New Fidelity Download Method No Longer Supports Detailed Transactions - Unacceptable!

This morning I was prompted to give permission for Quicken to download new transactions from Fidelity Investments. Quicken redirected me to a Fidelity login page where I read the agreement and checked two boxes to provide the authorization. It then asked to re-link the various accounts, which I did. It then went through the download process, but it only offers simple downloads and NO DETAILED TRANSACTIONS! This absolutely breaks Quicken for me as this is 90% of what I use it for. The only account unaffected was the Fidelity Visa that downloads through Elan. Is this by intent? The only way I can do detailed transactions is to disconnect from downloads! This is not going to work. Please fix!

Edit: I had to restore my Quicken Data from a recent backup and was then able to go in and change my connection from Quicken Connect to Direct Connect. This allowed me to select Detailed Transactions as the download type. Still have to go in and fix some missing data, but at least I'm back to where it was.

Edit 2 (12/13/23 1700 CST): Fidelity confirmed that the change was no intended to break functionality. They didn't promise a resolution but said they would track the problem. I intend to call Quicken support tomorrow.

Comments

-

"but it only offers simple downloads and NO DETAILED TRANSACTIONS!"

You might want to check to see if those investment Accounts have been "flipped" from complete accounting - transaction by transaction - to "Simple" accounting. Sounds like that might be the case.

0 -

Tom, that is the point. When you set up the new download method (which is required), the screen comes up where you select Simple or detailed transactions. There is no way to select anything other than Simple Downloads. If you do it after the fact in each individual account, it disconnects that account from downloading. I don't know if the problem is on the Quicken side or the Fidelity side.

-1 -

I wouldn't think Fidelity would dictate Simple accounting so I'd say it has something to do with Quicken. I've been forced to change from Direct Connect to EWC+ some time ago with Schwab, but I don't remember going through the simple/detailed screen you're describing.

I'd say give Official Quicken Support a call. And, there might be some "local to you" problem here that needs to be addressed. If this was a change dictated by Fidelity I'd expect this place to be overrun by posts similar to yours.

0 -

It doesn't appear to be a "local to you" problem as I have the same problem.

0 -

jamesdn…see my edit to my original post. Changing connection type to Direct Connect seems to still allow detailed transaction download.

1 -

Thanks for the tip. I restored my file from yesterdays backup. My Fidelity accounts were already setup for direct connect which still works for the time being. Direct connect doesn't appear to be an available option with the new Fidelity Investments and Retirement. Besides loosing all transactions the change messed up my Cash Management Account. Five new securities were added with each in the form of FDICxxxxx. I don't know what those are, where they came from, or how to get rid of them. The account value was doubled. Working ok with yesterdays backup so far.

0 -

Same issue for me as I was asked to change to a new connection type with Fidelity this morning. After the change, no details on several investment/IRA accounts. If you try to change Investment Tracking Method from Simple to Detailed, this is the message you get:

Fidelity-Investments & Retirement does not support downloading detailed investment information. If you want to use Detailed Tracking, you must disconnect this account and manually enter your investment transactions.

Kind of defeats the purpose if I can't see or track transitions for my investment accounts.

1 -

Just saw this:

0 -

Well, I hope Quicken fixes this. Just talked to Fidelity who gave me the brush off so I am thinking of dumping Fidelity. Whom should I go with?

Steve

Quicken Mac since 2017

Quicken Simplifi Safari & iOS since 2021

MS Money/Quicken Windows 1991-2017-1 -

Don't switch over this. I did talk to Fidelity tech support (not first line person but what they call Electronic Channel support) and they confirmed that there is a new connection method but it wasn't supposed to break functionality. Based on the notice that Quicken posted (see above), they are aware something is very wrong. It will get fixed, but I believe it will take some time. I've been happy with Fidelity and I've got too much money invested with them to make an easy jump. It would be quite a chore to switch.

1 -

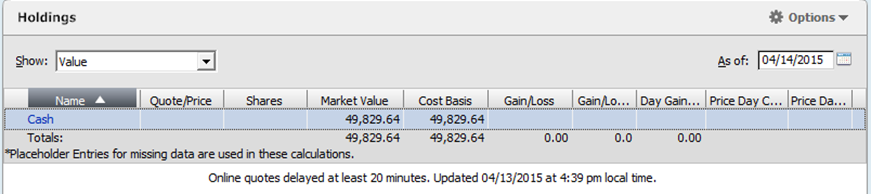

I found this on the Fidelity site and it may relate to those five FDIC positions you saw. Like you, my CMA account was a mess.

"To better support our customers, we’ve updated the FDIC core cash position in Quicken®. Now, an FDIC core cash position will be treated as Cash instead of as a security. This will suppress additional end of day net activity (Purchase and Redemption of FDIC Core) which displays daily for accounts that have an FDIC core cash holding. Follow the steps below and this will then provide a more accurate cash available balance in Quicken and suppress any Redemption and Purchase Core activity from displaying. You will only need to make this change once.

Step 1) Remove your Consolidated FDIC Holding. This can be accomplished by the following steps:

- In Quicken's main menu go to Edit > Transactions > New

- Enter Transaction as Remove – Shares Removed in the dropdown

- Select Consolidated FDIC in the Security name dropdown

- Select Specify Lots button to remove for each lot for the account that it is held

Step 2) Select the Cash link (shown below) to update you current cash value in Quicken.

Once completed, these steps will not be required again for future downloads. This will also suppress unnecessary Core Purchase and Redemption Transactions from displaying.

Note: If you have not already been deleting extra core transactions from their existing transaction view, it may be required to delete extra activity seen as Core FDIC Insured Buy/Sell transactions in the existing Quicken registry.

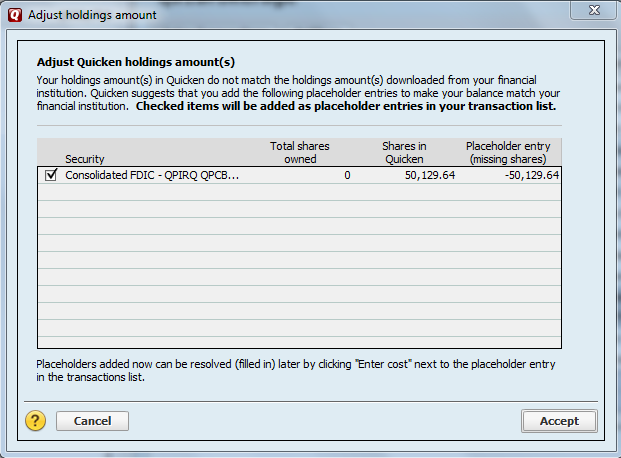

If the following message is being presented, it can also be addressed by following the steps below.

Step 1) Keep the box checked and select for Consolidated FDIC position and then select the Accept button. This will also remove the Consolidated FDIC position.

Note: Quicken will delete the Consolidated FDIC position after this step; however if you have multiple lots created, you may need to follow Step 1 mentioned above.

Step 2) Follow Step 2 mentioned above to now update current cash value.

Did you know you could avoid the steps above by creating a new Quicken File?

This can be accomplished by going to File > New Quicken File. This will automatically make all the necessary adjustments.

Note: By choosing this method, your history for up to the last two years will be refreshed for the new file being created, for all your accounts. As a result, consider saving a copy of your previous file before creating a new one by going to File > Save a copy as… seen in Quicken."

0 -

Hello All,

I truly apologize for the inconvenience that this has caused.

Fidelity has decided to no longer support detailed transactions within their API. In order to support any type of downloaded information, Quicken has to connect with the financial institution's API.

I hope this clarifies things.

Thank you!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

WOW - just WOW

Here are the 2 entries from here on the QWin side -

07776 07776 07776

Fidelity Investments

http://www.Fidelity.com (800) 544-7931

http://personal.fidelity.com/misc/partners/quicken/disclaimer.shtml ACTIVE

INVESTMENT,ACCOUNTINFO&DIRECT70419 70419 70419

Fidelity - Investments & Retirement Accounts

https://nb.fidelity.com/public/nb/default/home NA

https://nb.fidelity.com/public/nb/default/home ACTIVE

BANKING,CREDIT,ACCOUNTINFO,INVESTMENT&EXP-WEB-CONNECT0 -

Jasmine,

I don't know what you mean? Do you mean that detailed transaction downloads will not be allowed in Quicken going forward? Or, does that mean we will still be able to use the Direct Connect method with Fidelity in the future? Since I download score if not a hundred transactions a day not seeing detailed transactions is not acceptable. BTW others have noted after talking to Fidelity that Fidelity says it is Quickens fault and that Fidelity always supports downloadable transaction details.

0 -

It's the same on the Mac side, "Fidelity - Investments & Retirement" is EWC only while "Fidelity Investments Mac" still allows both DC and EWC; the latter is what I'm using for my accounts.

The web address for "Fidelity - Investments & Retirement" leads to a NetBenefits login screen; maybe folks using that should try switching to "Fidelity NetBenefits" instead, that still shows DC support.

1 -

I just spent 45 minutes on the phone with Fidelity and the Direct Connect is working again (it wasn't this morning). On the Mac connection, you can now select 'Fidelity Investments Mac' to Direct Connect and choose if you want Detailed or Simple Tracking (it was unavailable this morning).

2 -

@Quicken Jasmine When did this take effect? Because I have multiple transactions, dated 12/14, that downloaded from my Fidelity accounts into Q.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

Hello All,

We hope the guide below will clarify and clear any confusion.

- If you have only Direct Connect accounts with Fidelity, you’re not impacted.

- If you have any Express Web Connect (known as "Quicken Connect" on Mac) accounts with Fidelity, those are switching to Express Web Connect+ (which is an API connection to Fidelity’s servers).

- Most users with Fidelity Express Web Connect accounts are on Mac (known as "Quicken Connect" on Mac). The only Windows users impacted are using the Fidelity Rewards Credit Card.

- If you have a combination of Direct Connect and Quicken Connect accounts from Fidelity, you may be prompted to switch your Direct Connect accounts during the migration process; however, these Direct Connect accounts won’t change— they are appearing because the Fidelity API is sending them. If you continue through the migration process, it’ll only impact the Quicken Connect account(s) you have with Fidelity.

- The Fidelity Express Web Connect+ (API) connection does not send detailed transaction information, so this connection type only supports Simple Investing in Quicken Classic at this time.

- Direct Connect is available to users who want to use Detailed Investment tracking— but please verify this connection is set up through Fidelity (there may be a charge, or prior authorization needed to connect).

Thank you!

-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.0 -

It would have been great to explain this prior to notifying users who used Quicken Connect on Mac about these details. I'm also more than a bit quizzical as to why Windows Users of Quicken are unaffected by the change. This part doesn't make sense in that if they are using the same API, the information available should also be the same. Unless you are saying Quicken for Mac is a lesser product.

0 -

For mac quicken users, the migration didn't seem to give an option of sticking with direct connect, instead indicating the the move to the new method was mandatory.

Couple questions:

- Are you saying that the new connect method—which you list as Fidelity Express Web Connect—will take away transaction support permanently, or is this a bug that is being worked on and you expect that we will once again be able to download transactions?

- If the latter, is there a method to connect to Fidelity (for quicken on mac) that resumes the behavior of downloading transacitons?

Thanks

0 -

The solution to this Fidelity connection problem does not yet seem to be clear. For those of us who tried the new (required?) connection we were greeted with quite a disaster. As a Quicken for Mac user from the beginning of time I have never heard of "Express Web Connect" or Express Web Connect+". For us Mac users the connections have been "Direct Connect" or "Quicken Connect". For Fidelity investment accounts it is the "Quicken Connect" that is causing the problems. Based on multiple conversations in this Community it appears that this connection problem is trying to be corrected by Quicken team and Fidelity although there has been no solid affirmation of that. Fortunately, you can still use the "Direct Connect" option using the "Fidelity Investments - Mac" FI to connect to Fidelity investment accounts and it still works very well. Certainly the inability to download transactions from any account including Fidelity would be a "deal buster" and would make Quicken quite useless. So, I would guess that Quicken team wants to resolve the issue. But as they often say "there is no ETA" for resolution yet. Let's hope nothing dramatic happens to account downloading in the meantime. BTW, I would guess that Fidelity is not alone in changing the connection method to improve security. I would guess that other investment companies are or will be moving in the same direction. As they say stay tuned.

0 -

Friends, here is additional information from Fidelity I have gathered from their web site regarding the new Quicken account connection changes coming. Here are some highlights I have copied and pasted from Fidelity regarding their new “Fidelity Access” requirements for third party apps and aggregators (Quicken). If you are a Fidelity customer you can get more information by going to your Profile after logging in and then exploring the Security section down the page.

Based on what I have read it looks like Fidelity does not intend to limit access to data that is imported into Quicken (see the last statement below). However, Quicken has to comply with Fidelity’s access requirement system. Therefore, it seems it is up to Quicken to determine what they need to do to make sure we can download all transactions into our accounts. I am sure the Quicken team is working on this. However, Fidelity also says that if the third party does not comply with their new access requirements then we will have download transactions into Quicken manually - a big deal buster for me.

Fidelity’s statement about what they are doing to enhance security

“To enhance the protection of your account data, Fidelity has established a secure connection that better controls how third-party websites and apps that you've authorized, and the data aggregators they use, connect to your accounts. Fidelity is requiring these data aggregators to transition to this secure connection. Fidelity users of some third-party websites and apps may experience a disruption in the link between those websites and apps and their Fidelity accounts. However, there is no change to your ability to access your accounts or transact through the Fidelity app or on Fidelity.com.”

“What’s being done to allow third-party sites and apps to access my Fidelity information?

When you authorize third-party websites, apps, and data aggregators to access your Fidelity account information, if these third parties have established an integrated connection with Fidelity, they can retrieve your information through this connection. This means that they do not have to use your Fidelity username and password to log into your Fidelity account and screen-scrape your Fidelity account information.”

This is from the “Fidelity Access” FAQ page

“With Fidelity Access℠, will Fidelity limit the account information that I will be able to view on third-party financial sites and applications?

With Fidelity Access, you can grant access to your account data such as balances, holdings, and transactions—everything that is needed for budgeting, financial planning, analyzing spending, generating portfolio advice, and much more. Confidential, personally identifiable information is not available through Fidelity Access. However, if you want to provide that information on your own—and at your own risk—to a third-party financial website or application, you are free to do so.”

0 -

any news from either Quicken or Fidelity on the status of a fix for this?

1

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 248 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.5K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 124 Quicken LifeHub