What’s Going On Between Fidelity and Quicken?

Comments

-

@Quicken Kristina I don't know where you are getting a determination the cash balance issue has been fixed but it doesn't seem to be from users as they are still having issues even though it has been reported as fixed. I have updated from R62.16 to R64.25. There is no Cash Representation option for any Fidelity account, nor is there any option to Reset Money Market. The issue is not fixed.

Deluxe R65.29, Windows 11 Pro

1 -

@Quicken Kristina As can be clearly seen in the forum discussions, issues marked as Fixed are not Fixed for many users.

Deluxe R65.29, Windows 11 Pro

0 -

Thank you for your reply @leishirsute,

The information comes from the internal ticket that was submitted to report the issue. Since user feedback is saying the issue has not been fixed, I forwarded that feedback to our teams.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

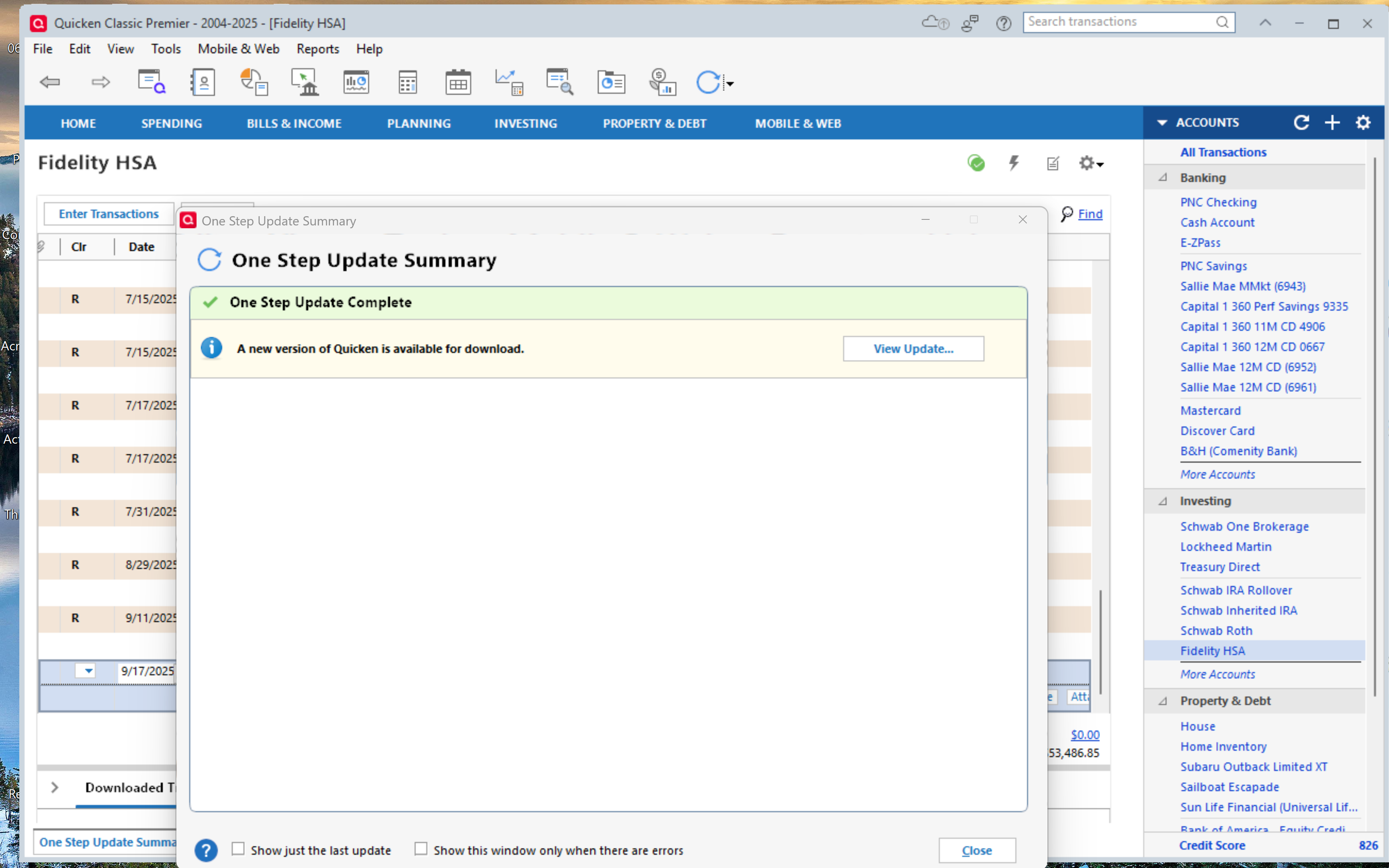

WELLLLL that was labor intensive. I contacted Quicken Support.

