Lending Loan Principal Payoff is Recorded as Income

I have been using Quicken to track lending loans for a while now. Loans are monthly interest only then the principal is paid off in full as a deposit into my checking account when the loan term ends. I categorize the deposits as split between interest and principal transfer to the loan asset; this process works fine. But the loan payoff i.e. principal transfer always shows up as income on the HOME screen under Income & Expense bar graph.

Comments

-

Hello @mfelmlee,

We appreciate you bringing this issue to our attention!

If you don't mind, could you please provide a screenshot of what you are seeing? If needed, please refer to this Community FAQ for instructions on how to attach a screenshot. Alternatively, you can also drag and drop screenshots to your response if you are not given the option to add attachments.

Thank you!

-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.0 -

When you originally made the loan and paid someone money from your checking account, what category did you use?

This should have been a transfer from Checking to the [Loan to Someone] account.Ditto for the repayment. Someone repaid the loan and you deposited the money in your checking account. This should have been a transfer from Checking to [Loan to Someone].

As a result, neither making the loan nor getting it repaid are Income or Expense.

0 -

The money left my fidelity brokerage account as a bank wire. I made the category the Property & Dept asset that I previously created. This made the balance of asset the correct loan amount.

I received the payoff into my checking account as a wire. I logged into my bank website and transferred the cash to my fidelity brokerage account. Once received into brokerage I changed the category in Quicken as the Asset. My asset loan balance then went to $0.

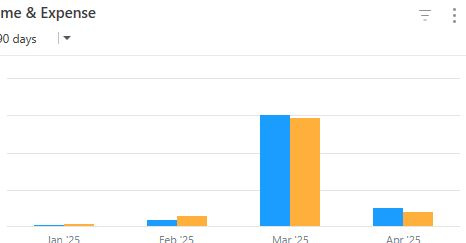

After I reset my report settings back to default now, I see both the income and expense categories include the loan payback amounts. Is this to be expected? This is much better, but it sure does expand the Y scale such that when I don't have loans coming back as in Jan. If this is "normal" then it would be nice to exclude loan asset payoffs from the reports.

0 -

@mfelmlee the payoff amount you received as "income" should be offset by the removal or paydown of the loan asset. The net amount of the two should be your true income.

0 -

The money left my fidelity brokerage account as a bank wire. I made the category the Property & Dept asset that I previously created. This made the balance of asset the correct loan amount.

- I'm assuming that the money that left your brokerage account was the money you sent to the borrower. Is this correct?

- And the Property & Dept Asset is the Lender Loan? Is this correct?

- If so, then the wired out money should have been entered into the brokerage account as a Cash Transferred out of Account or a Withdraw transaction with the category being [name of the Lender Loan account]. This transaction should be what funds the Lender Loan Account. It sounds to me like this is what you did, right?

I received the payoff into my checking account as a wire. I logged into my bank website and transferred the cash to my fidelity brokerage account. Once received into brokerage I changed the category in Quicken as the Asset. My asset loan balance then went to $0.

- The loan payment received should be entered into the checking account (either manually or downloaded from the bank) with the category being [name of the Lender Loan account]. Quicken will record this in the Lender Loan Account as principal received and it will decrement the balance of it.

- Then a 2nd transaction into the checking account needs to be entered (either manually or downloaded from the bank) transferring the repaid principal to the brokerage account with the category being [name of the brokerage account].

This being a no interest loan means there should be no income nor expenses recorded anywhere in Quicken. All of the transactions are simply transfers of assets between accounts. This process ensures that this will be how Quicken will record it.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0

Categories

- All Categories

- 52 Product Ideas

- 35 Announcements

- 240 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 507 Welcome to the Community!

- 676 Before you Buy

- 1.4K Product Ideas

- 55.1K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 827 Quicken on the Web

- 122 Quicken LifeHub