Why Doesn't Quicken Offer Finer Breakdown for IRS Tax Schedule A Categories (17 Merged Votes)

Comments

-

Hi All, our devs reached out and asked if Schedule A is working how you expected now in recent releases as there have been updates and refinements regarding this area in the Tax Reports.

Quicken Janean

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Thanks for the request @Quicken Janean

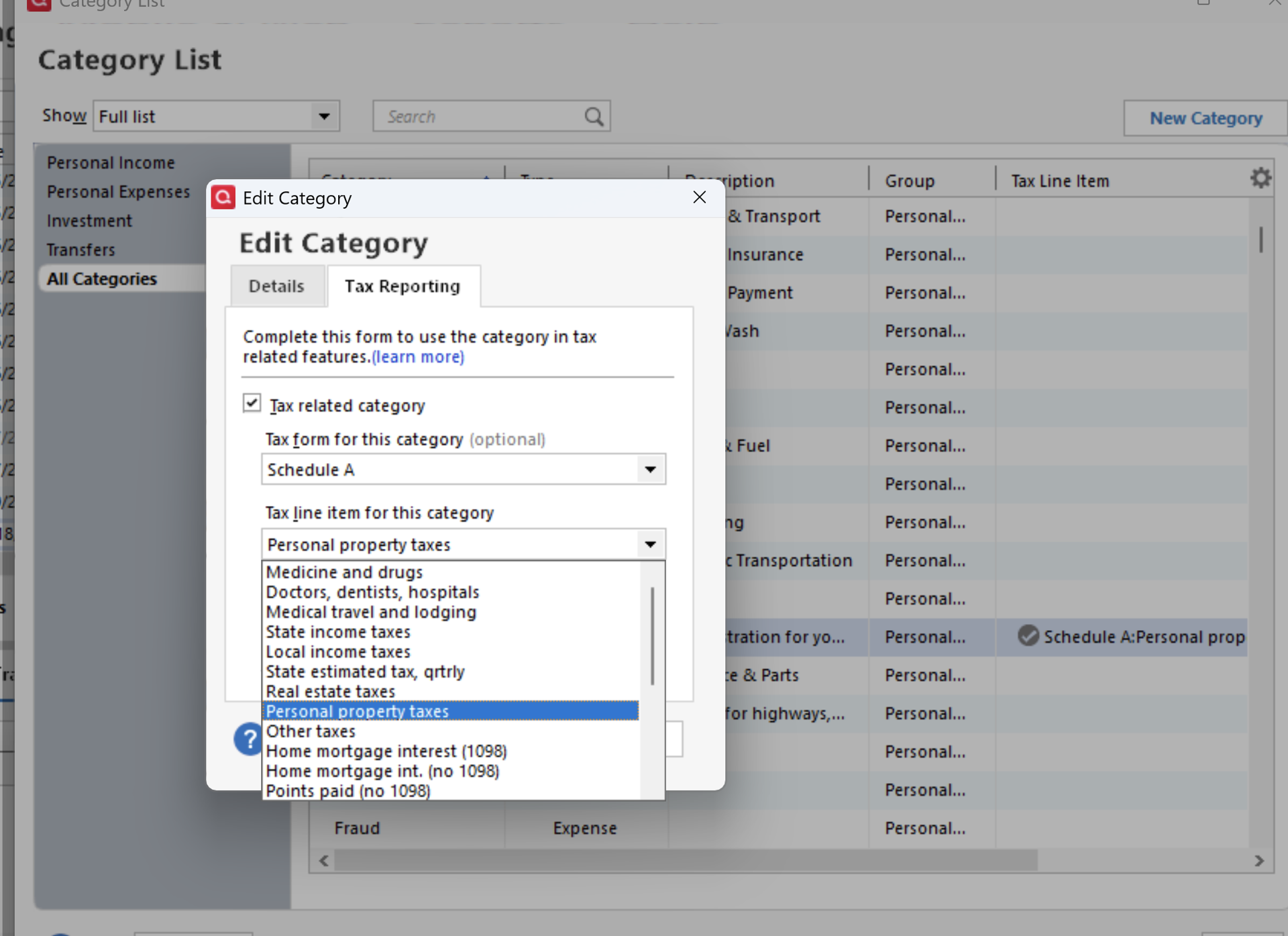

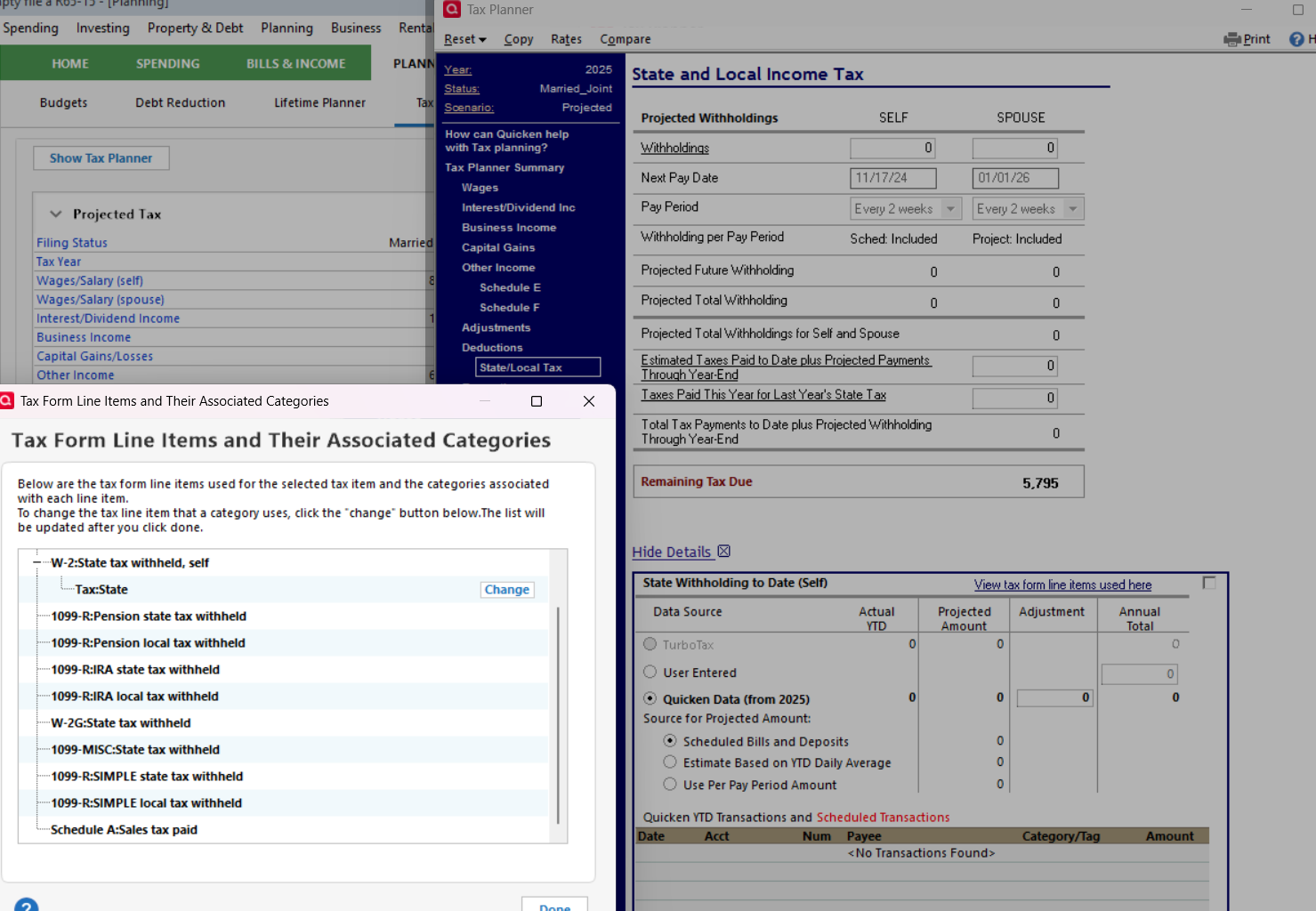

I looked at how the Sched A Tax line items flow to the Tax Planner in R65.17 and found the following:

- Sales Tax Paid is added to the Deductions > State/Local Tax > Withholding SELF line. I'm not sure where it SHOULD go, but that seems wrong. I believe the rule is that you can deduct either the sales tax paid or your other state and local taxes, but not both. As currently implemented, the Tax Planner does not support that calculation.

- Medical Mileage does not go anywhere that I can find in the Tax Planner

QWin Premier subscription0 -

Thank you @Jim_Harman. I have shared your feedback with the team looking into this.

Quicken Janean

Make sure to sign up for the email digest to see a round up of your top posts.

0

Categories

- All Categories

- 52 Product Ideas

- 34 Announcements

- 247 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 514 Welcome to the Community!

- 680 Before you Buy

- 1.5K Product Ideas

- 55.5K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 832 Quicken on the Web

- 126 Quicken LifeHub