First attempt was to deactivate my Fidelity Accounts, blank out the Financial Institution and Account Number fields. Then Re-add all 5 of my Fidelity Accounts. While the process seemed to work, none of my missing month and a half transactions were downloaded.

On to next process. Instructed to make a Copy of my Quicken File, and then open it within Quicken. This in effect deactivated ALL of my connected accounts, 5 Fidelity Accounts, 6 Credit Union Accounts, 4 Citi Credit Cards, 2 Chase Credit Cards, 1 Amex Credit Card, 1 Sams Club Credit Card and 2 Etrade accounts. I then reconnected the Fidelity Accounts and at "FINISH" missing transactions were downloaded. However, I did not do an "accept all" as some marked "new" from June and July were not new and this would have doubled those transactions. So, I work through each (approx 160) transactions, accepting the MATCH and NEW that were post 7/31/2025.

I then had to reconnect all of the other accounts (21) that were deactivated by the File Copy process. One step left is to manually check my current Fidelity Online Account and make sure it is in line with Quicken. I suspect the Cash/Money Market amounts could be misaligned.

"No Matter Where You Go, There You Are"Windows 11 Pro, Quicken SubscriptionIntel Core i7-12700, 32GB Ram2 -

Wow. what a lot of work. Do keep us updated on ANYTHING that might be amiss from all those changes.

0 -

Only Fidelity issue so far is the FDIC Bank Deposit Sweep transaction for Aug 29 in my two ROTH accounts should have been recorded as cash not as a reinvestment to the FDIC Bank Deposit Sweep (QIWSQ) security?

"No Matter Where You Go, There You Are"Windows 11 Pro, Quicken SubscriptionIntel Core i7-12700, 32GB Ram0 -

My Quicken just initiated the migration to Fidelity Connect+ and was a total bungle. Imported my 401(k) as Brokerage instead of Retirement (wasn't an option), didn't have an accurate list of accounts to link to, just blasted in a new account with no history. Restoring from backup, but seems like this problem is well over a month old. I'm on the latest patch. How is there any representation that these issues are resolved???

1 -

Another issue with the Fidelity Download cropped up today.

When I downloaded a new Option trade with an unrecognized contract, the Add New Security did not have the proper date and strike price. They showed up as Xs

Unfortunately, I didn't get the exact line that was there but it was something like HIMS XX XX XX $XX PUT.

The downloaded symbol had the correct expiration date and strike, just not the description line.

Quicken Classic Deluxe R64.25 Build 27.1.64.25

Windows 11 Home0 -

Still no transactions downloaded from Fidelity. How long before this issue is resolved.

Senior leadership at Quicken?

1 -

I think everyone on this board who is helping Quicken clear up their mess deserves at least one Year free subscription.

Quicken Classic Deluxe R64.25 Build 27.1.64.25

Windows 11 Pro 24H23 -

The sad part is that someone in Quicken is reporting many of these issues as Fixed.

Deluxe R65.29, Windows 11 Pro

1 -

Definitely NOT fixed. Still zero transactions downloading from Fidelity with EWC+. I don't think I am brave enough to do what Movie Nut did above, without being 100% certain that the Fidelity connection is truly fixed

2 -

Quicken KristinaQuicken Windows Subscription Moderator modSeptember 15Thank you for your reply@leishirsute,The information comes from the internal ticket that was submitted to report the issue. Since user feedback is saying the issue has not been fixed, I forwarded that feedback to our teams.Kristina, you appear to be the only connection with Quicken to fix issues other than individual phone calls to support.

Your problem list is the only summary we have. It would be far more useful if it contained ALL issues reported and their status: Resolved per Community, Resolved per Quicken, or Unresolved. It would be helpful to have a date when resolved or a date when it will be resolved.

Quicken well deserves their F rating from the Better Business Bureau for their premature release of this update, slowness in fixing issues, and lack of participation by management in the Community.

2 -

Well, while it was a bit labor intensive, I am glad I did it. I was already a month and a half past due on Fidelity Transactions and did not want my accounts to get so far out of date it might be impossible to reconcile. All my downloads are working, however if in fixing any root cause, Quicken breaks it again I would not like to go through the process of reconnecting all my accounts again. Two more things I did not mention, after all my accounts were reconnected, OSU performed a couple of times, I checked my Opening Balance on a couple of the non-Fidelity accounts and they were either not Zero or off by a specific recent transaction amount. I have seen this happen before when reconnecting accounts. Most of my accounts start with a ZERO balance, but a couple had a balance in them (i.e existing bank accounts) when I first started Quicken in 1994. The other item is, I closed Quicken, renamed my old Quicken file with the extra text of "Before Fidelity Fix", and then renamed the COPY file back to my original File Name.

"No Matter Where You Go, There You Are"Windows 11 Pro, Quicken SubscriptionIntel Core i7-12700, 32GB Ram0 -

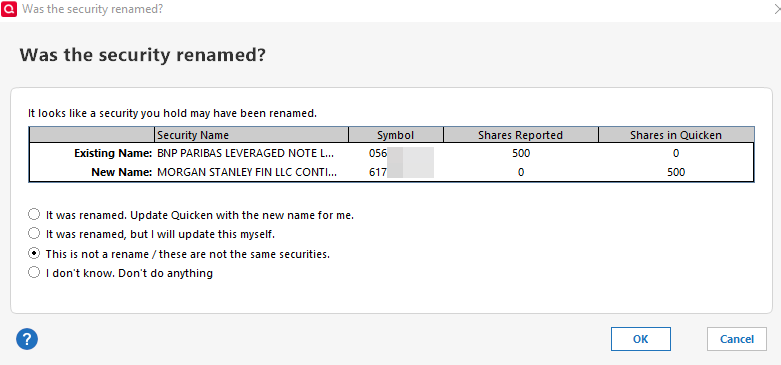

Quicken can't even stop trying to "fix" accounts that "look like" they are renamed, based solely on a share count.

How do we expect them to sort out this Fidelity mess (I'm affected as well)?

Below is one of several MLN accounts. Qucken frequently thinks I need to fix this. They don't even have close to similar names or CUSIP/symbol. Ridiculous that I pay a subscription for this garbage. Last week it changed 3 of 6 accounts at LPL to simple tracking, claiming they only supported Express Web Connect (they do not, they support Web Connect). I had to restore from a backup and reconnect those accounts after a few days of issues, they resolved.0 -

Thanks for the update. I have had that same issue with opening balances when restoring a backup.

0 -

When I start a OSU, I get a popup that says I need to re-authorize Fidelity Investment due to a new connection method. I go through all the steps, at the end a popup comes up listing all my Fidelity accounts, next to it saying "Do Nothing" and no way to match the accounts. After I click next, it pops up again at the beginning saying I need to reauthorize, and just keeps going through the same thing, over and over again.

0 -

This is not an issue specific to restoring a backup file. It is a known issue that whenever the connection method is updated or changed (i.e., Reset Account, Deactivate followed by Set Up Now or Add Account, Reauthorize) the Opening Balance of Spending Accounts (checking, savings, credit cards, etc.) will sometimes get changed. Since restoring a backup file that is more than just a few days old can break the EWC and EWC+ connections requiring them to be set up, again, that is a connection change and this issue will sometimes occur.

It's a really good idea for users to proactively enter and save the correct Opening Balance transaction dollar amount into the Memo Field of that transaction in each Spending Account. Or to manually enter the correct Opening Balance dollar amount as an account balancing transaction right after the actual Opening Balance and then change the Opening Balance transaction dollar amount to $0. Doing one of these 2 things makes it very easy to know when this issue has occurred and how to quickly fix it.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

4 -

Fidelity is still not updating or reporting that they did in the OSU or the Account Page. This is exactly the same as the PNC update problem!!!

Quicken R63.21 Windows 24H2 all patches. Reported through Quicken.

Also, if this, the PNC Bank, Sallie Mae Bank, and Citi Bank/Cards are fixed with new Quicken Updates, we now have to choose between these being fixed and the loss of the Portfolio X-Ray feature that is needed by any serious investor. Really Quicken, you need to fix all of these!!!

0 -

You might want to consider updating to R64.25. The R64.XX versions are supposed to have fixed some of the Fidelity EWC+ issues. But if you are talking about issues with Fidelity's DC connected account, I am not experiencing any such issues so I can't comment on them.

Also, I don't know anything about any PNC (with DC) or Citi Bank/Cards (with EWC+) issues because I have not experienced any with them.

Are you experiencing this with downloading from other financial institutions, as well? If so, you might have an issue with your runtime.dat file.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

Great Tip. I have updated my Memo fields as mentioned by Boatnmaniac.

"No Matter Where You Go, There You Are"Windows 11 Pro, Quicken SubscriptionIntel Core i7-12700, 32GB Ram1 -

Boatnmanic, I would upgrade to the current version, but I would lose the Portfolio X-Ray feature which was eliminated or left out in the R24.xx Quicken has become a nightmare.

0 -

For the first time today, I was given the option to "re-authorize" my accounts with Fidelity, , and I am glad that I read this thread before I did anything. When I started the process, I noticed that the only account types are "Brokerage", 'IRA or Keough Plan" and "529 Plan". Why is there not an option for 401k plans?

Also, has the simple vs. complete tracking issue been corrected? Thank you-

1 -

When I converted my test datafile to EWC+, I did not encounter any issue with Simple vs Complete. All my accounts correctly converted as "Complete". I recommend creating a test datafile and checking the behavior of Fidelity accounts under EWC+ connection to understand existing issues, become familiar with steps that will need to be taken (like deleting duplicate transactions), verifying cash balance. Quicken has labeled some of the issues as Fixed but they are not fixed for everyone.

Deluxe R65.29, Windows 11 Pro

0 -

Today I was asked to "reauthorize" all my Quicken to Fidelity "One step updates". It became a nightmare. After finally having to "deactivate" all Fidelity accounts within Quicken. Now it no longer allows me to link my Fidelity accounts within Quicken to Fidelity servers. I've tried several times and to no repair. I called Fidelity and got Chucky on the phone who knew nothing of what I was talking about. His initial answer was to "delete all my Fidelity accounts within Quicken" and start over. Bone head… I advised that wasn't happening and that he needed to go deeper. He called tech service and they indeed said it was a global issue. Has anyone else had this? Does anyone else have a fix or work around. For now I am stuck with NO price/account activity updates!

0 -

There is an option but it's just not where you think it would be. See my thread on this subject:

0 -

And a new issue reported by quicken today:

NEW 9/17/25 Fidelity Investments - 401(k) Unidentified Security during cutoverPlease Quicken; Do the right thing here and re-suspend the forced Fidelity cut-over on 09/25. This is not baked.

Eric Dunn, if you're out there… throw us a bone.

2 -

I wonder if these unidentified security might be private funds that many 401k plans have. Quicken can't identify the funds because they are not publicly traded so there is no data about them on the exchanges.

I had a couple of these unidentified securities pop up when I first set up a test file in early August to evaluate Fidelity's EWC+ connection. The best I could determine in my case was that they were a stock that had been delisted because the company went private and a mutual fund that had shut down. Both occurred a couple of years ago.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

Is your 401k plan downloaded from Fidelity NetBenefits? One of the Moderators had mentioned (last week, I think) that Fidelity NetBenefits was a little behind Fidelity Investments in making this migrations so maybe that is why there is no 401k type option.

However, I just ran OSU and got the reauthorization popup but with something new in it: A listing for Fidelity NetBenefits to be reauthorized. So, maybe 401k plan will now show up as a an account type option?

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

Responding to my own post….

I am now getting Fidelity Transactions downloaded, but having the same issue reported on another thread "https://community.quicken.com/discussion/7966058/quicken-r64-25-is-not-getting-correct-cash-balance-for-fidelity-accounts-w-ewc?UTM_medium=email&UTM_source=emaildigest&UTM_content=weeklydigest2025-09-17" with "CASH". My Cash is being recorded into "FDIC BANK DEPOSIT SWEEP NOT COVERED BY SIPC" security. This is being recorded as a Reinvest DIvidend, instead of just a Dividend or Interest that is deposited to CASH. Not sure if this will continue when the Aug interest posts but will be on the lookout for it.

"No Matter Where You Go, There You Are"Windows 11 Pro, Quicken SubscriptionIntel Core i7-12700, 32GB Ram0

Categories

- All Categories

- 56 Product Ideas

- 34 Announcements

- 240 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub