Issue with Merrill Lynch account since reauthorization - account balance is wrong [Edited]

Comments

-

The Merrill Lynch transaction downloads post change over to the new Express Web Connect+ security model is an acknowledged cluster. I spent way too much time troubleshooting what is an apparent known issue.

For me, after testing, the only current safe solution is to manually enter transactions while using the Merrill Lynch web site as guidance or bypass the Quicken for Windows "One Step Update" and use the manual Merrill Lynch QFX data download as this is the only accurate downloaded data I have found. The Quicken for Windows "One Step Update also is downloading inaccurate stock and mutual fund prices. This is adding much time and energy as I have ~7 Quicken data files and 13+ Merrill Lynch accounts… :(

Hopefully Quicken figures this out promptly…

Quicken has acknowledged the issue:

ONGOING 7/30/25 Bank of America/Merrill Lynch Investments - Missing Transactionshttps://community.quicken.com/discussion/7964414/update-7-24-25-bank-of-america-merrill-lynch-investments-missing-transactionsONGOING 7/30/25This issue remains ongoing, and our teams continue to work toward a solution. No ETA or further details are available at this time, and this Alert will be updated once more information becomes available.We apologize for any inconvenience and appreciate your patience.Thank you,======================

Quicken AnjaModerator mod10:51AMONGOING 8/6/25This issue remains ongoing and our teams continue to work toward a solution. No ETA or further details are available at this time, and this Alert will be updated once more information, updates, etc become available.We apologize for any inconvenience and appreciate your patience.Thank you!MEL0 -

Regarding the Null transaction that I reported above: When the transaction was settled I got another transaction downloaded for the same amount but with a proper description and date of 8/4/2025. I checked on line and there is only one such transaction so I deleted the null transaction. I did the OSU on 8/6/2025.

To Kristina: I sent in another problem report.

Thanks

Jim

1 -

Since reauthorization in July, my Merrill Lynch accounts in Quicken are in disarray. The balances are significantly off, and it appears that several investments (e.g. US Treasuries) are simply missing. I am several hours into trying to research and correct this issue, with no luck. I am disappointed in the lack of notification and follow-up communications from Quicken. We depend on this product to manage our personal finances. Given that this situation is well-known by Quicken, there should be proactive communication flowing to the subscribers who pay for this service.

4 -

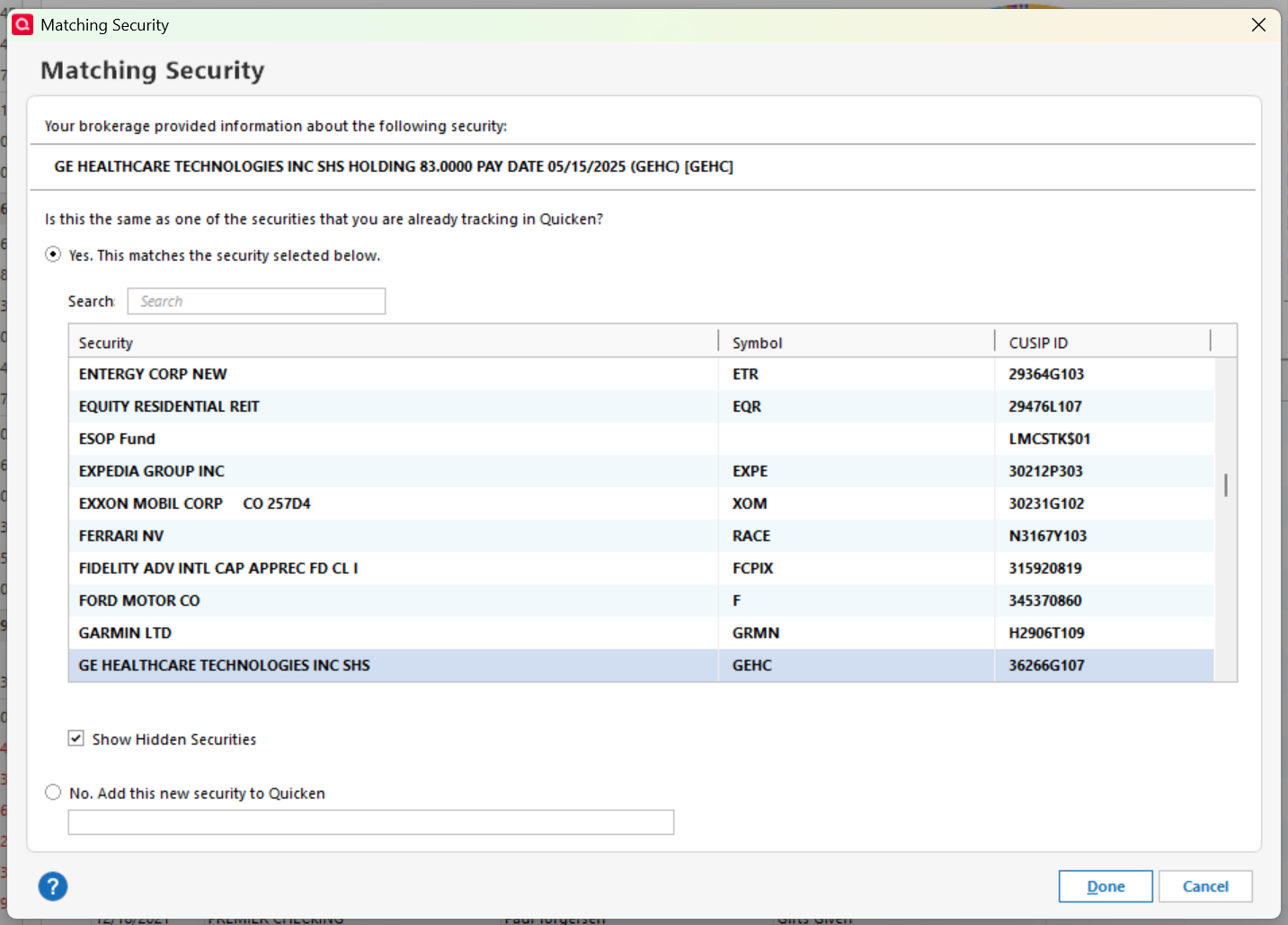

Another wrinkle to this reauthorization issue: ever since tht reauthorization, every time I get a transaction involving some security (e.g., dividend, buy or sell) I get a popup like this:

It is requiring me to "match" that weird security name with something I already hold (or at least once held). So far, Quicken has always guessed right in finding a matching selection but I worry about what will happen if ML happens to purchase something in my managed IRA that I have never owned before.

After the OSU I downloaded the qfx file just to see what was there and found this (redacted):

<INCOME> <INVTRAN> <FITID>20250815CA051135363591924 <DTTRADE>20250815110000.000[-5:EST] <DTSETTLE>20250815110000.000[-5:EST] <MEMO>Dividend: GE HEALTHCARE TECHNOLOGIES INC SHS HOLDING 83.0000 PAY </INVTRAN> <SECID> <UNIQUEID>36266G107 <UNIQUEIDTYPE>CUSIP </SECID> <INCOMETYPE>DIV <TOTAL>nn.nn <SUBACCTSEC>CASH <SUBACCTFUND>CASH </INCOME>I can't find anything to account for the "DATE 05/15/2025…" but maybe Web Connect data does not exactly match qfx content. I do own 83 shares so that's where the 83.0000 comes from.

Anyway, it has only (so far) been a bit of an annoyance. Anyone else seen this?

Thanks

Jim

0 -

"Anyone else seen this?"

Yes, this is happening to me also. It's getting to be more than an annoyance. Is this a Quicken issue or a Merrill issue? Is anyone working on fixing it? Also having issues with "reauthorization required" - I'm assuming this is a Merrill issue.

0 -

Hello @jdparker225 & @WoodCountry,

Thank you for reporting that you're also seeing this issue. It has already been reported to our teams for further investigation and resolution.

Thank you!

(CTP-13847)

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Yes, I'm seeing these same Merrill Lynch issues for way over a month now. It's been so frustrating and disappointing after several calls to Quicken Tech support, and the issues are still not resolved.

0 -

I was able to fix this issue, i'm not entirely sure why, but this seems to have resolved all the issues. I spoke with support, and they had me switch the Merrill Lynch accounts back to "Direct Connect" instead of the "Express Web Connect+" that was enabled during re-authorization.

To make the switch:

- Go to

Tools > Account List. - For each Merrill Lynch account, click

Edit, go to theOnline Servicestab, and clickDeactivate. - Once all accounts are deactivated, repeat the steps and click

Activateinstead. - You'll be prompted for your username and password—save them to the Password Vault.

- Make sure to link each account to the correct existing account.

After this, you should be back on "Direct Connect." This cleared up all the errors for me.

0 - Go to

-

The original notification about Merrill switching to EWC+ indicated that we all had to switch over by August 25th (next Monday). What are the odds that Direct Connect will be disabled as they said, but EWC+ won't be fixed yet?? Quicken: Can you please address this?

0 -

My recollection (which may be incorrect) is that the hard date for the ML transition to EWC+ was Aug 12. By that measure, we're a week past the cutover date and we're still on DC (a good thing). For reference, the Fidelity cutover, which is happening concurrently with ML, was scheduled for Aug 20, but it was just announced it's being postponed. No new date announced.

It appears that Quicken recognizes that neither of these major conversions is going well (a lot of the same issues) and they've applied the brakes. Whatever the ML date was/is, I don't think it will actually happen until substantial progress is made on correcting the identified problems. I think we're good for the time being.

0 -

I agree, I am back on Direct Connect and its working just fine. All the issues are gone. I am staying on Direct Connect till I absolutly have to change. I am hoping that EWC+ is not required going forward.

0 -

I am curious about what "This cleared up all the errors…" means. One of the big issues is the existence of the cash accounts being added to the holdings resulting in the apparent duplication of the cash in your account and a bad account balance. Do those cash accounts just disappear from the holdings when you go back to DC?

On a somewhat different note: what is the alleged advantage to EWC+? Why the switch?

1 -

As I posted earlier, my experience going back to Direct Connect was not that good. Nothing downloaded even the next day despite there being new transactions on the web site. Very curious why, but went back to EWC+ so at least I was getting something.

I am getting the money account discrepancies (IIAXX treated as a security rather than cash ) but just ignore them so my holdings and cash are correct in Quicken.

0 -

I had the same experience with Direct Connect in mid-July. Switched from EWC+ back to DC and got no transactions. Switched back to EWC+ and got the transactions, but they were not in the same format (ticker symbol same, but stock names were different) so Quicken thought they were being renamed (but they weren't). Also the same issue with cash accounts being treated as stock accounts. Today I switched back to DC based on the favorable comments in this thread - we'll soon see if they turned downloads back on or not.

QUICKEN: Please get this fixed ASAP. It can't be that hard. Your customers are depending on you!

0 -

Per another Quicken Support thread today:

Quicken AnjaModerator mod10:00AMRESOLVED 8/21/25This issue has been marked as resolved. However, this Alert will remain available for those who may still be experiencing it.If you’re still encountering the issue, we recommend reaching out toQuicken Supportfor further assistance.Thank you!MEL0 -

Okay…. What is the resolution? Will there be a fix comming out? If so, when? Whether there is a fix or not, is there some action users have to take?

The "another Quicken Support Thread" has nothing but the post that says it is resolved. Nothing that says there will be more information comming or is available somewhere else. Very poorly worded post by Anja. Or am I missing something that is obvious to everybody else.

0 -

Taking a closer look at the "another Quicken Support thread", it does not appearr to me to be the same issue as this thread. So I do not think that this thread's issues are resolved. In particular the other thread's issue "is not impacting the balance" while some of this thread's issues are.

I'd like to retract my comment on Anja's post with apologies.

0 -

Well…now that I have some new transactions to download and test via Merrill Lynch and the Quicken EWC+ interface, even though Quicken marked this as resolved on 8/21/25, it is not. Although a step forward, if I use the EWC+ in Quicken for Windows Deluxe, to download the transactions, I am still missing the memo field (I need to add it by going to the Merrill Lynch web site and manually copy and pasting it) and it is still adding pending transactions. If I use the manual quicken transaction download via the Merrill Lynch web site, all the detail continues to be populated. This is frustrating.

Quicken, are you all testing this? Please advise as to when all the Quicken EWC+ issues will be resolved.

Is anyone else having this similar issue, post Quicken reported resolution?

MEL1 -

Yes, I can attest that I'm experiencing the same issues:

1 - Direct Connect "appears" to connect without errors, BUT it doesn't download ANY transactions.

2 - EWC+ connects and downloads transactions, but for me it loads the memo field into the stock name. This makes the stock name different, longer, and only good for that one Tx (e.g., it appends "PAYABLE 08/24/2025" or similar to the stock name on a dividend Tx). It is also treating some dividend Tx as cash deposits, other div tx are treated as Dividends.

3 - Cash entries don't appear like they used to. Prior posts do a great job of describing the specific issues with this.

IS QUICKEN WORKING ON THIS? WE NEED A CLEAR STATUS UPDATE PLEASE!

1 -

I have a low transaction account with Merrill too and same problems. Merrill obviously needs some assistance in the coding for downloads. Not sure how it works BUT it would be nice if someone could assist them as I have not seen any improvements since the changeover.

Mismatches are very hard to fix due to multiple transaction dupes and option contracts are the wrong amount of shares so always a mismatch.

1 -

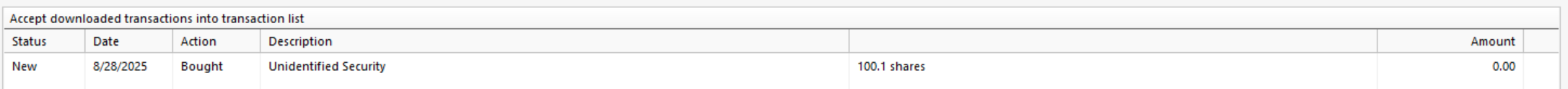

I just got this weird transaction from ML IRA account:

I checked on line and found this transaction, which is the only one that could be what drove that transaction although the date is not in agreement with what Quicken shows.

Still using the reauthorized EWC+.

Should I accept it or not? I am inclined to not accept it and wait for it to become not pending on ML web site and see what happens.

I downloaded the qfx file to see what it might have and found this:

<OTHERINFO> <SECINFO> <SECID> <UNIQUEID>55499U915 <UNIQUEIDTYPE>CUSIP </SECID> <SECNAME>BANK OF AMERICA, NA RASP <TICKER>IIAXX <UNITPRICE>1 <DTASOF>20250828110000.000[-5:EST] </SECINFO> <TYPEDESC>BANK OF AMERICA, NA RASP <ASSETCLASS>OTHER </OTHERINFO>Any ideas?

Thanks

Jim

0 -

Ok, not accepting the "Unidentified Security" transaction seems to have been the correct thing to do. Today I got this:

That one makes sense.

0 -

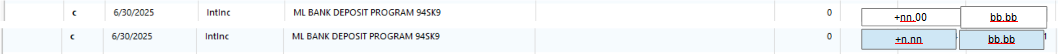

Addendum to previous post. I had the same transaction at the end of last month, which was after the reauthorization. It was handled differently by Quicken. These are the two transactions:

So there has been a change but it must be at the ML end. Does Quicken support think that they have fixed all the issues with ML reathorization by fixing some stuff on ML end? If so, they are quite wrong; there are still many issues remaining. Are they still working these issues? What is the status? What can we do as users to get answers?

Note: the biggest issue is the one that drove this thread: duplicated cash holdings resulting in incorrect balance in some ML accounts. I have 3 ML accounts: a brokerage account and 2 IRAs. The cash duplication is only with the brokerage account.

Thanks

Jim

1 -

The plot thickens with the new Quicken Merrill EWC+ interface. Since Quicken announced that the Merrill Lynch EWC+ interface issues have been resolved (8/21/25 - https://community.quicken.com/discussion/7964294/issue-with-merrill-lynch-account-since-reauthorization-account-balance-is-wrong-edited/p2), although maybe a small step forward, I am still missing the memo field (I need to add it by going to the Merrill Lynch web site and manually copy and pasting it) and it is still adding pending transactions. Today, at month end, I learned that it is putting interest in my cash account instead of recording it as an interest earned investment transaction and it is flagging re-invested interest as a cash transaction only too, instead of recording it as a re-investment investment transaction. I had to delete these transactions and manually re-enter them.

The only way I have found around all these issues is to either manually adjust every transaction with the Merrill Lynch web site or forgo any use of the Merrill Lynch EWC+ interface (If I try the EWC+ before a manual transaction download, it causes the manual transaction download not to work) and download the transactions manually via the Merrill Lynch web site using the Quicken file interface (QFX). That means checking the Merrill Lynch web site every day for all of my investments to see if any new transaction activities are pending or available.

This is becoming beyond frustrating, and it is adding a good amount of work for me as I use and download Quicken transactions everyday as for me, this means three different Quicken files and 13+ Merrill Lynch accounts that are affected in my seven Quicken data files.

I am not having any other issues with Quicken downloads via other financial institutions and this includes Direct Connect, EWC and EWC+ connections.

Quicken, please help.

Is anyone else having similar issues?

MEL0 -

Same issue with our ML accounts. We've got a near @$20,000.00 difference between what Quicken reports and what's actually in our account. It appears transactions are not downloaded correctly or not at all, but the market pricing is updating okay. I thought Quicken was supposed to simplify our personal finances, but at this point, due to Quicken Support's lack of action or transparency, it's no longer simple. If the customer has to start manually entering transactions, or start calling ML support for information, or anything similar to that, then Quicken Support is not doing its job. This should not be a customer generated fix, this is an issue between Quicken and ML. If it gets to a point that we cannot trust what Quicken is offering, we're going to move on to a different personal finance platform. The lack of Quicken Support or communication is BS, PERIOD.

1 -

Responding to MEL's most recent post: This is getting a bit confusing. For one thing, it seems that YMMV. Not everybody is having the same experience. My experience has been mixed based on which ML account. As previously mentioned, I have 3: a brokerage account and 2 IRAs. Bottom line: to answer MEL's question, yes I think I am having similar issues.

Bear with me a bit as I recap a bit and explain what has happened to me with regard to interest payments. I will eventually get to how this relates to MEL's post.

For me the re-authorization happened around July 19. The first thing I noticed was that the balance was wrong in the brokerage account because the cash was duplicated: there was the cash that had always been there and two new securities among my holdings: ML Bank Deposit Program account and a Preferred Deposit account. These two accounts were whole dollar shares. The cash in Quicken was mostly the whole dollar amounts in those two new holdings. When those two new holdings appeared in Quicken, the amounts in those two holding where not deducted from cash which resulted in most of the cash being counted twice in the balance. There are cash accounts in the 2 IRAs but they were not added to the holdings of those accounts.

I earn interest on the cash in all 3 accounts.

Prior to the re-authorization that interest for the brokerage account came in transactions like these:

The first transaction was the whole dollar amount going into the 2 cash holdings, the second was the change left over. The bbb.bb number was the total cash. Because I had 2 whole dollar cash holdings the change could be more than $1.00.

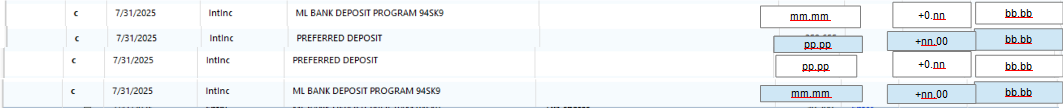

In July and August, after re-authorization, those transactions appear like this:

These transactions show the whole dollar and change interest for each of the 2 cash accounts separately. The mmm and ppp numbers are the totals in each of the 2 cash accounts (the change interest transactions do not increase the mmm/ppp values) and the bbb.bb is the running total of cash. At this point the account balance would be correct if the account balance did not include ppp and mmm.

For the IRAs, the story is different and closer to what appears to me like what MEL experienced. Prior to re-authorization, there are no “Intinc” transactions, they do exist in the ML website, and my Quicken balance in those accounts is off by about enough to be accounted for by the missing Intinc transactions for those accounts. Shame on me for not noticing but, oddly in this context, score one for the re-authorization (or maybe a half) because now there are transactions in Quicken for the interest earned. These are samples of the transactions I've gotten since re-authorization:

Notice the difference between the July and August transactions. The July transaction is Intinc but the August one is simply a deposit. Also notice that the cash account is not a whole dollar amount. Looking at the ML website, the IRA cash accounts (1 each) have fractional shares. A whole share is worth $1.00.

So my IRAs (not my brokerage account) are getting transactions for interest earned that are not noted as being interest, just a deposit. And it started this month. This seems similar to what MEL described.

But this particular issue is not coincident with the re-authorization. Perhaps ML did something after re-authorization, intending to fix re-authorization problems, that introduced this new problem.

FWIW, I looked at all the interest payments for all my ML accounts for June, July, and August on the ML website and they all are exactly as they should be and have not changed in how they appear over that span. But I only looked just recently, so maybe they looked different in the past.

Whew!!! Does any of this make sense?

One final thought (for now!): This whole scenario begs for the capability to restore a single account from a backup. When this mess is straightened out, I don't look forward to restoring from a pre-July 19 backup and then moving forward all of my accounts to the present. I think I could do it for the ML account: simply download the last couple of months worth of qfx files and process them. There are no transactions like checks that I'd have to hand enter or credit card transactions that I'd have to properly categorize.

2 -

@jdparker225 - Thanks for that information. Bottomline for me, we are both putting way too much energy and work into what should be straight forward transaction downloads that had been working, relatively well, albeit not perfect, before the EWC+ cutover. I've been downloading Merrill Lynch transactions for 10+ years and as I mentioned, all my other accounts and financial institutions using Direct Connect, EWC and EWC+ are working fine. My Vanguard downloads are so much easier to work with and reconcile…and I may bring everything over to them if this continues for much longer. I suspect that this is likely a Quicken issue, but Merrill Lynch should be motivated to get this fixed as well.

Quicken, is there a formal corporate response to these issues? Is there something I am missing? Do I need to rebuild all of my Merrill Lynch Quicken connections to Merrill Lynch? I have submitted technical support reports via Quicken, however, I'm not sure that fully explains all of the issues…

MEL0 -

I too have spent way too much time trying to download transactions from ML after the notification from Quicken that all ML accounts must be switched to EWC. I have 20+ ML accounts between 6 Quicken files. If this is an ML issue, it behooves Quicken to work with the ML Quicken online department to figure this out before its customers move on to other platforms. I've been using Quicken since the early 90's and am frustrated and disappointed. Entering transactions manually is not what I'm paying a subscription for.

2 -

Hello All,

What type of Merrill Lynch account is failing to download transactions?

If you are encountering this issue with IRA accounts, those should be supported, and I recommend that you contact Quicken Support directly for further assistance. They have access to tools that we can't access on the Community and they are able to escalate the issue as needed. The Quicken Support phone number can be found through this link here. Phone support is available from 5:00 am PT to 5:00 pm PT, Monday through Friday (They will be closed on Labor Day).

If the problem accounts are CDs, Annuities, Loans, or Health Benefit Accounts, those account types are not supported for transaction download into Quicken. For unsupported accounts, we recommend using Simple Investing to track balances and basic activity.

I hope this helps!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

-1 -

@

Quicken Kristina please read the thread above. The Quicken Merrill Lynch downloads are a mess. All over the board.Since Quicken announced that the Merrill Lynch EWC+ interface issues have been resolved (8/21/25 - https://community.quicken.com/discussion/7964294/issue-with-merrill-lynch-account-since-reauthorization-account-balance-is-wrong-edited/p2), although maybe a small step forward, I am still missing the memo field (I need to add it by going to the Merrill Lynch web site and manually copy and pasting it) and it is still adding pending transactions. Today, at month end, I learned that it is putting interest in my cash account instead of recording it as an interest earned investment transaction and it is flagging re-invested interest as a cash transaction only too, instead of recording it as a re-investment investment transaction. I had to delete these transactions and manually re-enter them. My Merrill Lynch statement share prices don't match the downloaded values, etc…

The only way I have found around all these issues is to either manually adjust every transaction with the Merrill Lynch web site or forgo any use of the Merrill Lynch EWC+ interface (If I try the EWC+ before a manual transaction download, it causes the manual transaction download not to work) and download the transactions manually via the Merrill Lynch web site using the Quicken file interface (QFX). That means checking the Merrill Lynch web site every day for all of my investments to see if any new transaction activities are pending or available.

This is becoming beyond frustrating, and it is adding a good amount of work for me as I use and download Quicken transactions everyday as for me, this means three different Quicken files and 13+ Merrill Lynch accounts that are affected in my seven Quicken data files.

I am not having any other issues with Quicken downloads via other financial institutions and this includes Direct Connect, EWC and EWC+ connections.

Honestly, investments can be bought anywhere, investment companies and financial software is a dime a dozen and I'm on the cusp on going into an entirely different direction. Vanguard is so much easier to work with, and their transaction downloads are so much easier to reconcile. Maybe Quicken should understand why that is.

These are my same Quicken data files with the same Merrill Lynch accounts as before the EWC+ cutover. Nothing changed on my end, except for the fiasco as described.

I've sent Quicken reports on the issue and never heard back. I don't have the time to fight this battle with Quicken.

My issues don't appear unique. Quicken, please help.

MEL1

Categories

- All Categories

- 58 Product Ideas

- 34 Announcements

- 239 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub