Looking For Advice - Best Method For Converting Q2015 Back To Q2013 Format?

Helping a friend who is trying to convert Q2015 data back to Q2013 format.

Could QXF (Quicken Transfer File) be used? What about QIF? What are the things to watch out for?

TIA

Quicken user since Q1999. Currently using QW2017.

Questions? Check out the Quicken Windows FAQ list

Comments

-

I have gone from subscription to QW2013 using QIF successfully, I did not convert my investment accounts, just banking and credit.

QuicknPerlWiz has some great advice on doing this on his website, read it and take it, it helps.

-splasher using Q continuously since 1996

- Subscription Quicken - Win11 and QW2013 - Win11

-Questions? Check out the Quicken Windows FAQ list1 -

@mshiggins there will be a lot of manual work involved. Not all information needed can be converted using QIF files, such as reminders, reports, and some security information. Also some account types do not convert properly. Here are some suggestions -

- If possible use two computers. Keep Quicken 2015 intact on one computer for reference for issues and items that need to be converted manually.

- Run as many reports as you can to capture everything you want to convert to Quicken 2013.

- Transaction reports are critical if you have reconciling issues or if transactions, especially transfers, go missing, or don't convert correctly.

- Since some account types don't convert properly, it might be better to set up the accounts in 2013 manually.

- Loans will not convert. If there are any current loans, they will come across as liability accounts with "plain account registers". It may be possible to recreate the loan, but may not be worth the trouble if the loan is not active.

- Have a net worth, or account balance report from Quicken 2015 handy so you can refer to it as you reconcile each account.

- Run a validate after the balances are loaded in Quicken 2013. Make sure to save the validation report. If there are issues with any of the transactions, that is your only reference, and it only outputs once.

This is all I can think of for now, but the important thing is to have reports, or another computer to refer back to during the conversion process.

1 -

@CaliQkn i think you have had some experience using QXF files to rebuild data - do you think QXF would work in this case?

Quicken user since Q1999. Currently using QW2017.

Questions? Check out the Quicken Windows FAQ list0 -

@mshiggins I tried using a QXF file but haven't used it in depth. The one thing I don't like about it is that its "all or nothing", you cannot choose what data transfers, or transfer accounts individually.

The other thing I have experienced with it is that some of the investment transactions are converted with incorrect "Actions" such as "Sold" changed to "SoldX".

It is definitely easier to use a QXF file, but still there is a lot of manual work involved to correct transaction issues and reconcile.

1 -

@mshiggins I forgot to mention another thing with QXF files. It's not able to convert all types of investment accounts. After you create a QXF file, it creates an error report that lists out transactions or accounts that won't transfer over.

1 -

My preferred method for rebuilding data or migrating back to an earlier Quicken version is QIF. Mostly because you can see and manipulate what is in QIF files and the QXF file cannot be examined or manipulated.

From my notes on what does not get included in QIF exports:

- tax line assignments

- all ESOG data and ESPP grant data

- investment sale lot information (assumes FIFO)

- add transactions' acquisition date

- online account info - fi, routing, account

- paycheck setup info

- watch list info

- retirement planner info

- scheduled transaction list info

- tax planner info

- transaction notes, also memos truncated to a shorter value than allowed in register

And on how to capture the various missing info, print the following to tab delimited text format (not plain text):

- print category list (includes tax line assignments)

- print account list with additional info, unhide hidden accounts! (includes fi, routing, account, comments)

- print scheduled transaction list

- print a report of cap gains for all dates, all accounts - unhide accounts or select hidden accounts in report customizations

Note a prep step for the capturing the acquisition dates for Shares Added transactions - put the lot open date in the Shares Added transaction's memo.

When importing the QIF, I prefer to do one account at a time and remove any transfers already entered from the previously imported accounts from the QIF. It is a slow and painstaking process.

Quicken user since Q1999. Currently using QW2017.

Questions? Check out the Quicken Windows FAQ list0 - tax line assignments

-

@mshiggins great list. I mentioned some other items in my previous comments, but you add these items that don't get updated or updated correctly with QIF files -

- Split transaction memos that are greater than 25 characters get truncated. I think they are exported correctly, but get truncated in the import process.

- Deposit transactions in investment account registers get changed to Misc Income transactions. I don't remember if the same happens with Withdrawal and Misc Expense transactions.

- Security Asset Class doesn't get converted. You can redownload this information for newer securities, but not for older ones, or ones with custom asset classes.

1 -

QXF importing was first put into Quicken 2012. If I remember correctly, it went downhill from there for many years. And in Quicken 2012 it only imported non-investment accounts. Which lined up with the fact that QXF was created to move a data file from Quicken Windows to Quicken Mac Essentials which at the time had no support for investment accounts. I think exporting of QXF files was done in something like Quicken 2010.

It hasn't been until recently that QXF imports even tried to import investment transactions, and it is still hit and miss. Some people have reported it working for them, but it has never been 100% correct for me.

And I have watched what happens on the import and find their approach "interesting". When I do it, it is evident that at least for part of this they create QFX data and import that. Given that format doesn't allow for categories and tags it is interesting that it works at all.

And even if it works for you, for sure it going to leave lots of information behind, I think pretty much the same kind of information that the QIF format leaves behind.

And if you have business accounts, …

Bottom line is the QIF is the only possible way to do this. And yes, it is painful, and in some cases not possible. For instance, any open options aren't going to work, because the QIF format has no format for security lots. Also, things that use "wizards" are not going to come through like paychecks, ESO, …

As for transfers. Quicken's importing of QIF is next to useless (and as a side note, with QXF I have been asked "Is this XXX transfer", which implies they are doing a similar importing, most like this the same QFX format importing).

My approach to the transfer problem is to convert transfers to regular categories. This is perfectly correct in a "double book" finances system and avoids Quicken's shotty import handling of them.

One note on this. In the QIF import you will see a checkbox for "Special handling of transfers". From what I have seen this doesn't even do anything different in Quicken Subscription, but it does in Quicken 2017 and below, but I have found neither selecting it or deselecting it to be "desirable".

With it selected, what it does is remove the "from side" of the transfer (why the heck they picked the from side instead of the "to side" is beyond me).

So, basically that means they don't have to do any matching of transfers, because only one side will be put in and it will create the transfer. The result though of picking the "from side" to remove is that any split, like a paycheck that has a transfer in it will be split into multiple transactions. One for the other split lines and one per transfer. Not exactly what would like.

Deselecting it means that both sides of the transfer are left in, but then that means you are relying on Quicken's matching to do the right thing, which of course it isn't going to do. You will need to manually enter every transfer, and ensure it is actually matching the right transactions. When you have thousands of transactions, more than 100 accounts, that isn't something that most people would do.

BTW note that in Quicken Subscription the QIF imports go directly into the account. This isn't even "automatic transaction entry mode". In that mode you would get a status for the New/New Match transactions so that you could review/correct problems. The Quicken Subscription QIF import just puts the transactions directly into the register is almost no processing, with one exception. It tries to do transfer matching. And I have found that it can't be turned off.

Note that for "what won't be transferred" we discussed this in detail in an old thread, and by miracle that thread still exists. I reference it on this webpage which talks about all of this:

Signature:

This is my website (ImportQIF is free to use):2 -

@Chris_QPW you bring up a very good point about importing transfers using QIF files. Trying to fix transfers after importing from QIF files is a royal pain, and I do this exact same thing to get around the issue -

My approach to the transfer problem is to convert transfers to regular categories. This is perfectly correct in a "double book" finances system and avoids Quicken's shotty import handling of them.

I wish there was a practical comprehensive guide to using QIF files for conversion. There is so much detail to remember about what to do, what to watch out for, and what not to do. But because, QIF files aren't really supported and maintained by Quicken, a comprehensive guide might be a futile effort.

0 -

There was/is a FAQ for this, but frankly I found that to be useless. It was about merging two data files and there was extensive manual changes you had to do before doing the export/import.

My process goes like this.

Do a QIF export, selecting all the options.

Create a new data file with cloud sync off and when asked to add an account just cancel it. Then go in and delete all categories (so that you don't have to deal with the default ones they create).

Drop QIF file on ChangeTransfers.exe which creates DATA_FILE_NAMEXfrsAsCategories.QIF

Import that QIF file selecting all the options (the "use special handling for transfers" doesn't matter because there aren't any transfers).

Wait (it takes a long time to do the import especially since the stock quotes are really slow to import). And that reminds me on one prep that needs to be done. Quicken will not import any security prices for securities that don't have a security symbol, and some securities naturally don't have security symbols. So, make sure you add one before you do the export. Something like this works fine _MySec.

In the case of Quicken Subscription where it the transactions go right into the register you don't even have to "accept" anything. About the only prompt is to it asks to create new categories/tags. In the case of Quicken 2017 and below you have to go through each account and do an "Accept All".

Note that all your hidden accounts and such will lose those settings. In Quicken Subscription this isn't too bad since you can go to the Manage Hidden Accounts menu/window and change them there, but for Quicken 2017 and below you are going to have to go into every Account Details → Display tab.

Also, since you can't have different versions of Quicken on the same machine, for different versions of Quicken I would use different machines for the conversion so that you can still look at the old data file. Trying to remember all the possible things that might not get transferred seems prone to missing something.

Which BTW if you are trying to do the matching of transfers it can be very frightening since the balances don't have a chance to being right until all the accounts/transactions have been accepted.

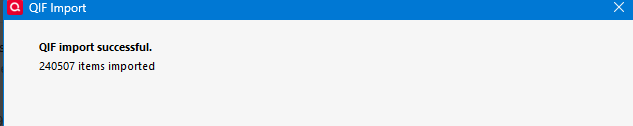

I just tried it for my data file.

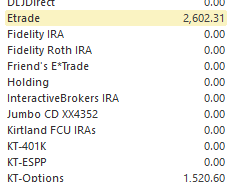

I certainly haven't gone into details, and the current total balance is certainly not proof that everything is correct, but I did get "pretty close" with a difference of $-4,122.91.

Once I hide all the old accounts then this showed:

Expanding out:

Not surprising, I remember that the Options account had a problem where for some reason 4 shares where not accounted for. And not sure about the cash remaining in the E*Trade account, but a balance adjustment there to remove it is easy.

And with that my current balances all look good, and the same for a net worth report for all the years I have been using Quicken.

I believe that @splasher didn't have the same luck where he had more problems with the investment accounts and decided just to not deal with them in the Quicken 2013 data file.

You also have to watch out for the fact that securities are no longer hidden and that all of them are selected for downloading.

Signature:

This is my website (ImportQIF is free to use):1 -

Just tried reconnecting one account for online service in the new data file. It looks like to make that work right you definitely need to turn off automatic transaction entry mode and delete all the "new/matching" transactions that come in.

This of course, only relates to doing this in Quicken Subscription.

Also, the resulting data file is about 1/3 the size of the original. I believe I have done this in the past and it quickly grows when you start downloading transactions again.

Signature:

This is my website (ImportQIF is free to use):1 -

One question, why is this desired or being pursued?

Have Questions? Help Guide for Quicken for Mac

FAQs: Quicken Mac • Quicken Windows • Quicken Mobile

Add your VOTE to Quicken for Mac Product Ideas

Object to Quicken's business model, using up 25% of your screen? Add your vote here:

Quicken should eliminate the LARGE Ad space when a subscription expires(Now Archived, even with over 350 votes!)

(Canadian user since '92, STILL using QM2007)0 -

In my case, while I run subscription as my primary setup, I wanted a version of Quicken that doesn't require a Quicken Id to install and use. It isn't very hard to keep it up to date since I do all .QFX or .CSV downloads and ImportQIF makes it easy to turn them into .QIF files for QW2013.

Also, if Q went under and didn't make a last modification to the program to not require an active subscription, I wouldn't lose 25% of my screen to the nags.

IMHO, QW2013 is a far better version than subscription with all of its QMobile/QWeb, Credit Score, Zillow, etc add-ons that just don't work 100% of the time as evidenced by the user posts on this forum.

-splasher using Q continuously since 1996

- Subscription Quicken - Win11 and QW2013 - Win11

-Questions? Check out the Quicken Windows FAQ list1 -

If I could prevent subscription version from syncing any of my data beyond confirming an active license, I would not be dead set against using a subscription version. With the sunsetting of Windows 10, I am uncertain if I will be able to make Quicken 2017 work on Windows 11. That leaves Q2013 or a personal finance application other than Quicken as the available options.

Quicken user since Q1999. Currently using QW2017.

Questions? Check out the Quicken Windows FAQ list0 -

With the sunsetting of Windows 10, I am uncertain if I will be able to make Quicken 2017 work on Windows 11.

@mshiggins , To my knowledge any commercially used program that works on Win10 also works on Win11. When Win11 first came out, I did run Q2017 on it. I also have an old program which was made during WinXP days that I still occasionally use today on Win11, from a company that went out of business in 2004!

- Q Win Deluxe user since 2010, US Subscription

- I don't use Cloud Sync, Mobile & Web, Bill Pay0 -

@splasher It has been a long time since I thought about this but I thought QW2017 was the last non-Quicken ID version. If so, then why QW2013?

@mshiggins If QW2017 does not work on Win 11, why would QW2013?

Have Questions? Help Guide for Quicken for Mac

FAQs: Quicken Mac • Quicken Windows • Quicken Mobile

Add your VOTE to Quicken for Mac Product Ideas

Object to Quicken's business model, using up 25% of your screen? Add your vote here:

Quicken should eliminate the LARGE Ad space when a subscription expires(Now Archived, even with over 350 votes!)

(Canadian user since '92, STILL using QM2007)0 -

Quicken Windows 2013 US is the last version without a Quicken ID.

The exact history is that Intuit retroactively put the Intuit ID into Quicken 2014 in a later patch release (and Quicken 2015 had if from the start). So, strictly speaking it is actually possible to install Quicken 2014 early release without a Quicken ID, but it just confuses people to bring this up, and also the earliest versions of Quicken 2014 has a bug where it will not convert a data file that is older than Quicken 2010 (this is the reason Intuit made Quicken 2013 install available).

And of course, when Quicken Inc took over these became Quicken IDs.

The version of Windows has no impact on the problem with using Quicken 2014 through 2017.

The problem is that to "authorize" the Quicken ID requires contacting the Quicken server. Quicken Inc changed something on the server and now Quicken 2014 through 2017 can't do that "authorization". You get a blank login screen. That login screen is most likely an embedded web page, and it is probably long since deleted by Quicken Inc.

So, how are some people able still use Quicken 2014 through Quicken 2017?

The workaround relies on something "very old". The licensing is held in the Quicken.ini file.

In other words, Quicken Inc built their Quicken ID system on the existing very old licensing system in the Quicken.ini file. The user logs into the server that in turn lets Quicken know that it should write out the right licensing information to the Quicken.ini file.

This is why the workaround is to copy the Quicken.ini to a new install.

So, any reinstall has the same likelihood of failure on a new machine.

BUT if it is that simple, why can I for instance do the work around?

Well, I don't have the Quicken.ini file with the right licensing, but in fact that isn't what is stopping me (there are workarounds for that too).

There is a lot hidden, so I can't be sure of these details, but this about what I have seen.

The first thing to understand is that your license to install that is connected to a Quicken ID is by definition part of that Quicken ID on the Quicken server. What this means is that if you create a new Quicken ID, you aren't going to be able to use if for installing Quicken, so the original Quicken ID that is connected to your purchase has to be used.

The second part of this is that Quicken keeps an idea of if your Quicken Id needs to be checked with the server or not. You are allowed "work offline". But there are various things that can trigger Quicken to get into the condition that it will require logging into the Quicken ID/Quicken server. Once this is tripped, the Quicken.ini file isn't going to work, at least not on that machine.

In a nutshell, I think one of the main reasons I have never been able to make this work is because I went ahead and bought and used Quicken Subscription, and it basically did something that invalidates me ever using a pre-Quicken ID version.

Signature:

This is my website (ImportQIF is free to use):2 -

@BK and @smayer97 the Quicken ID registration service for Q2014 through Q2017 no longer works. So a new install on any Win version machine cannot be registered. Without being registered, the data is inaccessible. Some users have been able to get new installs to work by copying files from a working install to the new install, but this does not work in all cases. So maybe I can get Q2017 working on a new Win 11 install, maybe not. Q2013 does not require Quicken ID so it can still be made fully functional on a new Win 11 install.

Quicken user since Q1999. Currently using QW2017.

Questions? Check out the Quicken Windows FAQ list3

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 247 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub