zzz-Fidelity Updates

Comments

-

No. The option is greyed out - I cannot select complete tracking for the Vanguard accounts. It has a link saying "Why can't I change…." which elaborates to saying can only choose simple with EWC - but the method shown on online screen is DC. Basically the same thinkg that was happening with Fidelity after trying to convert back that the create copy was meant to solve. However for me it has broken Vanguard :(

0 -

@geoffj were you using DC with Vanguard before the copy/template? Is it possible you somehow switched to EWC+ for Vanguard when you reconnected in the new file?

If you were using DC before and didn't accidentally switch to EWC+ check in the original file to make sure your FI name is the same in the copy as it was in the original for Vanguard.

If you can't get Vanguard working, I'm sorry it doesn't work, although you can switch back to your previous file (the one you made the copy from) without any issues and without having to restore a backup.

Barry Graham

Quicken H&B Subscription1 -

@geoffj This will solve your Vanguard issue BUT look below - I have a way based on this that you can use with your original file that won't break your Vanguard. Thanks to @Boatnmaniac

Barry Graham

Quicken H&B Subscription0 -

@Boatnmaniac thanks to your post I have figured out a way to restore DC to Fidelity using Complete Tracking without having to do a file copy. I will post more information later.

Barry Graham

Quicken H&B Subscription1 -

And still no further update on @Quicken Anja 's post almost a week later. But thanks @BarryGraham, at least I'm back to where I started with the DC connections. What utter nonsense.

0 -

I will be looking for your post on this! (I have not been keeping up on everything in this thread for the last couple of weeks because we've been moving and that is quite time consuming. So if you posted this previously I apparently have missed it.)

Also, wrt to you prior post: I am not aware of any way to set up Fidelity downloads with DC using Add Account or Set Up Now because the zzz-Fidelity Investments - DC financial institution is not included in the selection list. At present the only way that I've been able to get the DC connection working again is to restore a backup file from before the EWC+ migration.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

For those that didn't try my method to revert to DC, here is a way that doesn't require making a Template copy of your file and therefore doesn't require setting up download for all your accounts and doesn't break Vanguard. @geoffj you can use this method with the file you had before you did the copy/template that broke Vanguard.

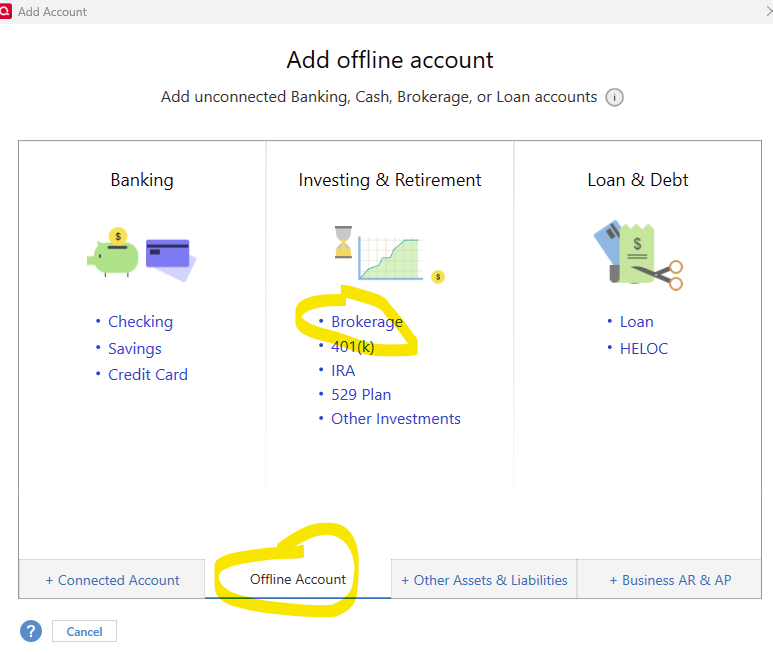

(1) If you have Brokerage accounts create a new manually tracked account (call it anything, say "TempBrokerage"). You will need to complete the dialog. Since this account will be deleted later it doesn't need to be perfect.

(2) If you have 401k accounts create a new manually tracked account (call it, say, Temp401k), using the same method but selecting "401k" instead of "Brokerage" on the screen above. You will need to complete the dialog. Since this account will be deleted later it doesn't need to be perfect.

(3) Go to the Account details of each of these.

(4) For the new Brokerage account on tab one type "zzz-Fidelity Investments - DC" for the financial institution and for the 401k account type "zzz-Fidelity NetBenefits".

(5) For each of the affected accounts, deactivate the account then on the first tab of "Account Details" blank out "Fidelity Investments" and click "OK" to close Account Details.

(6) On each of the new manual Brokerage and 401k accounts, go to Account Details, go to the second tab and click on "Set up Now"

(7) Connect to Fidelity and when it shows you the accounts, select the "Link to Existing account" option and link it to the right account (you will need to make sure you know the account numbers from logging in to the website - and you can hover over the account name in the menu that asks you to match accounts, in order to see the account number

(8) This will result in the accounts being set up or DC, with complete tracking - and won't break any other accounts like Vanguard. You can now delete the TempBrokerage and Temp401k accounts that you created earlier since you don't need them anymore.

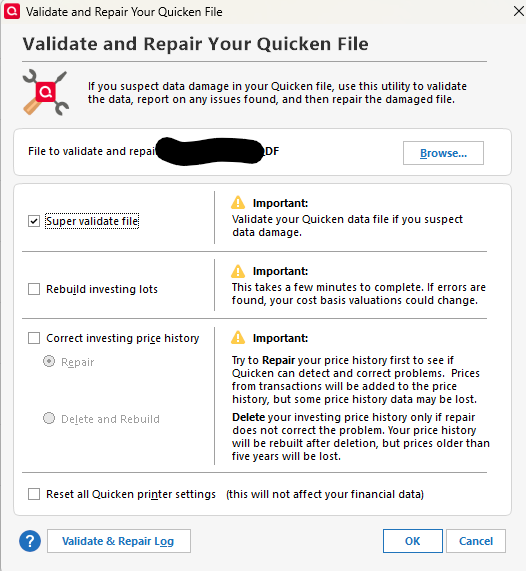

(9) Backup your file then Super validate the file using CTRL+SHIFT+File>Validate and Repair File, select the box shown and press OK -then wait a few minutes.

Barry Graham

Quicken H&B Subscription6 -

@BarryGraham Your steps worked for me (for two difference Fidelity login IDs, just repeat steps 5 and 6 for each login). However, it only downloaded activity for 1 day, so nothing historical downloaded. I will have to wait until later this week until I have transactions to confirm that new transactions are downloading.

However, all of the accounts retained complete tracking. Great find!

1 -

I second the thanks and applaud your research. Quicken owes you a free subscription for a couple of years imo — and I'm sure that doesn't come close to the number of hours you've spent banging on this.

@Quicken Anja @Quicken Kristina et. al. — why isn't Quicken posting stuff like this? Or revealing it during multi HOUR phone calls with support? Or updating ANYTHING in more than a week? Or letting this happen in the first place?

1 -

It's unfortunate that few folks, who have migrated to Fidelity/Quicken EWC+, are posting on what specifically works for them and needs further improvement, respectively, beyond general comments of EWC+ not working for them at all and seeking to return to DC. It would be helpful, to compare with one's experience and instructive to Fidelity & Quicken for additional EWC+ improvements - given that all Quicken users will end up on EWC+, eventually. Please note: this is not a complaint, this forum is named "zzz-Fidelity Updates" after all, it's apparently just difficult for a dedicated constructive Fidelity EWC+ Quicken forum to gain traction. That's it from this end, that's the comment.

0 -

@Quicken Anja My connection is currently working but I worry that Quicken will make changes between now and month-end and mess up my month-end transactions. Can we get a commitment for no changes from now until at least Sept 5th? I'm sure I'm not alone with this concern.

P.S. I'm using the legacy "zzz - Fidelity Investments - DC" connection on multiple Fidelity accounts.

1 -

Thanks! I'll settle for superuser status in this community instead! Seriously though it was rewarding enough just being successful finding a workaround that doesn't require creating a new file. I have to thank G-d for the inspiration and @Boatnmaniac for posting his help referred to above.

I think they didn't post it because nobody there figured it out like we did here. They should have had people trying to figure it out but maybe this just shows the value of this community.

Barry Graham

Quicken H&B Subscription2 -

I posted this elsewhere in the thread an perhaps off topic but not for this post which is one of the two I was trying to reply to. Someone else mentioned Win 11 need for TurboTaz too. No TPM module or BIOS setting changes needed and the script for working around it is covered:

On Windows 10 Dilemma. I've successfully updated two elderly PC's to run Windows 11 (with updates since then) normally, using this tool: Find a complimenting YouTube Video and of course, have your data well backed up before you pull the trigger. One of my functioning Win 10 machines probably started with Win 7 and is about 14 years old. Only update I'd done with it quite some time ago was to an SSD for the OS. Kept data intact but of course a Clean install is an option. It bypasses Microsoft's HW checks BUT does check for some immutable barriers that might exist on your machine before leaving you to decide what to do. Give the developer a few $$ if it works for you.

-1 -

Barry - you are a genius, and persistent! That has worked for me now back to where I was a month ago before this fiasco started. Hopefully they'll get it right before forcing us to EWC+

0 -

Frankly I got no correct transactions at all on the EWC+ connection to my 401k and BrokerageLink accounts. I only got silly realized gain amounts - this was from rebalances and sell orders.

0 -

If there aren't Quicken engineers seeing all these posts who have access to the source code (and thus could see straight off what would work and what wouldn't), that's scary, sad, whatever — pick your adjective of disgust.

1 -

I switch to the Fidelity EWC+ when it was first prompted. Day One problems:

- Switched all Fidelity accounts to Simple Tracking. I went in and switched all back to Complete.

- Switched the Account Type of many of the accounts. IRA's and Roth changed to Taxable. Can't remember how many I had to fix, not all, but most.

No new transactions have been downloaded. However, it didn't appear to mess anything else up either. Other than what I mentioned above. It would be nice to download transactions, but that has not happened. I have been adding my transactions manually.

Today I got my first download of Fidelity transactions. Not everything that was missed during the month. But previous day's transactions. They were all listed as "match" (I believe that was the word) because I had already entered them manually. So I just accepted the match.

It tells me my balances do not match, but that is because a rounding difference on the number of shares on one ETF. Annoying, hopefully it gets fixed.

Also, appears to want to treat my default MM fund (SPAXX) as a fund, whereas it always treated it as cash before. Would rather it kept treating it as cash. Hopefully that is fixed also, or there is a solution. Funny, that is say my Shares of SPAXX is off but doesn't care that my cash balance matches how my cash balance shows on Fidelity website. Fidelity website shows my SPAXX as a cash balance, that is how it was also displayed in Quicken.

Waiting and wishing to get this resolved and move on. Wanting to hear of options, I bookmarked several discussions about this issue. So now my inbox has been almost as annoying to deal with as Quicken. Sorry for the one more email everyone who has bookmarked this discussion.

0 -

The company I work at makes money selling AI assistants that decipher legacy code (adding explanations and comments) because nobody remembers how it works and the code is poorly (if at all) documented. So it's not surprising if Quicken doesn't have staff to decipher their source code. This is commonplace in many companies.

Barry Graham

Quicken H&B Subscription0 -

Thanks, and you get credit because it was your issues with Vanguard that got me exploring to see if there had been similar issues with Vanguard and that's how I found @Boatnmaniac 's solution to the Vanguard issue which led me to think of my solution for this.

Barry Graham

Quicken H&B Subscription0 -

I have worked on static software analysis tools and neural networks in past lives, so I feel your pain, Barry. ;-) Regardless, decent engineers can still read old code and debug it. And good engineers can rip it out and replace it with something better. I presume that's what Quicken Mac is meant to be — but it's still not at feature parity, and the migration of data from Quicken Windows is a dismal experience still, e.g., dropping transaction attachments! I'm sorry, you won't find much sympathy here for Quicken's litany of bugs and terrible QA.

0 -

My Fidelity (EWC+) has also returned to counting CD shares as sets of $100, but still shows the price around $1, so the number * price does not equal to the actual value of the CD. I adjusted all my CDs back at the end of July to be 1 share for each $1, so Quicken is now saying my number of shares do not match. I am also living with this mismatch for now to keep my CD values correct.

I also noticed that the last two dividend repurchases showed shares at 3 decimal places, so it seems that the 2 vs 3 decimal place problem has also been fixed.

2 -

@Bill6 @bmbass Thank you for your helpful input and feedback as active Fidelity/Quicken EWC+ users - very much appreciated! Yes, we also do see continuous change and some progress from our end, and look forward to how month-end August/ September transaction downloads under EWC+ will go.

Let's continue to compare notes with other EWC+ users, going forward. Undoubtedly, our feedback, both positive and negative, will support the Fidelity/Quicken teams working on the migration, as well. In the end, every Quicken with connected Fidelity accounts will be using EWC+, all the rest is, in the end, just transitory.

0 -

It's unfortunate that few folks, who have migrated to Fidelity/Quicken EWC+, are posting on what specifically works for them and needs further improvement, respectively, beyond general comments of EWC+ not working for them at all and seeking to return to DC.To get a list of issues, I asked ChatGPT the following.

Please read all pages of https://community.quicken.com/discussion/comment/20503939#Comment_20503939?utm_source=community-search&utm_medium=organic-search&utm_term=zzz and create a bulleted list of problems with EWC+.

ChatGPT said:Here’s a refined summary of the problems users report with Fidelity’s Express Web Connect+ (EWC+) connection to Quicken, drawn from the specified comment thread and broader related feedback across the Quicken Community:

1. Transaction Issues & Incomplete Tracking

- Automatic Downgrade to “Simple” Tracking

After switching to EWC+, accounts that were previously set up for Complete Tracking lose investment detail—for example, transaction-level data, splits, and cost basis disappear, making Quicken less useful for tracking investments properly. Quicken+15Quicken+15Quicken+15Quicken+2Quicken+2 - Incomplete Transaction Downloads / Unknown Securities

Transactions download only as a lump sum or generic entries—especially in retirement or 401(k) accounts—and are labeled as “unknown security,” requiring users to manually reconstruct each item. Quicken+7Quicken+7Quicken+7

2. Duplicates, Mismatches & Identifiers

- Duplicate Downloads Due to New Transaction IDs

EWC+ appears to use different identifiers for transactions compared to the old Direct Connect (DC), causing Quicken to treat previously downloaded transactions as new. Users must delete duplicates manually. Quicken+11Quicken+11Quicken+11 - Historical Transactions Re-downloaded

Along similar lines, past transactions often reappear and fail to match existing entries in the register, compounding cleanup effort. Quicken+8Quicken+8Quicken+8

3. Cash & Money Market Fund Misclassifications

- Cash Sweep Funds Misclassified

Funds like FDRXX or SPAXX, intended as cash equivalents, are inconsistently treated—as securities, bank transactions, or simply not recognized correctly—leading to mismatched registers and confusing messaging. Quicken+2Quicken+2Quicken - No User Control Over Cash Representation

Users cannot manually override how Quicken handles these funds—they prefer cash tracking, but Quicken forces a securities approach. Quicken+13Quicken+13Quicken+13

4. CDs & Price / Quantity Errors

- CD Prices Divided by 100

Prices for Certificates of Deposit (CDs) become off by a factor of 100 (e.g., from 99.99 to 0.9999). Quicken flags such changes with errors and mismatched quantities. Quicken

5. Account Setup & Tracking Confusion

- Connection Labeling Conflicts

Previously set-up DC accounts now display as “zzz‑Fidelity Investments – DC” or “zzz‑Fidelity NetBenefits,” signaling the upcoming change but causing confusion. QuickenQuicken+5Quicken+5Quicken+5 - Switching Back to DC Still Switches to Simple Tracking

Even after reverting to DC, accounts may still default to “Simple Tracking” or falsely report connection via EWC+, frustrating users who want to retain DC-level detail. Quicken+14Quicken+14Quicken+14

6. Errors & Connectivity Failures

- Frequent CC‑501 / CC‑506 Errors

These errors pop up across Fidelity and even non-Fidelity accounts during updates, indicating server or connection-level problems—not user error. Quicken+9Quicken+9Quicken+9

Summary of EWC+ Reported Issues

- Loss of Complete Tracking, leading to limited transaction detail

- Transactions labeled as “Unknown Security” or requiring manual matching

- Duplicate transactions due to mismatch in identifiers

- Money market funds treated inconsistently or misclassified

- No ability to control how MMFs are categorized (cash vs security)

- CD pricing off by 100×, with resultant balance errors

- Confusion over “zzz‑” prefix and account connection state

- Failed attempts to revert to DC still result in compromised tracking

- Persistent connection errors (e.g., CC‑501, CC‑506), affecting reliability

If you'd like, I can also group these issues by user impact (e.g. accuracy, usability, reconciliation) or suggest procedural workarounds until the issues are resolved—just let me know!

3 - Automatic Downgrade to “Simple” Tracking

-

Hi@RayThank you for the detailed and specific overview of EWC+ issues, which is helpful. Have you personally migrated to EWC+ and are directly experiencing all of those issues, currently? Thanks.No, I still use DC. Fortunately, I saw this forum before I was offered the update. I went through a similar disaster years ago when they changed the connection with Schwab. It literally took days to fix my accounts. I'm sympathetic to those who've made the change as the only recovery is to edit if they want correct history. Even my existing DC has problems in matching downloaded transactions to the correct security and fractional errors in the number of shares. Quicken 's incompetent management let this happen and won't even provide advice, status, or apologies.

0 -

@Ray Thank you for the update and information. I and other current EWC+ Fidelity/Quicken users will provide an update of the EWC+ status subsequent to the forthcoming month-end One-Step-Updates. This will provide first-hand information to Quicken users on this forum on the current state of affairs in respect to the Fidelity/Quicken EWC+ update process, which is continuously developing, as @bmbass pointed out in her/his earlier post, which I personally noticed also.

0 -

[Removed - Disruptive]

0 -

@BarryGraham, Unfortunately, I followed your steps and had transactions yesterday in Roth IRAs. The DC OSU today did not pull any transactions. So even though your steps allow it to be linked, it doesn't seem to be pulling transactions.

0 -

Regarding "In the end, every Quicken with connected Fidelity accounts will be using EWC+, all the rest is, in the end, just transitory."…

Back when Wells Fargo was forced to EWC+ I complained about the privacy intrusion. Luckily in that, DC was still capable of being set up — although previously a 2-factor authentication token would be required as configured on my account, and was somehow no longer required when using DC in Quicken.

Now we're being forced to EWC+ with no recourse, even though the prior systems already exist and work. The new system requires inclusion of a 3rd party (Intuit) with complete access to our account information. Thus, my 30 year "transitory" period with Quicken is complete. I have converted my data (all 30+ years!!) to <removed - 3rd party software> and everything works surprisingly well. Imports are manual but at least there's a viable method to import from CSV without manually manipulating the file beforehand.

I strongly prefer the Quicken interface and download convenience and am willing to pay the annual fees. Going backwards on privacy however is non-negotiable and I'm done hoping for the best. If DC is brought back as an option with 2FA, as was available YEARS ago, I'd consider returning — but with a limited window before the conversion back to Quicken would be painful, I'm not holding out hope.

I don't envision a large exodus from Quicken because of this, enough people just don't understand the consequences. Congratulations, Quicken — you now have 8 or so months of my subscription $$ that will go unused, spend it wisely. Best of luck to all working through the transition, I hope all gets resolved and goes well for you.

1 -

I saw the same, so I did a super validate and it did start downloading. I need to add this step to my solution.

CTRL+SHIFT+File>Validate and Repair File, select the box shown and press OK -then wait a few minutes.

Barry Graham

Quicken H&B Subscription0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub