Issue with Merrill Lynch account since reauthorization - account balance is wrong [Edited]

Comments

-

I think you misunderstood my problem. I don't think I need any adjustment to how cash is handled. What I need is some adjustment to the amount of the cash balanace that would have been accomplished by the popup asking me to check ML website and enter the correct balance. I know that my cash balance is off by some non-trivial amount.

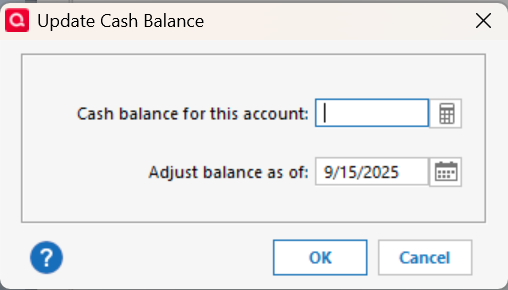

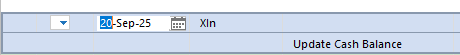

I did click on the cash link in my account and got this popup which looks a lot like the popup I saw just before the crash but I don't know for sure if it is the same thing (I do not think it is identical - I think there were at least some additional words):

How can I know whether this is the equivalent of what I saw before the crash?

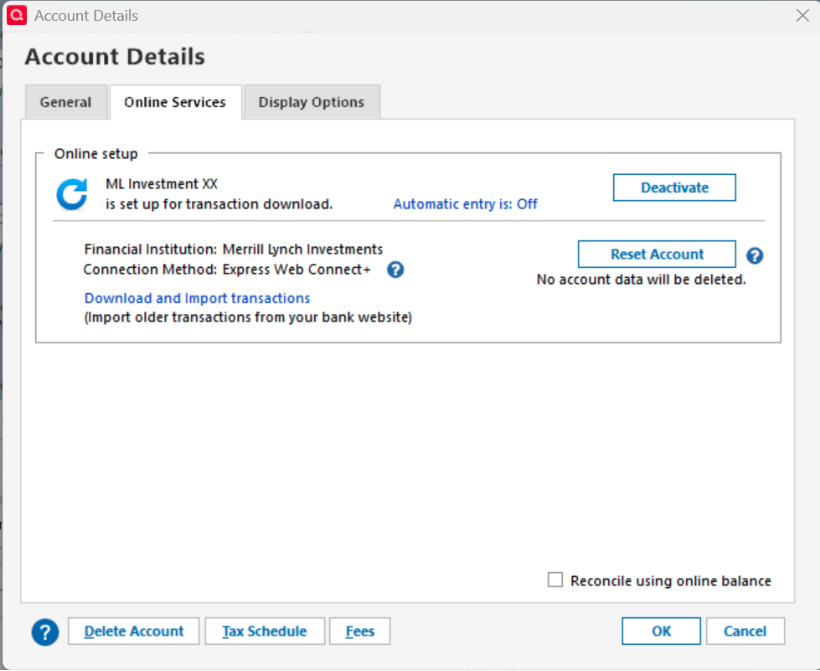

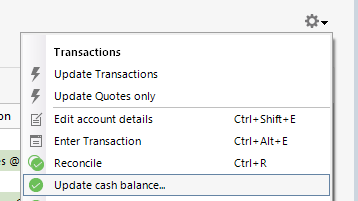

I also pressed the gear box for the account and got something that I can't get a screen shot of but it did not contain an Account Details selection. Neither did the gear box for the holding. There is an "Edit Account Details" in the account gear box so I tried that and got this dialog:

Note there is nothing there to specifically reset anything related to Money market stuff.

Thanks

Jim

[Edit - Removed partial account number & reduced image size]

0 -

@Quicken Kristina : I agree with @jdparker225 — I don't have a "Reset Money Market" link on the Online Services tab either. Please give us further details.

0 -

Testing today, 9/16/25. The Quicken Merrill Lynch EWC+ appears to be stable, without daily errors of reauthorization request, however, the download data is still missing information, most notable, the memo field. I can still download the manual QFX file directly from the Merrill Lynch web site to get data similar to the pre-EWC+ transition. So, in summary, still work to do Quicken. If I use the EWC+ I still need to go to the Merrill Lynch web site and manually download memo and detail information, or I need to go to the Merrill Lynch web site and manually download the QFX file. Both are generating more work for me.

Does Quicken have an official statement on the status of the transition to EWC+?

MEL0 -

Through ML I have been able to work on some of these issues directly with Quicken since the re-authorization and connection method change caused all sorts of issues. On the MAC, the following issues I had to work through so posting here to help anyone still working on fixing things up. A lot of fixes have been made to the Quicken Connect method since switching from Direct Connect early July. In fact an account that was set up in the middle of all this defaulted to Direct Connect and caused me further download issues, fixed since I switched it to Quicken Connect. For the other issues here is a quick update:

- 1. Payment/Expense transactions with no data just an amount being debited from the account or weird 'null' payee

- 2. Missing memo/notes for investment transactions

- 3. Dividend transactions having the Security/Payee with "PAY DATE xx/xx/xx" concatenation, or other additive "memo" type info (i.e. ML ACTING AS AGENT)

- 4. Add shares transaction switching into Buy transactions instead of Reinvestment transactions (the deposit of dividend cash, Add shares, Remove dividend cash stuff that was going on before)

- 5. Account cash balances not adding up to Money balance + Cash balance, so online balance reported is not the full cash balance(s) as before and manual reconciliation had to be done.

On items 1,2 and 4, although there are claimed fixes, I have not been yet able to validate until I get any of these type of transactions

On item 3 and 5 I can verify that these are fixed by Quicken. However item 3 above is a doozy. Unfortunately with the erroneous mapping/concatenation of PAY DATE, new securities were created and thus subsequent downloads caused that cusip code to be related higher in the index than the real security, so next download referring to same would mess up the Transaction again. The following solves the issue. Search for all transactions with PAY DATE in them from your register transactions view. Edit the PAY DATE concatenation out of the security in the Security/Payee field for each erroneous transaction. Make sure no space at end so it now will map to the real security. Then in the Security list (from Window menu item) search for PAY DATE again. You may see a bunch of securities with this added to them. Delete or merge those securities back to the original named security so that when the next download occurs for any holdings of those you may have as investments, it will not look up/convert the wrong security perpetuating the problem. I believe that once you have cleared this hurdle, the phantom transactions trying to match the shares reported will go away (because the shares reported automatically gets fixed when you remove the bogus securities with PAY DATE added). Do the same for any other security name in your portfolio or transaction register view since early July that may have this memo concatenations. They are easy to spot because the memo field is blank.

On item 4, you will see that there is now a dividend cash Deposit and a BUY transaction that is now used. A configuration change may allow that to be a single transaction of Reinvest, but when that may happen or not is not confirmed. Well it is an improvement on the old way of doing it requiring 3 transactions for a dividend reinvestment, not accounting for cost basis properly.

On item 5, the correct combined balance is now showing in the Reconciliation "online balance' view. Before it was only showing one balance between money and cash / sweep holding. For some there may also be a security called ML BANK DEPOSIT PROGRAM. This was trying to represent the other part of cash balances but apparently this has been removed in the latest configuration changes Quicken has made to the ML aggregation. If you don't see this in your portfolio list view, you probably can delete it as it was reported as "removed"

There is no release update as far as I have been told - these fixes have been addressed in config/mapping etc. behind the curtain. So unfortunately for those of us who had these issues arise from the change, you need to manually go through and fix things in the register and security lists as I described above.

For those who did switch back to Direct Connect then you may still run into problems because I had two distinct problems with one account that was still set this way and your mileage may vary - or even run out!

Hope this may help other frustrated ML downloaders!

3 -

Very helpful post - Thank you. Couple of questions/clarifications:

Re #3 - You say this has been fixed (on the Mac side). I'm using WIN, and I sure hope the same is true there. I'm planning on cutting over to EWC+ this weekend and from your analysis, it really does sound like its quite the mess. From what I can tell, ML has, at least for the recent past, been sending security names with all the junk. It looks like Quicken may have cleaned it up. Perhaps the problem is that Quicken has broken, or inadvertently eliminated its "de-concatenating" process?

RE: #4 - If I understand what you described, you're saying that a dividend (or CG) will now be coming down as an "Income" transaction, not a "Cash Deposit", correct? The latter would not be good. The former, along with an accompanying "Buy" would be an improvement over how it works now. A single "Reinvest" transaction (as Fidelity does) would, of course, be the best but hey, we take what we can get.

RE: #5 - There have been a lot of comments about how cash is being handled in the ML threads as well as on the Fidelity threads (I'm going to have have to do that cutover to EWC+ next week as well). I've found that ML has always been a little funky in how it handles cash and I've always done a certain amount of addition in my head to reconcile Quicken to the ML balances. I'm thinking this is not as much of a change as it seems.

Thanks again for posting this.

0 -

Concerning this in my first September 15 post:

"Second, the brokerage account no longer includes my 2 money accounts among the holdings. However, when I went to look at that account after the OSU, I got a popup about checking the cash balance in that account at the ML website and enter the correct balance into that popup. Then I changed focus from the Quicken window to my desktop and the system crashed with some kind of kernel security issue and restarted. When I restarted Quicken, I did not get that popup again even with retrying the OSU. I did notice that there are two placeholder transactions, dated 9/14/2025 (yesterday), that reduce the number of shares of my 2 money accounts to 0. This is the first time I have ever seen a placeholder transaction that did not result from my response to a Quicken popup noting a difference in the number of shares of something between what is shown in Quicken and what is reported by the financial institution. In fact my brokerage account has a number of them for the 2 money accounts starting when they were first added to holdings and for every time money was added to them since as a result of dividends or interest. So I guess I can delete them all now that they no longer are in my holdings. My question is: What do I do to accomplish what the popup would have accomplished had I been able to do it? I did check the website and my cash balance is a lot closer than it was with the 2 money account holdings added to it but it still is a bit off and it was not off pior to this re-authorization."

I know what happened and therefore know how to fix the balance. As I explained in another ealier post, prior to the July re-authorization I got 2 Intinc transactions at the end of each month for my brokerage account: one with the combined whole dollar amount of the interest on both of my money accounts and one with the combined change amount on both of my money accounts. After the re-authorization I got 4 Intinc transactions: a whole dollar amount and a change amount for each of the two money accounts. With my OSU on 9/15/2025, Quicken decided to rewrite history and gave me 4 Intinc transactions for April, May, and June and got them wrong. The July and August ones are (and were) correct. So all I have to do is correct the April, May, and June Intinc transactions and my balance will be correct again. Whoopee! Haven't decided whether to go back to what they were prior to 9/15 OSU (2 transactions) or leave it at 4 but correct them.

Here's hoping that September's Intinc transactions are correct - July and August were - so there's hope.

Thanks

Jim

1 -

What a mess… I'm troubled by the energy we are all putting into this process…

I'd still like to see a formal communication or statement from Quicken on these ongoing issues.

Also, why are these issues a problem with other vendors?

MEL1 -

Things are still not completely working: I got a Deposit transaction on 09/16/2025 that should have been a CGLong transaction in one of my IRAs. So still mischaracterizing some transactions.

0 -

I have found almost all the remaining issues are due to pending transactions. These usually show up with either blank or deposit/withdrawal in the "Action" field of the downloaded transactions , "Null" in the payee field, or the security being not an exact match, i.e. lower case instead of uppercase. These happen with dividend, interest, fees, buy, sell, and transfer transactions. In almost these cases, I can delete those downloaded transactions and wait to accept the "correct" transactions the next day or two when they have been posted on the ML site, and they will post in Quicken correctly.

If Quicken can stop the downloads of pending transactions and just process them after they have posted, which is what was done before EWC+, it would save us much of all the extra work we are having to do.

0 -

IF this is true (and I've seen other posts that seem to say the same), then Quicken should postpone the forced cutover until the unintended download of pending transactions is fixed.

@Quicken Kristina - Can you look into this and pass the info over to the dev team as well as to those who control the schedule? Thanks.

1 -

>> Welcome

Re #3 - You say this has been fixed (on the Mac side). I'm using WIN, and I sure hope the same is true there. I'm planning on cutting over to EWC+ this weekend and from your analysis, it really does sound like its quite the mess. From what I can tell, ML has, at least for the recent past, been sending security names with all the junk. It looks like Quicken may have cleaned it up. Perhaps the problem is that Quicken has broken, or inadvertently eliminated its "de-concatenating" process?

>> I think it will be true as the difference between the OS versions seems mainly to be capabilities. The rawest form of download of transactions, information, etc. is OFX and if you go to the ML site there is a way you can download an OFX. This is direct from web to your machine not middleman. When importing an OFX it maps everything correctly and always has - as people mention in this thread, however who would want to do this for each account instead of using the OSU method. There is one for Win and one for Mac but both files downloaded are the same. Using suppress-common-lines diff the only differences are file timestamps. I don’t know how the sausage is made in the Quicken factory, but the issue seems to be mappings. It seems that the config file mappings for the change in connection is where things may have gone wrong, and I think that the memo field got mapped to the Payee/Security field entities by mistake, the memo field seems to have no mapping so it becomes blanks, etc. etc. so it isn’t really a concatenation issue - it just comes across that way because the additional information is not the correct way to express a Security name.

RE: #4 - If I understand what you described, you're saying that a dividend (or CG) will now be coming down as an "Income" transaction, not a "Cash Deposit", correct? The latter would not be good. The former, along with an accompanying "Buy" would be an improvement over how it works now. A single "Reinvest" transaction (as Fidelity does) would, of course, be the best but hey, we take what we can get.

>> I am not sure for Win as the mappings might be slightly different if there are different entities used in the register processes, however the way it has been is that the cash added is an income transaction, followed by Add Shares (no monies) followed by a payment/deposit remove income. Now they changed that to an Income transaction followed by a Buy transaction with the monies equal to the income so it nets out and accounts for cost basis correctly. I wish they would do a single Reinvest transaction type as you point out the way it occurs with Fidelity. However, Fidelity actually do the same thing behind the scenes and send to Quicken an Income and Buy transaction, however Quicken has a config option behind the curtain that changes it to a Reinvest transaction type. I have pointed this out to ML Digital team and Quicken and hopefully they will get together and select this config option too.

RE: #5 - There have been a lot of comments about how cash is being handled in the ML threads as well as on the Fidelity threads (I'm going to have have to do that cutover to EWC+ next week as well). I've found that ML has always been a little funky in how it handles cash and I've always done a certain amount of addition in my head to reconcile Quicken to the ML balances. I'm thinking this is not as much of a change as it seems.

>> The issue is fixed which is mainly that in Quicken register it tracks a cash balance but obviously cannot distinguish the two elements of cash that is reflected on the ML side. So the solution was to add them together as the reported online balance so you could reconcile to this. This got broken in the cutover so Quicken has now fixed that. The funky aspect of it all (same with Fidelity) is that cash is held in investment type vehicles i.e. money market like SPAXX. Now when Fidelity report a cash balance for reconciliation they include that holding even though it is an ‘investment’ holding, so when they pay interest on it they classify it as a Dividend transaction. So every FI seems to handle things differently and provides Quicken with the options and mappings they want, is my interpretation of what is happening behind the scenes.

Hope this helps to clarify

0 -

Do you mean "not a problem"? If so agree - I have converted many other FI (Fin Institution) accounts to the newer more secure connection method error free over the past few years. I don't know what happened here with ML, they came late to the plate and made a real ear of it and claim it is a "Quicken problem"

2 -

Correct…happy fingers typing.

Why are these issues "NOT" a problem with other vendors?

I've had good success with Vanguard, Merrill Lynch's parent Bank of America, PenFed, KeyBank, USAA, American Express, and Discover to name a few, and all on Quicken Express Web Connect or Quicken Express Web Connect+.

Frustrating… [Removed - Rant]

MEL0 -

I can't even get past the reauthorization screen, when I do agree to link it then says the action is not to sync with Quicken, its a mess. Then one time it did let me and asked that I confirm each balance, so then it added that much more to my accounts, so now the old data is wrong and I don't know, but maybe I should just delete the account in Quicken all together and just check BoA and Merrill direct. What a **** show. And I am paying for this.

1 -

I have migrated all my retirement accounts from Merrill Lynch to Fidelity. Now thinking hard about transferring the taxable accounts as well.

I have never been able to reconcile my Merrill Lynch accounts perfectly in Quicken. I have no trouble at all reconciling my Fidelity accounts.

Both Merrill Lynch and Fidelity are connected via Quicken Connect (Mac). Recently the value of all FHLMC, FNMA and US Treasuries in my Merrill Lynch accounts are all over inflated, above their actual values.

With the migration of Merrill Lynch to Direct Connection, I too have lost Memo details that let me track both:

Foreign Tax e.g. "Foreign Tax Withholding: TAIWAN S MANUFCTRING ADR PAY DATE 10/09"

and

Foreign Depository Fees e.g. "Depository Bank (ADR) Fee: TOTALENERGIES SE DEPOSITORY BANK SVCE"QUICKEN , do you need us, the customer, to complain to Merrill Lynch ?

1 -

@dshemm From personal experience (limited) and from numerous comments in this thread, I've come to the conclusion that the issue lies clearly with Quicken, and not with ML. The main evidence supporting my conclusion is by using the "download data" function on the ML website to get a QFX file (a Quicken-specific OFX format). Running that file opens Quicken (if it isn't already) and Quicken processes the data in that file correctly - including security names and memo fields.

Something is wrong with the way that Quicken is parsing the ML data file in the EWC+(express web connect +) OSU (one step update) processing. Quicken has made some progress recently (it appears that security names and memo fields are parsing correctly, more about that below), however there are still issues with some pending transactions processing 1 day early with incorrect data, and then again the next day with correct data. And cash balances are still out of whack for some users, others are seeing corrections in the cash balances.

As for the security names, for example the one you showed above: TAIWAN S MANUFCTRING ADR PAY DATE 10/09. Now that it appears that transactions are being parsed correctly (at least for me and other users), in order to correct the prior erroneous transactions we have to manually edit each transaction to correct the sec name. Once we complete that step (not saying this is easy or quick, but it is do-able), then the suggestion is to open the Security List, expand that window to see the Delete button on the far right. Choose a security from the list and the Delete button will be either available or greyed out (if there are any transactions tied to that security). If the security is one of the bogus ones (with PAY DATE or any of the other incorrect things that Quicken added previously) AND if the delete button is available, you can delete that entry from the Security List. If it's a bogus name and the button is greyed out, that means there are still 1 or more transactions tied to that security that you need to edit to correct the name.

Hope this helps a little. Quicken still has more work to do. And please don't misunderstand - I'm NOT defending Quicken, nor am I happy with the extreme mess they created with sloppy coding and no testing or quality assurance. They have screwed this transition up royally, and as others have stated on this thread, they owe us all some measure of compensation for the hassles they put us all through.

2 -

@dshemm @WoodCountry "From personal experience (limited) and from numerous comments in this thread, I've come to the conclusion that the issue lies clearly with Quicken, and not with ML".

Although I agree with you that the OFX download is robust, it is a partnership between ML and Quicken to get the mappings correct for the new connection method. The gist of what I heard directly from Quicken engineering is that ML got that wrong. When I speak to ML Digital they point the issues to Quicken. At the end of the day, ML has never really been bothered about customer feedback on Quicken - I have raised issues over time and I have been on this since early July when the fiasco started. When ML Digital tried to explain what was going on with the FI's moving to Quicken Connect (aka EWC EWC+ for Win users), and other aggregators, they gave a whole story that was not at all pertinent to the issues with Quicken. Complete obfuscation. Further, they have asked me to enumerate the issues and asked me for examples. They clearly never tested any of this and when Customer started to complain for weeks now, they somehow have decided not to pull the conversion - why wouldn't they if it is a Quicken problem? They said it would all be fixed by end of August. I'm perplexed why there is no transparency of communication or action being taken on Merrill's side. I guess they think that their system is the official record and Quicken is not. As I said earlier, I have switched Connection methods with many FI's over the last few years (BofA, Eastern, Fidelity, Morgan Stanley, E*Trade to name a few) and not one of them had any issues. So makes you wonder what happened here with ML?

2 -

Got two things to say:

First: I tend to agree with QuickT. The OFX data (what you get from QFX file or with Direct Connect) is generated through a different process than the JSON data which is what you get with EWC+. I suspect that ML's contribution to the EWC+ process is not as good as what it is with the OFX generation process. They've been generating OFX data for years and have the kinks worked out. They are still working out the kinks for the EWC+ process which must be new to them. The shame on Quicken is that they should have done a better job making sure that ML's contribution was working before they allowed ML to use an EWC+ connection.

Second: Got 3 new Div transactions from one of my ML IRAs. All three dated 9/18/2025 in Quicken. I checked the ML web site and saw that one of them is still pending with a trade date and settlement date of 9/19/2025. There are 2 other pending Div transactions with the same dates that were not downloaded. The other 2 downloaded transactions were not pending and had dates of 9/18/2025. Those 2 9/18/2025 transactions were pening yesterday and not downloaded. And yes: I am looking at the ML website's recent activity when I do OSU. Seems like a prudent thing to do.

1 -

More on "Second: Got 3 new Div transactions from one of my ML IRAs…"

This morning I got the two Div transactions that were pending yesterday. Today they were not pending. BUT: they came in as Deposit transactions rather then Div transactions. So I had to correct them.

So the last five transactions for this IRA were all Div transactions that were pending on one day and not pending the next day and they were handled differently from each other.

1 -

Thanks for all of the comments and experiences with the Quicken Merrill Lynch EWC+ transition…

This thread is just making me steam!

The time I've wasted testing a product I am paying for, especially given my 7 Quicken accounts and many Merrill Lynch accounts is frustrating.

I've had good success with Vanguard, Merrill Lynch's parent Bank of America, PenFed, KeyBank, USAA, American Express, and Discover to name a few, and all on Quicken Express Web Connect or Quicken Express Web Connect+.

Today I tested a small Quicken account that I actively use to help manage my child's account. The EWC+ downloaded data was useless. I deleted it. I had to go out to the Merrill Lynch web site and manually re-create the transactions, actually, I downloaded the Merrill Lynch QFX file as these still are the only download options that work for me…

MEL0 -

I had this same experience. Pending dividends downloaded yesterday were just deposits so I deleted them expecting them to be correct today since that has generally been the case the last couple of weeks. But, no, today the posted dividends still downloaded as deposits. Interestingly, the security name was in the description field, not in the security field. I had to manually change about 8 transactions today. Why has nobody from Quicken responded to this lately? Very frustrating!

0 -

Hello @WoodCountry,

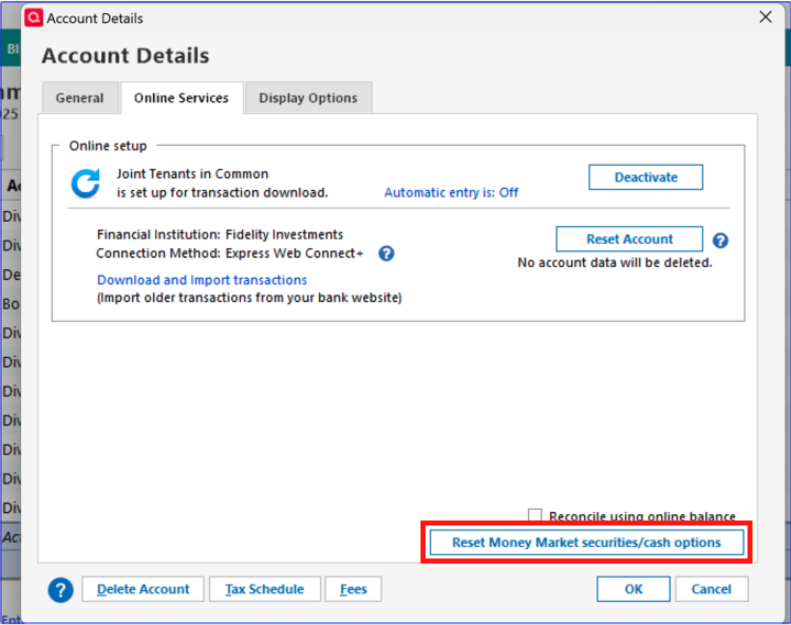

If the account has the option, you should see a button, like in the screenshots below.

Hello @jdparker225,

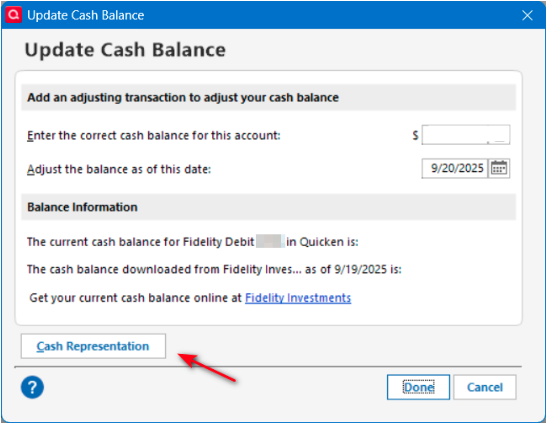

If you need to adjust the cash balance, you can click the blue cash amount near the lower right of your investment register, or click the gear icon and select Update cash balance… option.

That will bring up the windows that shows in your first screenshot. It performs the same function as the pop-up you saw prior to the crash. You input the correct information and it will add an adjustment to the cash balance in your account that will bring your cash balance to the amount you specified.

Did this behavior just start today?

Thank you for letting us know you're seeing this behavior also.

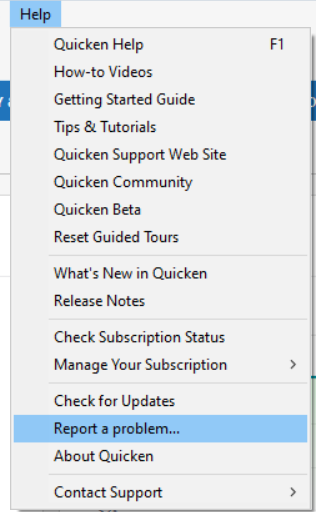

@jdparker225 & @Michael Sloss,

I'm not seeing any existing tickets for the issue with pending dividends downloading as deposits. I reported the issue to the proper channels for further investigation and resolution. Please navigate to Help>Report a Problem and send a problem report with log files attached. Please also include samples of the dividend transactions that incorrectly downloaded as deposits. If possible, please include screenshots showing the transactions on the Fidelity website and how they downloaded into Quicken. (Note - Problem Reports allow a maximum of 10 attachments, if you need to include additional attachments, please send a 2nd problem report.)

Thank you!

(CBT-825)

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

1 -

Thank you for responding. I forgot to mention in my post that I did send a report for this issue today with a screenshot.

Did this start today? For posted transactions, yes. Or more specifically, it returned after it appeared to have been fixed for several weeks.

For pending transactions, no. I and many others have posted numerous examples of pending transactions causing this and other issues ever since the switch to EWC+. Fixing OSU to only download posted transactions should be the highest priority for Quicken and ML, IMO. Pending transactions have never downloaded with any accounts before this, and it needs to go back to that basic standard.

2 -

For me it was not the case that pending dividends downloaded as despoits. In one case, on 9/18/2025, a pending dividend downloaded as a dividend but with the wrong date. Two settled dividends on that date downloaded as dividends. It was two settled dividends on 9/19/2025 that downloaded as deposits. These two dividends were pending on 9/18/2025 but did not download. I did just submit a problem report.

2 -

Thank you for your replies,

Thank you for the additional information and for sending logs. I updated the ticket with this information.

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Perhaps demonstrating my profound grasp of the obvious: I suspect that there is a disconnect between the data on the ML website and that which is on the EWC servers. There may be more to it than that but I'm guessing that that is at least part of the problem. I am also guessing that, although the disconnect may in part be a delay in getting the data, the disconnect is not simply a delay in the data getting to EWC servers.

2 -

I was somewhat taken aback today when I received an e-mail from Quicken regarding a yearly subscription prices increase to $101.88 (Quicken Classic - Premier)…

"We’re writing to let you know that your Quicken Classic subscription price will increase at your next renewal. Until then, your current rate stays the same. We’ve included all your renewal details below.

Your continued support helps us keep improving the product you rely on — from fixing over 200 bugs to enhancing performance."

I replied to Quicken with the following e-mail:

"I’m currently paying for a subscription service for a product that is broken. The Quicken “Direct Connection” to the “Express Web Connection +” with Merrill Lynch has been broke since it was initiated and with the hard cutoff transition of 9/22/25, it still fails to work correctly. Feedback on the Quicken support forums confirms this fiasco.

[Removed-Disruptive]

Thank you,"

MEL1 -

UPDATED 9/23/25 Bank of America/Merrill Lynch - Cut-Over Migration — Quicken

https://community.quicken.com/discussion/7965587/new-9-3-25-bank-of-america-merrill-lynch-cut-over-migration

Quicken AlyssaQuicken Windows Subscription Moderator mod3:12PMUPDATE 9/23/25The previous force cut-over scheduled for 09/22/25 has been postponed. There is currently no ETA for when it will resume.We are still encouraging everyone to make the switch soon to prevent interruptions.Thank you!MEL0 -

My current issue with Merrill EWC+ is that for dividends, I end up with duplicate Div and Deposit transactions for the same amount. So I have to delete the Deposit one manually.

0 -

@DougSharpe - That is because you get a deposit transaction for the the pending dividend the day before you get the correct one after it is posted. Just delete the first one instead of accepting it until they get around to fixing this.

0

Categories

- All Categories

- 54 Product Ideas

- 34 Announcements

- 240 Alerts, Online Banking & Known Product Issues

- 20 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.1K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub