Tax planner does not include correct paycheck info

Tax planner has recently (after last update) become unable to find any scheduled / future paychecks for total wage projections and thus defaults to "estimate based on YTD average". This makes "remaining tax due" inaccurate. I am using current release of Quicken Classic Premier for Windows.

Best Answers

-

Hello All,

Thank you for providing problem reports and all of the helpful information.

This issue has been reported and is being investigated by my team. Please keep in mind, there is no current ETA. However, I will update this thread with any new information as I receive it.

Thank you all for your continued support and patience!

(CTP-13623)

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

@Boatnmaniac thanks updated this way and the tax planner issue is fixed

0 -

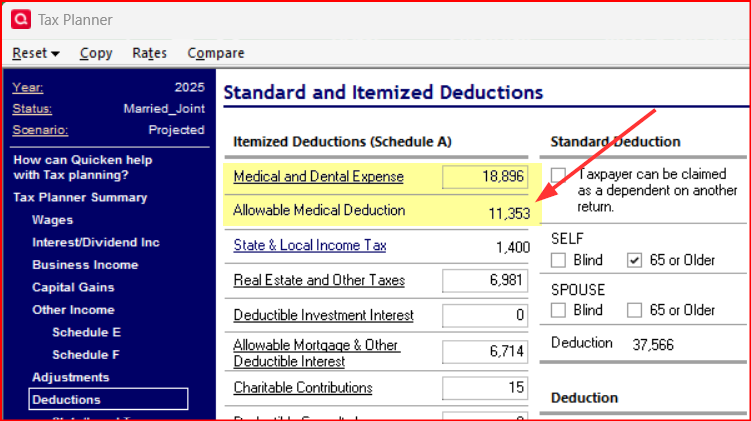

Tax planner does that calculation automatically. It shows all of the transactions in the Medical and Dental Expenses data entry section but if you go up to the Deductions level you will see that it distinguishes between the total expenses and the Allowable Medical Deduction.

In this regard it works just like every tax software in the market: Enter ALL of the deductions data and the software will then determine how much of that is going to be deductible.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

1

Answers

-

Tax planner cannot see my scheduled paycheck wage info. The option to select "scheduled bills and deposits" for "wages" is greyed out. It then defaults to " estimate based on YTD daily average" which is incorrect. Interestingly, the projected federal and state tax withholdings for each paycheck are being tracked correctly and the "scheduled bills and deposits" option is available and correct for those categories. I am using current version of Windows Classic Premier. Help! Tax planning is the #1 reason I use Quicken!

[Merged Post]

0 -

I'm having the same issue and reported to Quicken.

0 -

Thank you for bringing this issue to our attention.

Could you please provide the exact steps that you take that result in this issue? This is so that I may attempt to replicate the issue and better assist you with the next steps.

Let me know!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

My issue isn't resolved, I just noticed the problem today.

0 -

Thanks for responding! I understand that you are still experiencing this issue. Would you mind using my previous response to provide the exact steps to replicate this issue and to submit a problem report?

Let me know, thanks!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

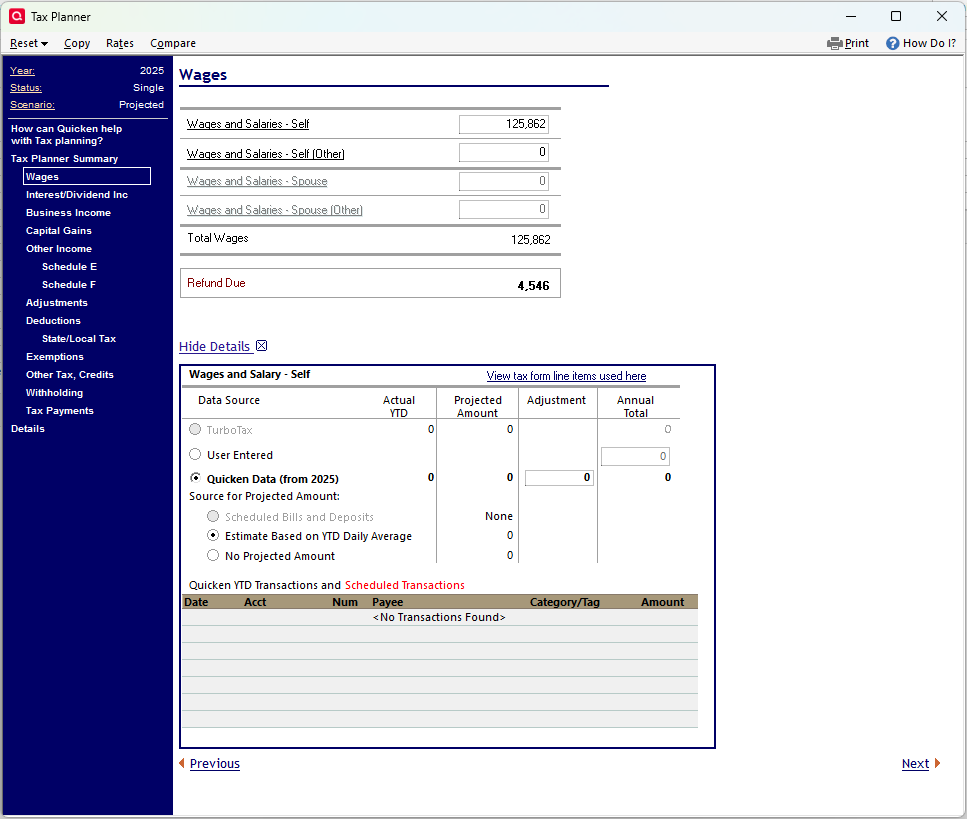

I have the same issue. Ever since the last update. The steps taken

- Click "Planning" on banner at top of screen

- Select "Tax Center"

- Click "Show Tax Planner"

- Click "Wages" on the left menu

From there, the table "Wages and Salary - Self" does not show any wage income info from my paycheck. It does not have any YTD values, and the option to select "Scheduled Bills and Deposits" for the "Data Source" is greyed out. The table "Quicken YTD Transactions and Scheduled Transactions" is empty. There are values in the Annual Total, but I don't know where that data is coming from and the numbers don't make sense.

0 -

I totally agree. The Tax Planner has stopped tracking scheduled (or prior) paycheck wages. The details table is either blank or contains minimal pre-tax deductions (like only 401k deductions) and the taxable paycheck income totals are not accurate and the option for scheduled future transactions is greyed out. Please fix this!!!!!!

0 -

Hello @hurtmj,

Thank you for joining this thread and for sharing the steps to reproduce this issue. Could you please also submit a problem report using the instructions I provided earlier?

Let me know!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

Quicken Jasmine - I also submitted a problem report regarding this Tax Planner issue. I started the thread.

0 -

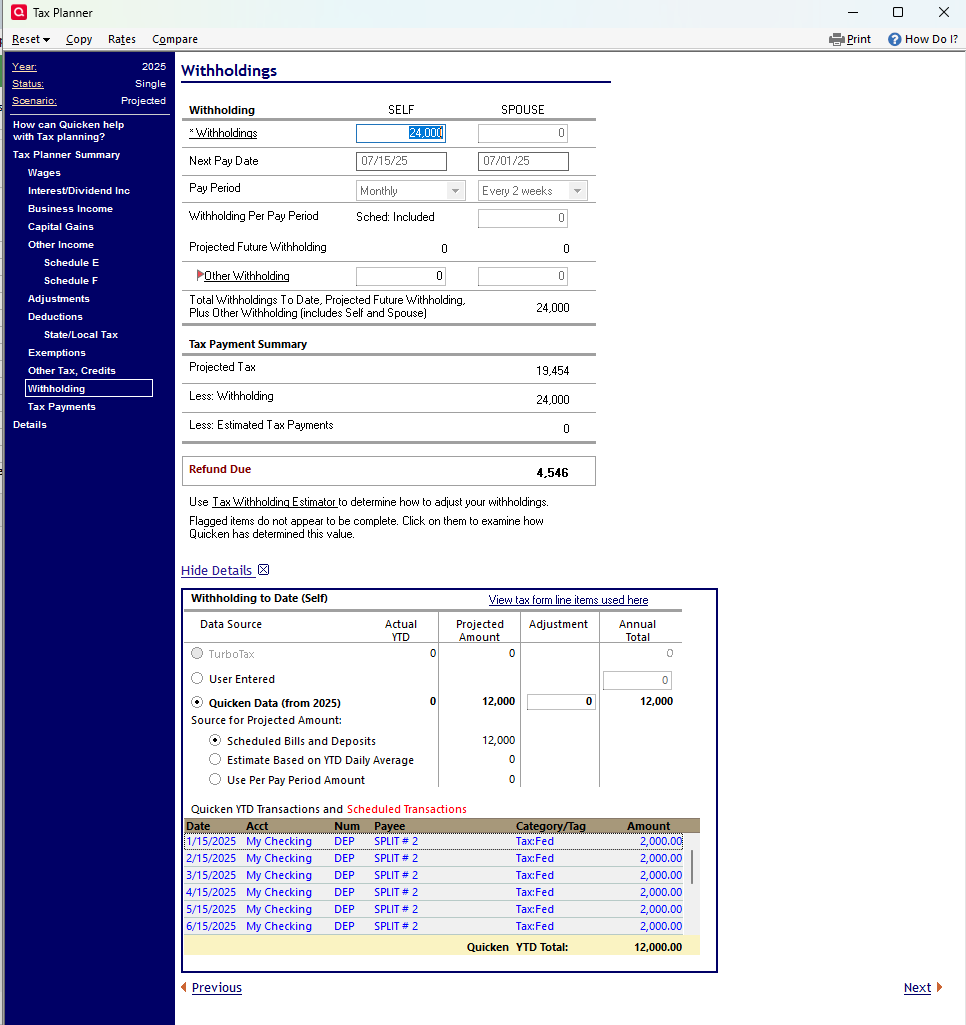

I tried creating a new sham paycheck and the future wages for this new paycheck were not tracked in Tax Planner. All the future after-tax deductions (Fed / State tax, etc.) were tracked correctly.

0 -

Hello All,

Thank you for providing problem reports and all of the helpful information.

This issue has been reported and is being investigated by my team. Please keep in mind, there is no current ETA. However, I will update this thread with any new information as I receive it.

Thank you all for your continued support and patience!

(CTP-13623)

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

with release 63, I noticed that on the projected tax summary, tax withholding from my scheduled paycheck was showing correctly, but wages were not. "no transactions"

when I went back to release 62, it showed correctly.

this is a bug that needs to be fixed.

0 -

Hello @Carousel Kate,

Thank you for letting us know you're also impacted by this issue. I merged your post with the ongoing discussion on this issue. Per @Quicken Jasmine's earlier post, this issue has been reported and is being investigated:

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

I am also experiencing this issue. My wages no longer appear as scheduled transactions in the tax planner. All results are based on "Estimates based on YTD Average"

0 -

Is there a way to go back to previous version so I can use the tax planner? This is one of the main reasons I use Quicken.

0 -

Hello @mmidori,

If you want to try rolling back to a previous version of Quicken, first, backup your Quicken file. Then, you can use the article linked below for instructions and to download a previous Quicken patch:

I hope this helps!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Hello,

I am having the same issue after the last update. Has anyone tried rolling back the last update? Did it resolved the issue?

Thank you

0 -

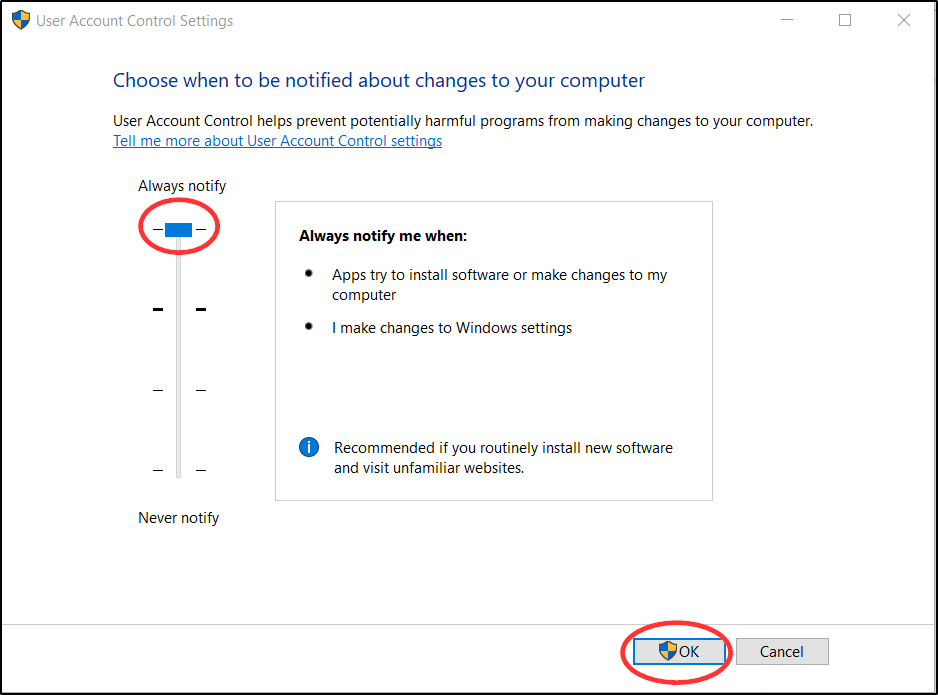

For those of you who do revert back to an earlier version, know that eventually Quicken will try to update again to the current version (or the next new version) and for many it will happen without their permission. I suspect for many of you that you will not want this to happen until another Hot Fix or new version update becomes available.

There is a simple way to stop those automatic version updates so they only occur only when you are ready for them to occur: Open the Windows User Account Control Settings, make sure the setting is set to Always Notify and then click on OK. Once this is done, Windows will notify you when Quicken (or other non-MS applications) try to update the software version and you will have the opportunity to either accept or to decline the update.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

I reverted back to Release 62 and now Tax Planner is tracking paycheck wages (and everything else) correctly. I also adjusted notification settings on Windows as suggested by Boatnmaniac. Thanks to all for the help! As many have said, Tax Planner is one of the most important features of Quicken and it is imperative that it works correctly!

1 -

I see the same issue in R63.21

I set up a simple test file with one checking account and a Paycheck using the Paycheck Wizard that includes gross salary and tax deductions. The monthly Paycheck starts on 1/15/25 with a gross salary of $10,000. I accepted the Paycheck reminders for Jan - June.

The deductions are shown correctly in the Tax Planner but the Wages and Salary details are not shown. The "Scheduled bills and deposits" option is greyed out.

Wages and Salary detail - note YTD transactions and scheduled transactions section is blank and Scheduled bills and Deposits option is greyed out.

Federal tax withholding - this is correct

I have reported this issue via Report a Problem, others who are experiencing this should do the same.

QWin Premier subscription3 -

Same issue… it's only the future paycheck income that isnt being seen so you can't use scheduled bills and deposits option at all for wages

0 -

I rolled back to R62.16 and I am still having the same issue.

0 -

I have the same problem. I use Tax Planner for my Estimated Taxes. My wife and I do seasonal work. Wages/Salary (self) and Wages/Salary (spouse) do not show our wages in the 'Quicken YTD transactions and scheduled transactions' window.

0 -

I have not heard of this issue occurring with R62.16. Does Help > About Quicken show your current version is R62.16?

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

Any update on fixing the Tax Planner? Also, will the fix include details of the Big Beautiful Bill which looks like it passed the legislator and will be signed by Trump?

0 -

Hello All,

Thank you for continuing to update this thread and check in.

I reviewed the internal ticket and can see that my team is still actively investigating this issue. There is no new information to share.

Thanks!

-Quicken Jasmine

Make sure to sign up for the email digest to see a round-up of your top posts.

0 -

The next year's tax code changes typically get updated into Quicken in the December before they take effect but sometimes it slips a bit into January. I'm guessing that's largely because tax code changes for the next year don't get finalized by the Gov't until then.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

My understanding is that some of the changes in the "big beautiful bill" will affect 2025 taxes, including the Standard Deduction, SALT deduction limit changes, etc.

It would sure be nice to include them in the Tax Planner sooner rather than later. Maybe we need an Idea for that.

QWin Premier subscription0 -

I think there’s something that people don’t really understand on how our government/taxes system works. They write these big bills. But that’s not the end of it then go to the they have to translate that into what it means. For if any given thing like the tax rules and regulations. And also at any given time during the year, they can make changes. So taxes are not finalized until at the very end of the year, and sometimes even pass There’s a reason that TurboTax doesn’t even come out until like November and is constantly being all the way up to April and sometimes beyond..

it is interesting to note that if they put out a several thousand page bill, that will probably be translated into hundreds of of pages of the regulations and stuff.

for quicken to update for tax laws and things like that in July would be way too premature.

Signature:

This is my website (ImportQIF is free to use):0 -

I understand tax laws are constantly evolving and are never really "finalized" however, the major changes in the current bill that affect 2025 taxes are set now - SALT, "senior bonus," charitable giving, etc. These changes will affect estimated tax calculations which are due Sept, 2025 and Jan, 2026. We really need Tax Planner to be updated and fixed soon so these calculations are as accurate as they can be at those times.

0

Categories

- All Categories

- 58 Product Ideas

- 34 Announcements

- 240 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 511 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.3K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 123 Quicken LifeHub