Fidelity Migration in Quicken Classic

I was notified of the migration for the first time today during my weekly update on 9/13. What a mess, none of the posted fixes worked. I have duplicate transactions, missing transactions, duplicate accounts, new unidentified accounts, zero cash balances even though i manually entered them in the setup. Whatever you're doing it's not working. I reverted to my latest backup and have not attempted any further updates. Quicken is now useless to me

Eric Sussman

Comments

-

Hello @es114,

Thank you for sharing the details of the issues you’re experiencing. Since these problems are persisting despite the posted fixes, I recommend reaching out to Quicken Support directly for further assistance and possible escalation.

Phone support is available Monday–Friday, 5:00 am–5:00 pm PT, and chat support is available 7 days a week from 5:00 am–5:00 pm PT.

We apologize for any inconvenience!

-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.0 -

Hello Anja,

Please provide an update on the Fidelity migration. August 19th is the last time that Quicken gave any sort of update (Fidelity Cut-Over Migration by Kristina) and that was to say that "the migration will not move forward as planned tomorrow". That's almost a month ago. Or maybe I am looking in the wrong place for an update. If so, please direct me to a more recent update.

I have been unable to use Quicken since the end of July. EWC+ caused my file irreparable damage in late July. I restored an old file that was on Direct Connect so I could stay with Direct Connect until all of the problems between Quicken and Fidelity are sorted. When I did OSU with Fidelity, erroneous unrealized gains were added to one account during the 2020 - 2024 timeframe, significantly increasing values, for example, in the Net Worth report.

-1 -

Hello @TiH,

Thank you for reaching out. According to the Community Alert linked below, most of the issues reported to us have been corrected:

Our teams are still working on making sure transactions for 401(k) accounts are properly mapped. The issue with cash and money market funds being improperly or inconsistently handled was reported fixed, but some customers are still reporting issues because not all account types give the option to choose whether to track as cash or money market fund.

I hope this helps!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

@Kristina, thank you for attaching the Post with the update. Please create one thread where Quicken will update us on a regular daily basis on issues and fixes. I thought your thread from August 19th (Fidelity Cut-Over Migration) was this one place, but obviously I was wrong. I do not want to have to sift through all of the threads and like I did, miss one which has a critical update. Please also let us know in that thread when all known issues are fixed. That's when I will start using Quicken again. What date does Quicken now expect all problems to be fixed? And do they have a new last day for migrating to EWC+?

0 -

Thank you for your reply,

Unfortunately, our teams do not give ETAs. The alert I linked above is the main alert to track the known issues currently.

Was the unrealized gains issue the only problem you encountered initially, or are there other issues you encountered?

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Thank you Kristina. Understand regarding ETAs.

When I first switched to EWC+, I encountered all of the issues that have been discussed at length in the various threads.After one+ week of working with tech support to get EWC+ working, they suggested I restore an old data file that is connected with DC and continue that way until EWC+ issues are solved. This is when I encountered the unrealized gains issue. So neither EWC+ nor DC are working for me. I haven’t been able to use Quicken since late July. Hope this helps. Happy to answer any questions and/or hear your advice.

0 -

correction:

After one+ week of working with tech support to try to get EWC+ working, they suggested…

0 -

Thank you for your reply,

The alert tracking the known issues shows the problems have mostly been resolved. We are still seeing reports of missing transactions and cash not always being handled correctly. There are also a couple issues that have their own alerts:

The migration isn't mandatory yet. If you want to test if you'll be impacted by any issues, you can backup your Quicken file and try migrating to EWC+. If you'd rather not, you can also wait until it becomes mandatory.

I hope this helps!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

[Removed - Off Topic]

0 -

@Kristiana, thank you for the additional information. Very helpful.

Regarding trying out EWC+ or waiting until it is mandatory, after having spent so much time on this in late July/early August, I decided to take the ‘wait’ approach. My concern now is, I haven’t been able to do a Fidelity OSU since late July. My understanding is that Fidelity will only send data via OSU for the last 60 days. I am now very close to that 60 day mark. Will they or can you ask Fidelity to extend that timeframe to 90 days to give time for the mandatory migration?

0 -

I see my post about this migration was somehow off its topic?

TiH, FWIW I spent around an hour cleaning up the data after my restore and subsequent update but it had worked on the "zz" account type. There were about 20 mortgage transactions 2017-2020 that had unlinked, and a handful of others. They key my brother gave me is, run a report on categories and you can view only uncategorized transactions which typically includes unlinked transfers.

0 -

Thank you for your reply @TiH,

Unfortunately, we're not able to ask Fidelity to increase the amount of data they send to 90 days. Would it be a lot of information to enter manually, if it doesn't download?

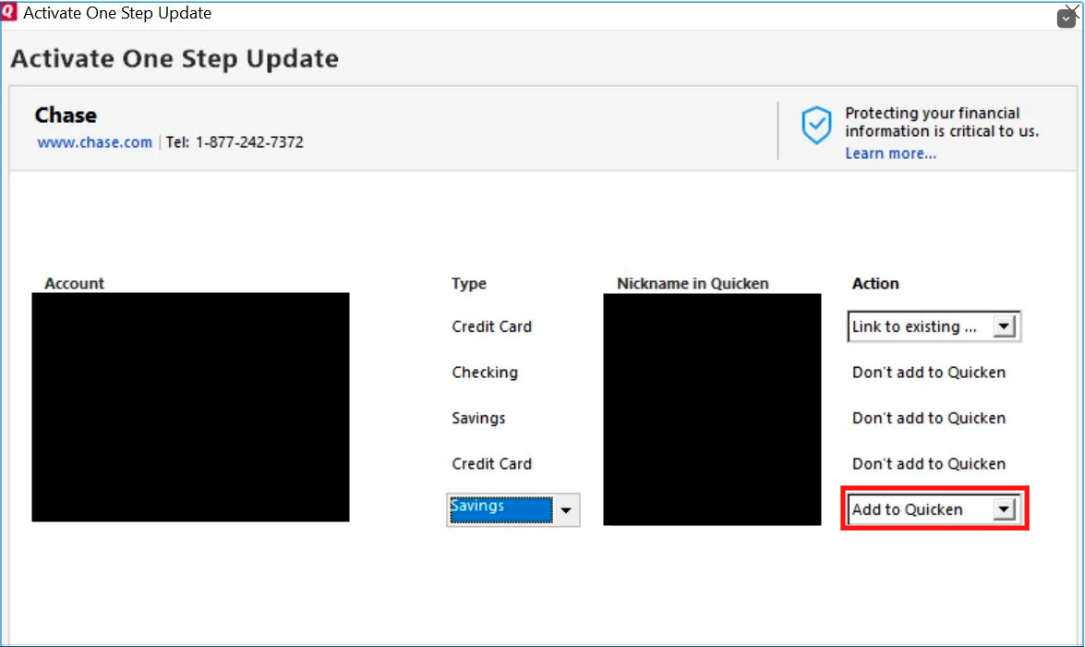

If it would be a lot to manually enter, and you don't want to try migrating your existing accounts to the new connection method yet, then you may want to consider adding the Fidelity accounts as new accounts in your Quicken so that you can download the transactions before you go past the 60 day window.

To do that, backup your Quicken file, navigate to Tools>Add Account, follow the prompts, and add your Fidelity accounts as completely new accounts rather than linking to the existing.

Note - Having duplicate accounts in your Quicken will throw off some report data, since some of the information from those accounts would be counted twice.

Once the data is downloaded into the new accounts, you would want to review to make sure everything looks correct. Then, you could either use the gear icon, choose Move Investment Transactions, and move the newly downloaded information to the existing accounts, or just deactivate the new accounts and keep that transaction information handy just in case it does not download when you migrate your existing accounts. Once the new accounts are no longer needed, backup your Quicken file and delete them.

I hope this helps!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

@Kristina, can you provide another overall high level status of the outstanding issues (from the Community topics it seems that there are many issues still unresolved) and estimation of when EWC+ will become mandatory?

0 -

Thank you for your reply @TiH,

The one I've seen the most posts about is ongoing issues with cash representation in Fidelity accounts. The most recent update, R64.30, added the ability to reset cash representation for many Fidelity accounts, which has helped with that issue.

We do have a Community Alert giving instructions on how to correct cash representation. To view the alert, click here.

There is also this related alert, for customers who want to override the cash representation and have Money Market accounts show as a security (Quicken for Windows only). To view the alert, click here.

There are still some reports of missing transactions, although the issue doesn't seem to be as widespread now.

There have been a small number of reports of connecting and having an incorrect $0 balance. For more information, see this Community Alert.

Another issue that is less common is having unidentified securities show up in Fidelity 401k accounts after migrating to the new connection. For more information, please review this alert.

If you have Fidelity NetBenefits accounts, one issue some customers have reported is that they won't support Complete investing. You can view the Community alert for that issue here.

The Fidelity Updates alert is also still getting updated when there is new information. The most recent update is about the cash representation issue. To view that alert, click here.

I know the date was tentatively set for the 25th of September.

I hope this helps!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

@Kristina, is there a new date for a mandatory migration to EWC+?

0 -

Thank you for the follow-up,

We have not yet been given a solid date when it will be mandatory for everyone, but it appears that some users have already been forced to migrate to Express Web Connect+ (EWC+) as of 8 October. Based on that, I expect migrating to EWC+ will be mandatory for everyone soon.

I hope this helps!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

1 -

None has been announced.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0

Categories

- All Categories

- 44 Product Ideas

- 34 Announcements

- 245 Alerts, Online Banking & Known Product Issues

- 23 Product Alerts

- 512 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub