New Fidelity Connection - Incorrect # of Shares/Missing Investment Accounts [WIN]

Comments

-

Someone posted earlier that they talked to Fidelity and found out that @Quicken support had no test Fidelity accounts. if that is the case, I don't see how it could have been tested in advance and the end user is the tester.

Deluxe R65.29, Windows 11 Pro

1 -

Any status on when/if a fix is coming? I don't want to edit my reinvested dividend transactions with more decimal places for ever.

0 -

Quicken's handling of Fidelity has always been a huge problem. Cash balances have always been out of whack but the latest updates have introduced new problems. My account is primarily short-term treasure bills.

Among the things I've seen.

1. duplicated transactions2. when a T-bill matures the holdings still remain even though they are cashed out.

3. some T-bill holdings do not include CUSIP and the maturity date is garbled.

It's not worth it to me to try to fix all this manually with the current snapshot of data.

At this point I am left with only two options:1. Delete the current Fidelity account and re-create it hoping a clean download will at least be correct. Not concerned about having a full history.

2. Just stop using Quicken for Fidelity. It's been nothing but grief.

I'll have to deal somehow with the history of bank transfers in/out of Fidelity.

In the past, when I put bank transfer transactions where the matching account is not defined in Quicken, a trick I have used is to set the transfer account in the category to be same as the account where I am creating the transaction. The point behind this is I don't want the transfer to be categorized as income or spending. Any other ideas welcome.0 -

Has this been resolved yet?

0 -

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Share amounts are back to 3 digits this morning. I downloaded several reinvestment transactions that had the correct share balance. Hopefully it stays that way.

3 -

The issue I described above: Vanguard 500 Index Fund Admiral vs Vanguard 500 Index Fund (not Admiral) still exists this morning. Not sure if this same issue exists with other similarly named funds.

0 -

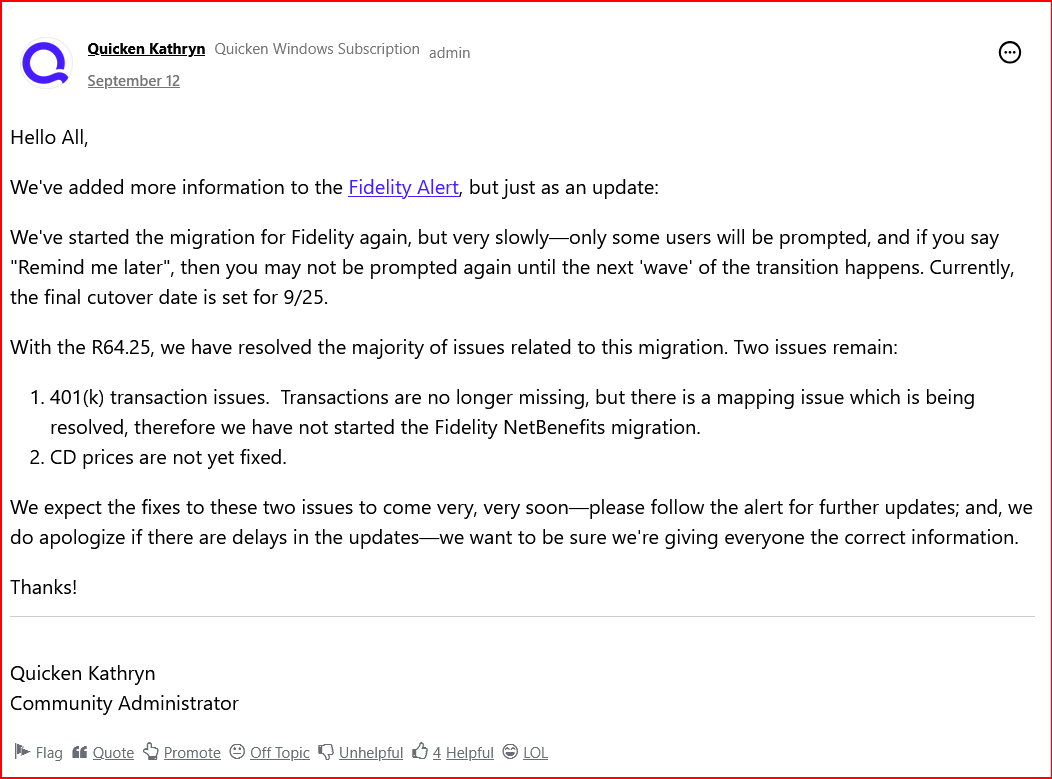

Hello All,

We just posted a new Fidelity alert with the latest updates on what’s been fixed, what’s in progress, and available workarounds. You can view the full details in this Community Alert.

Highlights include:

- Duplicate Transactions (Windows) > fix included in R64 release.

- Missing Transactions (401k, Brokerage, IRA) > fixes verified/rolling out.

- Bond redemptions showing as cash > fix live.

- $0 account balances > fix verified/complete.

- In progress: incorrect CD balances, doubled cash balances in Money Market accounts.

Please bookmark the alert thread to stay updated.

Thanks for your patience while we work through these!

-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.0 -

As of today (8/30/2025) I am still seeing the issue: Vanguard 500 Index Admiral versus Vanguard 500 Index.

-1 -

A new problem I am seeing beginning with the end of August Fidelity download to Quicken:

My wife and I each have IRA accounts. Each account has "uninvested" cash held in a Money Market Fund (FDRXX). Each month we receive interest / dividends on the cash held in this money market. Through the July download, both Quicken and Fidelity viewed these funds as "cash" and the balances in Quicken and Fidelity matched. I just downloaded the August interest / dividends which are now shown as "reinvested" in FDRXX. And now, Quicken shows a discrepancy to Fidelity - Quicken shows the "cash" balances through July and a "FDRXX" balance for the August interest / dividends. And, Quicken wants to add a placeholder transaction to adjust the cash balance. Something has changed since this is the first time I have seen this issue.

0 -

Until the issue is fixed, just edit the dividend reinvestment transaction to a Dividend transaction and your cash balances should agree.

0 -

Thanks Thomas. I agree and that is how I fixed it for now.

0 -

I have this same problem. I hope it gets fixed soon.

0 -

Further to to the issue I noted a few posts above (i.e., how uninvested cash is now being treated in my two IRA accounts — "August interest / dividends which are now shown as "reinvested" in FDRXX (whereas previously these dividends went to "cash"). And now, Quicken shows a discrepancy to Fidelity - Quicken shows the "cash" balances through July and a "FDRXX" balance for the August interest / dividends."

Rather than accept both the August dividend and dividend reinvestment transactions downloaded from Fidelity for FDRXX (money market fund), I only accepted the dividend transaction believing just my cash balance in Quicken would be increased accordingly. However, today I am reconciling my Quicken balances to the August Fidelity statement and I found that Quicken now shows a balance for FDRXX equal to the August dividend - even though I did not accept the "dividend reinvestment" transaction downloaded from Fidelity, while at the same time my cash balance is correct (i.e., the August FDRXX dividend was also added to the Quicken cash balance). So, my holdings for the end of August are over-stated by the amount of the FDRXX dividends.

This is obviously a problem and needs to be correct asap. Also, I still see the issue with Vanguard 500 Index Admiral versus Vanguard 500 Index (not Admiral).

0 -

I deleted the downloaded August FDRXX interest / dividend transactions and manually re-entered them. This seems to have fixed the August ending balance issue for now — but not an ideal solution, obviously.

0 -

9/12/25 - 25+ year user of Quicken and frustrated…..My Fidelity connection was working fine until the updated connection came out last night. All my cash balances are now missing and will not update (cash invested in Money Market funds). Also, auto updated my connection from complete to simple. Why do I want simple if I can get that off the website\??. I track everything in Quicken so I can get reports are performance data. Please fix this Quicken! I see it is an ongoing issue.

0 -

Can we get an official status update on the Fidelity EWC+ transition ? I'm starting to get prompts to "re-authorize" my various Fidelity accounts (at this point, still delay-able). The Community Discussions were pretty busy with unhappy affected customer comments in the late July and August timeframe due to the numerous issues from the initial EWC+ rollout. The recent comment from Nancy Burrows and others before her suggest there are still issues needing to be resolved. Based on the preponderance of evidence (many customer issues upon initial rollout, myself included and continuing adverse customer comments with those accepting the EWC+), I feel compelled to hold off until: 1) Official statement declaring all customer issues are resolved, and 2) Affirming customer comments indicating the same.

Eagerly awaiting Official Status statement, and/or further customer experience comments …

0 -

Please note that a cutover date is set for 9/25/2025 and was posted in (Re: zzz-Fidelity Updates) on 9/12, which is a thread may be worthwile to bookmark as it seems pretty current.

Deluxe R65.29, Windows 11 Pro

0 -

@Quicken Kathryn It's disappointing to see Quicken being insensitive to its user base by mandating a cutover date a few days before the end of a quarter. This is the worst possible time for a cutover from a financial user's perspective. October 8-14 would be MUCH better, giving users time to get through the end-of-quarter processes and reporting, THEN having time to deal with any technical issues at relative leisure.

1 -

@Quicken Kathryn I agree with @BrittMayo that the Sept 25th mandatory cutover date is absolutely unacceptable as it is both quarter- and month-end. The fact that Quicken would ever decide on this causes me to think that Quicken has no clue of the potential impact on users or even how users use Quicken. What was done end of July was really bad when I thought I was being forced to hit the "fix it" button to continue using Fidelity accounts. I realized in a couple of days that it was a huge mess and was able to restore a back up copy and get back to the legacy Direct Connect. I wasted hours of time because of this. Please do not force this on us before October 8-14 as @BrittMayo suggested so we can get thru quarter end smoothly.

0 -

Feedback:

After updating to the latest release, the issue persists. When attempting to use the new connection on the latest Mac stack, my Fidelity accounts are updated incorrectly. This appears to stem from the new access protocol that will have a hard switch date soon.Manually correcting these errors would require significant effort across dozens of accounts. Given that this results from a failure to properly maintain the product as outlined in the Terms & Conditions, I believe compensation is warranted. A credit for a free year of the product would be a reasonable resolution.

Resolution Requested: ASAP.

2 -

I agree … this has been going on far too long … After updating to the latest release, quicken now does not recognize bills being paid from my Fidelity Cash Management Account … it just adds the transaction and I have to manually deleted it and mark the bills as paid …

0 -

I updated the Fidelity connection and to no ones surprise, I ended up with incorrect cash issues in several of my accounts. As before, Quicken is picking up investments in money market funds and treating them as core cash. This is not how Fidelity manages those money market funds. They are treated as investments and managed accordingly. I am not updating this connection again, until I know these errors have been resloved.

0 -

Actually some of the cash funds ARE being treated as cash properly after moving to EWC+. Please post here the ticker symbols of the ones that are not being treated as cash. The easiest way to find this out is by going to Online Center, selecting Fidelity Investments as the Financial Institution, and for each account look at the list of holdings. Any that have a unit price of $1 are likely to be the fund that you need. The symbol is under the "Ticker" column. For me, SPAXX is still not being reported correctly. FDIC99318 and FDIC99201 are being reported correctly as cash.

Barry Graham

Quicken H&B Subscription0 -

The funds that I have that are traded at $1/share are FSIXX, FZDXX and FDRXX. These are treated as investments in Fidelity and should NOT be part of Core cash. Unfortunately, the Quicken conversion treats them as cash. This is wrong. They should be treated as Fidelity treats them, as investments.

0 -

The main phrase of your last sentence is so true … "They should be treated as Fidelity treats them" … and should be the core guiding principle that defines success in this very error-ridden and protracted transition. Positions in investments should never be confused or misidentified as Cash. Likewise, Cash is Cash, and IS NOT a bought/buyable/sellable investment position in whatever the Core Position happens to be. The Core Position is really incidental, and is merely the identifier of the "deemed investment" Fund whose dividend performance is used as the basis for how Cash dividends are calculated, accrued, and credited to the Cash in any given account. I don't know why this is apparently so difficult for the Quicken Team to grasp and deliver properly behaving software and functionality.

0 -

If you are saying that core positions should never be reported as cash in Quicken, many would disagree, including me. If you don't want them reported as cash, you can go to Edit>Downloaded transactions and check "Never interpret downloaded Money Market funds as cash".

Barry Graham

Quicken H&B Subscription0 -

I am not saying core cash positions should not be treated as cash. They should be. Some of the positions that are being treated as cash are treated as investments in Fidelity.

0 -

I am still having an issue with Vanguard 500 Index Fund Admiral (VFIAX) versus Vanguard 500 Index Fund (VFINX; not Admiral). I hold the Vanguard 500 Index Fund Admiral in my Fidelity account and show it in Quicken (both my Fidelity website and my Quicken portfolio use the same VFIAX ticker symbol).

Before the recent changes made by Quicken and Fidelity, the data downloaded from Fidelity was correct (i.e., correct fund / symbol / data). However since the change was made, the data downloaded from Fidelity is shown as Vanguard 500 Index Fund (VFINX) even though I verified the ticker symbols in both my Fidelity account and Quicken are VFIAX. For example, on September 30 I received a dividend for VFIAX (shown correctly on my Fidelity website) however this morning's download from Fidelity to Quicken shows a dividend for Vanguard 500 Index Fund (VFINX). And, Quicken shows a "Securities Comparison Mismatch" report stating that the "Shares in Quicken" don't match the "Shares Reported" from the Fidelity download due to the VFIAX versus VFINX data issue.

So, I must manually enter data for this fund into Quicken and delete the downloaded data from Fidelity. I previously reported this issue. Please fix it asap. Thanks.

1 -

Hello All,

I am closing this discussion because it is overly long and has multiple issues mixed together, which can make it difficult to follow.

If you are having issues with Fidelity accounts in your Quicken, please review this alert:

If the issue you are encountering is not listed in the alert, please start a new discussion.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

1

Categories

- All Categories

- 56 Product Ideas

- 34 Announcements

- 240 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub