Is cash handling in a Fidelity brokerage account part of the Fidelity issues I see posted?

I am a Windows user and have what I will call a ready cash holding in a Fidelity brokerage account I download from every day. The ready cash holding pays 0 interest, but it is tied to a money market account that currently pays over 4%. I keep small amounts of cash in the ready holding so if I draw more than the holding contains, the balance is automatically drawn from the money market account. Fidelity calls the ready cash holding FCASH and the interest bearing holding it is linked to FDRXX. My actual total cash would be the total of the two. However, Quicken does not handle this situation properly. Currently I see a line in the account called FCASH and the a cash balance for the account at the bottom. Neither number is correct.

Answers

-

Hello @Dennis6@,

Thank you for letting us know you're impacted by this issue. I can see that inconsistent handling of Money Market Funds, such as FDRXX (sometimes as cash, other times as holdings, or disappearing altogether), is a known issue.

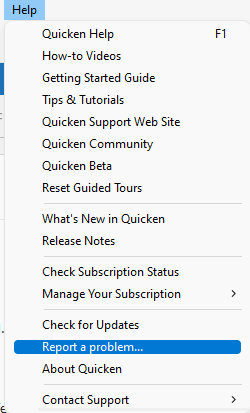

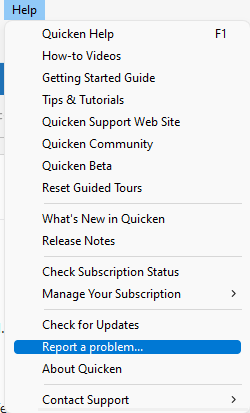

If you wish to contribute to the investigation of this issue, please navigate to Help>Report a Problem and send a problem report with log files attached. Please include ATTN-CTP-13955 in the Subject line.

While you will not receive a response through this submission, these reports will help our teams in further investigating the issue. The more problem reports we receive, the better.

We apologize for any inconvenience! Thank you.

(CTP-13955)

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

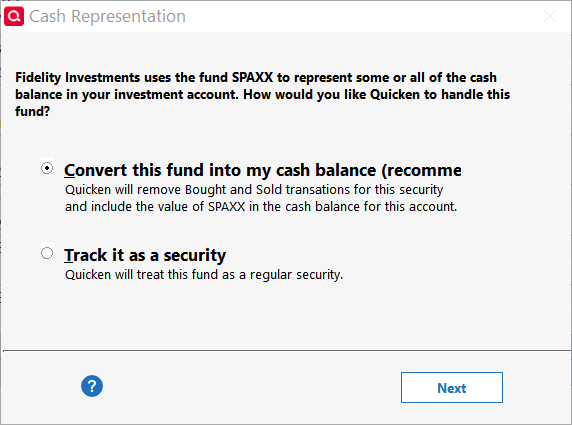

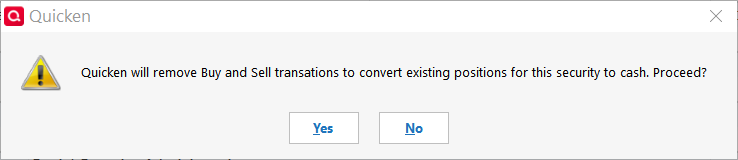

I have noticed the same stated issue. Within the last 30 days I have disconnected and reconnected online services with Fidelity hoping to fix the issue. At reconnect online services, Quicken throws a dialog box how I want to handle "cash" held in money market account with symbol "FDRXX." Quicken is recommending that I treat this as "cash." I disagree: it should be handled as a security. Indeed, Fidelity treats it as a security.

1 -

I have an issue with Fidelity downloaded interest on cash transactions that started at the end of July. Quicken has a Cash account within each brokerage account and properly posts dividends to that Cash account. However, interest on cash in each Fidelity brokerage account comes into Quicken and Quicken looks for a security named CASH and treats the interest as a reinvestment in the security called CASH. This creates two cash balances in Quicken, the total of which equals the Fidelity cash balance. Fidelity support claims to not have changed anything noting that Brokerage cash has always been held in a security called FCASH within their system. Does anyone have a solution to this?

1 -

Just because Quicken recommends something, doesn't mean that you have to do it.

The real problem here is that at the moment Fidelity isn't sending consistent data. It is both trying to treat these mutual funds as cash in one part of the downloaded data and as a security in another. Fidelity will have to fix this. By doing a Help → Report a problem, Quicken Inc can get the information to help resolve this problem.

I also encourage people to vote for this idea, which would put the choice in the hands of the user instead of just what the financial institution thinks it should be. Yes, some of us rather just treat it as cash.

Signature:

This is my website (ImportQIF is free to use):1 -

Actually, Fidelity treats it both ways.

On the Positions tab of your online account at Fidelity.com you will see FDRXX (or whichever security you have selected as the Core Account) listed as a holding under Cash or Core Account.

On the Balances tab it will be included in the cash Available to trade (all settled), Available for withdrawal and Cash or credits buckets (along with the value of other money market funds).

Since at least the early 2000s Fidelity generally downloaded the value of the Core Account as Cash balance rather than as MMF shares. It caused problems when the Core Account was set up in the online account incorrectly or when the account holder sets up buy or sell orders for the Core Account MMF which would cause Fidelity to download both the MMF shares and the Cash Balance causing a duplication of value.

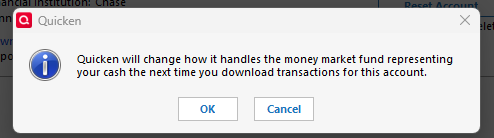

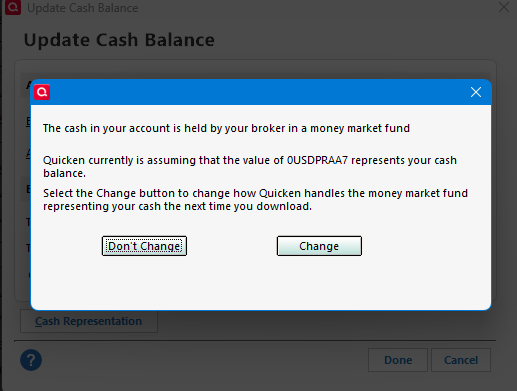

It's just recently (since the EWC+ connection migration in late-July) where Fidelity and/or Quicken seems to have gotten "confused" about what is to be downloaded. This new prompt asking people to decide how the Core Account is to be reported in Quicken is an attempt to give users a choice as to how their Core Fund value is to be reported. The concept is good but from my experience with it so far it needs some improvements:

- When the popup comes up it does not identify which investment account that popup is for.

- The popup does not ask me specifically how I want the Core Account downloaded…as cash or shares. It simply asks me if I want to change how it is downloaded so I never know what will be happening when I opt to change it…change it from what to what?

- The popups I've gotten for each account all reference the same FDRXX MMF. But which Core Account MMF is used can vary from one account to another (and that is very true for my wife's and my accounts).

- Once a decision has been made to change how the Core Account value is to be reported to Quicken, there is no option to reverse that decision or to change it in the future. So, I'm stuck with it forever unless I restore a backup file and try all over, again. So, the ability to reverse that decision (on the Online Services tab?) would be a really good thing.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

2 -

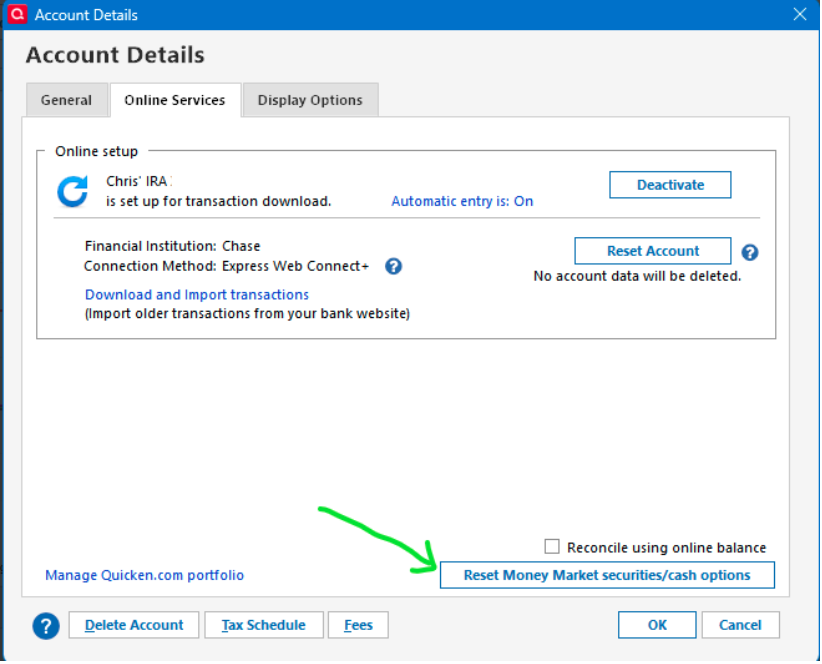

@Boatnmaniac you should be able to change your choice, but they have hidden it (just like the one from switching from reconciling away from reconciling to an online balance). This option should appear if the financial institution has given you this choice.

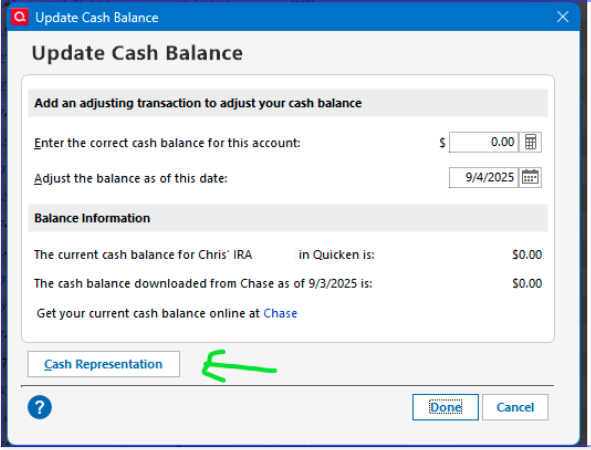

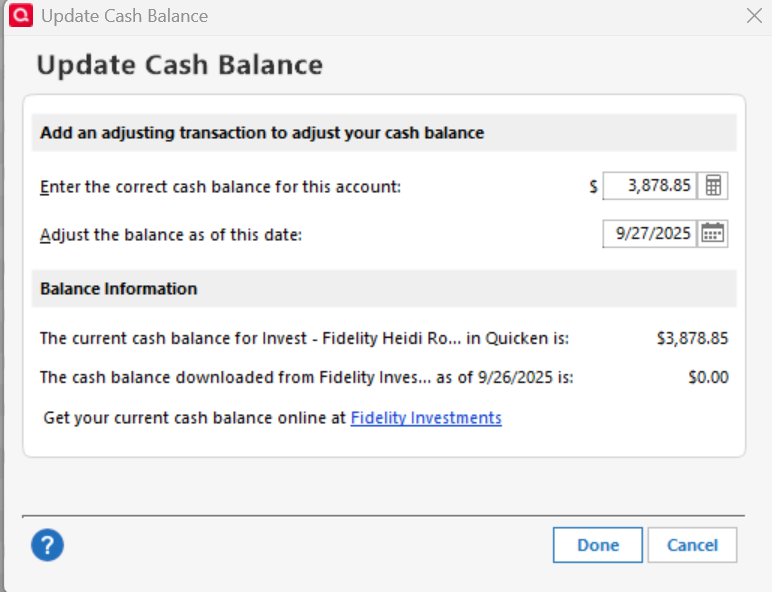

And it is also available if you select the gear icon and then Update Cash Balance:

Which BTW has a much better description:

[Edited - Removed partial account numbers]

Signature:

This is my website (ImportQIF is free to use):1 -

What you posted is what I had expected seeing. But:

- That Reset button on the Online Services tab is not showing up for any of my 9 Fidelity investment accounts.

- The Update Cash Balance popup also does not have the Cash Representation button for me.

- I have not ever seen that last picture you posted which says how Quicken is showing the Core Account MMF in the account.

I've gone through the EWC+ download process 3X over the last few days. Two of them were restored backup files when I tried to undo the issues observed in the prior download(s). I got the exact same results each time.

I haven't run the test file in the last couple of days. I think I'll restore the backup file, again, and try doing that later tonight or tomorrow morning to see if anything has changed.

If it doesn't show improvement I will likely set up a new test file and start over from scratch. That might be the best thing to do, anyway, because there are so many other account data issues from the EWC+ downloads that it makes it really difficult to do any troubleshooting with the current one.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

This is the reason why I really don’t like this hidden kind of authorization for representing a security as cash.

There isn’t any consistency with it especially now with something like fidelity switching over to a new connection method.

And at this point with fidelity still in flux, it might not be worth even trying to get it to work.

I know @Rocket J Squirrel was getting inconsistent behavior even between different accounts at Fidelity.

Signature:

This is my website (ImportQIF is free to use):0 -

I know @Rocket J Squirrel was getting inconsistent behavior even between different accounts at Fidelity.

Yes. I have 4 Fidelity accounts. 3 are IRAs and one is a taxable brokerage account. The IRAs all offer me the option how to handle cash, but the taxable account - the only one I want to change - does not.

Quicken user since version 2 for DOS, as of 2025 using QWin Premier (US) on Win10 Pro & Win11 Pro on 2 PCs.

0 -

None of my Fidelity accounts (brokerage, IRAs, or Net Benefits) are showing that option under the online services or update cash balances. I've always elected to have Quicken treat the core money market as cash. This has worked well since I've had a Fidelity account. My accounts haven't changed to the new connection method yet (or if they have, I was able to switch them back). So far everything is still working as I want it to work. The money market shares are being treated as cash. I hope it continues to let me do that (and I wish Vanguard would allow the same).

Thanks to @Chris_QPW for helping to promote my suggestion to have Quicken give users the choice of how to handle these money market sweep accounts.

[Edit - Enabled Link]

0 -

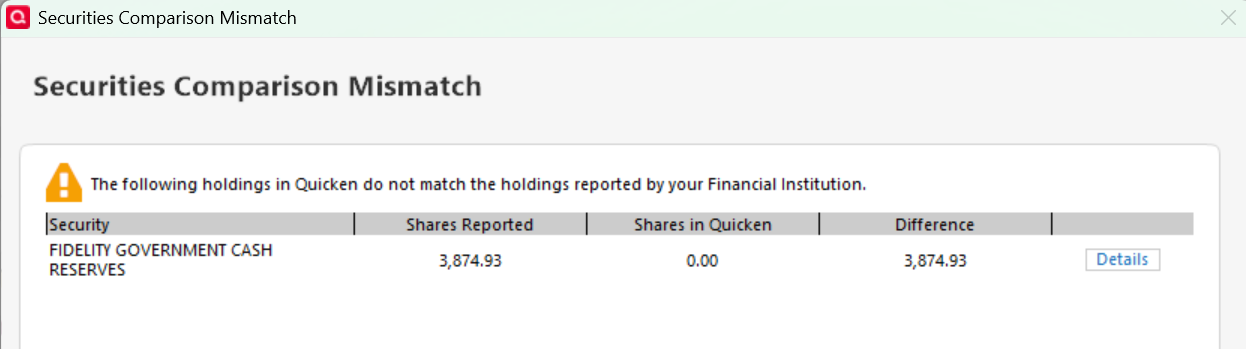

In my case I have 3 Fidelity accounts. 2 are IRAs and one is a taxable brokerage account. The IRAs use FDRXX as the core/sweep/cash account while the taxable brokerage account does not use a money market fund as the core/sweep/cash account. I have always treated the core account as cash. Now after the latest update Quicken/Fidelity wants to treat all 3 core/sweep/cash accounts as a security. Therefore, after downloading transactions I am now prompted to add FCASH as a security in the taxable brokerage account. The IRAs are now shown to have a mismatch in holdings regarding FDRXX: Quicken reports zero shares while Fidelity reports the amount of cash in the core/sweep/cash account.

Hopefully Quicken/Fidelity can get this straightened out soon.

0 -

I think that is one of the primary issues with regards to how Quicken treats the Fidelity Core Account MMFs with EWC+. At least for me, it seems that it is incapable of assigning/managing how to treat Core Accounts on an investment account-by-investment account basis. For me, it seems that once an instruction is given on how to treat the Core Account MMF for one account it applies that same decision to all investment accounts even though those other investment accounts might have different Core Account MMFs and those other investment accounts might not even contain that designated MMF.

And for me, there still is no clarity provided as to which investment account the Core Account assignment applies to. But maybe that is part of the same issue of not recognizing that each investment account can have a different Core Account MMF.

FYI REGARDING FCASH: I have been a strong vocal opponent to Fidelity's replacement of Core Account MMFs for taxable brokerage accounts this year with FCASH because it cut dividends in half (MMFs have been paying about 4% annually but FCASH pays about 2% annually) and there was no way for us to online revert to a MMF, again.

Saturday I was very pleasantly surprised to find out that Fidelity now allows me to change my Core Account from FCASH to either SPAXX or FZFXX! I was disappointed to see that I no longer could choose FZDXX which is a premium MMF but both SPAXX and FZFXX are about 2X better on returns vs. FCASH.

Quicken Classic Premier (US) Subscription: R65.29 on Windows 11 Home

0 -

I think that is one of the primary issues with regards to how Quicken treats the Fidelity Core Account MMFs with EWC+.

It isn't Quicken that decides.

Here are the ways that the financial institution might send down the data.

- They treat the mutual fund as cash by not sending any transactions for that mutual fund(s). Therefore, the cash comes/goes to the cash balance in the Quicken register.

- They treat it just the same as any other security. As such, you get buys and sells for it, and of course this can be different by account, it is up to the financial institution. I don't think I have ever seen a financial institution that mixes these first two in different accounts (at least not before this mess up with Fidelity), but there is nothing to stop them from doing it.

- Then there is they put in the same buys and sells as above, but flag it as "possible cash". It has never been determined what flags this, but the result is that Quicken ask you how you want to treat it. And it will ask in every account that this this true in. I know this because that is the behavior I get with Chase. In fact, with Chase they move money around between "hidden accounts" for different stages of a buy. It uses both "US DOLLAR" and QDERQ. And Quicken will ask me each time they switch between them if I want to treat that security as cash (Quicken currently only allows one security to be treated in this manner at a time).

Clearly if the financial institution isn't sending any buys/sells for the security it can only be represented by cash in the Quicken register.

The third option is limited to only one security (per account), which isn't ideal, but even more troubling it requires the financial institution to do some "unknown flagging" that is definitely flaky.

That is the reason I believe everyone should be voting to get a feature that allows the user to decide this.

Signature:

This is my website (ImportQIF is free to use):1 -

@Boatnmaniac thanks for the info regarding FCASH. At some point in the past Fidelity had made FCASH the default core account for taxable brokerage accounts and I had not found how to change it online. I just checked my account and have now changed my core account from FCASH to SPAXX.

0 -

Hello,

I have been through several problem with my fidelity accounts since 8/29/25. I reauthorized my fidelity brokerage accounts as instructed and at the same time update to R64. I am not sure which caused my problems.

FIRST PROBLEM: there were duplicate transactions in some accounts, mostly dividend transactions that were posted between 8/29/25 and 9/15/25. I manually deleted the duplicates.

SECOND PROBLEM: Is the option of how to handle MMF as cash. This option shows up on the "Online services screen" as indicated in the above chain of comments. My problem is, I have seven accounts at Fidelity, the option is there for 5 accounts, but 2 accounts the option is not there. the cash balances in these 2 accounts agree between Quicken and Fidelity, but the MMF SPAXX, show a share mismatch when using the online "compare portfolio" option. It shows shares of SPAXX in Fidelity but not in Quicken. when looking at the details, fidelity reflects the SPAXX shares and treats it as cash. Quicken account reflects the correct amount as cash (therefore the account balances agree) but Quicken does not show shares of SPAXX associated with the cash and this causes the share mismatch.

There was no problem prior to the account reauthorization or Quicken update.

Has there been a fix reported for the cash option being available for some fidelity accounts, but not others?

0 -

Hello @deathrs,

Thank you for sharing your experience! What kind of account are the two that do not give an option to reset cash representation (brokerage, 401k, etc.)?

Have you checked the transaction register for the problem accounts to verify if there are any placeholders or remove shares transactions causing SPAXX to not reflect properly?

I look forward to your reply!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Hello Kristina,

The two fidelity accounts that are at issue are both brokerage investment accounts.

I have checked the transaction registers both in Quicken and at Fidelity and they match.

The problem seems to be with the money market fund SPAXX. when I look at fidelity, it treats SPAXX as cash. when I look at the account in Quicken it reflects SPAXX as cash and the amounts match in quicken and fidelity.

When I view the account in Quicken using the "Online tool" and select the "online services" option for the account. then select "compare the portfolio" option. I get the account is mismatched, shares in Fidelity and no shares in Quicken.

I believe there is a problem these two accounts in Quicken, in that the option how to handle money market funds does not appear for these two problem accounts, when I go to the online services option or when I go to the change cash balance option screen. the option does appear on both screens for my other fidelity accounts and there is no problem with them.

A secondary problem with these same two accounts is with money market fund FZDXX. Fidelity treats this fund as a security but shows it in the cash balance. Quicken treats FZDXX as a security and does not show it in the cash balance. I believe if we could get the "how to treat money market funds" option to work for these two accounts, I could get the cash balances synced up by telling Quicken to treat FZDXX as cash.

I have tried using the rest account option on the online services tab, but that seemed to have no effect.

I really appreciate you trying to help me resolve this.

0 -

Thank you for your reply @deathrs,

The issue you report with SPAXX and not having the option to change cash representation for those accounts matches a known issue reported under ticket CTP-14526. So that I can add you to the ticket, please navigate to Help>Report a Problem and send a problem report with log files attached. Please let me know when you send the problem report.

Is FZDXX a core MMF for those accounts?

Thank you!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

The same thing happened to me. I saw the duplicate transactions when I did a download. I just never accepted them and, instead, deleted them. Everything seems to be OK now.

1 -

I changed Cash representation to use FCASH as Cash, but I am told I am not reconciled on several accounts.

Fidelity Government Cash Reserves show shares equal to my cash in Quicken.

Also, some accounts do not have a Cash Representation option.0 -

I am experiencing a similar problem when trying to connect my Fidelity IRA account. My core holding (cash) is kept in FIDELITY GOVERNMENT CASH RESERVES (FDRXX). For years, Quicken has shown this holding as "Cash" rather than as a security.

Today, I tried to reconnect this account, believing that the latest update (R64.30) would resolve the cash display issues I had encountered with my Fidelity accounts. However, upon reconnecting and updating, Quicken is now reporting a securities mismatch for cash. Essentially, Quicken indicates that there are shares for FDRXX in the download, but none exist in Quicken. It appears Quicken expects me to treat my core cash holding as a security.

Quicken does NOT prompt me to adjust how FDRXX is managed, nor do I find an option to change how cash is displayed for this account.

The latest Quicken release (R64.30) did NOT resolve this problem.

Meanwhile, I have disconnected online services for my Fidelity account and am manually entering transactions until a proper fix is available.

0 -

Hello @Andrew Kurtz & @gtgerbo,

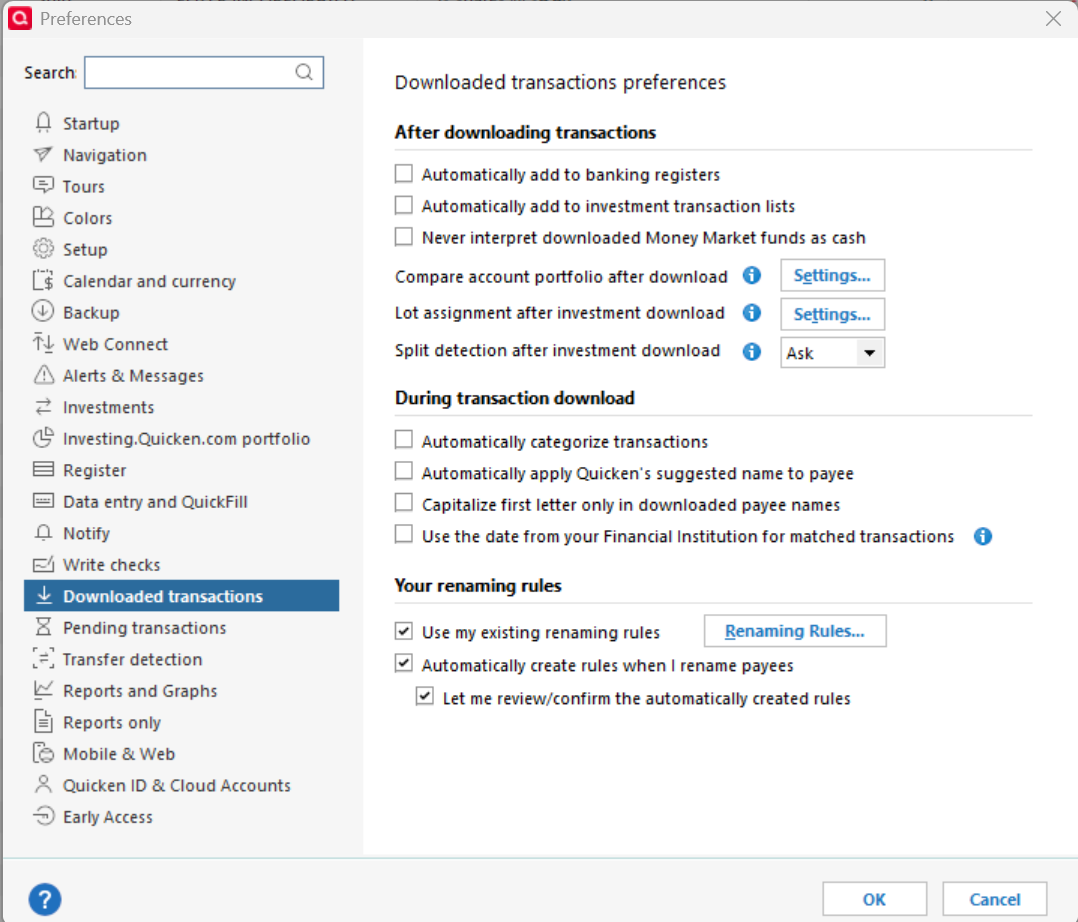

Thank you for sharing your experience. Based on our recent Community Alert (linked below), government money market funds should reflect in Quicken as cash.

You may want to navigate to Edit>Preferences>Downloaded Transactions and check to see if "Never Interpret downloaded Money Market funds as Cash" is selected.

Please let me know how it goes!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0 -

Quicken isn't going to remove transactions that are already there. If the imbalance is due to Quicken having shares of this security, then the transaction that deal with that security would need to be deleted.

Signature:

This is my website (ImportQIF is free to use):1 -

Hello, I updated to R64.30 today. This fixed my problem of 2 of my accounts not having the option of how to handle MMF in cash or security. All my accounts agree with the brokerage account.

I do still have a small problem with One step Update. When I run OSU, all seems to run as normal. When OSU finishes. I get a pop up screen, telling me there was a connectivity problem with one of my fidelity accounts. it is error code cc-506. there are two buttons one says "update now", but it is greyed out, so can't select. the other button says "fixit" it asks several questions about the particular account, but at the end just says try later. The particular brokerage account in Quicken agrees with Fidelity. So I think it is actually updating despite the error message. I haven't had any transactions activity in the account since 9/19/25. so I will watch and see if it updates with the next transaction.

Thanks to all who helped with the missing cash option.

0 -

I am having the same problem as described by @deathrs in their post from 9/22. I was able to clear up the duplicate transactions by manually deleting them. However, I'm having the same issue with just about all of my Fidelity investment accounts showing Securities Comparison Mismatch in Quicken. I have 11 investment accounts with Fidelity (1 brokerage, 2 IRA's and 8 Wealth Management accounts). All were updated to the Express Web Connect+ connection method on 9/18. I'm running Quicken Classic Premier (R64.30).

I have different types of MMF assigned for the various accounts:

Brokerage - FZFXX, IRAs - SPAXX and Wealth Management accounts - FDRXX

Currently, only the 2 IRAs show the option to change the Cash Representation. the brokerage and wealth management accounts do not show that option when looking at the cash balance. The brokerage and the wealth management accounts all show a Securities Comparison Mismatch. I did not have this problem prior to the account reauthorization that took place back on 9/18.

I saw in an earlier post in this thread that there was a known issue (CTP-14526) and that it was recommended to submit a problem report and reference that ticket number. I did this tonight. Is this still a known issue that Quicken is working on?

Thanks,

Clark

0 -

Quicken isn't going to remove transactions that are already there.

Actually, it will, if you so choose.

Quicken user since version 2 for DOS, as of 2025 using QWin Premier (US) on Win10 Pro & Win11 Pro on 2 PCs.

0 -

well, well, that is new!!!

Signature:

This is my website (ImportQIF is free to use):0 -

That is not checked. And I keep getting notified that my shares are out of balance. And the account does not have an option to reset the cash representation.

0 -

Cash management not working for my account:

0 -

Thank you for your reply,

I recommend that you contact Quicken Support directly for further assistance, as they have access to tools that we can't access through the Community and they can escalate the issue as needed. The Quicken Support phone number can be found through this link here. Phone support is available from 5:00 am PT to 5:00 pm PT, Monday through Friday.

I apologize that I could not be of more assistance!

Quicken Kristina

Make sure to sign up for the email digest to see a round up of your top posts.

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub