Total Market Value is Hugely Wrong With Correct Number of Shares and Correct Price

In one of my Quicken accounts, I am tracking one brokerage account. All transactions have been manually entered based on Etrade confirmations. No downloads from Etrade. The account lists the total correct number of shares broken down into XYZ Corp., XYZ Option ISO, XYZ Option NQ, and XYZ RSU (because over time I have exercised ISO and NQ options, vested RSU's, and outright bought the stock). Each of these is associated with the XYZ ticker. I have downloaded the price history of XYZ and even entered today's closing price (though this has been an ongoing issue). The total market value in Quicken is off by hundreds of thousands of dollars or roughly 30% below the actual market value.

Quicken shows the correct number of shares and the correct price, but the total market value (which is number of shares x price) is shown as 30% less than reality. Why? I see other historical posts about this same issue but no one seems to know the solution.

Answers

-

What's the real name of what you're calling XYZ? What quote is Q showing? What do you believe it should be?

With this info, we can do some research ourselves and perhaps come up with some ideas.

Without such, it's all speculation.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

The symbol is CFLT at $27 per share. As far as the correct total market value, this is, of course, the total number of shares times the market price. The Quicken total market value is about 30% less than this calculation and what Etrade shows.

0 -

I went to my brokerage and got a $27 quote (pre-opening) for CFLT. In your 1st sentence, are you saying that's what it should be … or what's showing in Q? If "should be", what's in Q?

As an experiment, go to the account that holds your CFLT, click on any transaction and then do CTRL-Z to recalculate the account.

Did that help?:

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

I had a weird thing like that happen to my checking account. Scroll to the start of your register and see if there's an entry that doesn't make sense. I discovered when I made copies and reduced the size of my working file at year's end, the opening balance was wrong, making the value of my account wrong. Because everything had reconciled correctly before the copy, I wasn't expecting it, so it took a while to find it. I reported it, but no reply or fix yet. It seemed to have something to do with some far-in-the-future scheduled transactions that were somehow folded into the new opening balance, but that's as far as I could get with the limited information. It's possible that something similar can happen with an investment account. I went back to backups that I'd saved and confirmed the monthly reconciled amounts, and that's how I discovered that a new year started with the wrong opening balance, because January's reconciled ending balance was now wrong, even with the correct entries for the month. I ended up making an entry to compensate for the math error (and commenting it in the Memo), so the Quicken values once again matched the reconciled values. Because you have all the pricing data entered, compare your previous statements to the Quicken amounts for the same date. You may find an entry that doesn't make sense and throws off all the calculations from then until your most recent values.

0 -

Clicking CTRL ran a process that took less than one second and did not change anything. Reviewing the early transactions did not reveal anything incorrect. I have six years worth of transactions so it would be extremely laborious to verify every transaction.

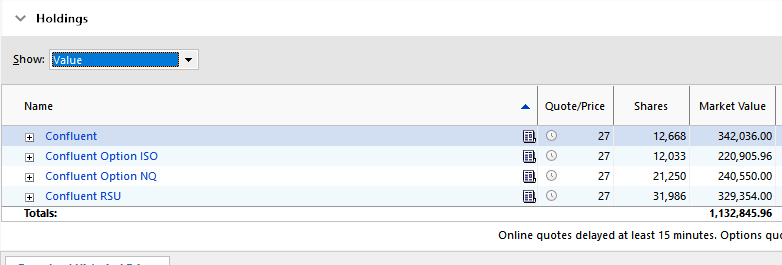

I did notice that Quicken shows the correct number of shares and the correct price but the wrong total market value of three out of four of my stock types as Quicken tracks them. I track them as XYZ, XYZ Option ISO, XYZ Option NQ, and XYZ RSU. The XYZ total value is correct but each of the other three market values is much less than the actual value (shares x price). This means that there is some error in Quicken that is causing a miscalculation of the value of shares derived from ISO options, NQ options, and RSU's. I see no way to make Quicken show the correct values.

0 -

Are you referring to "market value" here or "cost basis"?

So you are literally stating that you are seeing a situation along the lines of:

[Some flavor of XYZ]: "X" shares (correct) x "Y" market value (correct) = $ABC (incorrect)??

That's hard to believe. Computers are generally darn good at math.

Why don't you post a picture of the "Holding's" in that Account to show us? Blank out the name of the Company if you wish, but as far as I can tell "robkunz1" could be my next door neighbor or live in China.

0 -

As you see, the math is wrong.

-1 -

Is the market value of the options reduced by the strike price?

0 -

Originally I was going to ask if all "flavors" of Confluent was stock that you actually owned outright, but then I didn't. So, do you own outright all the shares in each and every flavor of Confluent show in the Holdings view?

I've played around with Quicken's options "wizard" to know that, properly entered, the wizard works correctly with respect to the possible mechanics of options and typically uses a stock name that's some variation of the company's traded stock, but my impression, and I don't know how and where I got that impression, was that option grants were generally handled in a Quicken Account that was not the ultimate place in the real world where stock acquired via exercise or vesting would end up. And I never bothered to see how such grants were "priced" so perhaps that's the problem?

But RSU stock doesn't really have an "out of pocket" cost at vesting, so even there I'd expect that the math on the RSUs would show correct "Market Value."

0 -

Quicken and Etrade show the same number of shares owned. Obviously Quicken is using an incorrect method to calculate the market value because clearly the math is wrong using shares x price. I have used the Wizard when entering every stock transaction.

-1 -

Do you own 100% of the ISO, NQ and RSU? Q might be calculating using your owned percentage.

You never answered @Tom Young's question on this point.

SO, you haven't demonstrated you allegation of "incorrect method".

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

Thank you for all the attempts to solve this. It does not seem like anyone knows what the problem is. Yes, of course I own the shares. Shares I don't own aren't vested and Quicken knows that. I did state that Quicken and Etrade show the same number of shares but the Etrade value is much higher and correct as they are using shares x price.

0 -

What’s the market value of 100 shares of an NQSO currently trading at $20/sh with an exercise price of $15/sh? It’s $500 not $2000.

0 -

I assume that part of your effort here has been to Validate the file?

It seems like we're missing something or computers are no longer are good at math.

Try calling Official Quicken Support , allowing screen share so they can see for themselves what you're seeing, and maybe they can figure it out.

If they do please comeback and tell us if it's a pure calculation error on the part of Quicken, or something else.

0 -

Hello All,

Thanks for sharing this issue.

We would like to know if you are still experiencing this?

Let us know!-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub