Please clarify exactly what changed with R64.30

In this announcement:

It says that Quicken is now going to treat the money market accounts as cash unless overridden.

Is this restricted to only Fidelity (the part of treating the money market accounts as cash)?

Looking at my Chase accounts, they still seem to allow me the choice on an account-by-account basis.

Given that it is clearly Quicken that is making this decision, I would hope for a much more generic solution like this suggestion:

Signature:

This is my website (ImportQIF is free to use):

Comments

-

Hello @Chris_QPW,

Thanks for bringing this up! I’ve reached out internally to confirm the specifics. Once I hear back, I’ll follow up here with a clear breakdown of what changed and how it applies beyond Fidelity accounts.

Appreciate your patience while I get the details clarified!

-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.0 -

@Chris_QPW Following up on this, I've just heard back, and it is not just for Fidelity. However, Kathryn has posted a more detailed update on this, which can be found in this Community Alert here.

Hope this helps!

-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.0 -

@Quicken Anja thanks! Sounds very promising.

Signature:

This is my website (ImportQIF is free to use):0 -

You're welcome!

-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.0 -

Note this might even serve to fulfill the “intent” of this idea:

Signature:

This is my website (ImportQIF is free to use):1 -

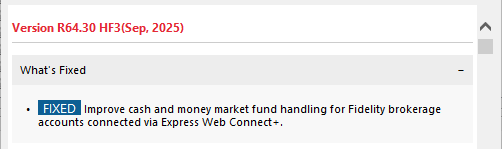

The release notes presented when you do the R64.30 after applying the R64.29 patch show only the following.

So it seems that there is some discrepancies between some of the above posts. Some imply only Fidelity, others imply all FIs.

It would be nice if the wording was consistent.

The program update webpage at doesn't show a R64.29 section and lists all of its "changes" under R64.30.

-splasher using Q continuously since 1996

- Subscription Quicken - Win11 and QW2013 - Win11

-Questions? Check out the Quicken Windows FAQ list0 -

Thanks for pointing this out, @splasher! I’ll forward your feedback internally so the team can review the discrepancies and consider clarifying the release notes.

-Quicken Anja

Make sure to sign up for the email digest to see a round up of your top posts.0 -

I'm using version R64.25, does R64.30 fix this issue?

Quicken reports Fidelity cash balance a day late with EWC+ vs DC connectionDeluxe R65.29, Windows 11 Pro

0 -

I'd doubt that. The day delay is somewhat inherent in the way that EWC works, vs how DC works.

With EWC(+), your account is accessed by Intuit servers overnight (time frame unknown), and Intuit holds the info until you request a download. IF Intuit does it's thing before Fido has completed theirs, you've got a delay.

With DC, Q is directly accessing Fido's servers. If you request a download of, say a MF, before the results are posted you won't get anything, but for stocks you'll only have the couple of minutes delay.

Q user since February, 1990. DOS Version 4

Now running Quicken Windows Subscription, Business & Personal

Retired "Certified Information Systems Auditor" & Bank Audit VP0 -

Thanks for clarifying. I guess my Quicken cash balance for my Fidelity checking will rarely be in sync with the online account balance as it was with the DC connection.

Deluxe R65.29, Windows 11 Pro

0 -

This is basically the reason I gave up trying to push Quicken Inc to have investment accounts do reconciling to the online balance. Note that this isn't a Direct Connect vs Express Web Connect + thing. Chase was sometimes late on updating the cash balance with Direct Connect too. What I have found with them is basically they update their transactions almost real time, but the cash balance isn't until at least late at night.

So, Quicken's cash balance is "ahead" of Chase's (and it seems Fidelity's too) at times.

Signature:

This is my website (ImportQIF is free to use):0 -

It will be interesting to see how EWC+ will deal with the vanishing transactions issue (see my July 1st post in this thread). Turns out the reason I was randomly missing last day of the month transactions from Fidelity was that they were actually missing on Fidelity's site. At some time around 8pm (west coast time) before the SPAXX dividend hit the account, all transactions of that day would vanish. OSUs done at that time would never get those transactions because they weren't in the Fidelity list of transaction. Later that night, when the SPAXX div hit, all the other transactions were back. The problem was, if you ran OSU during the time of the mysterious vanishing data, you'll never get those transactions to automatically download on subsequent OSUs because Quicken (and/or Fidelity) assumes you already got everything from the last OSU and only requests transactions from after that last 'successful' OSU. To prevent this (and as other warned for other reasons), I avoided doing OSUs on the last day of August and that worked. If EWC+ download timing controlled by quicken, it will be interesting to see if I start seeing the missing transactions again at the end of the month.

In the meantime, I'll be happy when they either treat all sweep accounts as cash or let us choose how to handle them. For now. I will keep delaying the EWC+ transition until everyone thinks it's working (or I'm forced to switch over to EWC+)

0

Categories

- All Categories

- 57 Product Ideas

- 34 Announcements

- 235 Alerts, Online Banking & Known Product Issues

- 19 Product Alerts

- 510 Welcome to the Community!

- 678 Before you Buy

- 1.4K Product Ideas

- 55.2K Quicken Classic for Windows

- 16.7K Quicken Classic for Mac

- 1K Quicken Mobile

- 828 Quicken on the Web

- 121 Quicken LifeHub