Fidelity money market automatic redemptions

I have searched to find recent/relevant discussions about Fidelity, and give up and am creating this post.

There is an announcement thread last updated on 10/28 by @Quicken Janean

In it, you write:

"If you experience one of the issues above, please bookmark this discussion for updates and share your details in the related discussion so our teams can investigate further."

There is no link to "the related discussion."

The issue is probably related to

Money Market Fund Redemptions Missing (CBT-884)– Missing redemption transactions for multiple securities.Status: Under investigation.

I wanted to fill in some details.

This occurs on both Windows and Mac.

My core fund is FDRXX.

To re-test this, at Fidelity I transferred money from one account to another, making sure that there was not enough cash in the core fund to cover the cost of the entire transfer. Fidelity sold some of my shares in FZDXX, which is the Fidelity Mmkt Premium Class money market fund and is an additional money market fund in the account

In Quicken, my core was represented in cash. (Most likely because I periodically adjust the number of FDRXX shares back to 0, and adjust the cash balance.)

The transfer, as represented in Quicken, is entirely attributed to cash, and no FZDXX gets sold. (The redemption transaction at Fidelity is entirely ignored). The result is that the cash position in Quicken becomes negative, while the FZDXX shares remain too high. The workaround solution is to remove the proper number of shares of FZDXX, and increase the cash balance to $0.

If people have their cash position in Quicken represented in an actual core fund (like SPAXX), I speculate a similar thing would happen, except that the number of shares in the core fund would become negative. If someone has a setup that lets them confirm that, please add to this discussion your findings.

At the Fidelity web site, these automatic redemptions of non-core money market funds are represented in an unusual way, which suggests confusion at Fidelity itself. The text for the activity reads:

REDEMPTION FROM CORE ACCOUNT FIDELITY MMKT PREMIUM CLASS (FZDXX) (Cash)

The thing that is wrong is that the redemption is NOT from the actual core account.

But the fact that they use this text suggests at some level Fidelity "thinks" it really is redeeming from the actual core, and so they might pass it that way to Quicken - which would explain why the cash in Quicken goes negative.

In QWin, this is shown as a Withdraw transaction, with a memo stating the name of the account the money is being transferred to. (The receiving account gets a Deposit transaction, with a memo stating the name of the account the money is coming from.)

In QMac, this is shown as a Payment/Deposit transaction, with the Security/Payee field stating the name of the account the money is being sent to, and a Description/Category of "Transfer." (The receiving account gets a similar Payment/Deposit, with the Security/Payee stating the name of the account the money came from, and a Description/Category of "Transfer.")

I apologize if these details are already included in CBT-884.

Comments

-

Hello @qudtp,

Thank you for taking the time to share these detailed observations and examples. Your insights into how Fidelity money market redemptions are being handled in Quicken are very helpful.

We appreciate your effort in documenting this!

-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.0 -

I have a similar issue. Seems like Quicken needs to know for each fidelity account in Quicken what the CORE cash position (money market) is being held it. It could be SPAXX, FZFXX or FDRXX or something else. Fidelity owners can change their CORE position from SPAXX to FDRXX. I'm not sure if there are other options. I'm sure the same might be true at other financial institutions. Have you considered this @Quicken Anja ?

0 -

I'll try leaving a comment again as my last didn't post. FDLXX auto-redemption transactions are not being downloaded into Quicken Mac. For documentation details see this comment thread:

0 -

Hello @rotygolf,

Thanks for sharing your observations! This aligns with reports we’re currently tracking in an open ticket regarding missing redemption transactions for Fidelity money market funds.

Our team is actively investigating, though we do not have an ETA available at this time.

Thank you!

(CTP-15049)-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.0 -

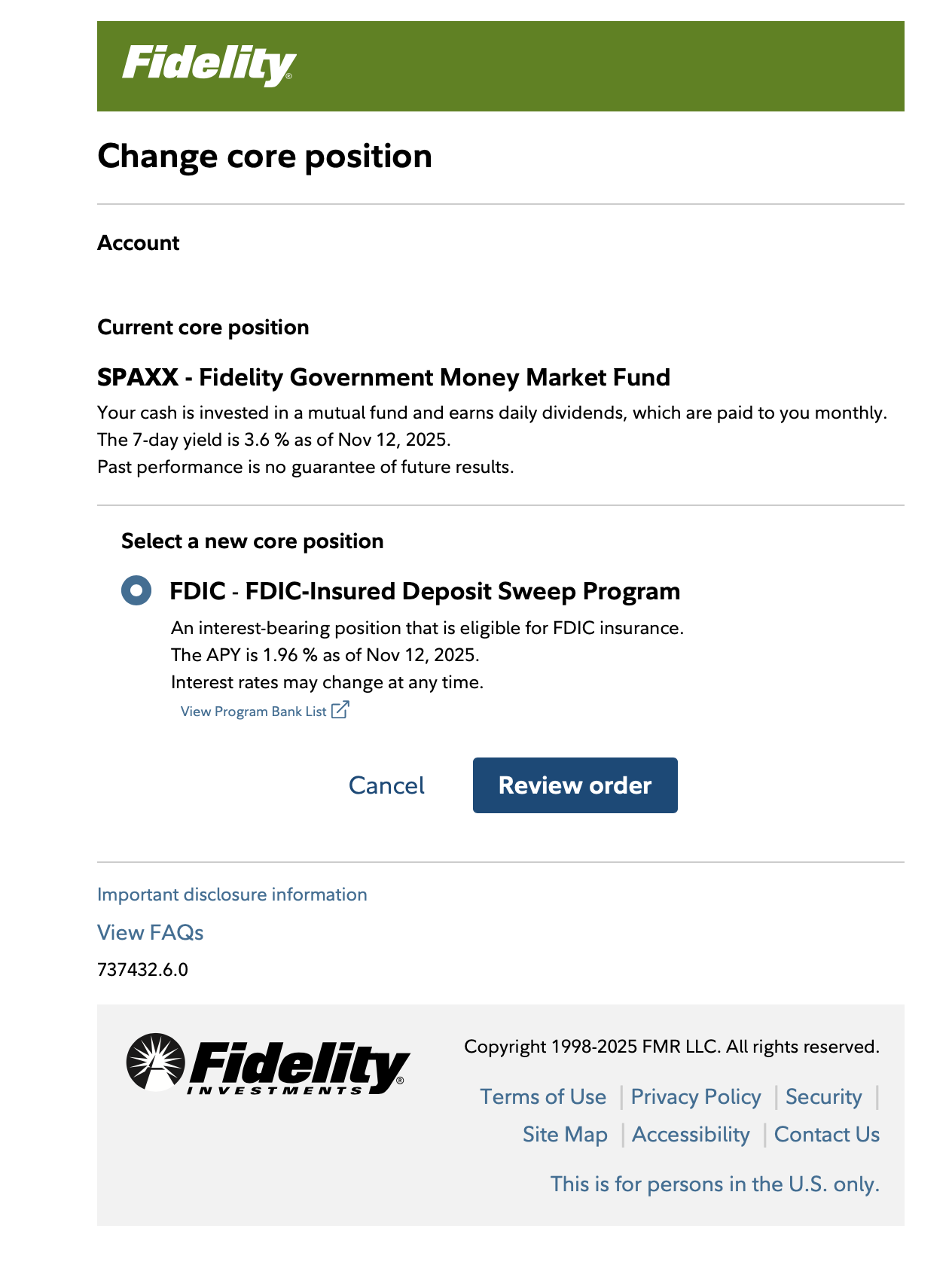

Hi, Just for clarification, Fidelity lets the user choose core ("cash") is being held. AFAIK, those choices are limited to:

Fidelity Government (available for use as a core position in a retirement or non‐retirement account, used for processing cash transactions and for holding uninvested cash)…..SPAXX

Fidelity Treasury (available for use as a core position in a non‐retirement account, used for processing cash transactions and for holding uninvested cash)…..FXFXX

Fidelity Government Cash Reserves , symbol: FDRXX

Fidelity Treasury Only , symbol:FDLXX

FDIC Insured Deposit Sweep, aka bank sweep. Not a money mkt acct.

Funds that are transferred into the account or cash resulting from an asset sale, non-reinvested dividend, cap Gain payout, etc are swept into one of these [edit] FIVE options.

Investors are free to use OTHER Fidelity Money Market funds in their account, and one feature that Fidelity provides (that Schwab does not) is auto-redemption of the money market fund to pay for a stock purchase, cash transfer out of account, auto-debit of credit card payment or other bills, etc. These can be used for auto-redemption, but they are not available for auto-sweep of cash into the fund. The user must make a buy transaction to move money from their core fund to their money market fund that has the auto-sweep feature. AFAIK, the NON-CORE POSITION funds available for auto-sweep are:

Fidelity Government Cash Reserves, symbol: FDRXX

Fidelity Treasury Only, symbol: FDLXX

For Investments of $100,000+, $1million+, or $10million+

Fidelity Government – Premium Class

FIMM Government – Class I

FIMM Government – IL Class (FRGXX)For investors seeking more conservative funds with potentially lower yields

- FIMM Treasury - Class I

- FIMM Treasury - IL Class (FRBXX)

- FIMM Treasury Only - Class I

- FIMM Treasury Only - IL Class (FRSXX)

See this link for validation:

The above is to the best of my knowledge, but I am not the authoritative source!💡

1 -

For my Cash Management account, Fidelity only offers SPAXX or FDIC as options for the Core position.

0 -

@Quicken Anja Is there a specific post where we can track the status of CTP-15049? After the many months of Fidelity EWC+ being a complete nightmare, this one remaining issue continues to annoy.

0 -

Thank you @Pacific_Shark_Chum for sharing those detailed observations!

@bdantes Regarding CTP-15049: this ticket is internal only, so there isn’t a public post to track it. That said, you’re always welcome to ask any of us community moderators for a status update—we have access to review the ticket. It’s currently still open and actively being worked on, but there’s currently no ETA for a fix.

Thank you for your patience while our teams continue investigating!

-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.0 -

I believe my problem is described by CBT-884. CMA Account. Core position is SPAXX with zero SPAXX shares held. Holdings in FZCXX are auto-liquidated for each cash debit, yet the FZCXX transactions never get downloaded. Bug report filed. To be clear, this worked fine for years under Direct Connect.

0 -

Hello @Quick92,

Thanks for the clarification!

Just to clear up the ticket reference—CBT-884 and CTP-15049 are actually the same issue. When we moderators submit a ticket, it initially starts with a CBT identifier. Once our escalation/development teams take it over, that ticket is converted into a CTP number. So the CBT number you mentioned is simply the earlier version of the same ticket I referenced.

The issue is still open and actively being worked on, though we don’t have an ETA yet.

Thank you for taking the time to submit a bug report and for your patience while our teams continue investigating!

-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.0 -

Well, here we are in December and the issue that has persisted from July has still not been fixed. Can we get a status update? TIA.

1 -

Hello @Pacific_Shark_Chum,

Thank you for following up. The ticket for this issue (CBT-884/CTP-15049) is still open and actively being worked on. There is no ETA available at this time.

This ticket is internal only, so there isn’t a public post for tracking it. However,we moderators do have access to monitor the ticket, so you are welcome to check in anytime.

We appreciate your patience while our teams continue investigating.

-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.-1 -

Hey Quicken, you've got over 20 Fidelity issues open under one forum topic that was last updated on Oct 28. How about an update?

1 -

@Quicken Anja @Quicken Kristina

Can we get an update on CTP-15049 — missing SoldX transactions from Fidelity under EWC+? 5 months after the initial transition and this problem still remains.

2 -

I am having similar issues with Fidelity. Specifically although transactions download, the Positions are reported incorrectly. SPAXX and FTEXX are not listed at all in the Positions. Additionally the balance of FZDXX, although listed, is completely incorrect. Please advise.

0 -

Currently you have to manually enter all your FZDXX automatic redemptions since they don't get downloaded.

0 -

When I have read Quicken's list of open issues, this one has always been left open with further analysis needed. Though users on this site have described this problem repeatedly, sometimes vaguely but sometimes highly precisely with a complete set of screencaps or exact quotes from Fidelity's Activity pages, I have never gotten the impression that Fidelity and Quicken even understand the problem report.

In the activity the missing sale is listed by Fidelity as a redemption from "core" even though it is not precisely that, and I'm sure that the missing explicit redemption is the cause of this problem. Maybe Fidelity is not passing enough information for Quicken to be able to reliably detect that sale, or maybe sufficient information is being provided but Quicken isn't interpreting it properly.Even if a solution has not yet been found, the problem statement itself is so crystal clear that you would think that at least quicken would report that the problem was understood even if a fix is not scheduled. But there has never been such an acknowledgment. This issue just lives in its own black hole and as users come along to report the bug again, I guess they get captured by the gravity and swept into the black hole too.

I figure you'll have to insert the sale yourself in Quicken. If you want quicken to stay automatic, then don't use the Fidelity convenience feature – always do a

straight transfer of money from the secondary to the core money market,sale of the required number of secondary money market shares, which will put cash into the core MMA, wait it for it to clear or at least be accessible in the core money market, and then do your activity. This might cost you a day in delays (in theory the cash should be instantly available in the core at least for trading purposes, but probably not immediately available to withdraw), but at least a clear sequence of transactions would be recorded and would download cleanly into Quicken.Edited: for clarity

0 -

I believe this started for me when I responded to a query by Quicken about whether I wanted to change how FIMM was tracked. I now have to enter all the redemption transactions myself. Very frustrating. I wish I could go back and make a different decision. Though I can't recall exactly when this was. I think it was in October.

0 -

@Quicken Anja @Quicken Kristina

Coming up on almost 7 months living with this bug. We need more frequent and substantive updates. Please ask your engineers to inform users for CTP-15049:

1) if they have managed to consistently reproduce it and know the root cause — and if so, what is it?

2) If the fix is entirely within Quicken's hands, what is the timeline for the fix? And if it is in Fidelity's, what timeline have they given for a fix, and what is a case or reference number that we can use when calling Fidelity Electronic Channel Support?

The generic "we know it's still a problem but still have no ETA" response is just inadequate. We need more information.

3 -

@Quicken Anja @Quicken Kristina

It's been another week with no update on this topic that I can easily find. Can you please respond?

2 -

Thank you for the follow-up,

I can see that the ticket was recently marked resolved. Could you please confirm if this issue is still happening with newly downloaded transactions?

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

I am on the latest Windows release, 65.29, and SoldX auto redemption of money market fund transactions are definitely still not coming down.

1 -

Thank you for confirming,

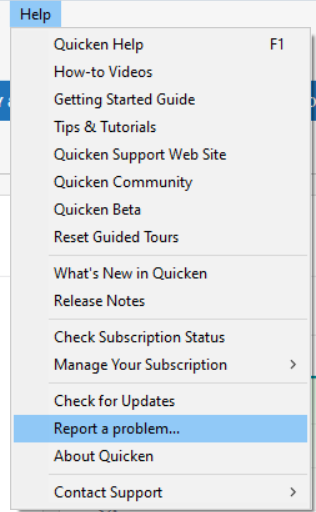

I'll notify our teams that the issue is persisting. Please navigate to Help>Report a Problem and send an updated problem report with log files attached so that our teams can further look into this issue.

Thank you!

(CTP-16241)

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Are you confirming that the issue should be fixed in 65.29? Are there any other steps after getting the release containing the fix, such as reconnecting the Fidelity accounts from scratch?

If the issue has been fixed, can you please get engineering to provide some feedback on what the problem was? Was it strictly a bug in Quicken all this time? Was/is there an issue with Fidelity's with EWC+ feed? Both?

1 -

Still not working correctly — I did report the bug through the app again referencing this thread. Please get engineering to provide the details requested above.

1 -

Thank you for your replies,

The issue should have been fixed in the update, with no further action on your part (aside from correcting anything which had already been downloaded incorrectly). They didn't provide insight into what caused the issue.

Thank you for providing the problem report with log files attached. That will help our teams further investigate the issue.

You mentioned two MMFs specifically in your problem report, but implied there were others you're seeing this issue with. Please let us know exactly which MMFs you're seeing this behavior with.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

The two I mentioned are the ones where the problem is still actively occurring. But last year I think I recall seeing SPAXX have an issue as well.

Please ask engineering to disclose details on the exact nature of the issue. I think we customers at least need to know if this entirely a Quicken-side issue, or if we should be pursuing Fidelity to fix something in their EWC+ feed. The more details the better. The black hole of information just makes problems 10x worse.

1 -

Just adding my voice to say it's still broken.

0 -

Today I saw progress — a bunch of transactions came down for the redemptions, but instead of being the expected Sold/SoldX transactions, they were CvrShrt/CvrShrtX transactions. I'm not sure I'd call selling off MMF shares to generate cash as "short cover," but I suppose one could make that argument. Is this expected/correct behavior as far as Quicken is concerned?

What definitely appears wrong though is that I'm also seeing CvrShrt/CvrShrtX transactions for the MMF that is considered the cash position of the account, like SPAXX. It looks like a regression may have occurred reintroducing a prior bug in fixing this one. I reported this as a bug directly in the app.

1 -

I see the same thing reported by bdantes. It's a change in behavior, but I don't know that it should be called progress. To be specific, I see a "CvrShrt" for what shows on the website as "REDEMPTION FROM CORE ACCOUNT FIDELITY GOVERNMENT MONEY MARKET (SPAXX) (Cash)" and in another account that has a linked checking account, they show up as CvrShrtX

Perhaps related: I also have some IRA accounts where the red flag appears (indicating downloaded transactions) but no downloaded transactions can be seen. Clicking on the red flag does nothing. I reported a bug for each situation I described here.

0

Categories

- All Categories

- 58 Product Ideas

- 34 Announcements

- 238 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 512 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub