearing out of financial name ensures that it will have to get it from the new setup. If you try to reactivate from the Online Services tab Quicken tries to use that financial name to select it and bypass that dialog in the setup flow. Removing it and using the Add Account ensures that you are presented with the dialogs that ask you which financial institution you want.

Signature:

This is my website (ImportQIF is free to use):0 -

Thanks for the detailed reply, but it didn't work for me. I've been using Quicken for a long time. It seems they don't care about their customers, or if it's Chase's issue they should be able to exert some pressure on them to fix it, after all we’re still Chase's customers having these problems. My subscription is coming up for renewal, so can you recommend another accounting program similar to Quicken I can try.

0 -

so can you recommend another accounting program similar to Quicken I can try.

Even if I could, which I can't because I don't use anything else outside of what my financial institutions provide, they wouldn't allow us to discuss other companies products in this Quicken forum.

Signature:

This is my website (ImportQIF is free to use):0

Categories

- All Categories

- 44 Product Ideas

- 34 Announcements

- 245 Alerts, Online Banking & Known Product Issues

- 23 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub