RE: Updated 12/19/25 Fidelity Updates

@Quicken Kristina Thanks for the status update.

There's an issue that's been discussed several times in this forum over the past few weeks, but is not included on yourlist:

- Short Term Capital Gains transactions are incorrectly categorized as Dividends. At one point this was happening with Long Term Cap Gains as well, but that was fixed.

Can you please add it to your list?

Thanks.

Fixed or Being ReleasedGood news! Several earlier issues have been resolved or are now rolling out to all customers.

Duplicate Transactions (Windows)– Some users saw up to two years of duplicate transactions after switching to EWC+.Status: Fixed.

Missing Transactions– Previously affected 401(k), Brokerage, and IRA accounts.Status: Fixed for most users. 401(k) transactions are downloading, though we’re continuing to monitor a minor mapping issue.

Bond Redemptions Showing as Cash– Bond sales were incorrectly downloading as cash deposits.Status: Fixed.

$0 Account Balances (Windows)– Some Brokerage and IRA accounts temporarily showed zero balances.Status: Fixed.

Cash Balance Doubled (Money Market Accounts)– Cash and Money Market securities both appeared, doubling balances.Status: Fixed.

Incorrect CD Balances– CDs displayed correct totals but incorrect share/price details.Status: Fixed.

Fidelity Price History for US Treasuries Doesn’t Update (CTP-14502)– Price history for U.S. Treasuries isn’t updating automatically.Status: Fixed

EWC+ Cash Balance Still Incorrect (CTP-14526)– Some customers continue to see incorrect cash balances.Status: Fixed in R65.17

Duplicate Transactions (Windows & Mac) (CTP-14567)– Some users still see 60+ days of duplicates instead of the expected 7–30.Status: Fixed; 7-30 days worth of history should download.

Core Money Market Fund Prompt Issues (CTP-15031)Fixed:FZDXX is a premium Money Market Fund from Fidelity. If you would like to track as a security, you'll need to add a buy transaction (under FZDXX) for the total cash balance in Quicken. That will make sure everything reconciles properly.

Core Money Market Fund Prompt Issues (CTP-15030)Fixed:If you would like to track as a security, you'll need to add a buy transaction (under SPAXX) for the total cash balance in Quicken. That will make sure everything reconciles properly.

Fidelity Downloaded Transactions Not Matching Manual Entries (Mac) (CTP-15035)– Users report that downloaded transactions don’t match manually entered ones.Status: Fixed in 8.3.3

Fidelity Cash Core Position FDRXX Not Represented Properly (CTP-14817)Status: Fixed in R65.17

Delayed Updates (CTP-15323)– Some users report delays of 1–2 days in Fidelity updates compared to previous Direct Connect timing.Status: Normal delays of one day are expected. Updated information is typically available around 3:30am PT.

Fidelity NetBenefitsNot Supporting Complete Investing (Ticket 11957850)– Still not available for NetBenefits.Status: Fixed

NetBenefits – Non-Public Traded Funds Share Price Updates Not Downloading (CTP-14996)Fixed

Service Unavailable Message (CTP-14930)Fixed– If you see this error, please wait 2–4 hours and retry. If it continues, contact Fidelity.

Foreign Dividends Downloading as Deposits (CTP-14945)– Dividends for foreign stocks download as deposits instead of dividend transactions.Fixed

In Progress or Under InvestigationWe’re continuing to work with Fidelity and our connectivity partners on the following issues.

Fidelity Investments

Incorrect Error in Fidelity, BofA, and Merrill Lynch – Doesn’t Prompt Migration (Ticket 11992337)– Some customers still see migration prompt errors or OL-297 messages.Status: Monitoring. These reports are tapering off as Direct Connect is fully phased out.

No Transactions for Fidelity HSA Accounts (Ticket 11999090)– HSA accounts are not downloading transactions.Status: Ongoing. The only current workaround is manual entry.

Core Money Market Fund Prompt Issues (CTP-15029)– Some prompts don’t show which accounts they apply to, or show invalid funds like FZDXX.Status: Fix in development.

NetBenefits – Reinvest Dividends (CTP-14859)– Dividend reinvestment issues reported in both Windows and Mac.Status: Under investigation; still gathering information to work towards a fix.

NetBenefits Price History Rounding to 4 Decimal Places (CTP-14997)Status: Working with Fidelity to fix this.

Fidelity Transaction Sign Errors (CTP-14951)– Some dividends or sales are downloading with incorrect signs.Status: Fix in development.

Money Market Fund Redemptions Missing (CTP-15049)– Missing redemption transactions for multiple securities.Status: Under investigation; still gathering information to work towards a fix.

CDs Showing Two Decimals Instead of Three (CBT-889)– Rounding differences cause small discrepancies between Fidelity and Quicken.Status: Under investigation; still gathering information to work towards a fix.

EWC+ Brokered CD Maturity Date Missing (CTP-15117)Status: Open and Ongoing. No ETA.

Non-Public Fund Decimal Issues (CTP-14997)– Rounding differences for some funds.Status: Working with Fidelity to fix this.

Other Known Issues. These are less widespread but still being monitored.

Reauthorization Prompts After Migration– Often caused by duplicate or hidden accounts still connected under the old method.Workaround:Windows: Tools > Account List > Show hidden accounts and disconnect any old Fidelity connections.Mac: Accounts > Hide and Show Accounts to review for duplicates.Duplicate Securities (Mac)– Merge duplicate securities in your Security List to correct mismatches. We’re Continuing to Work Closely with Fidelity.

We’re actively partnering with Fidelity and our aggregation teams to ensure all accounts download and display data accurately. We’ll continue to update this alert as fixes are released or verified. If you experience one of the issues above, please bookmark this discussion for updates and share your details in the related discussion so our teams can investigate further.

Thank you again for your patience as we continue improving the Fidelity connection experience in Quicken.

— The Quicken Care Team

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

Comments

-

New request is, essentially, a dupe of this thread. And, see my comment at the bottom of it.

[Edit - Enabled Link]

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

Another item to add to the list:

The prices of all call options in my Fidelity portfolios no longer automatically update. They need to be entered manually. Here is one example:

CALL (AAPL) APPLE INC AUG 21 26 $260 (100 SHS)

Symbol: AAPL260821C260

0 -

Apparently I have the same problem reported on this thread. Quicken shows an equal balance for both "Cash" and "Fidelity Cash Reserves (FDRXX). This doubles the amount of cash for one of my Fidelity accounts which is incorrect.

Fidelity does not show FDRXX in my Fidelity account. It shows Cash.

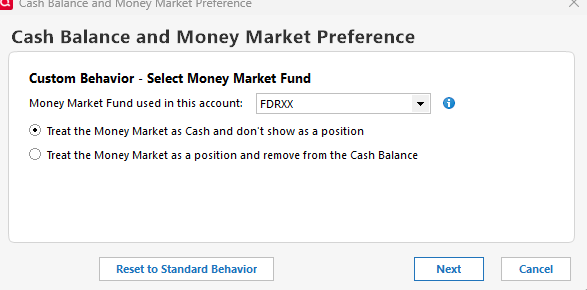

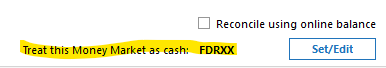

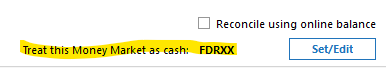

I tried Tools—> Account List —> Account Details —> Online Services. At the bottom of that screen it says: "Treat this Money Market as cash: FDRXX" Set/Edit

that goes to "Cash Balance and Money Market Preference" which says: "Custom Behavior: The following Money Market fund is treated as cash in this account: FDRXX. T select a different standard behavior during the next account update click Reset to Default. If you would like to manually configure a money-market fund, click Customize."

This is confusing. What is "standard behavior'? What is "Default behavior"?

Under Customize it says: "Money Market used in this accounte: FDRXX" With two radio-buttons. This button which is selected says "Treat the Money Market s Cash and don't show as a position. Okay, that's what it should be BUT when I click 'Next' Quicken crashes.

This was not a problem in the past.

[Merged Post]

1 -

4 months in… Fidelity transaction downloading still broken/paused.

[Removed - Disruptive/Rant]

Do keep us posted!2 -

Until Aug 2025: My primary financial institution: Fidelity. My primary source of account info: Quicken.

Dec 2025 till now: Primary financial institution: Fidelity. Primary source of account info: Fidelity. You can't count on Quicken anymore.

1 -

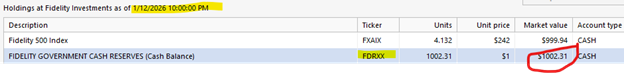

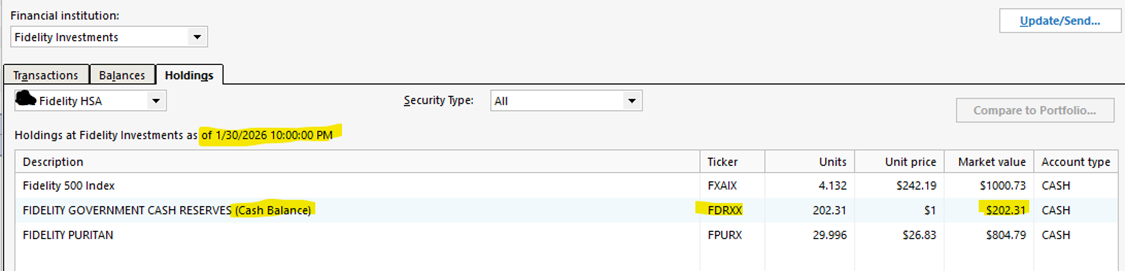

First, I think this same Cash balance/FDRXX issue is affecting the Fidelity HSA account issue too. I will provide some screen shots of my own issue below that @TA3 describes above, showing I think similar irregularities that he/she is seeing. Note that I do not have any other Fidelity accounts in my current R65.29 Windows version of Quicken, so I can't compare the items I mention below vs. other Fidelity investment accounts that use SPAXX instead, for example. It would be great if someone else could provide similar screen shots of this type of Fidelity account example, particularly if these accounts have the 3 variables under "Balances" tab I mention further below.

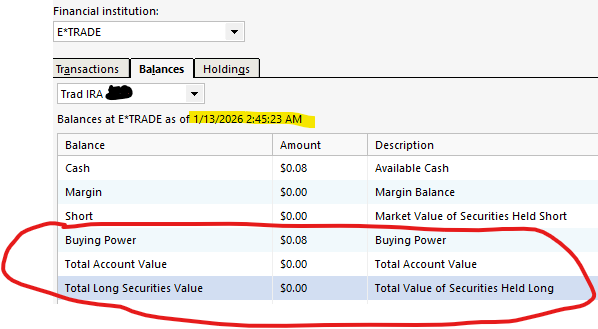

Via my own troubleshooting and visual deduction, I will preface to say that it appears Quicken is using the downloaded data found under "Balances" and "Holdings" tabs for the specific account under Tools…Online Center… to display the values seen under the Quicken "Cash Balance and Money Market Preference" screen shots shown below. For my Fidelity HSA account, and comparing it to my working Etrade accounts, the Fidelity HSA account does NOT contain the below variables/values under "Balances" - is this impacting these Fidelity issues with FDRXX/Cash balance and/or the transactional downloads not working for Fidelity HSA accounts? Can someone confirm if these variables and associated values show under the "Balances" tab for their other non Fidelity HSA account(s) (with transactional downloads apparently working)?

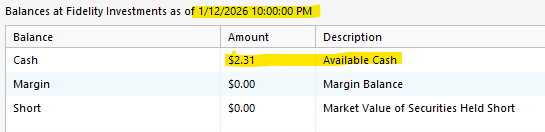

E*trade investment account variables seen under "Balances" tab in Quicken under Tools…Online Center… , but not seen for my Fidelity HSA account:

Buying Power

Total Account Value

Total Long Securities Value

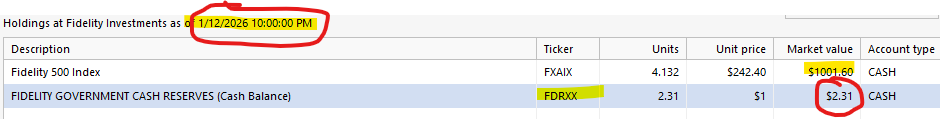

Lastly, before the screen shots, I have noticed that data from the Fidelity HSA account is lagging and not necessarily accurate with time. I understand that this may be expected to a certain degree, but I don't have this issue with my Etrade direct connect accounts. I don't know if this is the case for other Fidelity investment accounts as well? As an example, I bought a mutual fund with this HSA account that was processed the evening of Friday, 1/9. Online at Fidelity direct, this showed "Pending activity" until Monday 1/12, settlement date of 1/12. I understand this is expected due to the weekend. From dates seen in Quicken "Downloads" and "Holdings" tabs, it appears this HSA account data from Fidelity only updates once per day, always at 10:00 PM(not sure what time zone?). So my latest download shows "…as of 1/12/2026 at 10:00:00 PM". However, the data on the "Holdings" tab is still not totally updated per my 1/9 security purchase(ie, FDRXX is showing inflated value by +$1000), thus manual sum of these 2 securities is incorrect. However, what is strange is that the new security IS showing here, but the CASH has NOT been removed from the "FDRXX" security "Market value" column? Further, the "Balances" tab DOES show the CORRECT amount of $2.31 for "Available Cash". Thus, if one manually sums up what is showing up for the 2 securities in the "Holdings" tab, it is really nearly 2x vs. the actual account total account value. However, as mentioned previously above, the "Total Account Value" for this Fidelity HSA account is not shown in the "Balances" tab, so does Quicken not accurately know what the total account value is, perhaps causing these issues for a lot of people?

Below are from Tools…Online Center… :

Below are all variables showing in E-trade accounts, but the last three are missing for the Fidelity HSA account (ie, compare below vs. above, notice the 3 variables circled missing for the Fidelity HSA account above):

[Merged Post]

0 -

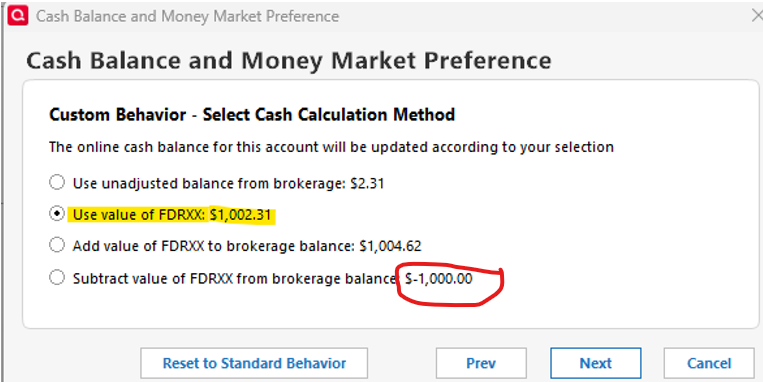

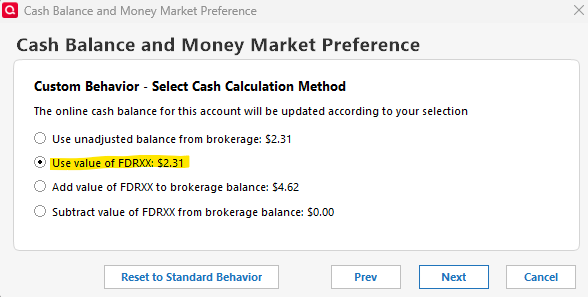

I thought I included this in above post, but don't see it and unable to add/update, getting error "Attempt to assign property "FormatBody" on false" when trying to save updated post, whatever this error message means? Regardless, below is the other screen shot I wanted to show, which shows as this after changing how the Cash Balance is supposed to be calculated using the FDRXX security:

[Merged Post]

0 -

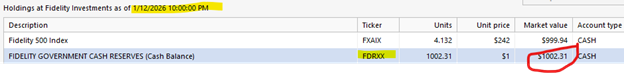

So I have downloaded my accounts throughout the day today, 1/13, the same calendar day as my 2 posts immediately above this, and I noticed the values updated under the "Holdings" tab in Online Center for this Fidelity HSA account to correct values. This is good progress, but there are still issues:

(1) Even though the current stated market values are now correct, the "as of" date/time is EXACTLY the same as the date/time of the prior bad values. How/why could this be? See below screenshots. I'm guessing Quicken could potentially have all kinds of data integrity and potential display issues if it downloads data(or Quicken itself is setting this timestamp?) that has different sets of security market values with the same exact download day and timestamp?

(2) The "Balances" tab still has the 3 variables I mention above(found in my Etrade accounts) missing in this Fidelity HSA account. Are these variables and values needed by Quicken to make everything accurate and complete?

(3) Nothing has changed with the Quicken register for my Fidelity HSA account. There are no downloaded transactions here and all the cash/security values here are totally independent of the values shown under the Online Center "Holdings" tab and/or the custom "Treat this Money Market as cash: FDRXX" settings mentioned in this post. It appears the values shown in the register are only based upon my own manual entries and nothing else. It is unclear to me if this is by design or shouldn't be acting this way? At a minimum, I would have thought that the custom "Treat this Money Market as cash: FDRXX" setting would have to also have some sort of logic also tied to the Quicken register?

Early CT 1/13, WRONG market values displayed, total sum is approximately 2x more than reality:

Around noon CT 1/13, total sum is correct now, but why is date/time EXACT as above??? My expectation is that this date should be current to the most recent Quicken download day/time?:

[Merged Post]

0 -

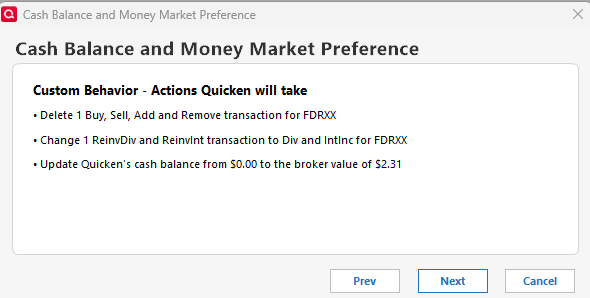

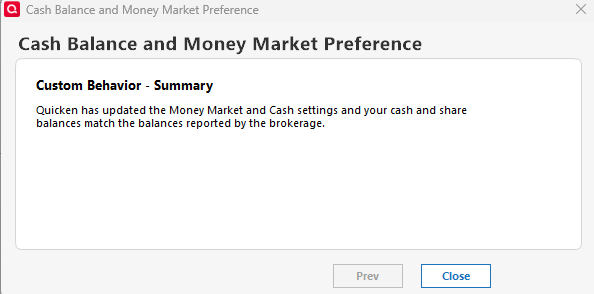

In the afternoon of 1/13, I re-ran the "Set/Edit" option next to the "Treat this Money Market as cash: FDRXX" in the bottom right corner of the "Account Services…Online Services…" tab for the Fidelity HSA account. This had already been set as this, but I wanted to see if any changes would be made/seen in the register after I saw the above 1/13 "Holdings" CORRECTLY change from $1002.31 ⇒ $2.31 for the FDRXX security in Online Center "Holdings" tab.

Below are the results, showing the Registry was now 'auto adjusted' for the cash portion of the account, which hadn't been the prior state. I hadn't seen the second window below previously, I'm thinking due to how the numbers had worked out because of the overall sum being inflated (ie, Fidelity added the newly purchased security to the holdings, but has a delay in time before the actual cash is removed from the FDRXX cash security):

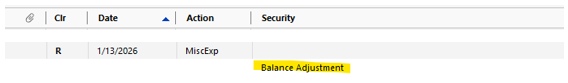

Below is the entry that was auto-added the account register by Quicken via the above process, which correctly adjusted the account cash balance:

Note that the above process DID NOT add the newly purchased security to the "Holdings" tab in the account register. I believe Quicken fixing this is within scope as part of Ticket 11999090, but I am not 100% sure? In addition, I'm thinking me having to manually re-run this "Set/Edit" option in order to get the cash account correct is NOT executing as designed? Shouldn't this cash balance in the register be compared every time a Fidelity download is done, and if the value of FDRXX on download is not matching the cash balance in the Quicken register, then a "Balance Adjustment" should automatically occur at that moment in time, as opposed to the end-user having to manually execute this "Set/Edit" option again on their own accord(and likely not realize this is needed to correct a relatively hidden problem)?

To get the security added into the register, I manually changed the above "MiscExp/Balance Adjustment" register entry above(again, this transaction was auto created by Quicken's own "Treat this Money Market as cash: FDRXX" process) to a "Buy - Shares Bought" entry instead, updating the purchase date/security name/number of shares/total cost values. After this was done, both the cash total and security details are now correct, at least currently. However, it remains to be seen how this will behave going forward with other changes/data updates, such as more cash adds, security purchases/sales, security dividend adds, etc…..

It is my own opinion that much of this functionality is lacking/buggy because many irregular software changes have been made over recent months due to Fidelity Direct Connect ⇒ EWC+ changes that I believe Quicken has mandated, perhaps with valid reasoning, but just poor planning/execution? But I am just a messenger, looking forward for some permanent fixes soon!

[Merged Post]

0 -

FYI, per this post, it appears HSA account transaction downloads started working late afternoon on 1/15/25. Hopefully this is consistent for everyone.

1 -

This content has been removed.

-

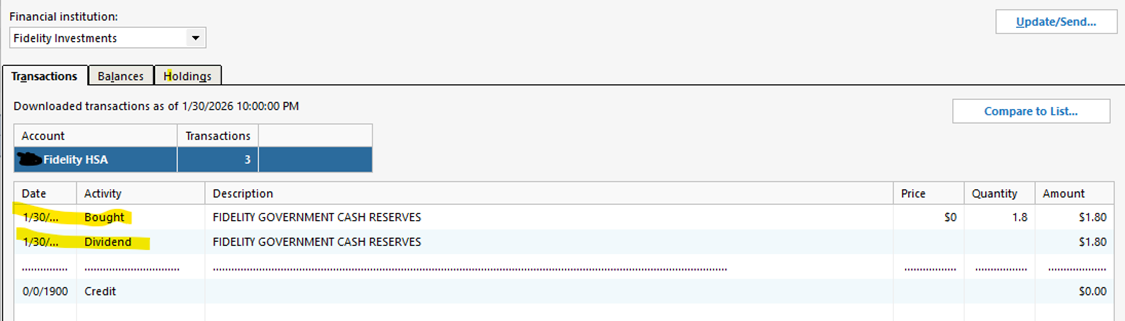

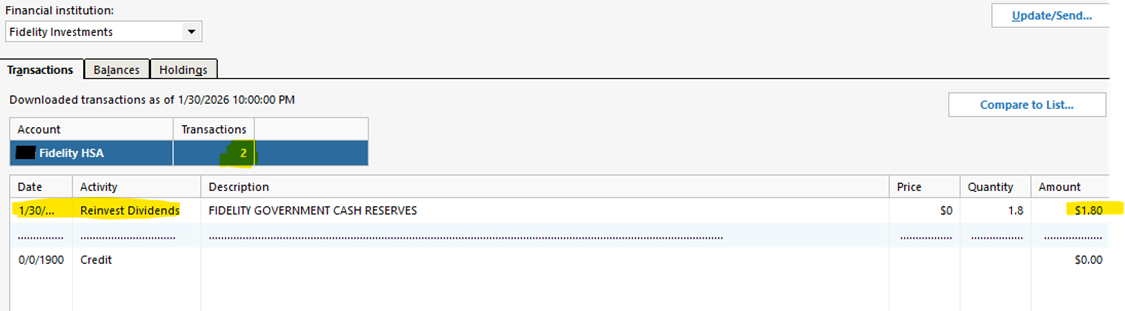

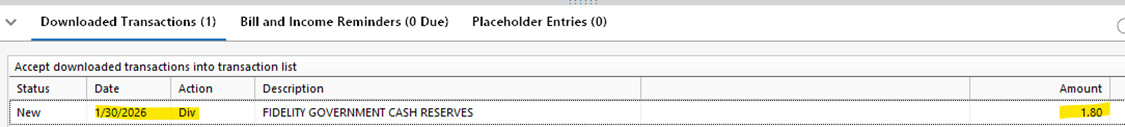

Below is my own experience update of getting known new/expected transactions at the end of January in Fidelity HSA account. As I previously mentioned in the past above, I have NOT had to re-run the "Set/Edit" option next to the "Treat this Money Market as cash: FDRXX" in the bottom right corner of the "Account Services…Online Services…" tab for the Fidelity HSA account. So it appears in general, the cash balance is getting correctly summed using the FDRXX fund as this cash balance. However, as shown below, there does still appears some problems/questions pertaining to certain types of transactions and/or download timing of certain transactions.

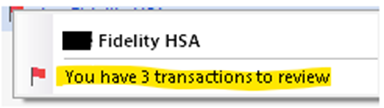

On early 1/31, I updated transactions and the below two new transactions(dated 1/30) showed up in Online Center for the normal monthly cash account dividend, but NOT under downloaded transactions in the register, as well as not accounted for in “Holdings” within Online Center. Also note that the red flag next to account in Quicken did update, stating “You have 3 transactions to review”, thus the +2 new transactions are being accounted for in this display count, even though they are NOT being accounted for/shown in the Register “Downloaded Transactions” tab.:

Fidelity HSA account Register:

Online Center:

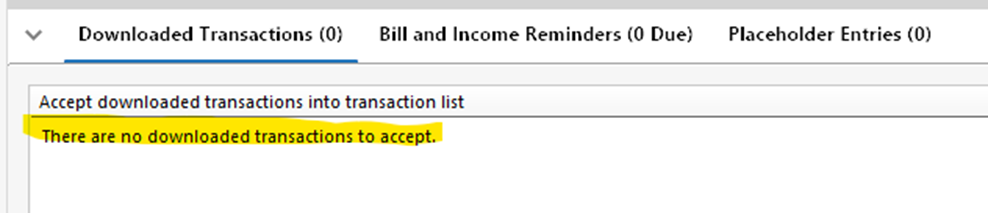

Some time within +2 hours later and doing another OSU, a register downloaded transaction NOW SHOWS UP, which is the expectation. Before accepting, I looked at Online Center and see this has been updated, showing just one transaction now and this new transaction is defined as “Reinvest Dividends”, a different type vs. the previous “Bought” and “Dividend” type transactions. These other two prior transactions have been automatically removed within Online Center, and the transaction count has been updated from the prior 3 value to now 2(from my own observations, it appears Direct Connect type accounts do NOT include this $0.00 transaction in the Online Center “Transactions” count, while EWC/EWC+ type accounts DO include this $0.00 transaction in this “Transactions” count; however, I am not 100% sure what is designed/correct/expected.):

»»»»»>

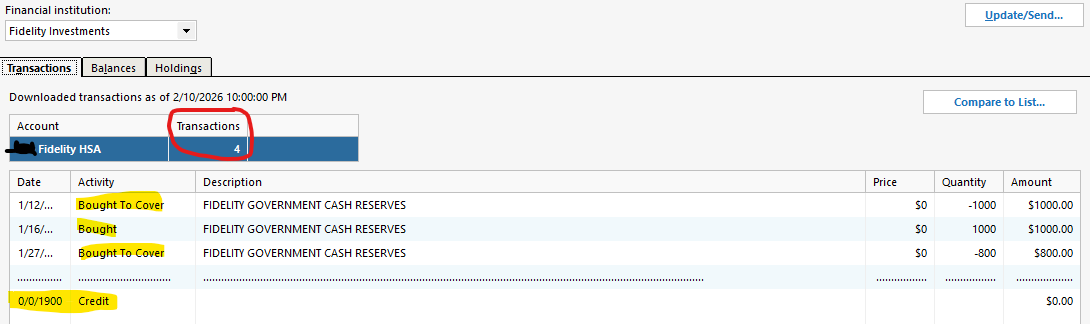

It is now 2/11, 11 days later from above, and I just noticed that there are 3 unexpected/unknown transactions showing in the "Transactions" tab of Online Center for this Fidelity HSA account. I have not been monitoring this closely over the past 11 days, so I don't know exactly when these "phantom transactions" showed up here, nor if/when/how they will be deleted from this window? From my perspective, these transactions have already been accounted for in the Quicken register via past downloads. The transactions here all show dates of 1/2026 and seem to want to relate to the cash FDRXX fund, yet the only one that is legit is the one from 1/16, which was a cash deposit (but already accounted for in the past in my register). I think there still is some stuff erroneously being sent to Quicken and/or being dealt within Quicken related to these Fidelity HSA transactions.

0 -

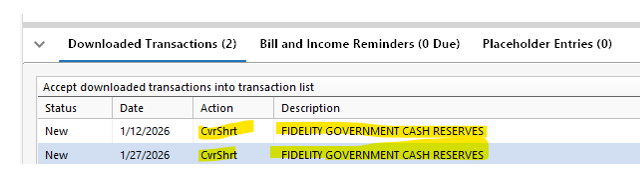

fyi, after doing a second OSU, the below 2 transactions did show up as new downloaded transactions in the Register. I believe the 1/16 transaction is not shown because there is a seen "auto match". The dated 1/12 and 1/27 transactions here actually occurred on 1/9 and 1/26, respectively, and are already in the Register for these correct dates. It is my belief these 2 records don't "auto match" because the dates here do not match what is already recorded in the Register.

Regardless, to me, it seems like these FDRXX "Bought to Cover" transactions are not necessary, as isn't this already accounted for by other "Bought" transactions of the shares bought, which have already been previously sent and accounted for in the Register? If these "Bought to Cover" transactions are not/can not be filtered out by the Quicken app or from being sent by Fidelity themselves, then shouldn't these transactions at least have the correct date on them vs. each being +1 business day off, so they can potentially auto match a record already in the Register for the same thing???

0 -

You are correct that the CvrShrt transactions should not be there. According to a Fidelity rep this a transaction that is internal to Fidelity and should not have been downloaded. An Alert has been posted about this issue and it tells you what you can do to address these transactions:

UPDATE! 2/11/26 Fidelity Core Cash Transactions Downloading as “Cover Short Sale (CvrShrt)”.

There are several other threads regarding this issue that will show up if you do a search for "CvrShrt".

Yesterday I got multiple CvrShrt transactions in 9 different Fidelity accounts going back to the beginning of January. I hold my Core Position MMFs as Cash Balance and not as Shares. So, for me there should not be any Core Position MMF shares transactions downloaded at all. I just deleted them instead of accepting them into the account registers and there were no other corrections needed.

In one account, though, I had too quickly accepted those transactions into the account register. That created a shares held discrepancy which generated a Placeholder. Deleting the CvrShrt transactions removed the shares held discrepancy which allowed me to then delete the Placeholder. I also noticed that they had caused a cash balancing transaction to be entered which I also deleted. Then I was able to reconcile the Cash Balance and all was good.

I only got these transactions during yesterday morning's OSU. Last evening's OSU and this morning's OSU there were none downloaded. So, I'm hoping it was just a 1X fluke but I'll need to be on the lookout for this for the next couple of weeks to see if it happens, again, when Fidelity does additional internal Core Position MMF transactions.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0

Categories

- All Categories

- 56 Product Ideas

- 34 Announcements

- 240 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub