zzz-Fidelity Updates

Comments

-

I gave up and restored backup from before the [Removed - Language] transition. I'm now successful using the old connection now renamed zzz-fidelity. And it is no longer prompting me to transition to the new so-called improved method. Almost as if Quicken knows it is all messed up. I should know to delay transition to see if it seems to work before becoming their unwitting beta tester, but it didn't look like I had a choice. Why does quicken do these things at month end? Really messed up.

0 -

Downloads are coming through with a total of shares from 2008 and 2013 when the accounts were first open with a total # of shares that I own today. As such, it doubles the # of shares and inflates the value of the accounts. I tried to remove those shares since the download tool adds those shares but the remove shares feature does not change the total value for some reason. If I delete the add shares, the next download they appear again.

How do I get rid of these add shares transactions with the new download feature. Yes I mapped/validate my accounts based on forced prompts to move to new download process. I prefer to go direct and not through quicken but was not offered a choice (yes I got the email in June).

0 -

Thank you Krisina,

I deactivated and reactivated my Fidelity accounts to update to the new download method. My NetBenefit accounts are still set to "Complete - Positions and Transactions". Since this is a know issue, I had already manually updated the missing transactions.

0 -

Failed AGAIN and losing faith in Quicken!

Tried the account reset, went through the re-authorization and it corrupted the quotes, CDs and number of shares again!!!!

Fell back to the backup, but will not touch any suggestions until fixed [Removed - Disruptive]

No downloaded transactions or updates! [Removed - Rant]

0 -

There are now 7 pages to this one thread and still NO acknowledgement by Quicken that this seems to be a royal screwup on a product that was improperly tested. The only advice given is "use a backup and we'll fix it later."

When selling and managing a product whose sole purpose is to help them with their money, the bar for performance and reliability is should be VERY high. Quicken has fallen well below the goals of high reliability.

2 -

The first paragraph is true, but there has also been interaction from Quicken staff, and indication that they are working on the issues.

I agree that it should have been tested. Quicken has a well oiled beta testing process that would have caught this, had this migration been tested in a beta activity.

Barry Graham

Quicken H&B Subscription1 -

I searched for information on beta testers. I didn't find anything indication the program exists. From the dialog in this thread and

Quicken KristinaQuicken Windows Subscription Moderatorencouraging us to report the issues with feedback, we appear to be the beta testers.I just spent 6+ hours fixing incorrect securities symbols from the download fiasco I reported False New Security & Matching Security Pop Up — Quicken. I thought I'd fixed them but found more.

Frankly, I'm disgusted with Quicken for allowing this update to continue.

1 -

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

1 -

Thanks. The page and the FAQ don't answer my questions. Is there a contact email or phone number?

0 -

If you join the beta program there is a mechanism for asking questions. Otherwise this page shows the various ways to contact support.

https://www.quicken.com/support/quicken-support-options/

Barry Graham

Quicken H&B Subscription5 -

Bugs can and do happen with most products. That doesn't make the end user a tester.

Barry Graham

Quicken H&B Subscription0 -

to this extent it does

1 -

FIDELITY ACCOUNTS ARE ALL INACCURATE ONCE I GAVE PERMISSION FOR FIDELITY TO SHARE MY DATA. ALL MY FIDELITY ACCOUNTS ARE WORTHLESS!!! I AM MANUALLY UPDATING THEM NOW UNTIL I THINK THIS IS FIXED. DON'T THINK I'LL RENEW AGAIN. THIS IS TOO FRUSTRATING.

-1 -

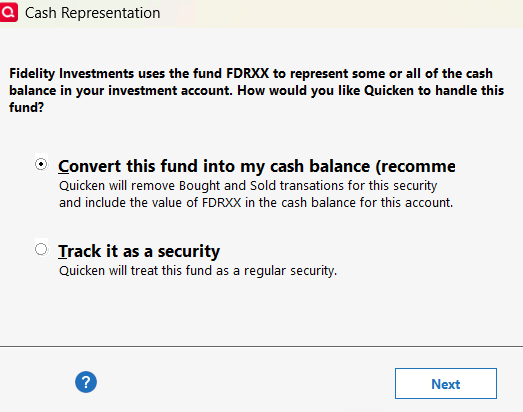

This dialog I got during One Step Update doesn't specify the account:

0 -

It is frustrating, although since I've been using Quicken successfully for more than 25 years, I'm not going to throw it out and cause myself a lot more work, over this one very annoying disastrous migration, which will get fixed eventually.

Barry Graham

Quicken H&B Subscription2 -

My concern is what Quicken considers to be "fixed".

Hopefully, fixed means that all features using EWC+ will work exactly the same as with the prior Fidelity DC connection.

Deluxe R65.29, Windows 11 Pro

0 -

I hope so too.

Barry Graham

Quicken H&B Subscription0 -

As I am sure you know, beta testing is when they roll it out to a subset of users with the intent of ironing out the bugs before release (which is what should have happened here but maybe it's not possible to do that with a financial institution connection method change). Since that isn't what happened here, this isn't beta testing and if it were, they would not be paying us to test it (referencing a comment made elsewhere).

I also wish that when people start a new thread about an issue that has already been reported, the moderators would catch that. Having multiple threads about the same issues just makes it harder for Quicken staff to manage and pass on the issues being reported.

Barry Graham

Quicken H&B Subscription2 -

disagree. If things like 3 decimal places were not caught, it was not well beta tested. That should have been caught. As should the difficulty to postpone. So in effect we are finding the bugs and by definition are the beta testers.

Enough. With any luck Fidelity will become functional again. And until folks like boatnmaniac report same I shall avoid the change.

Question just came to mind:

Sweep accounts can be checking accounts and they require direct connect to pay bills. I have never tried, but did that ever work with Fidelity and will it work again?1 -

It wasn't beta tested at all. That's the problem. Beta testers would have caught this immediately.

You can use Quick Pay and Check Pay with Bank of America which uses EWC+ - I don't know if that answers your question. If it doesn't, hopefully someone else can answer your question. I have a Fidelity HSA and track the cash separately, but I pay all my medical bills by credit card and then reimburse myself from my HSA so I've never tried to use Quick Pay or Check Pay with it. The Quicken Bill Manager menu does appear to allow the HSA Cash account to be used as a bill payment account, but I'm not going to trying enabling it.

You are correct that the traditional "Bill Pay" as well as many other important features don't work with EWC+. It was very frustrating when BofA switched to EWC+. Quick Pay and Check Pay are workarounds that have advantages but don't compensate for all that was taken away.

Barry Graham

Quicken H&B Subscription1 -

One would hope that Quicken developers had arranged to have some Fidelity accounts for which they were able to have tested the migration and not just relied on those subscribers that have Fidelity accounts to uncover problems. Although, the latter seems to be the case.

Deluxe R65.29, Windows 11 Pro

1 -

Why are you continuing to use the EWC+ connection instead of doing what many users (including me) have done to restore the DC connection? If you restore the DC connection then your accounts will be accurate, again.

To restore the DC connection with Fidelity:

- Restore a recent backup file dated from just before you reauthorized Fidelity to change the connection to EWC+. The restored backup file will have your DC connection for your Fidelity accounts (and for any other financial institutions that you had set up with DC) still intact and functional.

- When you run OSU, if you are prompted to reauthorize EWC+ decline that by clicking on "Remind me later" at the bottom right of the reauthorization popup. That will cause the popup to go away. If you are taken to the Fidelity website to log in, DO NOT log in….close that browser window. Run OSU, again, and make sure to click on "Remind me later" if that popup comes up again. Repeat declining this popup if it comes up, again, until it is reported that the EWC+ migration issues have been resolved or until we are forced to migrate from DC to EWC+ (currently scheduled for 8/20).

- Note that when restoring a backup file, the EWC and EWC+ connections that you might have set up with other financial institutions might have been deactivated. For those accounts that have been deactivated you will need to set them up, again, via Add Account or Set Up Now. This will be just a 1X occurance.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

5 -

[Removed - Off Topic]

-1 -

This morning, I had 106 notifications of new posts. I don't have time to read all this but do need the information. I asked ChatGPT to read all postings and to create a bulleted list of issues and suggestions for users. I don't know how accurate the results are. I don't intend this to trigger a bunch of discussion as there's enough other comments.

Here’s a consolidated summary of the “zzz‑Fidelity Updates” thread on Quicken’s community forums, based on all seven pages, highlighting reported issues in bullet points:

🔍 Key Issues with Fidelity → Quicken (Express Web Connect+) Migration

- Account Naming Renamed with “zzz‑” Prefix

- Fidelity accounts now appear as “zzz‑Fidelity” during One Step Update (OSU), indicating pending transition to a new connection method Quicken+11Quicken+11Quicken+11.

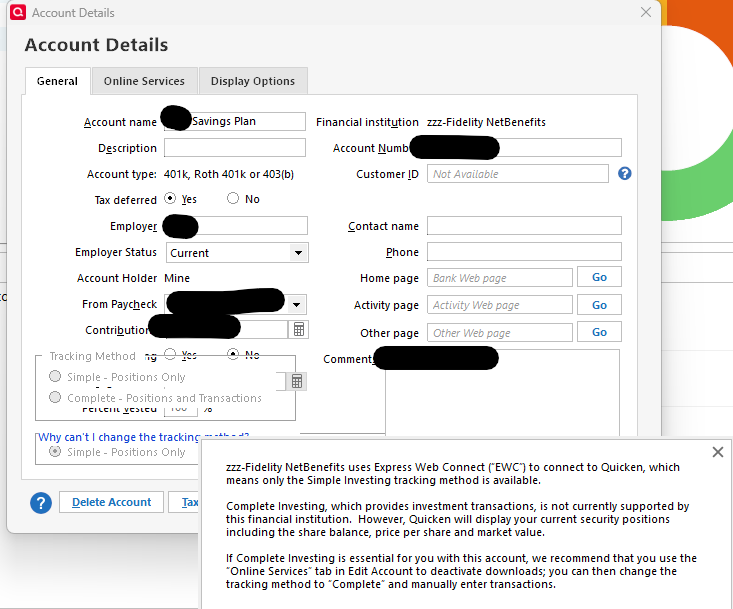

- Loss of Complete Investment Tracking

- Direct Connect (DC) has been removed or no longer available for new/reactivated accounts, forcing users into EWC+ with only “Simple” tracking—which lacks transaction details and limits tax reporting and investment analysis Quicken+9Quicken+9Quicken+9.

- Duplicate Transactions on Migration

- Users reporting 20–30 duplicate entries per account post-migration, requiring extensive manual cleanup Reddit+11Quicken+11Quicken+11.

- Incorrect or Missing Share Balances

- Share quantities are rounded inconsistently (e.g. 2 decimal places instead of Fidelity’s typical 3), causing miscalculated holdings, especially for mutual funds and reinvestments Reddit+7Quicken+7Quicken+7.

- Misclassification of Securities, Especially Money Market Funds & CDs

- Fidelity cash sweep funds (e.g., FDRXX, SPAXX, SPAXX) are being treated as securities instead of cash, or vice versa, leading to placeholder transactions and mismatches. CDs are misidentified as stocks with inflated share quantities and distorted prices Reddit+9Quicken+9Quicken+9.

- Transaction Mismatches & Placeholder Entries

- Historical trades redownloaded as new entries, failing to match existing register items, forcing manual resolution. Inaccurate placeholders and doubled balances frequently occur in cash management accounts Quicken+3Quicken+3Quicken+3.

- Net Worth Balance Errors & Reconciliation Failures

- Rounding issues, duplicate/missing transactions, and misclassified holdings contribute to incorrect net worth projections. Some users report discrepancies in the millions due to massive cumulative errors Quicken+7Quicken+7Quicken+7.

- Incomplete Data Download / Missing Updates

- Some migrated accounts report no transaction updates despite indicating success in OSU. Fixed‑income prices (e.g. bonds, CDs) sometimes fail to update or download incorrectly Quicken+1.

- Migration Timing & Backups as Workaround

- Users recommend restoring a backup created before migration, then postponing reauthorization prompts ("Remind me later") to maintain legacy DC connection—buying time before being forced into EWC+ by August 20 deadline Quicken+1Reddit+7Quicken+7Quicken+7.

- Active Investigation & Support Ticket (CTP‑13955)

- Quicken moderators confirm multiple specific issues (account mismatches, rounding errors, misclassification, transaction duplications) are under investigation, with escalation tickets open and a tentative 4–5 business days expected for resolution Quicken+8Quicken+8Quicken+8.

🔧 Short-Term Workarounds (Preventative & Corrective)

✅ If you haven't migrated yet:

- Delay migration: When prompted to "reauthorize" Fidelity accounts, click “Remind me later”.

- This keeps the existing Direct Connect (DC) active until August 20, 2025 (estimated cutoff).

- Back up your file: Before any update or account change, create a manual backup of your Quicken data file.

- File → Backup and Restore → Back up Quicken File.

❌ If you already migrated:

- Restore from backup: If migration caused major corruption (duplicate transactions, bad balances):

- File → Restore from Backup → Choose backup file created before reauthorization.

- Delay EWC+ prompt as above.

- Switch to "Simple Tracking" temporarily:

- Edit account → Online Services → Use Simple tracking (not ideal, but prevents transaction corruption).

🛠️ Mid-Term Fixes (After Migration)

- Clean up duplicate transactions:

- Sort register by date or amount.

- Use

Ctrl+Clickor tag transactions for deletion.

- Fix placeholders:

- Look for gray "Placeholder" transactions that Quicken inserts for reconciliation mismatches.

- Either delete (if incorrect) or adjust manually to match real share counts.

- Reclassify incorrectly labeled securities:

- For CDs or sweep funds (e.g., SPAXX/FDRXX), consider reentering manually or adjusting investment type.

- Turn off automatic entry of investment transactions:

- Edit > Preferences > Downloaded transactions → Uncheck “Automatically add to investment transaction lists.”

📣 Report & Monitor the Issue

- Upvote and follow the main thread:

ZZZ-Fidelity Updates - Reference CTP-13955 when contacting support.

- Submit Feedback → Report a Problem via Quicken app to add your voice to the known issue.

🔄 Alternatives While Awaiting Fix

- Use Fidelity's CSV exports as a temporary import method:

- Download CSV of transactions from Fidelity.

- Manually enter or import via File → File Import → Web Connect (.QFX) or CSV (3rd-party tools may be required).

- Track manually or use third-party portfolio tracker (e.g., Empower, Personal Capital, Yahoo Finance) until Quicken’s EWC+ implementation improves.

🧠 Best Practices Going Forward

- Always back up before accepting EWC+ conversions.

- Keep a separate testing Quicken file for verifying account migrations before accepting changes in your main file.

- Track key forum threads or check Quicken Alerts for resolution announcements.

9 - Account Naming Renamed with “zzz‑” Prefix

-

Nice job @Ray! Just be careful because many chatbots have been caught faking it, but this looks good.

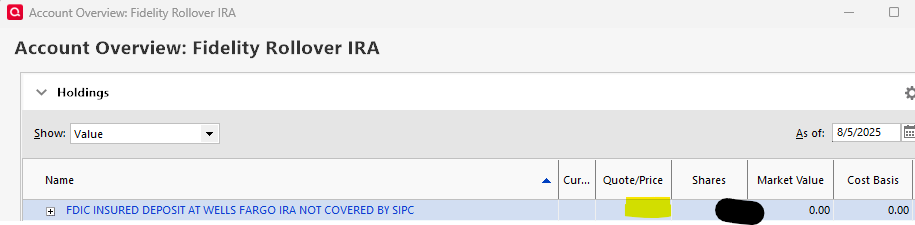

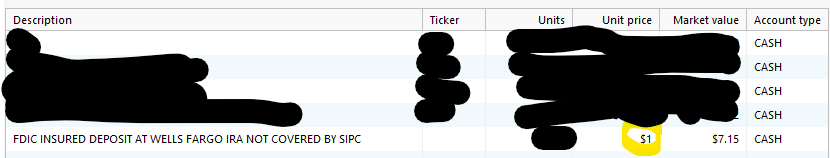

Since my DC copy is so old that it would require hours of data re-entry, I downloaded all the transactions into my 4 accounts, fixed the errors, and, to workaround the cash balance issue, I added the shares corresponding to the cash balance manually then set the price to zero in Holdings

(when you do this, the price is blank).

so it doesn't skew the value of the account. I went to Online Center>Holdings and did "Compare to Portfolio" on all 4 accounts and they now match.The odd this is that the unit price is still $1 even though I set it to zero earlier.

It will be interesting to see what happens the next time there are transactions to be downloaded.Barry Graham

Quicken H&B Subscription0 -

I saw an alert saying that they were pausing migration due to the issues. Has anyone tried to see if the DC options have returned as a connection type?

0 -

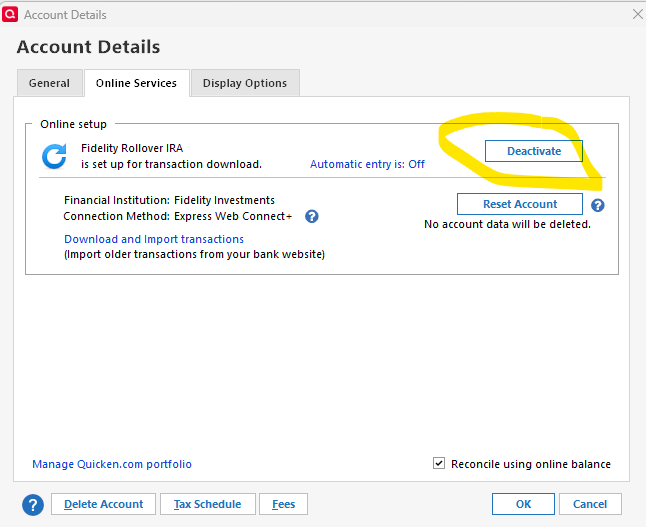

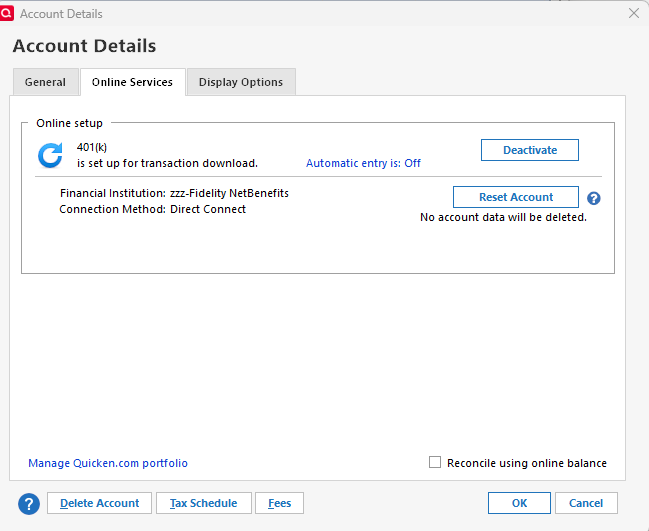

It's a not shown as a visible connection but you can still use them by adding "zzz-" to the start of the FI name on the first tab. Here are the steps:

(1) Deactivate the account.

(2) Switch to the "General" tab and delete all the text in the Financial Institution box.

(3) Click "OK"- this is important otherwise the changes won't stick (and there are instances where it won't stick anyway in which case you can't do what I am describing).

(4) Bring account details back up again (Actions>Edit Account Details)

(5) Type "zzz-Fidelity Investments - DC" or "zzz-Fidelity NetBenefits" in the Financial Institution box depending on which type of account it is.

(6) Go to "Online Services" tab and click the button to set up download.

(7) Enter your userid and password when prompted.

(8) Link the shown accounts to the correct accounts that are already in Quicken.

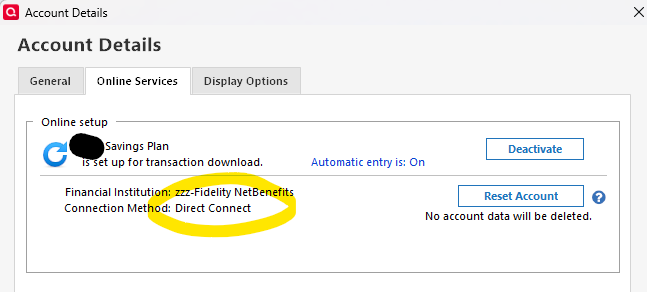

(9) Example after doing this with NetBenefits:

Note that when I tried to do this, as I mentioned above, it insisted on converting the accounts to Simple Tracking. The only way to undo this was to deactivate the account and switch back to Complete tracking. If you are setting up a brand new account using DC with my method, then you CAN use complete tracking, but if your account has ever had EWC+, it seems to object to Complete Tracking when you switch back to DC. It says that you are using EWC even though as you can see in the second image, you are using Direct Connect.

So, in short, the answer to your question is "Yes" - it can be done, but only if you want to use Simple Tracking or to create a brand new account (and import all your old transactions) that are missing).

Barry Graham

Quicken H&B Subscription5 -

Thank you for sharing!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

I have yet to receive a response from Quicken to my response to them. I would appreciate a reply answering the questions and noting that there are many others experiencing big problems with the EWC+ and when they intend to fix the issue.

0 -

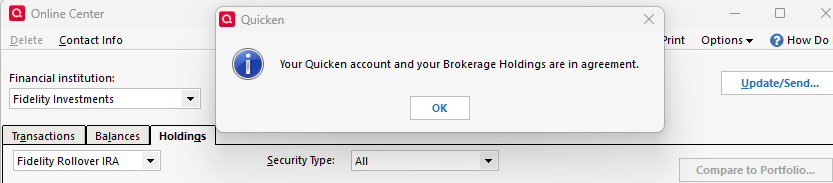

Be careful of the Compare to Portfolio. (Tools > Online Center > Holdings tab > Compare to Portfolio button.)

I have 2 data files with 2 Fidelity IRA accounts each. Both continue using the "zzz - Fidelity" Direct Connect. I haven't been prompted to change to EWC+. Considering all the issues, I'll delay as long as I can.

I download their holdings from Fidelity's website and comparing the symbol, shares, and value with those in Quickens Portfolio Value report. In the spreadsheet, I sorted by symbol and use a formula to compare them. I found several with symbols that didn't match. Compare Portfolio said everything matched even though some didn't.

Schwab uses EWC+. I compared a Schwab account. The spreadsheet said they matched. Quickens Compare to Portfolio said they matched also.

1

Categories

- All Categories

- 56 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub