Bought with Transferred Funds not Working

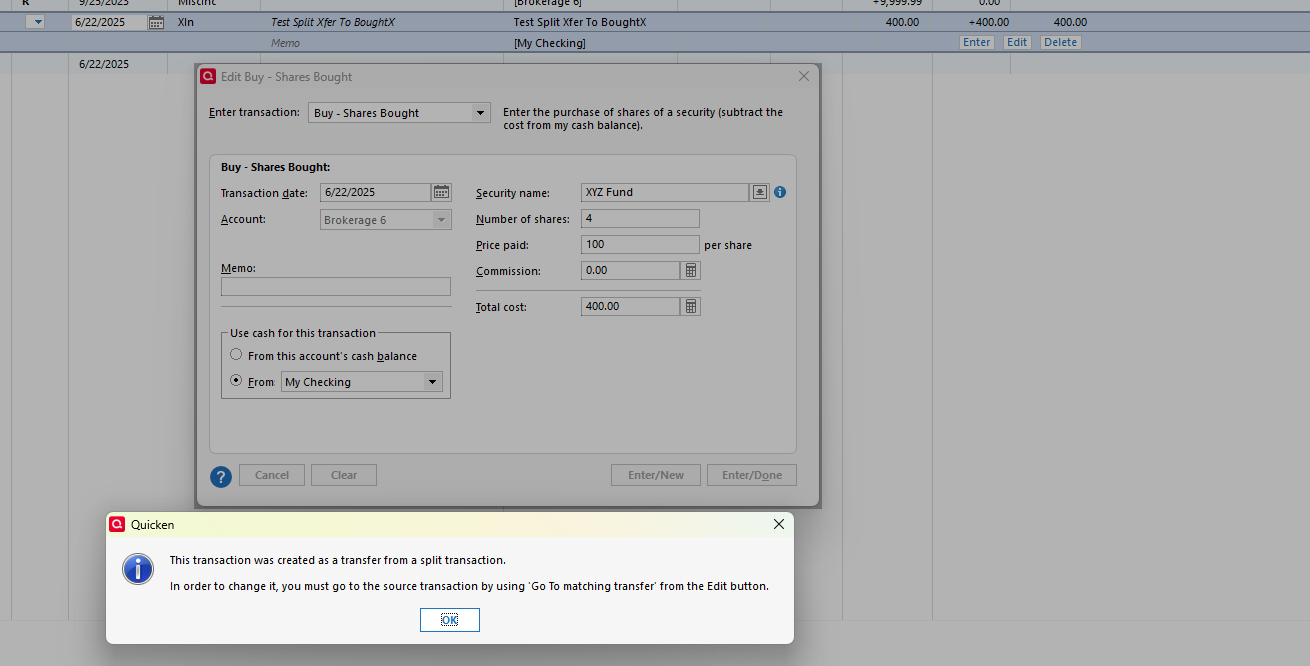

For years I have had paychecks set up with 401k contributions. I then edit the Xin transaction that appears in the 401k account to be a Boughtx (shares bought with transferred funds) transaction, and enter the appropriate fund, # of shares, and purchase price in the transaction, choosing the account from which the funds were transferred (default is from the cash balance). This is no longer working with the latest Quicken update. I get this error now: "This transaction was created as a transfer from a split transaction. In order to change it, you must go to the source transaction by using "Go To matching transfer" from the Edit button. Is anyone else experiencing this?

A workaround would be to create a separate Bought transaction to move the money from the cash balance into the appropriate fund, but that now creates a separate transaction that shouldn't really need to be there. This seems to be a bug that hopefully Quicken will fix.

Comments

-

Hello @jslim1999,

Thank you for coming to the Community with this issue. To help troubleshoot, please provide additional information. You mentioned this stopped working with the latest update. Do you recall when your Quicken updated to R63.21? Does going to the matching transfer and editing the transaction there work? If not, what happens when you attempt it?

I look forward to your reply!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

I tried this and I see the same result in R63.21.

In a checking account, create a split transaction that includes a transfer to a brokerage account. The transfer shows as an XIn in the brokerage account.

Edit the XIn, changing it to a Bought for the same amount with the cash coming from the checking account. Hit Done and see the following:

The error message is misleading, because you can't go to the checking account and change the other side of the transaction to change the transfer to make it a BoughtX in the brokerage account.

You can remove the transfer from the split in the checking account and enter it as a separate transaction, then edit the XIn in the brokerage account to make it a BoughtX, or as @jslim1999 suggests, you can enter a separate Bought transaction in the brokerage account, using the cash from the transfer.

I can't try this in an earlier version, but I think this is an intentional change, and an improvement. In the past, editing a transfer in an investing account to make it a different type of transaction would often result in a broken transfer.

QWin Premier subscription1 -

I am still running R62.16 and tested this three ways.:

First, I set up and entered a Paycheck Reminder with a 401K deduction transferred to the 401K account. Then in the 401K account I edited the XIn cash deposit transaction changing it to a Buy transaction with the cash coming from the checking account.

- The edit was accepted without error and there was no error message in the 401K account. It now shows in the 401K account register as a BoughtX transaction.

- The split category Paycheck deposit transaction in the checking account was not affected and the split category line for the cash transfer to the 401K account remained intact.

Second, I entered a split category net deposit transaction (not a Paycheck Reminder) to the checking account with the 1st line of the split being the gross income amount and the 2nd line being a transfer to the 401K account. I then followed the same process as in the 1st test and got the exact same results with no error encountered.

Third, I entered an individual expense transaction into the checking account with a single category transfer to the 401K account (not a Paycheck split transaction transfer). I then followed the same process as in the 1st & 2nd tests and got the exact same results with no error encountered.

Some other observations:

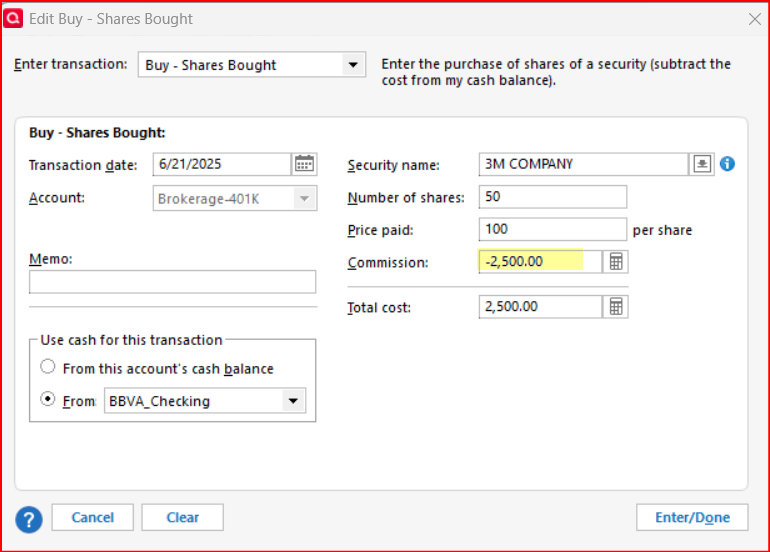

- In the checking account I changed the dollar amounts in each of these 3 transactions. These changes did update the net amount in the 401K account transactions BUT the changes were entered into the transaction details as Commission as highlighted in the following picture. That is certainly odd and inaccurate.

- I could not edit the dollar amounts in the 401K account transactions and got the normal error message that I need to go to the source transactions (in the checking account) to make the change.

- In the 1st and 2nd transactions in the checking account, which are split category transactions, the Go to matching transfer function was grayed out and non-functional. But that is normal for split category transactions.

- In the 3rd checking account single category transfer transaction the link to Go to matching transfer functioned perfectly.

So, if I understand the issue correctly and performed the testing correctly, it appears that this issue was likely caused by some change with one of the post-R62.16 versions.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1 -

Thank you for the additional information @Jim_Harman and @Boatnmaniac,

I was able to replicate the issue and have forwarded this to the proper channels for further investigation and resolution.

Thank you!

(CTP-15185)

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

1 -

Kristina,

I did the update as soon as I was prompted to do so, but I do not recall the exact date. But I have been entering my 401k transfers in this way for both my wife and myself for every biweekly paycheck for 15+ years and have never experienced this error before and I do recall doing an update shortly before I observed this behavior. My paycheck is set up as a recurring paycheck and my wife's is set up just as a recurring transaction (deposit) with splits. I'm now on R63.21 (Build 27.1.63.21).

You could edit the matching transfer to change the amount for example, but you cannot choose the funds that were purchased with the transfer from the other transaction, as @Jim_Harman indicated. I hope this wasn't an intentional change, that would seem to defeat the whole point of the Boughtx transaction (i.e., purchase with transferred funds). I've never observed broken transfers when using Boughtx before.

Thank you for responding, confirming, and forwarding to the proper channels. Also, thank you @Jim_Harman and @Boatnmaniac for testing and helping document the issue.

1 -

I'm having the same issue and reported it under a different thread. I've been using Quicken for over 30 yrs and never had this issue until now. My current release is R63.21…but did not have any issues with previous releases until now. Please fix this bug.

0 -

We need to be careful here not to change programming for a process that only a few users seem to utilize. The use of BoughtX described in this thread, in my opinion is very unorthodox and I don't think it was ever meant to work this way. Any time a contribution is made to a retirement account via cash deposit, a simple Bought transaction should be used to buy investments.

I don't consider this a bug, but a fix for a long-time loophole that allowed the BoughtX transaction to be used for a purpose never intended.

-1 -

@CaliQkn I'm curious what you think the intended usage of a Boughtx transaction is and why you feel the usage I described is unorthodox? This seems to me to be exactly what this type of transaction is for. It sounds like you prefer to use separate Xin → Bought transactions, and that's fine. If I use a separate Bought transaction to purchase the funds from my cash balance, now I have two transactions in the register instead of one. Furthermore, when I then synchronize and clear downloaded transactions, the transactions do not match properly. I do not have two transactions in my investment account register, so why should I have two transactions in my Quicken account register?

Also, FWIW, the issue only appears to be presenting for transfers that come from split transactions, which seems to me to support it being a bug. Using a split transaction for 401k paycheck contributions (which ultimately go automatically into a single designated fund) seems like a pretty standard use case to me. If you have your contributions set up to go into multiple funds, that seems like a case to use the Xin and have separate Bought transactions for each separate funds purchase.

0 -

@jslim1999 quite simply a BoughtX transaction is used for investment accounts with linked checking accounts and single fund Mutual Fund accounts. For both of these account types there is no cash in the investment accounts for buys or sells, so the cash needs to be drawn from another account.

For a 401(k) account that has a cash component, investments are always purchased with cash deposits (contributions) to the account. The use of BoughtX transactions goes against what really happens in real life. Bottom line, if you were to take a look at your online 401(k) account with your provider, you will see exactly what happens to your 401(k) contributions.

The way that a cash transfer transaction is being changed to a BoughtX on Quicken can only lead to issues. A cash transfer from a paycheck was not meant to be changed to a BoughtX transaction because a BoughtX transaction normally gets funding from a single source, and not from a split transaction. I have seen these jerry-rigged transactions get corrupted or unraveled when there is a programming change or a version update. Which I think is the case we are seeing here.

0 -

@CaliQkn We will have to agree to disagree. I've been routinely using Boughtx transactions (for paycheck split transactions) for three separate financial institutions (Vanguard, TIAA, and Transamerica) for several decades and have never had any issues until this latest update. And the online (and downloaded) transaction history with those three providers does not show multiple intermediate transactions through a cash balance as you suggest. Maybe that's happening under the hood, but that is not what I see in my transaction history. This thread was started to see if others were seeing the issue and to attempt to get some resolution to it, not to debate how to use Quicken functionality.

0 -

@jslim1999 certainly. Quicken is a tool for you to use they way that works best for you. It has many options that are used differently by users.

But a fundamental rule never changes, contributions are deposited, which creates a cash balance in your retirement account. Then, investments are purchased with that cash balance.

0 -

I also have been using Quicken for about 30 years (DOS Ver 3.0). I also have been transferring money from a split paycheck entry into my 401-K retirement account and then buy shares with the BoughtX transaction as described above. When I enter the paycheck from 6/13/25 the BoughtX worked as it has always worked. The paycheck entry from 6/27/25 did not work. To get the BoughtX transaction to work the same way it has always work reverted back to Quicken version R62.16. build 27.1.62.16. When will this bug be fixed?

0 -

@Rick C In R62.16, when you edit the XIn to make it a BoughtX, does the contribution show up correctly in the Tax reports and the Tax Planner?

I don't want to get involved in the discussion about whether this is a good idea or not, I am trying to understand why the developers might have made this change.

QWin Premier subscription0 -

@Jim_Harman FWIW, I've never used Tax Reports or the Tax Planner, so I couldn't speak to whether or not there were issues with my Boughtx transactions in those previously.

I've reviewed the release notes, and I did not see anything about this being an intentional change. I'm not sure how complete those typically are though.

0 -

Download the patch/version you need as described below (R62.14) and install it, that is all it should take. This article is about what to do if your subscription has expired, but the process will let anyone revert to an earlier version.

To prevent Quicken from automatically updating to a newer version, you should also go to Windows settings and search for UAC. Set it to the top position or one notch below and be sure to cancel any proposed Quicken update.

QWin Premier subscription0 -

@Jim_Harman Not sure what you exactly mean by Tax reports. When I run Investment reports them seem to run correctly.

0 -

@CaliQkn I have been using Quicken the exact way you have suggested and the same way @Rick C says he is using it. I have a paycheck entry deposited into a paycheck account, but within the paycheck entry, I have deducted federal, state taxes, health care premiums and also 401K contributions which are going into one mutual fund, but to two different securities with different amounts. In the mutual fund, I have always used Boughtx transaction to allocate the money to the correct security (price, shares, total cost). Worked for 30 years that way…don't think it is unorthodox either.

Also, reverting back to a previous version is not sustainable. With the current yearly subscription model, you need to stay updated with the current software and security patches.

So…I agree with jslim1999 and the others who say this is a bug and needs to be fixed.

0 -

@dma05 when funds are purchased in your 401(k) account, you should be able to use a Bought transaction and not need a BoughtX because the cash for the purchase had been transferred from your paycheck and is already in the 401(k) account.

But, Quicken is a versatile financial tool that can be used many ways. There are several ways to get to the same end result. Your method has worked for you for 30 years. But we don't have enough information to determine if this change was intended and done to fix or prevent another issue from occurring. It would be up to Quicken to determine if the BoughtX change is a bug that needs to be fixed.

In the meantime, I can't see any reason why you couldn't just use a Bought transaction to purchase your 401(k) investments. That would just entail leaving the cash contribution transfer as-is, and then doing a separate Bought transaction.

0 -

@CaliQkn You have mentioned that before about using a seperate bought transaction to record each security transaction....fair enough. But as others have said before that is duplicating efforts. What if a person is buying 10 seperate securities thru their payroll deduction, each security is in the same 401K mutual fund. You are suggesting that person create 10 seperate bought transaction when all ten securities could be handled by one boughtx transaction. Does that make sense and is it efficient!? I had that same scenario many years ago where I bought 7 different securities thru paycheck transaction that went to one 401k mutual fund....I would use boughtx and allocate each monetary amount (which could be different) to the correct security. Boom - done with just one transaction.

I agree with you that whenever you make software changes there can be secondary effects...that is the nature of software development.

But what I'm having a problem with is a function that worked for so long, is no longer working. And if it was so detrimental to the efficiency and functionality of the software, why is just being corrected now and not 10 or 15 yrs ago?

0 -

I don't understand how one BoughtX could buy multiple securities. How would Quicken know how many shares of each to buy and at what cost per share?

Or did you treat the basket of securities as one master security?

QWin Premier subscription0 -

@dma05 I don't think there is another way except to do a separate Bought transaction for each security purchase.

Like @Jim_Harman, I am curious to know how you use one BoughtX transaction to purchase multiple securities?

0 -

I have used Quicken for over 30 years and this is worse change and I am trying read through all this and figure out to overcome the update R63.21 which obviously happened at the end of June 2025. My early June transaction still worked with BoughtX. Now that is not even an option. This stinks and I am not sure what is going on… The process was not wrong before and right now no matter how much you as a company think this is the way it should be done.

0 -

I'm not fully understanding what @dma05 is trying to do, but if you could do it before with a single Boughtx transaction, you should be able to do it now with a single Bought transaction.

On a separate note, this doesn't seem like it's going to be fixed. I've had to adapt to just use separate Bought transactions and it is working fine like that. I still maintain that having two separate transactions through a cash balance does NOT match what I see in my online retirement account transaction history (for any of my three retirement institutions), which leads to all of the incoming paycheck transfers not being cleared automatically as I accept the downloaded transactions. But at this point, whatever.

0

Categories

- All Categories

- 44 Product Ideas

- 34 Announcements

- 245 Alerts, Online Banking & Known Product Issues

- 23 Product Alerts

- 512 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub