Standard deduction for seniors updated but is wrong

A few weeks ago the tax planner updated to show the new $6000(singles) or $12000 (MFJ) bonus deduction for seniors for 2025-2028. This is in addition to the $34700 regular deduction for seniors MFJ. The bonus deduction is income-based and phases out completely for MAGI above $250000. Based on my MAGI, I should not be eligible for this, but the tax planner appears to give me a significant part of the bonus deduction. I should have the senior standard deduction of $34700, and since my MAGI is above $250000, that should be my total deduction. The tax planner shows my total deduction as $40180. This total deduction is clearly income-related since it goes down if I increase any part of my income, so it seems to be giving me an income-based portion of the bonus deduction even though my MAGI is over the limit. Yes, I could simply deduct this amount of income from the total, but this seems like a big enough mistake that it ought to be corrected, unless I'm missing something.

Comments

-

Hello @sugarleah,

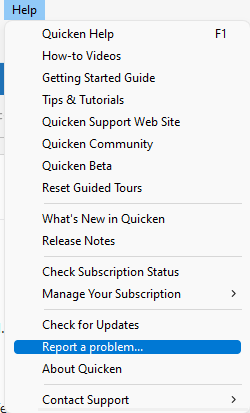

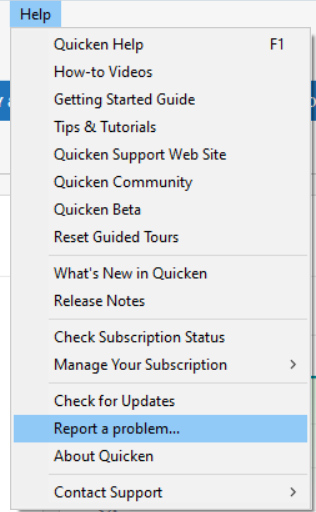

Thank you for letting us know about this! I forwarded this to the proper channels for further investigation and resolution. To contribute to the investigation, please navigate to Help>Report a Problem and send a problem report with log files attached.

Thank you!

(CBT-797)

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

As of the release issued today, 9/3/2025, this issue has been fixed. Problem solved. Resume normal.👍️

0 -

Note that the release backed out the incorrect $6K senior deduction calculation but it did not implement the correct calculation.

That has reverted to a work in progress for a future release. You can manually calculate it and add the deduction in the Adjustments to Income section. Keep in mind doing that artificially lowers your AGI and may affect other calculations dependent on your AGI, e.g., Itemized Deductions Medical Expenses, 0% capital gains rate threshold, IRA deductibility, NIIT, …..

4 -

Thank you for the follow-up @sugarleah,

I'm glad to hear that the 3 September update corrected the issue for you!

If you need further assistance, please feel free to reach out!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

I don't see $12000.00 bonus (MF) in the standard deduction after the last download of Quicken (version R 64.23)

1 -

I also noticed the programming gap that unfortunately omitted the 'New and Temporary' $6k deduction for Single or equivalent and $12k for MFJ statuses for those over 65 y/o. Thank goodness for astute Users that find and flag problems after updates. Looking forward to corrected sw.

0 -

Our teams are aware of an issue where the new senior bonus deduction was not being calculated correctly and they are working to resolve the issue. We do not have an ETA, but the issue should be corrected in a future update.

Thank you!

(QWIN-25636)

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

1 -

I just downloaded Release 64.30, and this is STILL an Issue. So, it remains WRONG thru seven Releases!!!

This Seems like such a Simple FIX. When is it going to be FIX'd?!?!?!?

0 -

I do not know if it is that easy.

It looks like the IRS has added a new line on the 1040/1040-SR and a Schedule 1-A.

On the 1040/104-SR the line 13 now shows 13-a and a 13-b.

How that is incorporate into Quicken is any ones guess.

Check the 1040 draft forms. Search for 1040

The 2025 1040 draft looks totally different that of the 2024 1040.

Quicken Windows Premier (Subscription) - Using the latest version -Windows 11 Pro

3 -

-

Hello Moderator Kristina, as follow-up to your update from four wks ago, when can Users expect to see solution that incorporates formula for extra Senior deduction? Thanks for anything you can do to advocate this corrective action's release. Hopefully, an update will come before typical monthly version.

-1 -

Hello Moderator. I'm waiting on this feature, too. As follow-up to my 10/10/25 request, when can Users expect to see solution that incorporates IRS' extra Senior deduction? If no corrective action is queued, kindly let Users know that as well. End of year planning depends on this otherwise useful Quicken tool. Thank you.

-1 -

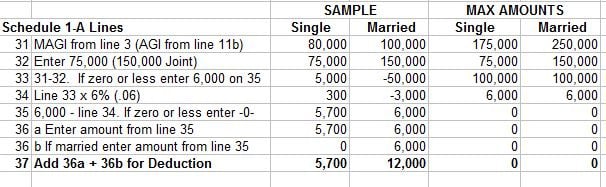

If anyone is interested I made a spreadsheet to calculate the Senior Deduction. It may be a little complicated for Q to add it in fast. The income limit is 75,000 (150,000 Joint), it is reduced by 6 cents for every dollar of income over.

I'm staying on Quicken 2013 Premier for Windows.

3 -

Seems Simple enough. What is the Holdup at QUICKEN?!?!?

As of Release 64.35, we are Still Waiting on the FIX!!!!

0 -

TurboTax (downloaded version) has it working.

1 -

That's good to know.

But, where did you get TT for tax year 2025?

Not even on sale yet. As far as I know.In case you don't know Intuit (TT) and Quicken are two different companies.

Quicken Windows Premier (Subscription) - Using the latest version -Windows 11 Pro

0 -

Turbo Tax 2025 hasn’t come out yet. The Desktop program usually comes out early Nov and Online opens late Nov or Dec.

I'm staying on Quicken 2013 Premier for Windows.

0 -

Hello All,

I checked the status of the ticket, and can see it was marked resolved.

Since I can see in this discussion that the issue is persisting, I forwarded this to the proper channels for investigation and resolution. If you haven't sent a problem report with logs attached recently, please do so by navigating to Help>Report a Problem.

Thank you!

(CTP-14998)

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

1 -

Looks like this has, FINALLY, been Fixed in Release 65.15

Thank You

1 -

I got TurboTax 2025 via download a week ago. This was via annual purchase subscription.

-1 -

@Ray Cosner How does that relate to the Topic being descussed, here?

-2 -

Scroll up 6-8 posts, some users made statements regarding TT that I knew to be incorrect.

1 -

Thank you for the follow up @Frank Hartman,

I'm glad to hear it's fixed in R65.15!

If you need further assistance, please feel free to reach out!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

You need to look at the date that was posted and the fact that @volvogirl stated that the Desktop version comes out in early November. BTW @volvogirl is a long standing SuperUser on the TT forum.

@EvDob was using the What If in TT 2024.

Signature:

This is my website (ImportQIF is free to use):0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 122 Quicken LifeHub