IRA Transfers and Dividends Qualified vs. Unqualified

Hello,

We have two suggestions for Quicken software:

- When we make a transfer between IRA accounts at different brokerages, Quicken requires specification of which year to record the IRA contribution. But it is not a contribution, there should be a way of recording inter-IRA transfers without marking them as contributions.

- It would help for record-keeping purposes if there were a way of distinguishing qualified vs.non-qualified dividends. Obviously, one cannot know this information in real-time, the information does not appear until the following year's 1099-DIV's are received, but it would help if this information could be recorded somehow.

Thank you.

Comments

-

Hello @Howard1,

I went ahead and changed your post to an Idea so other users who have the same or a similar request can vote on your idea by clicking the up arrow (see below).

Ideas are also reviewed by our Development and Product teams in order to improve Quicken and implement new features requested by customers.

Thank you!

-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.0 -

For your first idea, are both of your accounts marked as Tax deferred in the Account Details, and are they both traditional IRAs? If so, I agree a transfer (known technically as a Rollover) should not be flagged as a Contribution.

Also in the receiving account, if you go the Account Details and click on Tax Schedule, what tax line item does it show for does it show for Transfers in?

For your second idea, please review and vote on this active Idea post. There are several options on how it might be implemented. To vote, go to the top post in the discussion ad click on the little up arrow below the vote count. This Idea already has 37 votes; it takes about 50 votes before an Idea is considered for implementation.

QWin Premier subscription0 -

…are both of your accounts marked as Tax deferred in the Account Details, and are they both traditional IRAs? If so, I agree a transfer (known technically as a Rollover) should not be flagged as a Contribution.

The IRS considers tax deferred account rollovers as two tax-related events: 1) A distribution event from one account and 2) A contribution event to the other account.

We should also be receiving two tax forms for rollovers: Form 1099-R for the distribution from one account and Form 5498 for the contribution to the other account. We need these forms when completing our tax returns so the IRS knows whether or not the distribution is a taxable distribution or a non-taxable rollover.

This Contribution flag occurs only from Jan 1 - Apr 15 of each year. This is because the intent of an IRA or 401K distribution in this window can either be a prior year contribution or it can be a current year rollover contribution. Quicken has no way of knowing which it is unless we tell Quicken which year the contribution applies to. This Contribution flag is where we tell Quicken which it is and that has big implications as to how Quicken captures the data in tax reports and the Tax Planner.

I think it is important for Quicken tax reports and Tax Planner to show data that matches the tax forms we will receive from the brokerages and in projecting our tax liability. IMO, that Contribution flag for the Jan 1 - Apr 15 window is not only desired but it is necessary. So, I would not favor changing it.

Quicken Classic Premier (US) Subscription: R66.12 on Windows 11 Home

0 -

I know that Quicken asks for which year a contribution is for, but can anyone tell me where that information is actually used in Quicken?

I can't find any place that I see it.

Signature:

This is my website (ImportQIF is free to use):0 -

The contribution year is used in the Tax Schedule Report and perhaps other Tax reports.

However it is used incorrectly in the Tax Planner and Taxable Income YTD. See this discussion

and this one

QWin Premier subscription1 -

Here are two contribution transactions I entered into a in a test file…one for 2025 and one for 2024. Note where the contribution year appears in the transactions lines.:

Here are how these 2025 contribution transactions, one made in 2025 for 2025 and one made in 2025 for 2024, appear in the Tax Reports and Tax Planner:

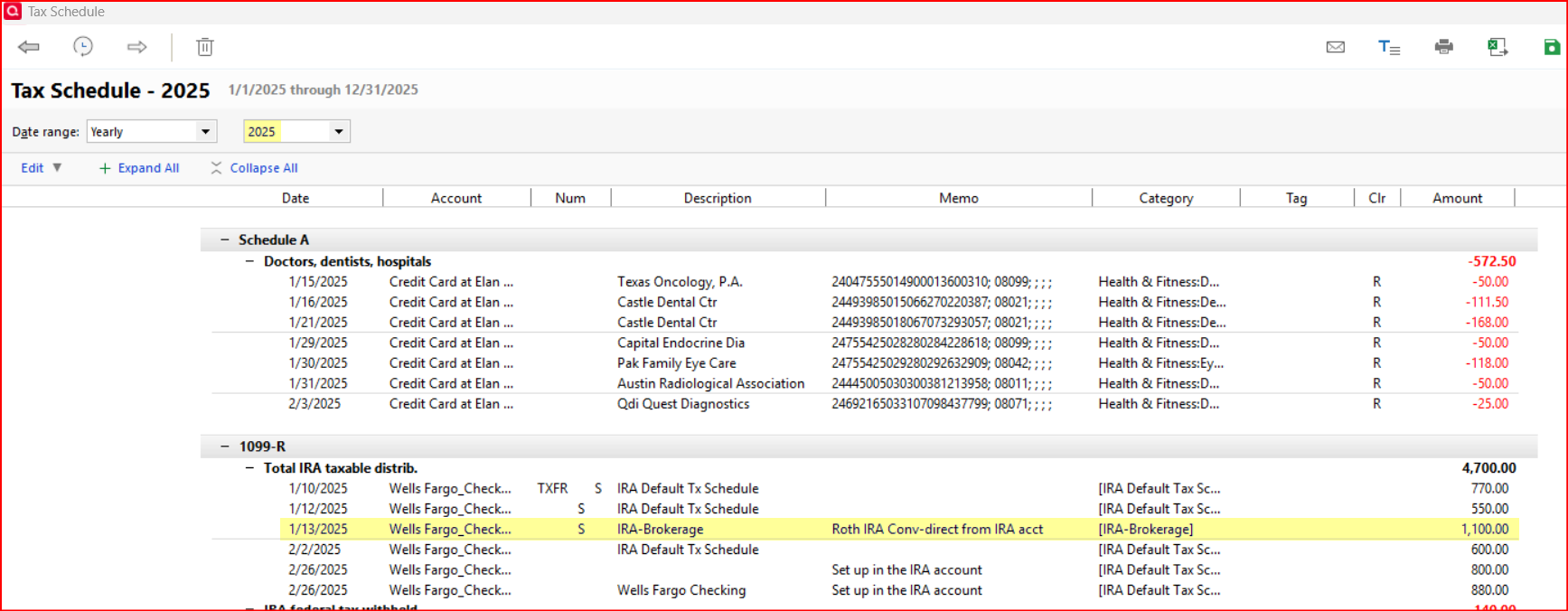

- Tax Schedule Report:

- Tax Summary:

- Tax Planner:

Unfortunately, I could not find where a 2024 IRA contribution made in 2025 shows up in the Tax Planner for 2024. I believe it should be showing up under Adjustments > Allowable IRA Deduction but in my test file it does not. A bug?

Quicken Classic Premier (US) Subscription: R66.12 on Windows 11 Home

1 -

Thank you guys, I really appreciate it.

Signature:

This is my website (ImportQIF is free to use):0 -

Thanks, @Boatnmaniac

Except for the 2024 tax planner and the associated 'contribution' made in 2025 (your final comment), I think I am seeing all transactions properly reported. Is that the way you (and others) see it, or am I missing something?

0 -

That's how I'm seeing it, too.

Quicken Classic Premier (US) Subscription: R66.12 on Windows 11 Home

0

Categories

- All Categories

- 46 Product Ideas

- 34 Announcements

- 246 Alerts, Online Banking & Known Product Issues

- 22 Product Alerts

- 513 Welcome to the Community!

- 679 Before you Buy

- 1.4K Product Ideas

- 55.4K Quicken Classic for Windows

- 16.8K Quicken Classic for Mac

- 1K Quicken Mobile

- 829 Quicken on the Web

- 123 Quicken LifeHub