incorrect balances for Fidelity accounts

A few weeks back Quicken forced me to upgrade my connections for Fidelity Investments. I was using the older direction connection specifically because it was the only way to get correct balances. The new connection continues to show incorrect balances in Quicken for Mac, something that has been a problem for more than a year. I have reported the probelm many times, sending logs and screenshots, but reporting problems to Quicken is like shouting into a black hole and they never fix anything.

Comments

-

Hello @quickj,

Thanks for bringing this issue to our attention!

- When you say the balances are incorrect, are the holdings/shares wrong, the cash balance, or both?

- Do the account balances in Quicken differ by a consistent dollar amount, or does it vary after each update?

- If you log directly into Fidelity, do the balances there match your downloaded transactions, or only the overall account total?

- Are you seeing this across multiple Fidelity accounts, or just one?

Looking forward to your response!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

I have "bought this issue to your attention" numerous times via the app's (terrible) Report Feedback feature, including screenshots… This has been a problem for a long time. It is mainly the cash balance that is wrong.

Two examples: For Account A, a cash management account, Quicken shows one account balance as $XX,532.36, which is $396.99 greater than the actual balance reported by Fidelity. It doesn't match Fidelity in any way — not the total balance, not the settled cash, and not the available to withdraw. For Account B, an investment account, Quicken shows the balance of holdings as $XX,223.10, which is $90.92 higher than all balances reported by Fidelity. One of my IRA's is $25 higher. One of my accounts is only 2 cents off, but every single Fidelity account I have in Quicken has an incorrect balance.

1 -

Thank you for your reply,

The transition to the new connection method is relatively recent, but you made reference to balance issues that have been going on for over a year. Were you using the Fidelity NetBenefits connection option? Did the balance issues happen only when using Simple investment tracking (transactions tab greyed out), or were they happening even when using Direct Connect and Detailed investment tracking?

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

-1 -

You had introduced a "new" connection to Fidelty previously and forced it on me. It was at least a year ago. I don't recall exactly when, but it worked even more poorly and I switched all of my accounts back to the direct connection method. The direction connection was labeled "Fidelity Investments Mac" and always provided the correct balance. Now you've removed that entirely and only have the one Fidelity connection. The older "new connection" I used previously was not for NetBenefits, but it only supported simple investment which was frustrating. The old new connection was "Fidelity - Investments and Retirement accounts" and was the default option you offered for Fidelity at the time (I had to specifically search for Fidelity Investments Mac to get to the direct connection). Regardless, incorrect balances with Fideltiy it not a new issue and I've posted about it here before as well as frequently reporting in the app (with screenshots).

1 -

Thank you for your reply,

Based on your description, and the history you provided, I suspect the balances may be off due to inconsistencies with how cash and money market funds with Fidelity are being handled. Are the balances off due to cash being double counted (both as cash and as a security)? Are any there any funds that aren't showing up at all? Are you using Simple investment tracking (transaction tab greyed out) or Detailed investment tracking?

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

-1 -

I am using detailed tracking. All my investments are listed and cash is not counted being twice. I have 3 cash management accounts and the balance for 2 of them is just wrong. Quicken shows a balance that is higher than actual cash in each account and it does not correspond with the settled cash, total balance, available to withdraw amounts, or pending deports reported by Fidelity. Quicken reports one of them is $20 higher, and the other is $448.35 higher.

2 -

Thank you for your reply,

Due to the nature of this issue, I recommend that you contact Quicken Support directly for further assistance as they can walk you through troubleshooting steps in real-time and escalate the situation as needed. The Quicken Support phone number can be found through this link here. Phone support is available from 5:00 am PT to 5:00 pm PT, Monday through Friday.

I apologize that I could not be of more assistance!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

-1 -

I have reported this to support previously. They are not helpful in resolving. It has been a problem for a while, and as is typical of Quicken, you rarely fix issues.

1 -

Thank you for your reply,

Do you have the ticket number from when you reported this to Support previously? It would be helpful to look up that ticket.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

I do not have a ticket number. I have reported it numerous times using the built in Help > Report a Problem and also Help > Send Quicken feedback. No response on either. When I had the issue using the Investments and Retirement Accounts connection previously I spoke with support and they had no resolution.

1 -

Thank you for your reply,

Sending a problem report is not the same thing as contacting Quicken Support. Problem reports are reviewed daily to track multiple reports of the same trending issues and/or for troubleshooting/escalation purposes. When multiple reports of the same issue are received, those reports are also investigated further. Reports that can be replicated or verified are then submitted as tickets to the proper channels.

There is currently a Community Alert for several known issues with the updated Fidelity connection. Some of those issues do affect balance and may be causing some of the problems you are seeing. If you haven't already done so, to be notified of any updates, once available, and know when the issues are resolved, please bookmark the Community Alert below:

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Hopefully they are fixed soon. One of my Fidelity cash accounts now shows a balance that is $500.66 less… That's a cash account, not an investment, so no reason for it to lose value.

2 -

Thank you for your reply,

Since our teams do not provide ETAs, I recommend bookmarking the alert (linked in my earlier post) to track the status of the known issues.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

SAme issue here more or less. Fidelity balances are off and it seems to have started with the new "On Line Bills system" updates and they dropped support for several of my accounts and someplace. Also in the last two updates they destroyed Bill Reminders that have worked for years. These updates and new additions are mostly full of bugs as far as I can tell, and I cannot see why they open up this code that was working! Very frustrating buy in regard to Fidelity, with the new "On Line Bills system" it immediately had balance difference issue dialog boxes popping up and then the wrong total balance by a few thousand dollars after let it put "placeholders" in to correct the issues the code thought were there, but the code simply made more issues.

I have used the reporting system to report errors. They do indeed drop into the bit bucket.

I suppose I could go through customer service but I do not think they'll help since this is an obvious set up bugs injected into the code in the last two updates.

I have used Quicken for decades now . . . this is the first week in a long time where I really felt very negative about its performance.1 -

Have had same issues with Fidelity downloads, but am at least connecting now. However, some of the security prices on the Fidelity website are NOT downloading correctly. I am manually updating several every day.

FYI, the date refreshed stock prices are correct in the Excel sheet I maintain.

Like many others I am frustrated!

0 -

This content has been removed.

-

Same issue. Very frustrating. Bring back the old "Fidelity Investments Mac" connection!

1 -

I'm also running into this issue. It started happening recently after the Fidelity connection changed. Are there any workarounds for this issue? This is severely affecting our ability to use Quicken. I'm considering moving to a different product at this point unfortunately, as it is affecting all my reporting and I'm concerned this might affect my data file's history.

1 -

Hello @TuckQuick25 & @Powomeister,

Thank you for letting us know you're seeing balance issues. Have you been able to identify what is throwing the balances off?

Due to a change in the way Money Market Funds/Cash is represented in Quicken, it's possible that's the source of the balance discrepancies you are seeing. If that is the case, following the steps in the Community Alert linked below should help resolve the issue:

I hope this helps!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

I am having the same issue. I updated my Fidelity connection today (Quicken forced me to) and both 401(k) accounts show the wrong balance. One of them is a zeroed out account, since all the money was moved to IRAs. Should be easy, right? Just show $0.00? Nope. Quicken shows a balance of -$63k, which is a number that has no relation to anything. And the transaction list is a complete mess.

The other 401(k) shows completely random numbers, and Quicken also divided one of the investments into two of the same thing (but with different values, neither correct). When I say random, I mean random… Every time I select "Update Account" in Quicken, the value of this 401(k) changes. (I'm doing this minutes apart on a Saturday…) It started at $668k, then showed $440k-something, then went back to the first number, and now says $263k. None of these is correct. The next time I refresh it might be negative! (Weirdly, while this account keeps changing values, the other 401(k) has remained the same—still wrong but unchanged.)

The IRA and Roth IRA do show the correct values.

Please fix this. I'm sure it's more complicated than I realize, but aren't we in effect just pulling numbers off a spreadsheet?1 -

Hello @badgerjohn,

Thank you for sharing your experience. I'm sorry to hear the 401(k) accounts got so messed up when you migrated to the new connection. Are you seeing any placeholders and/or duplicate securities? Those are both possible culprits for the value showing incorrectly. You mentioned that the balance changes with every One Step Update. Have you been able to identify what (other than the balance) is changing?

I look forward to your reply!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

I am seeing the same behavior and when you fix it via the reconcile feature - this is only a temporary fix. the next time there is a cash transaction to a mutual fund, the issue comes back. Please fix this behavior. It seem that every month there is another issue with another financial company…. @Quicken Kristina

1 -

I've had to stop auto-reconciliation due to this issue. Either Fidelity or Quicken has recharacterized certain securities/transactions which has broke auto-reconciliation.

@Quicken Kristina, if you need specific examples, I can turn auto-reconciliation back on for my Fidelity accounts and provide.

0 -

My issue is similar, after the shares were corrected in the money market account (cash was zero) I made a stock buy and the number (and value) of the money market shares stayed the same. I tried to "sell" the proper amount of money market shares and it did not change the share count or value. very frustrating.

0 -

Hello @ericrose12 & @Shing,

Thank you for letting us know you're seeing the issue return every time there is a cash transaction to the mutual fund. To help troubleshoot this issue, please provide more information. Which specific fund(s) is this happening with? I suspect the issue would be happening if the problem funds are not being recognized as core funds.

Hello @msilver,

Thank you for reaching out. That does sound like unusual behavior. Which security is this happening with? When did this behavior start?

I look forward to your replies!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Hi @Quicken Kristina

This is happen in more than one Fidelity account that I have. I keep getting a placeholder entry as well so I need to add in a manual entry to get the account to reconcile. Very annoying.Fidelity Cash Reserve

BTW: this issue, Amex not working all the time now and also HealthEquilty not working anymore… we pay a lot for the subscription with more issues….0 -

@Quicken Kristina, I re-enabled auto-reconciliation and will report back once I have new downloaded transactions. I think this issue goes beyond the core fund. It seems to impact multiple money market funds. Where before Quicken recognized those funds using the fund's ticket symbol only, it now recognizes it with both the fund's ticket symbol and as a cash transaction, thus doubling the value of the portfolio for every transaction. That's why @ericrose12 said he has been entering adjustments to correct the value.

0 -

Thank you for your replies,

I recommend that you contact Quicken Support directly for further assistance, as they have access to tools we can't access on the Community and they're able to escalate the issue as needed. The Quicken Support phone number can be found through this link here. Phone support is available from 5:00 am PT to 5:00 pm PT, Monday through Friday.

Please let me know what happens when new transactions download!

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

@Quicken Kristina, I finally have a transaction to share that demonstrates the issue.

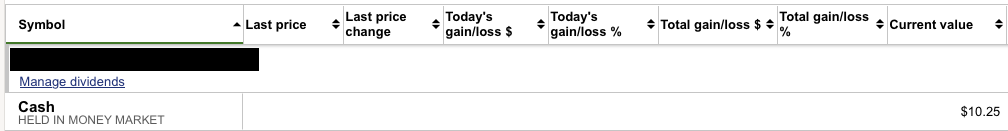

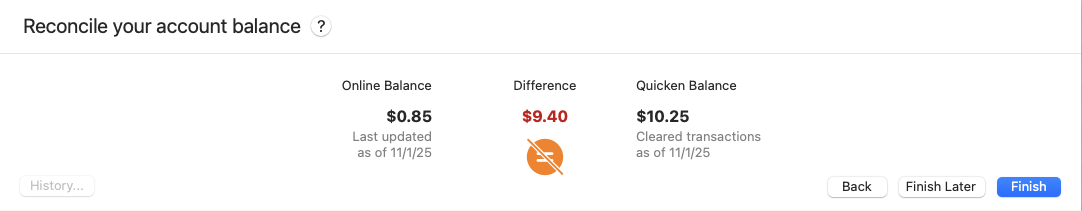

This is a taxable brokerage account, i.e., not an IRA account. The "core" cash is invested in SPAXX (a money market fund). On 10/29/2025, the balance of the core was $.85. On 10/31/2025, Quicken download transactions related to the monthly interest earned on the core in the amount of $9.40. Below is a screenshot of the transaction related to this action. This causes the register balance to equal $10.25 which agrees with what I see when I log into my Fidelity account. Below is a screenshot from the Fidelity website showing the balance. So far so good.

Now this is where is the issue begins. QMAC indicated the auto-reconcile did not balance. The reconciliation window shows the following.

It shows the online cash core balance of $.85 (which was correct on 10/29/2025), but it does not include the $9.40 in monthly interest deposited into the core on 10/31/2025 (the $10.25 balance). It looks like the problem is how QMAC is either receiving or interpreting the online cash core balance from the download.

If I click "Finish," QMAC asks if I want to make an adjustment entry for an amount of -$9.50 so that the register shows a balance of $.85 which is not correct.

0 -

Thank you for your reply @Shing,

To clarify, everything looks correct until it's time to reconcile, and then Quicken is seeing the wrong online balance? Is the online balance incorrect exclusively on the reconcile screen, or does it also see an incorrect online balance if you set the Account sidebar to show online balance?

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub